Understanding Your Financial Landscape: A Prerequisite to Getting a Personal Loan

Before embarking on the journey to secure a personal loan, it is essential to have a clear understanding of your financial situation. This knowledge will empower you to make informed decisions and increase your chances of approval. A personal loan can be a valuable tool for consolidating debt, financing a major purchase, or covering unexpected expenses. However, it is crucial to approach the process with a solid grasp of your financial landscape.

Your credit score plays a significant role in determining the interest rate you will qualify for and the loan terms you will be offered. A good credit score can help you qualify for a lower interest rate, which can save you money over the life of the loan. On the other hand, a poor credit score can lead to a higher interest rate and less favorable loan terms. Understanding your credit score and how it affects your loan options is vital to finding the best way to get a personal loan.

In addition to your credit score, your income and expenses are also critical factors in determining your eligibility for a personal loan. Lenders will typically evaluate your debt-to-income ratio to ensure that you have sufficient income to repay the loan. A high debt-to-income ratio can make it more challenging to qualify for a personal loan, as lenders may view you as a higher risk. By understanding your income and expenses, you can take steps to improve your debt-to-income ratio and increase your chances of approval.

Furthermore, having a clear understanding of your financial goals and objectives is essential to finding the right personal loan for your needs. Are you looking to consolidate debt, finance a major purchase, or cover unexpected expenses? Different loan options may be better suited to different financial goals. By understanding your financial goals, you can select a loan that aligns with your needs and helps you achieve your objectives.

In conclusion, understanding your financial landscape is a critical step in finding the best way to get a personal loan. By grasping your credit score, income, expenses, and financial goals, you can make informed decisions and increase your chances of approval. Take the time to review your financial situation, and you will be well on your way to securing a personal loan that meets your needs.

How to Choose the Right Lender for Your Personal Loan Needs

When it comes to finding the best way to get a personal loan, choosing the right lender is crucial. With so many options available, it can be overwhelming to decide which lender to work with. However, by understanding the different types of lenders and their respective advantages and disadvantages, you can make an informed decision that meets your needs.

Traditional banks are a popular option for personal loans, offering a wide range of loan products and competitive interest rates. However, they often have strict credit requirements and may not be the best option for those with poor credit. Credit unions, on the other hand, are member-owned cooperatives that offer more flexible credit requirements and competitive interest rates. They may also offer more personalized service and a stronger sense of community.

Online lenders have become increasingly popular in recent years, offering the convenience of applying for a loan from the comfort of your own home. They often have faster application processes and more flexible credit requirements than traditional banks. However, they may also charge higher interest rates and fees. Peer-to-peer lenders, which match borrowers with investors, offer another alternative to traditional banks. They often have more flexible credit requirements and competitive interest rates, but may also charge higher fees.

To find the best lender for your needs, it’s essential to research and compare different options. Look for lenders that offer competitive interest rates, flexible credit requirements, and low fees. Consider the lender’s reputation, customer service, and loan terms. Read reviews and ask for referrals from friends or family members who have used the lender in the past.

When comparing lenders, consider the following factors:

- Interest rates: Look for lenders that offer competitive interest rates and flexible repayment terms.

- Fees: Consider the fees associated with the loan, including origination fees, late payment fees, and prepayment penalties.

- Credit requirements: Check the lender’s credit requirements and ensure they align with your credit profile.

- Reputation: Research the lender’s reputation and read reviews from other customers.

- Customer service: Consider the lender’s customer service and support options.

By taking the time to research and compare different lenders, you can find the best way to get a personal loan that meets your needs and helps you achieve your financial goals.

The Role of Credit Score in Personal Loan Approval: What You Need to Know

Credit score plays a crucial role in personal loan approval, and understanding its significance can help you increase your chances of getting approved. A credit score is a three-digit number that represents your creditworthiness, and it’s calculated based on your credit history, payment history, and other factors.

A good credit score can help you qualify for a personal loan with a lower interest rate, which can save you money over the life of the loan. On the other hand, a poor credit score can lead to a higher interest rate and less favorable loan terms. In some cases, a poor credit score can even lead to loan rejection.

So, how does credit score affect personal loan approval? Here are some ways:

- Interest rates: A good credit score can help you qualify for a lower interest rate, which can save you money over the life of the loan.

- Loan terms: A good credit score can also help you qualify for more favorable loan terms, such as a longer repayment period or a lower monthly payment.

- Approval: A good credit score can increase your chances of getting approved for a personal loan, while a poor credit score can lead to loan rejection.

Now, you may be wondering how to improve your credit score to increase your chances of getting approved for a personal loan. Here are some tips:

- Check your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date.

- Make on-time payments: Make all your payments on time, including credit card payments, loan payments, and utility bills.

- Keep credit utilization low: Keep your credit utilization ratio low by keeping your credit card balances low compared to your credit limits.

- Don’t open too many credit accounts: Avoid opening too many credit accounts, as this can negatively affect your credit score.

By following these tips, you can improve your credit score and increase your chances of getting approved for a personal loan. Remember, a good credit score is essential for getting the best way to get a personal loan, so take the time to improve your credit score before applying.

Personal Loan Options: Weighing the Pros and Cons of Different Types of Loans

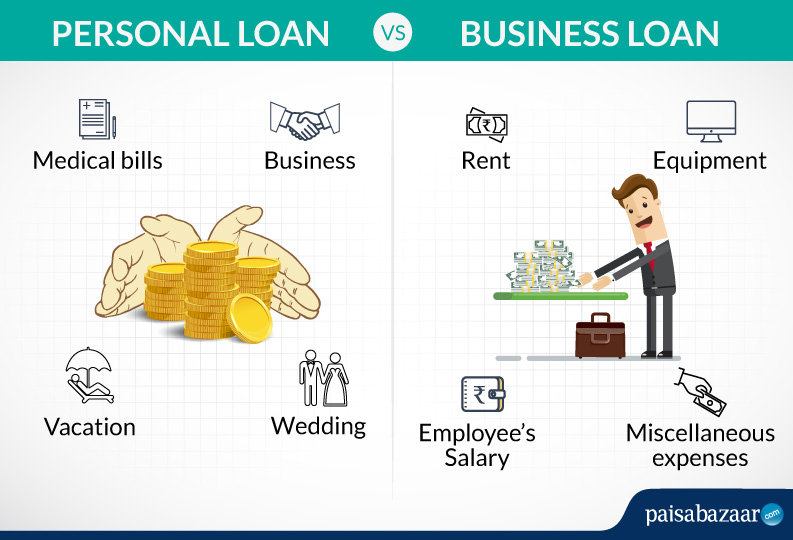

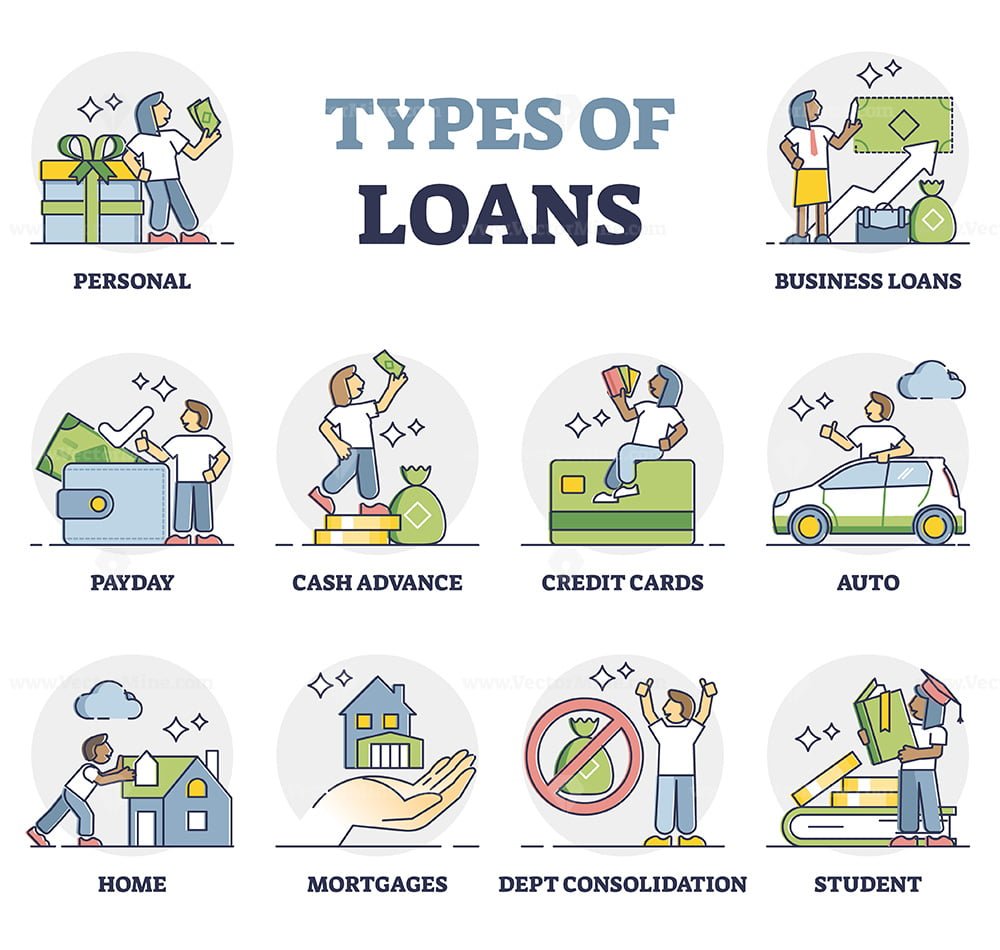

When it comes to finding the best way to get a personal loan, understanding the different types of loans available is crucial. Each type of loan has its own set of benefits and drawbacks, and choosing the right one can make all the difference in your financial journey.

Unsecured loans are one of the most popular types of personal loans. They do not require any collateral, and the lender relies on the borrower’s creditworthiness to approve the loan. Unsecured loans typically have higher interest rates than secured loans, but they offer more flexibility and convenience.

Secured loans, on the other hand, require collateral to secure the loan. This can be a valuable asset, such as a car or a house, or a savings account. Secured loans typically have lower interest rates than unsecured loans, but they also come with a higher risk of losing the collateral if the borrower defaults on the loan.

Lines of credit are another type of personal loan that offers a flexible and convenient way to borrow money. A line of credit is a revolving loan that allows the borrower to draw on the funds as needed, up to a certain limit. Lines of credit typically have variable interest rates and fees, and they require regular payments to avoid default.

When choosing a personal loan, it’s essential to consider the pros and cons of each type of loan. Here are some factors to consider:

- Interest rates: Compare the interest rates of different loan options to find the best deal.

- Fees: Consider the fees associated with each loan, including origination fees, late payment fees, and prepayment penalties.

- Repayment terms: Choose a loan with a repayment term that fits your financial situation and goals.

- Credit score: Consider the credit score requirements for each loan and choose one that aligns with your credit profile.

By understanding the different types of personal loans and their pros and cons, you can make an informed decision that meets your financial needs and goals. Remember, finding the best way to get a personal loan requires research, patience, and a clear understanding of your financial situation.

How to Prepare a Winning Personal Loan Application: Tips and Tricks

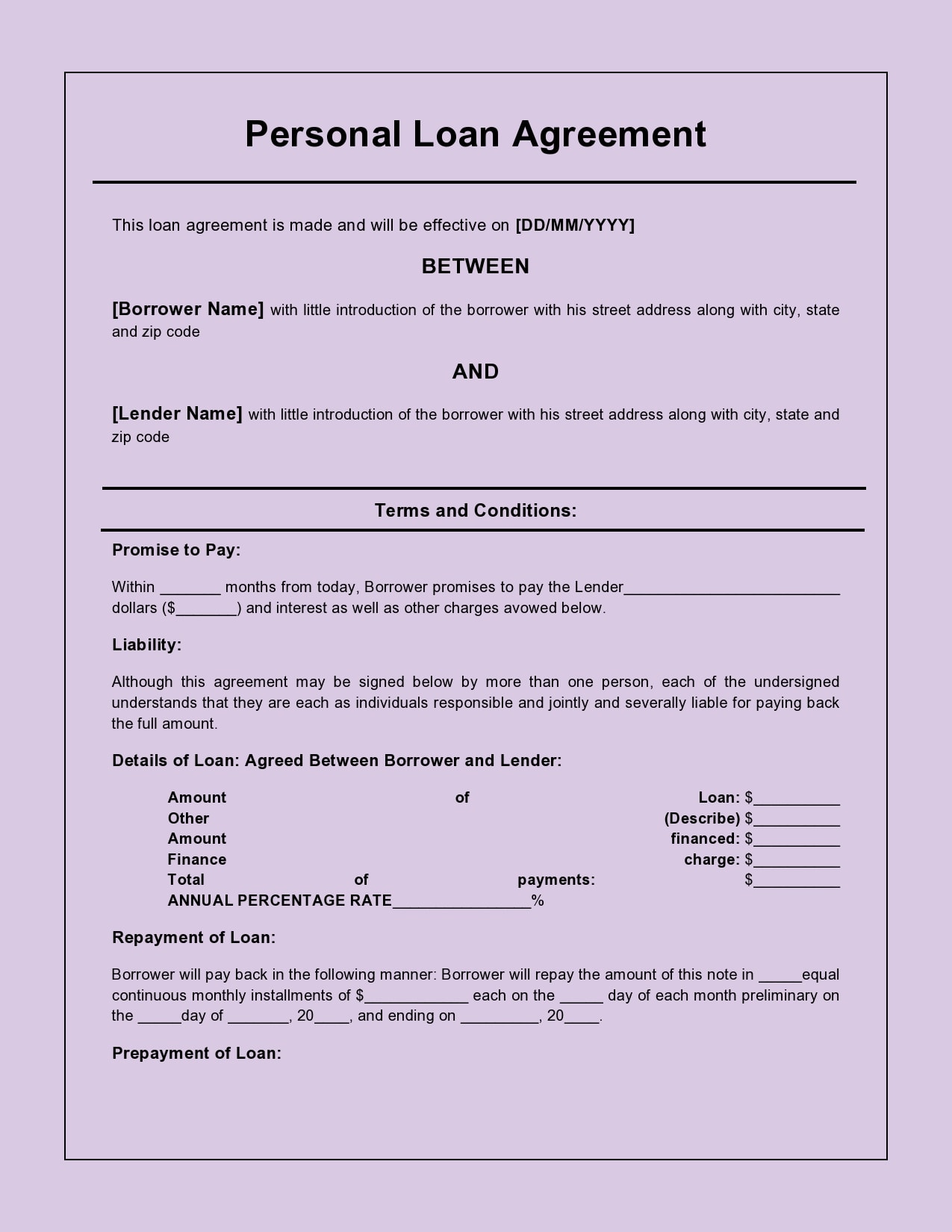

Preparing a successful personal loan application requires careful planning, attention to detail, and a thorough understanding of the lender’s requirements. By following these tips and tricks, individuals can increase their chances of approval and secure the best way to get a personal loan for their needs.

Before starting the application process, it is essential to gather all necessary documents, including proof of income, employment, and identification. Lenders typically require recent pay stubs, bank statements, and tax returns to verify an applicant’s financial situation. Having these documents readily available can help streamline the application process and reduce the risk of delays or rejection.

When filling out the application form, it is crucial to provide accurate and complete information. Inaccurate or incomplete applications can lead to rejection or additional scrutiny, which can prolong the approval process. Applicants should carefully review the form, ensuring that all fields are completed correctly and that all required information is provided.

In addition to providing accurate information, applicants should also be prepared to explain their credit history and any adverse marks on their credit report. Lenders may request additional documentation or explanations for late payments, collections, or other negative marks. Being prepared to address these issues can help alleviate concerns and increase the chances of approval.

Another critical aspect of the application process is the loan proposal. This document outlines the loan amount, repayment terms, and interest rate. Applicants should carefully review the proposal, ensuring that it aligns with their financial situation and goals. It is also essential to ask questions and seek clarification on any aspects of the proposal that are unclear.

Finally, applicants should be prepared to wait for the lender’s decision. The approval process can take several days or even weeks, depending on the lender and the complexity of the application. During this time, applicants should avoid making any significant changes to their financial situation, such as applying for new credit or changing jobs, as this can impact the lender’s decision.

By following these tips and tricks, individuals can increase their chances of securing the best way to get a personal loan for their needs. Remember to gather all necessary documents, provide accurate and complete information, and carefully review the loan proposal. With careful planning and attention to detail, applicants can navigate the application process with confidence and secure the funding they need.

Common Mistakes to Avoid When Applying for a Personal Loan

When applying for a personal loan, it’s essential to avoid common mistakes that can lead to rejection or unfavorable loan terms. By being aware of these mistakes, individuals can increase their chances of approval and find the best way to get a personal loan for their needs.

One of the most significant mistakes people make is not checking their credit reports before applying for a personal loan. Credit reports play a crucial role in determining loan eligibility and interest rates. Errors or inaccuracies on the report can lead to rejection or higher interest rates. It’s essential to obtain a copy of the credit report, review it carefully, and dispute any errors or inaccuracies before applying for a loan.

Another common mistake is not comparing rates and terms from different lenders. This can lead to accepting a loan with unfavorable terms, such as high interest rates or fees. It’s essential to research and compare rates from various lenders, including banks, credit unions, and online lenders, to find the best option.

Not reading the fine print is another mistake that can lead to unexpected surprises. Loan agreements often contain hidden fees, penalties, or clauses that can increase the overall cost of the loan. It’s essential to carefully review the loan agreement, ask questions, and seek clarification on any unclear terms or conditions.

Applying for multiple loans simultaneously is also a common mistake. This can lead to a decrease in credit score and increase the risk of rejection. It’s essential to apply for one loan at a time and wait for the lender’s decision before applying for another loan.

Providing inaccurate or incomplete information on the loan application is another mistake that can lead to rejection. It’s essential to provide accurate and complete information, including income, employment, and credit history, to ensure a smooth application process.

Finally, not considering alternative options is a mistake that can lead to accepting a loan that’s not suitable for one’s needs. It’s essential to consider alternative options, such as credit cards or lines of credit, and evaluate their pros and cons before applying for a personal loan.

By avoiding these common mistakes, individuals can increase their chances of approval and find the best way to get a personal loan for their needs. Remember to check credit reports, compare rates, read the fine print, and provide accurate information to ensure a successful loan application.

What to Expect After Approval: Understanding Personal Loan Repayment Terms

After securing a personal loan, it’s essential to understand the repayment terms to ensure timely payments and avoid defaulting on the loan. Repayment terms include interest rates, fees, and repayment schedules, which can vary depending on the lender and loan type.

Interest rates are a critical component of personal loan repayment terms. They can be fixed or variable, and lenders may offer different interest rates based on credit score, loan amount, and repayment term. Borrowers should carefully review the interest rate and calculate the total interest paid over the loan term to ensure they can afford the monthly payments.

Fees are another important aspect of personal loan repayment terms. Lenders may charge origination fees, late payment fees, or prepayment fees, which can add to the overall cost of the loan. Borrowers should review the fee structure and factor these costs into their budget to avoid unexpected expenses.

Repayment schedules outline the frequency and amount of payments, which can be monthly, bi-weekly, or weekly. Borrowers should review the repayment schedule to ensure they can meet the payment obligations and avoid defaulting on the loan.

To manage personal loan repayments effectively, borrowers should create a budget that accounts for the monthly payments, interest rates, and fees. They should also prioritize debt repayment and consider making extra payments to reduce the loan term and interest paid.

Additionally, borrowers should be aware of the loan’s repayment flexibility, such as the ability to make early payments or skip payments. Some lenders may offer flexible repayment options, which can help borrowers manage their cash flow and avoid defaulting on the loan.

Understanding personal loan repayment terms is crucial to finding the best way to get a personal loan for your needs. By carefully reviewing the interest rates, fees, and repayment schedules, borrowers can make informed decisions and avoid costly mistakes. Remember to ask questions and seek clarification on any unclear terms or conditions to ensure a smooth repayment process.

By managing personal loan repayments effectively, borrowers can build credit, reduce debt, and achieve their financial goals. It’s essential to stay organized, prioritize debt repayment, and communicate with the lender to ensure a successful loan repayment experience.

Conclusion: Finding the Best Way to Get a Personal Loan for Your Needs

Securing a personal loan can be a daunting task, but by doing your research, understanding your financial situation, and choosing the right lender, you can increase your chances of approval and find the best way to get a personal loan for your needs.

Throughout this article, we have discussed the importance of understanding your financial landscape, including your credit score, income, and expenses. We have also explored the various types of lenders, personal loan options, and repayment terms, and provided tips on how to prepare a winning personal loan application and avoid common mistakes.

By following these guidelines and taking the time to research and compare lenders, you can find a personal loan that meets your needs and budget. Remember to carefully review the loan terms, including interest rates, fees, and repayment schedules, and ask questions if you are unsure about any aspect of the loan.

Ultimately, finding the best way to get a personal loan requires patience, persistence, and a thorough understanding of your financial situation. By taking the time to do your research and make informed decisions, you can secure a personal loan that helps you achieve your financial goals and improve your overall financial well-being.

In conclusion, securing a personal loan can be a straightforward process if you know what to expect and take the necessary steps to prepare. By following the tips and guidelines outlined in this article, you can increase your chances of approval and find the best way to get a personal loan for your needs.

Remember, the key to finding the best way to get a personal loan is to do your research, understand your financial situation, and choose the right lender. By taking the time to make informed decisions, you can secure a personal loan that meets your needs and helps you achieve your financial goals.