How to Choose the Right Term Life Insurance Policy for You

Choosing the right term life insurance policy can be a daunting task, especially with the numerous options available in the market. To find the best rated term life insurance policy, it is essential to consider several factors, including coverage amount, term length, and premium costs. The coverage amount should be sufficient to cover outstanding debts, funeral expenses, and maintain the family’s standard of living in the event of the policyholder’s death.

The term length of the policy is also crucial, as it determines the duration of coverage. Policyholders should consider their financial obligations, such as mortgages, car loans, and education expenses, when selecting a term length. A longer term length may provide more comprehensive coverage, but it also increases the premium costs.

Premium costs are another critical factor to consider when choosing a term life insurance policy. Policyholders should assess their budget and financial situation to determine how much they can afford to pay in premiums. It is also essential to compare premiums from different insurance companies to find the best rates.

Assessing your financial situation and goals is also vital when selecting a term life insurance policy. Policyholders should consider their income, expenses, debts, and financial objectives when determining the right coverage amount and term length. By carefully evaluating these factors, individuals and families can find the best rated term life insurance policy to provide financial protection and peace of mind.

Additionally, policyholders should also consider the insurance company’s financial strength, policy options, and customer service when selecting a term life insurance policy. A company with a strong financial rating and excellent customer service can provide policyholders with confidence and security.

How to Choose the Right Term Life Insurance Policy for You

Choosing the right term life insurance policy can be a daunting task, especially with the numerous options available in the market. However, with a clear understanding of your needs and a thorough evaluation of the available policies, you can make an informed decision that provides you and your loved ones with the necessary financial protection. Here are some key factors to consider when selecting the best-rated term life insurance policy for your needs.

First and foremost, assess your financial situation and goals. Consider your income, expenses, debts, and financial obligations. Determine how much coverage you need to ensure that your loved ones are financially secure in the event of your passing. A general rule of thumb is to opt for a coverage amount that is 5-10 times your annual income.

Next, consider the term length of the policy. Term life insurance policies are available for various term lengths, ranging from 5 to 30 years. Choose a term length that aligns with your financial goals and obligations. For instance, if you have young children, you may want to opt for a longer term length to ensure that they are financially protected until they become independent.

Premium costs are another crucial factor to consider. Compare the premium costs of different policies and choose one that fits your budget. Keep in mind that the premium costs may increase over time, so it’s essential to choose a policy with a stable premium structure.

Additionally, consider the insurance company’s financial strength and reputation. Look for companies with high ratings from reputable rating agencies such as A.M. Best, Moody’s, and Standard & Poor’s. A financially strong insurance company is more likely to pay out claims and provide stable coverage.

It’s also essential to evaluate the policy’s flexibility and customization options. Some policies may offer riders or add-ons that allow you to customize your coverage to suit your needs. For instance, you may want to add a waiver of premium rider, which waives your premium payments if you become disabled or critically ill.

Finally, consider working with a licensed insurance agent who can help you navigate the complex world of term life insurance. They can provide you with personalized recommendations and help you choose the best-rated term life insurance policy for your needs.

By carefully evaluating these factors and considering your individual needs, you can choose a term life insurance policy that provides you and your loved ones with the necessary financial protection. Remember to shop around, compare policies, and read the fine print before making a decision. With the right policy, you can have peace of mind knowing that you’re prepared for the unexpected.

Top-Rated Term Life Insurance Companies: A Review

When it comes to choosing the best-rated term life insurance, it’s essential to consider the financial strength, policy options, and customer service of the insurance company. Here’s an in-depth review of three top-rated term life insurance companies: Northwestern Mutual, New York Life, and State Farm.

Northwestern Mutual

Northwestern Mutual is one of the largest and most reputable life insurance companies in the US. With a financial strength rating of A++ from A.M. Best, Northwestern Mutual offers a range of term life insurance policies, including level term, decreasing term, and increasing term. Their policies are highly customizable, with options for riders and add-ons. Northwestern Mutual is known for its excellent customer service, with a 95% customer satisfaction rate.

New York Life

New York Life is another top-rated term life insurance company, with a financial strength rating of A++ from A.M. Best. They offer a range of term life insurance policies, including level term, decreasing term, and increasing term. New York Life is known for its flexible policy options, including the ability to convert to a whole life policy. Their customer service is also highly rated, with a 94% customer satisfaction rate.

State Farm

State Farm is one of the largest insurance companies in the US, with a financial strength rating of A++ from A.M. Best. They offer a range of term life insurance policies, including level term, decreasing term, and increasing term. State Farm is known for its competitive pricing and flexible policy options, including the ability to customize your policy with riders and add-ons. Their customer service is also highly rated, with a 93% customer satisfaction rate.

When choosing the best-rated term life insurance company, it’s essential to consider your individual needs and goals. All three of these companies offer high-quality term life insurance policies, but the best one for you will depend on your specific circumstances. Be sure to research and compare policies before making a decision.

In addition to these three companies, there are many other top-rated term life insurance companies to consider. Some other notable companies include Prudential, Transamerica, and Lincoln National. When researching these companies, be sure to consider their financial strength, policy options, and customer service.

Ultimately, the best-rated term life insurance company for you will depend on your individual needs and goals. By researching and comparing policies, you can find the best term life insurance policy for your needs and budget.

Term Life Insurance Riders: What You Need to Know

Term life insurance riders are additional features that can be added to a term life insurance policy to provide extra benefits and flexibility. These riders can enhance the coverage and value of the policy, but they can also increase the premium costs. Here are some common term life insurance riders and their benefits and drawbacks.

Waiver of Premium Rider

This rider waives the premium payments if the policyholder becomes disabled or critically ill. This rider can provide financial protection and peace of mind, but it can also increase the premium costs. The waiver of premium rider is usually available for an additional fee, which can range from 10% to 20% of the premium costs.

Accidental Death Benefit Rider

This rider provides an additional death benefit if the policyholder dies as a result of an accident. This rider can provide extra financial protection for the policyholder’s loved ones, but it can also increase the premium costs. The accidental death benefit rider is usually available for an additional fee, which can range from 5% to 10% of the premium costs.

Long-Term Care Rider

This rider provides a portion of the death benefit to pay for long-term care expenses, such as nursing home care or home health care. This rider can provide financial protection and peace of mind, but it can also increase the premium costs. The long-term care rider is usually available for an additional fee, which can range from 10% to 20% of the premium costs.

Conversion Rider

This rider allows the policyholder to convert the term life insurance policy to a whole life insurance policy without providing evidence of insurability. This rider can provide flexibility and options for the policyholder, but it can also increase the premium costs. The conversion rider is usually available for an additional fee, which can range from 5% to 10% of the premium costs.

When considering term life insurance riders, it’s essential to weigh the benefits and drawbacks of each rider. Riders can enhance the coverage and value of the policy, but they can also increase the premium costs. It’s crucial to carefully review the policy and riders to ensure that they align with your needs and budget.

In addition to these riders, there are many other term life insurance riders available, including a return of premium rider, a terminal illness rider, and a disability income rider. Each rider has its benefits and drawbacks, and it’s essential to carefully review and compare them before making a decision.

When shopping for the best-rated term life insurance, it’s essential to consider the riders and features that are available. Look for policies that offer flexible riders and features that align with your needs and budget. By carefully reviewing and comparing policies, you can find the best term life insurance policy for your needs and budget.

Term Life Insurance vs. Whole Life Insurance: Which is Right for You?

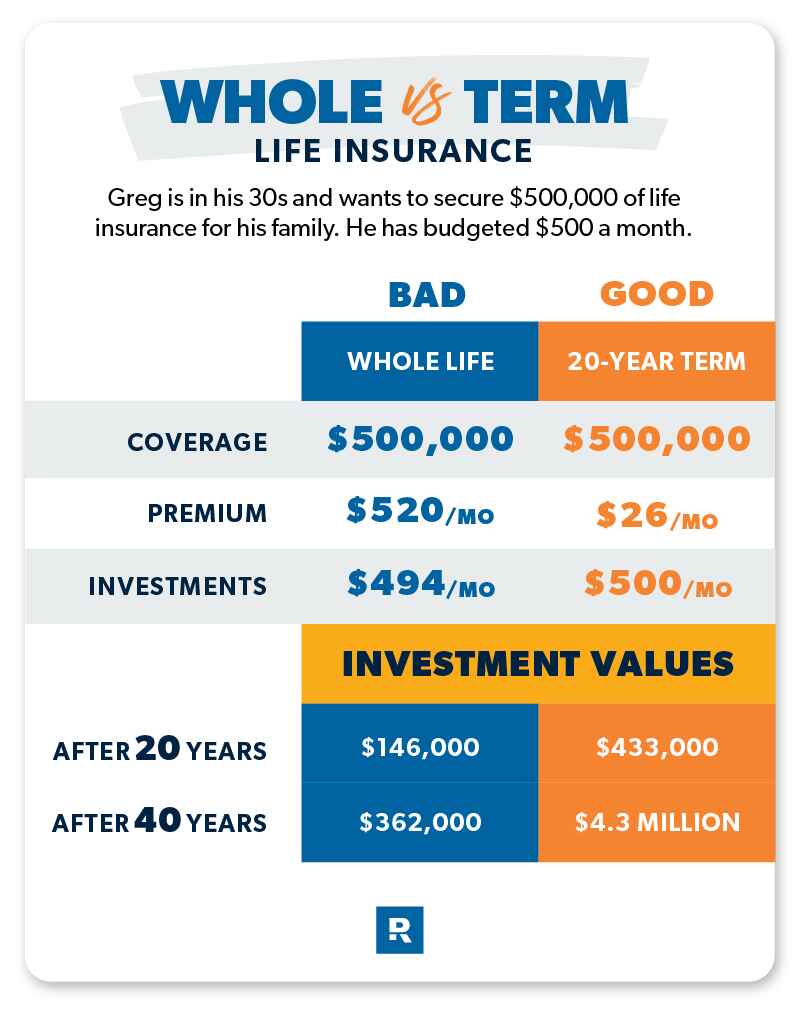

When it comes to choosing a life insurance policy, two of the most popular options are term life insurance and whole life insurance. Both types of insurance provide a death benefit to the policyholder’s loved ones, but they differ in their coverage, premiums, and cash value accumulation. In this article, we’ll compare and contrast term life insurance and whole life insurance to help you decide which type of insurance is best for your needs.

Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 5 to 30 years. If the policyholder dies during the term, the insurance company pays a death benefit to the beneficiary. Term life insurance is generally less expensive than whole life insurance, especially for younger policyholders. However, the coverage expires at the end of the term, and the policyholder may not be able to renew it.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides coverage for the policyholder’s entire lifetime. As long as the premiums are paid, the insurance company will pay a death benefit to the beneficiary. Whole life insurance also accumulates a cash value over time, which the policyholder can borrow against or withdraw. However, whole life insurance is generally more expensive than term life insurance, and the premiums may increase over time.

Key Differences

The key differences between term life insurance and whole life insurance are:

- Coverage period: Term life insurance provides coverage for a specified period, while whole life insurance provides coverage for the policyholder’s entire lifetime.

- Premiums: Term life insurance premiums are generally less expensive than whole life insurance premiums.

- Cash value accumulation: Whole life insurance accumulates a cash value over time, while term life insurance does not.

- Flexibility: Term life insurance is generally more flexible than whole life insurance, as policyholders can convert or renew their policies.

Which is Right for You?

The choice between term life insurance and whole life insurance depends on your individual needs and goals. If you need coverage for a specific period, such as until your children are grown and self-sufficient, term life insurance may be the best option. However, if you want lifetime coverage and a guaranteed death benefit, whole life insurance may be the better choice.

When shopping for the best-rated term life insurance or whole life insurance, it’s essential to consider your financial situation, goals, and budget. Look for policies that offer flexible coverage options, competitive premiums, and excellent customer service. By carefully reviewing and comparing policies, you can find the best life insurance policy for your needs and budget.

Term Life Insurance Quotes: How to Get the Best Rates

Getting the best term life insurance quotes requires some research and comparison shopping. Here are some tips to help you get the best rates:

Shop Around

Don’t settle for the first quote you get. Shop around and compare quotes from different insurance companies. You can use online quote tools or work with a licensed insurance agent to get quotes from multiple companies.

Compare Policies

When comparing policies, make sure to look at the coverage amount, term length, and premium costs. Also, check the policy’s features, such as the ability to convert to a whole life policy or add riders.

Improve Your Insurability

Your insurability can affect your premium costs. To improve your insurability, make sure to:

- Quit smoking

- Lose weight

- Exercise regularly

- Manage your blood pressure and cholesterol

Work with a Licensed Insurance Agent

A licensed insurance agent can help you navigate the complex world of term life insurance. They can provide you with personalized quotes and help you choose the best policy for your needs.

Look for Discounts

Some insurance companies offer discounts for things like being a non-smoker, having a good driving record, or being a member of a certain organization. Ask about discounts when you’re getting quotes.

Read Policy Fine Print

Before buying a policy, make sure to read the fine print. Understand the policy’s terms and conditions, including the coverage amount, term length, and premium costs.

By following these tips, you can get the best term life insurance quotes and find a policy that meets your needs and budget. Remember to always work with a licensed insurance agent and carefully review policy fine print before making a decision.

When shopping for the best-rated term life insurance, it’s essential to consider your financial situation, goals, and budget. Look for policies that offer flexible coverage options, competitive premiums, and excellent customer service. By carefully reviewing and comparing policies, you can find the best term life insurance policy for your needs and budget.

Common Mistakes to Avoid When Buying Term Life Insurance

When buying term life insurance, it’s essential to avoid common mistakes that can lead to inadequate coverage, unnecessary expenses, or even policy cancellation. Here are some common mistakes to avoid:

Underestimating Coverage Needs

One of the most common mistakes people make when buying term life insurance is underestimating their coverage needs. This can lead to inadequate coverage, leaving loved ones with financial burdens. To avoid this, consider your income, expenses, debts, and financial obligations to determine the right coverage amount.

Not Reading Policy Fine Print

Another mistake people make is not reading the policy fine print. This can lead to misunderstandings about the policy’s terms and conditions, including the coverage amount, term length, and premium costs. Always read the policy fine print carefully and ask questions if you’re unsure.

Not Reviewing Policies Regularly

Term life insurance policies should be reviewed regularly to ensure they still meet your needs. Failing to review policies can lead to inadequate coverage or unnecessary expenses. Review your policy every few years or when your circumstances change.

Not Disclosing Medical Information

Not disclosing medical information can lead to policy cancellation or claims denial. Always disclose your medical information accurately and honestly to avoid any issues.

Not Considering Riders

Riders can enhance the coverage and value of your term life insurance policy. However, not considering riders can lead to missed opportunities for additional coverage or benefits. Always consider riders when buying a term life insurance policy.

Not Working with a Licensed Insurance Agent

Working with a licensed insurance agent can help you navigate the complex world of term life insurance. Not working with an agent can lead to inadequate coverage or unnecessary expenses. Always work with a licensed insurance agent to get the best term life insurance policy for your needs.

By avoiding these common mistakes, you can ensure you get the best term life insurance policy for your needs. Remember to always read policy fine print, review policies regularly, and work with a licensed insurance agent to get the best coverage and value.

When shopping for the best-rated term life insurance, it’s essential to consider your financial situation, goals, and budget. Look for policies that offer flexible coverage options, competitive premiums, and excellent customer service. By carefully reviewing and comparing policies, you can find the best term life insurance policy for your needs and budget.

Conclusion: Finding the Best Term Life Insurance for Your Future

Term life insurance is an essential financial tool for individuals and families. It provides financial protection and peace of mind, ensuring that loved ones are taken care of in the event of an unexpected death. With so many options available, it’s crucial to find the best-rated term life insurance policy that meets your needs and budget.

In this article, we’ve provided a comprehensive guide to term life insurance, including its benefits, types of policies, and top-rated insurance companies. We’ve also discussed common mistakes to avoid when buying term life insurance and provided tips on how to get the best rates.

When shopping for term life insurance, it’s essential to consider your financial situation, goals, and budget. Look for policies that offer flexible coverage options, competitive premiums, and excellent customer service. By carefully reviewing and comparing policies, you can find the best term life insurance policy for your needs and budget.

Remember, finding the right term life insurance policy is a crucial step in securing your financial future. Don’t wait until it’s too late – start exploring your options today and take the first step towards protecting your loved ones.

By following the tips and advice outlined in this article, you can find the best-rated term life insurance policy that meets your needs and budget. Don’t settle for anything less – take control of your financial future and start exploring your options today.

With the right term life insurance policy, you can have peace of mind knowing that your loved ones are protected. Don’t wait – start your search for the best-rated term life insurance policy today and take the first step towards securing your financial future.