Why Financial Projections are the Backbone of a Successful Business Plan

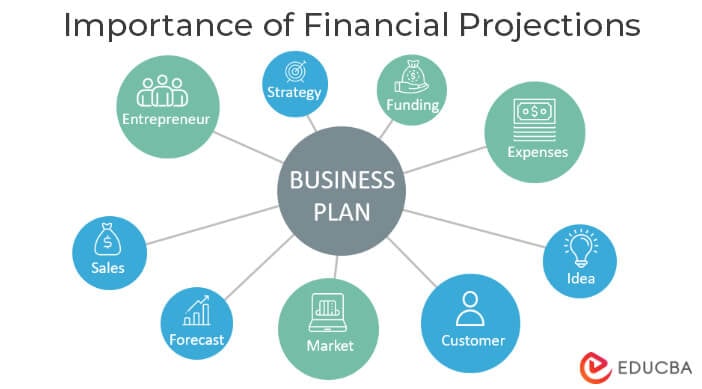

Financial projections are a crucial component of a business plan, serving as a roadmap for a company’s financial future. By creating accurate and comprehensive financial projections, entrepreneurs and small business owners can make informed decisions, secure funding, and measure performance. A well-crafted financial projection helps to create a realistic vision for a company’s future, enabling business leaders to prioritize initiatives, manage risk, and drive growth.

A business plan financial projection provides a detailed picture of a company’s financial health, including revenue, expenses, and cash flow. This information is essential for securing funding from investors, who want to see a clear understanding of a company’s financial situation and potential for growth. Financial projections also help business leaders to identify areas for cost reduction, optimize resource allocation, and make strategic decisions about investments and expansion.

Moreover, financial projections enable business leaders to measure performance and track progress towards goals. By regularly reviewing and revising financial projections, entrepreneurs and small business owners can refine their strategies, address challenges, and capitalize on opportunities. This continuous process of review and revision helps to ensure that financial projections remain accurate and relevant, providing a reliable guide for business decision-making.

In addition, financial projections play a critical role in guiding business decisions, such as investments, funding, and resource allocation. By analyzing financial data and projections, business leaders can prioritize initiatives, manage risk, and drive growth. Financial projections also help to identify potential challenges and opportunities, enabling business leaders to develop strategies to address them.

Overall, financial projections are a vital component of a business plan, providing a roadmap for a company’s financial future. By creating accurate and comprehensive financial projections, entrepreneurs and small business owners can make informed decisions, secure funding, and drive growth. As a key element of business planning, financial projections help to ensure that companies are well-positioned for success in an increasingly competitive business environment.

How to Create Realistic Financial Projections for Your Business

Creating realistic financial projections is a critical step in developing a comprehensive business plan. To create accurate projections, entrepreneurs and small business owners must gather historical data, research industry benchmarks, and use financial modeling tools. This process involves making assumptions and estimating revenue, expenses, and cash flow.

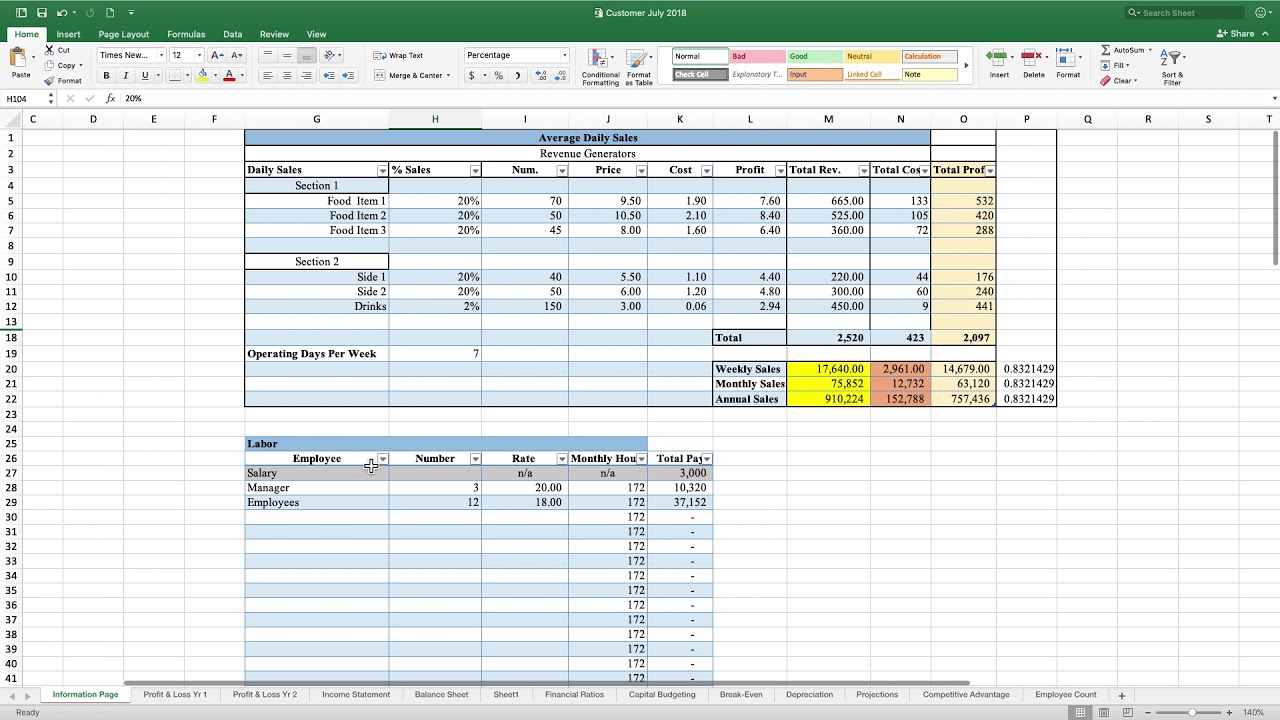

The first step in creating financial projections is to gather historical data on the company’s financial performance. This includes reviewing income statements, balance sheets, and cash flow statements to identify trends and patterns. Next, entrepreneurs and small business owners should research industry benchmarks to understand the financial performance of similar companies. This information can be used to create realistic assumptions about revenue growth, expense management, and cash flow.

Financial modeling tools, such as Excel templates and financial modeling software, can help entrepreneurs and small business owners create accurate and comprehensive financial projections. These tools enable users to create detailed financial models, including income statements, balance sheets, and cash flow statements. By using these tools, entrepreneurs and small business owners can create realistic financial projections that take into account various scenarios and assumptions.

When creating financial projections, it is essential to make realistic assumptions about revenue growth, expense management, and cash flow. This involves estimating revenue based on historical data and industry benchmarks, as well as identifying areas for cost reduction and optimization. Entrepreneurs and small business owners should also consider risks and uncertainties, such as market fluctuations and economic downturns, when creating financial projections.

Another critical aspect of creating financial projections is to estimate expenses and cash flow. This involves identifying fixed and variable costs, as well as estimating cash inflows and outflows. By creating accurate estimates of expenses and cash flow, entrepreneurs and small business owners can create realistic financial projections that take into account the company’s financial situation.

Finally, entrepreneurs and small business owners should regularly review and revise financial projections to ensure they remain accurate and relevant. This involves updating assumptions and estimates based on new information and financial performance data. By regularly reviewing and revising financial projections, entrepreneurs and small business owners can create a realistic vision for their company’s future and make informed decisions about investments, funding, and resource allocation.

Key Components of a Comprehensive Financial Projection

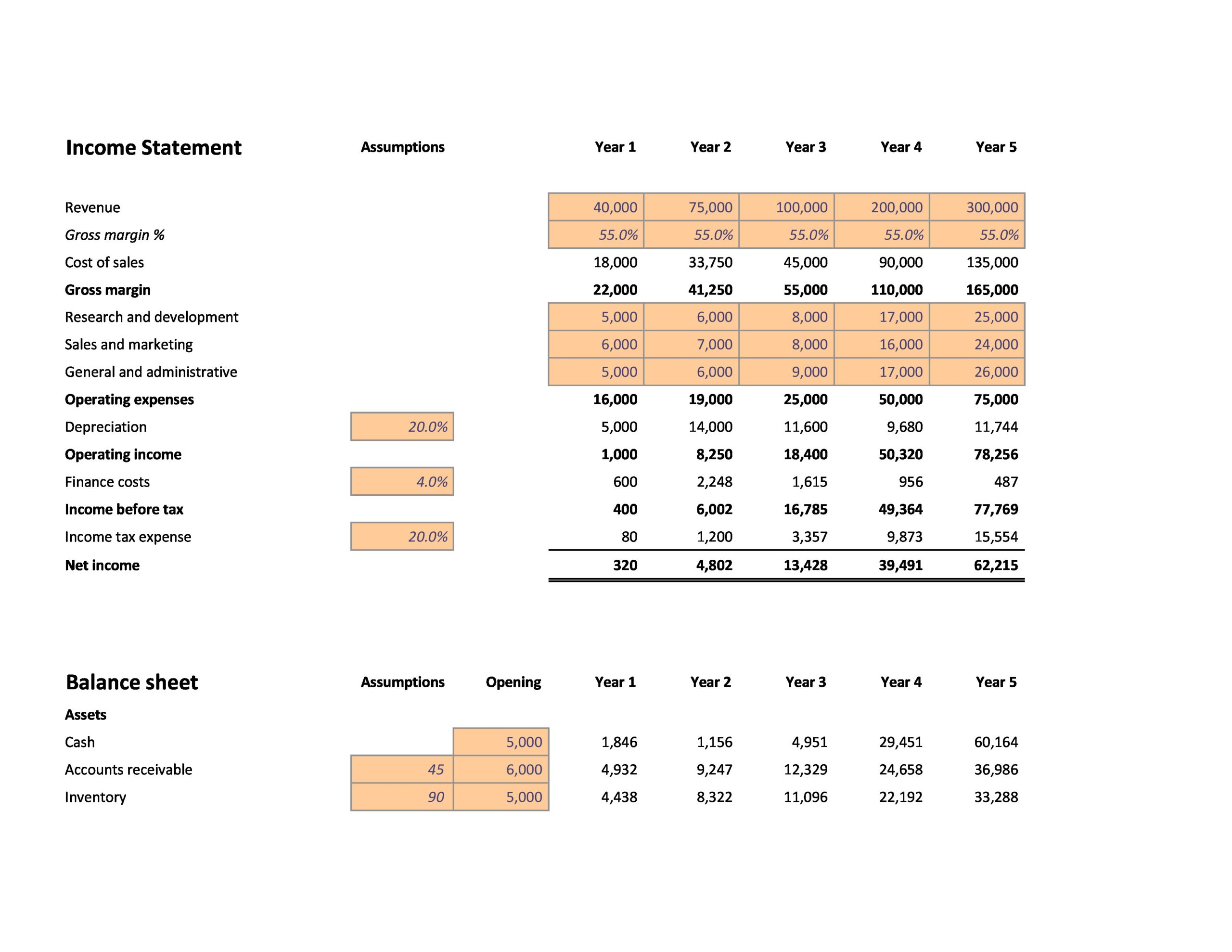

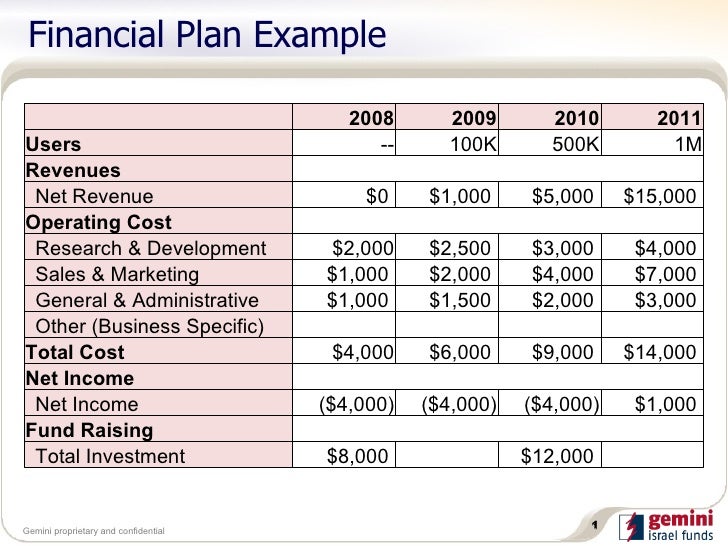

A comprehensive financial projection is a critical component of a business plan, providing a detailed picture of a company’s financial health and performance. There are three essential elements of a financial projection: income statements, balance sheets, and cash flow statements. Each component provides a unique perspective on a company’s financial situation, enabling entrepreneurs and small business owners to make informed decisions about investments, funding, and resource allocation.

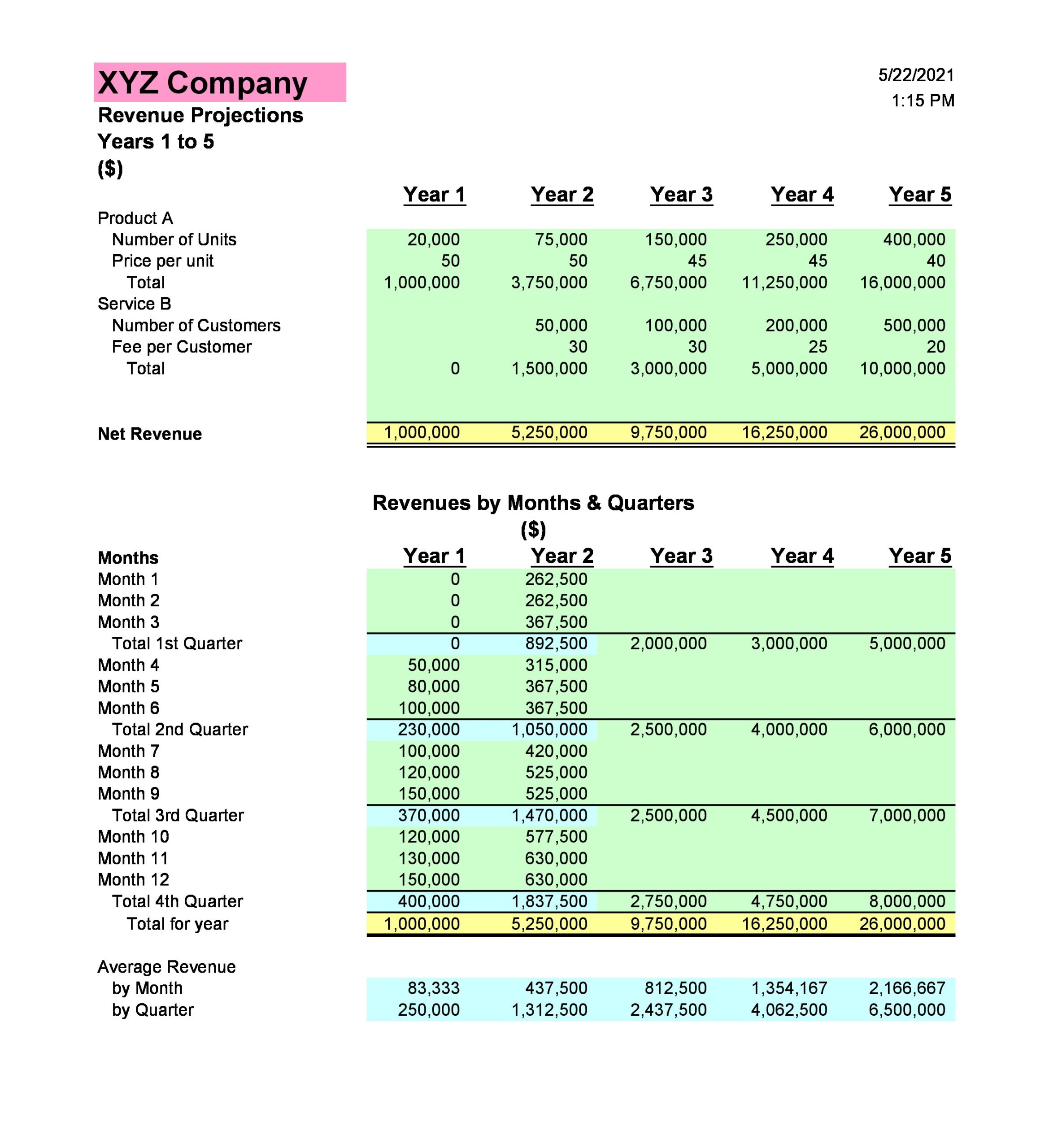

Income statements, also known as profit and loss statements, provide a snapshot of a company’s revenue and expenses over a specific period. This statement includes revenue, cost of goods sold, gross profit, operating expenses, and net income. By analyzing income statements, entrepreneurs and small business owners can identify areas for cost reduction, optimize resource allocation, and make strategic decisions about investments and expansion.

Balance sheets, on the other hand, provide a snapshot of a company’s financial position at a specific point in time. This statement includes assets, liabilities, and equity, providing a comprehensive picture of a company’s financial health. By analyzing balance sheets, entrepreneurs and small business owners can identify areas for improvement, manage risk, and make informed decisions about investments and funding.

Cash flow statements, also known as statements of cash flows, provide a detailed picture of a company’s inflows and outflows of cash over a specific period. This statement includes operating, investing, and financing activities, enabling entrepreneurs and small business owners to manage cash flow, identify areas for improvement, and make strategic decisions about investments and expansion.

Together, these three components of a financial projection provide a comprehensive picture of a company’s financial health and performance. By analyzing income statements, balance sheets, and cash flow statements, entrepreneurs and small business owners can create a realistic vision for their company’s future, make informed decisions about investments and funding, and drive growth and profitability.

In addition to these three components, a comprehensive financial projection should also include assumptions and estimates about revenue growth, expense management, and cash flow. This information should be based on historical data, industry benchmarks, and financial modeling tools, enabling entrepreneurs and small business owners to create accurate and realistic financial projections.

By including these key components in a financial projection, entrepreneurs and small business owners can create a comprehensive and accurate picture of their company’s financial health and performance. This information can be used to inform strategic business decisions, manage risk, and drive growth and profitability.

Common Mistakes to Avoid When Creating Financial Projections

Creating accurate and realistic financial projections is a critical component of a business plan. However, entrepreneurs and small business owners often make common mistakes that can lead to inaccurate projections and poor decision-making. By avoiding these mistakes, entrepreneurs and small business owners can create more accurate and comprehensive financial projections that help them achieve their business goals.

One of the most common mistakes entrepreneurs make when creating financial projections is overestimating revenue. This can lead to unrealistic expectations and poor decision-making. To avoid this mistake, entrepreneurs should base their revenue projections on historical data and industry benchmarks. They should also consider the competitive landscape and market trends when estimating revenue.

Another common mistake is underestimating expenses. This can lead to cash flow problems and poor financial management. To avoid this mistake, entrepreneurs should carefully estimate their expenses, including fixed and variable costs. They should also consider the impact of inflation and other economic factors on their expenses.

Failing to account for risks and uncertainties is another common mistake entrepreneurs make when creating financial projections. This can lead to inaccurate projections and poor decision-making. To avoid this mistake, entrepreneurs should consider the potential risks and uncertainties that may impact their business, such as market fluctuations and economic downturns. They should also develop strategies to mitigate these risks and ensure the long-term sustainability of their business.

Using unrealistic assumptions is another common mistake entrepreneurs make when creating financial projections. This can lead to inaccurate projections and poor decision-making. To avoid this mistake, entrepreneurs should base their assumptions on historical data and industry benchmarks. They should also consider the competitive landscape and market trends when making assumptions.

Not regularly reviewing and revising financial projections is another common mistake entrepreneurs make. This can lead to inaccurate projections and poor decision-making. To avoid this mistake, entrepreneurs should regularly review and revise their financial projections to ensure they remain accurate and relevant. They should also use financial performance data to refine their projections and make adjustments to their business strategies.

By avoiding these common mistakes, entrepreneurs and small business owners can create more accurate and comprehensive financial projections that help them achieve their business goals. They can also use these projections to inform strategic business decisions, manage risk, and drive growth and profitability.

Using Financial Projections to Inform Business Decisions

Financial projections are a critical component of a business plan, providing a roadmap for a company’s financial future. By using financial projections to inform business decisions, entrepreneurs and small business owners can make strategic decisions about investments, funding, and resource allocation. Financial projections can also help entrepreneurs and small business owners prioritize initiatives and manage risk.

One of the primary ways financial projections can inform business decisions is by identifying areas for cost reduction and optimization. By analyzing financial projections, entrepreneurs and small business owners can identify areas where costs can be reduced or optimized, such as streamlining operations or renegotiating contracts with suppliers. This can help improve profitability and increase competitiveness.

Financial projections can also inform business decisions about investments and funding. By analyzing financial projections, entrepreneurs and small business owners can identify areas where investments can be made to drive growth and profitability. This can include investing in new technologies, expanding into new markets, or hiring additional staff. Financial projections can also help entrepreneurs and small business owners determine the best sources of funding, such as loans, grants, or investors.

Another way financial projections can inform business decisions is by identifying areas for risk management. By analyzing financial projections, entrepreneurs and small business owners can identify areas where risks can be mitigated, such as diversifying revenue streams or developing contingency plans. This can help ensure the long-term sustainability of the business.

Financial projections can also inform business decisions about resource allocation. By analyzing financial projections, entrepreneurs and small business owners can identify areas where resources can be allocated more effectively, such as allocating more resources to high-growth areas or reducing resources in areas with low returns. This can help improve efficiency and increase competitiveness.

Finally, financial projections can inform business decisions about strategic partnerships and collaborations. By analyzing financial projections, entrepreneurs and small business owners can identify areas where strategic partnerships and collaborations can be formed to drive growth and profitability. This can include partnering with suppliers, customers, or other businesses to drive innovation and growth.

By using financial projections to inform business decisions, entrepreneurs and small business owners can make strategic decisions that drive growth and profitability. Financial projections can help entrepreneurs and small business owners prioritize initiatives, manage risk, and allocate resources more effectively. By incorporating financial projections into the decision-making process, entrepreneurs and small business owners can create a more sustainable and competitive business.

Best Practices for Presenting Financial Projections to Investors

Presenting financial projections to investors is a critical step in securing funding for a business. To effectively present financial projections, entrepreneurs and small business owners should follow best practices that showcase their financial expertise and demonstrate the potential for growth and profitability.

First, it is essential to create a clear and concise narrative that explains the financial projections. This narrative should provide context for the financial projections, including the assumptions and estimates used to create them. It should also highlight the key drivers of growth and profitability, such as revenue streams, cost structures, and market trends.

Visual aids, such as charts and graphs, can also be used to effectively present financial projections. These visual aids can help to illustrate complex financial concepts and make the financial projections more accessible to investors. They can also be used to highlight key trends and patterns in the financial data.

Another best practice for presenting financial projections is to address common questions and concerns that investors may have. This can include questions about the assumptions and estimates used to create the financial projections, as well as concerns about the potential risks and challenges facing the business. By addressing these questions and concerns, entrepreneurs and small business owners can demonstrate their financial expertise and build trust with investors.

In addition to these best practices, entrepreneurs and small business owners should also be prepared to provide additional information and support to investors. This can include providing detailed financial models, such as Excel spreadsheets, and offering to answer questions and provide updates on the business’s financial performance.

Finally, it is essential to remember that presenting financial projections to investors is not a one-time event, but rather an ongoing process. Entrepreneurs and small business owners should be prepared to regularly review and revise their financial projections, and to provide updates to investors on the business’s financial performance.

By following these best practices, entrepreneurs and small business owners can effectively present their financial projections to investors and secure the funding they need to grow and succeed. By showcasing their financial expertise and demonstrating the potential for growth and profitability, entrepreneurs and small business owners can build trust with investors and achieve their business goals.

Financial Projection Tools and Resources for Entrepreneurs

Creating accurate and comprehensive financial projections is a critical component of a business plan. To help entrepreneurs and small business owners create more accurate and comprehensive financial projections, there are a variety of tools and resources available. These tools and resources can help entrepreneurs and small business owners streamline the financial projection process, reduce errors, and create more accurate projections.

One of the most popular financial projection tools is Excel. Excel provides a variety of templates and formulas that can be used to create financial projections, including income statements, balance sheets, and cash flow statements. Excel also provides a variety of add-ins and plugins that can be used to create more advanced financial models.

Another popular financial projection tool is financial modeling software. Financial modeling software provides a variety of features and functions that can be used to create more accurate and comprehensive financial projections. These features and functions include data visualization, scenario planning, and sensitivity analysis.

Online platforms are also available to help entrepreneurs and small business owners create more accurate and comprehensive financial projections. These online platforms provide a variety of tools and resources, including financial modeling software, Excel templates, and data visualization tools.

In addition to these tools and resources, there are also a variety of financial projection templates available. These templates can be used to create more accurate and comprehensive financial projections, and can be customized to meet the specific needs of a business.

When selecting a financial projection tool or resource, entrepreneurs and small business owners should consider a variety of factors, including the level of complexity, the level of customization, and the level of support. By selecting the right tool or resource, entrepreneurs and small business owners can create more accurate and comprehensive financial projections, and can make more informed business decisions.

By using financial projection tools and resources, entrepreneurs and small business owners can create more accurate and comprehensive financial projections, and can make more informed business decisions. These tools and resources can help entrepreneurs and small business owners streamline the financial projection process, reduce errors, and create more accurate projections.

Reviewing and Revising Financial Projections: A Continuous Process

Creating business plan financial projections is not a one-time task, but rather an ongoing process that requires regular review and revision. As a business evolves, its financial projections must also adapt to reflect changes in the market, industry, and company performance. Regularly reviewing and revising financial projections ensures that they remain accurate and relevant, providing a reliable roadmap for business decision-making.

A thorough review of financial projections should be conducted at least quarterly, or as needed, to reflect significant changes in the business. This review should involve comparing actual financial performance to projected performance, identifying areas of variance, and making adjustments to projections accordingly. By regularly reviewing and revising financial projections, businesses can refine their financial models, improve forecasting accuracy, and make more informed decisions.

When reviewing financial projections, it’s essential to consider multiple scenarios, including best-case, worst-case, and most likely-case scenarios. This helps to identify potential risks and opportunities, and to develop strategies to mitigate or capitalize on them. Additionally, businesses should consider seeking input from external advisors, such as accountants or financial consultants, to provide an objective perspective on their financial projections.

Revising financial projections also provides an opportunity to reassess business strategies and goals. By analyzing actual financial performance and comparing it to projected performance, businesses can identify areas for improvement and make adjustments to their strategies to get back on track. This may involve revising revenue projections, adjusting expense budgets, or identifying new opportunities for growth.

Businesses can use various tools and techniques to review and revise financial projections, including financial modeling software, spreadsheet templates, and data analytics platforms. These tools can help to streamline the review and revision process, providing real-time insights and enabling businesses to make data-driven decisions.

In conclusion, reviewing and revising financial projections is an essential part of the business planning process. By regularly reviewing and revising financial projections, businesses can ensure that they remain accurate and relevant, providing a reliable roadmap for business decision-making. By incorporating this process into their business planning routine, businesses can improve forecasting accuracy, refine their financial models, and make more informed decisions to drive growth and success.