Why a Solid Business Plan is Key to Attracting Investors

A well-structured business plan is essential for any entrepreneur seeking funding. It serves as a roadmap for your business, outlining your goals, strategies, and financial projections. A solid business plan demonstrates to potential investors that you have a clear vision for your company and a comprehensive understanding of the market. This, in turn, helps to establish credibility and trust with investors, increasing the likelihood of securing the funding you need to grow your business.

When crafting a business plan funding request, it’s crucial to remember that investors are looking for a return on their investment. They want to know that your business has the potential for growth and profitability. A well-written business plan provides investors with the information they need to make an informed decision about your company. It should include a detailed financial projections section, a market analysis, and a management team section that highlights your team’s skills and expertise.

A business plan funding request should also demonstrate a clear understanding of your target market and the competitive landscape. This includes identifying your target audience, analyzing your competitors, and outlining your marketing and sales strategies. By providing a comprehensive overview of your business and its potential for growth, you can increase your chances of securing funding and achieving your business goals.

In addition to providing a clear and concise overview of your business, a solid business plan should also demonstrate a thorough understanding of the financial aspects of your company. This includes developing accurate and comprehensive financial projections, such as revenue projections, expense forecasts, and cash flow statements. By providing investors with a detailed financial picture of your business, you can help to establish credibility and trust, increasing the likelihood of securing the funding you need.

Ultimately, a well-structured business plan is essential for any entrepreneur seeking funding. It provides investors with the information they need to make an informed decision about your company and helps to establish credibility and trust. By crafting a comprehensive and well-written business plan, you can increase your chances of securing the funding you need to grow your business and achieve your goals.

Understanding Your Funding Options: Choosing the Right Path for Your Business

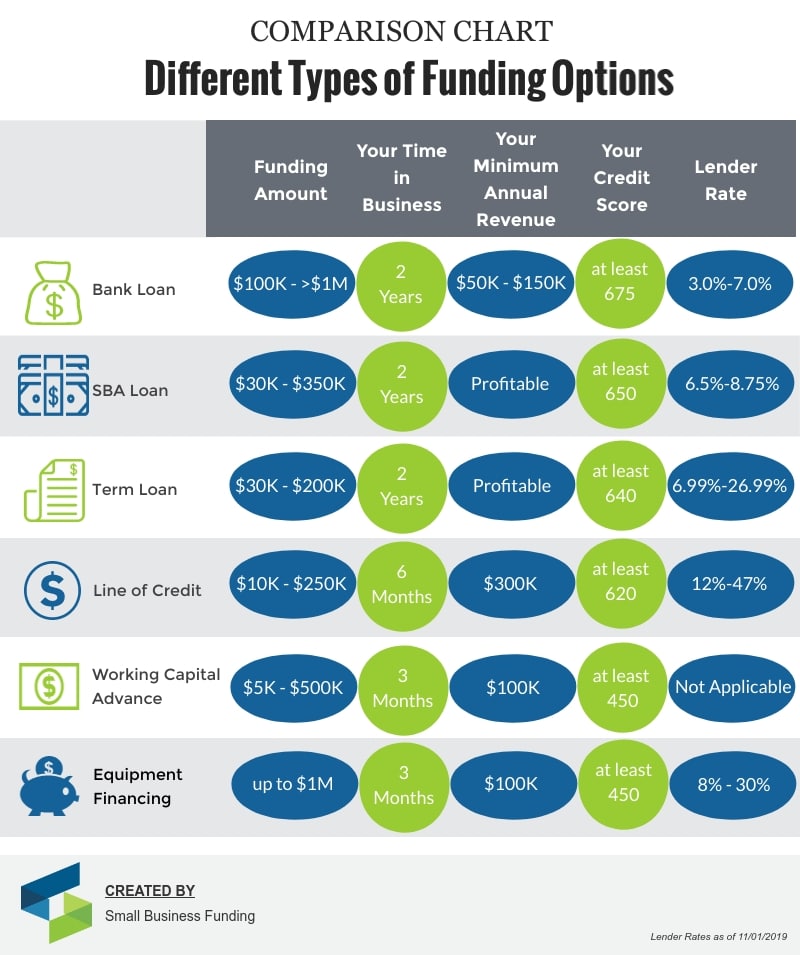

When seeking funding for your business, it’s essential to understand the various funding options available to you. Each type of funding has its own advantages and disadvantages, and choosing the right one can make all the difference in securing the funds you need to grow your business. In this section, we’ll explore the different types of funding options, including venture capital, angel investors, crowdfunding, and small business loans.

Venture capital is a type of funding that involves investors providing capital to businesses in exchange for equity. This type of funding is typically suited for businesses that have high growth potential and are looking to scale quickly. Venture capital firms often have a strong network of contacts and can provide valuable guidance and support to businesses.

Angel investors, on the other hand, are high net worth individuals who invest in businesses in exchange for equity. They often provide funding to businesses that are in the early stages of development and have high growth potential. Angel investors can provide valuable guidance and support to businesses, and can also introduce them to their network of contacts.

Crowdfunding is a type of funding that involves raising small amounts of money from a large number of people, typically through an online platform. This type of funding is often used by businesses that are looking to raise a small amount of money to launch a product or service. Crowdfunding can be a great way to validate a business idea and build a community of supporters.

Small business loans are a type of funding that involves borrowing money from a lender and repaying it with interest. This type of funding is often used by businesses that are looking to expand their operations or purchase equipment. Small business loans can be obtained from banks, credit unions, and other financial institutions.

When choosing a funding option, it’s essential to consider your business goals and needs. You should also consider the pros and cons of each funding option, including the cost of capital, the level of control you’ll have to give up, and the potential for growth. By understanding your funding options and choosing the right one, you can increase your chances of securing the funds you need to grow your business and achieve your goals.

In addition to understanding your funding options, it’s also essential to have a solid business plan in place. A business plan funding request should include a clear and concise executive summary, a detailed financial projections section, and a strong management team section. By having a solid business plan in place, you can increase your chances of securing funding and achieving your business goals.

How to Write a Compelling Executive Summary that Grabs Investors’ Attention

An executive summary is a critical component of a business plan funding request, as it provides a concise overview of your business plan and vision. A well-written executive summary can make a significant difference in grabbing the attention of potential investors and persuading them to read on. In this section, we’ll provide tips and best practices for writing a clear, concise, and compelling executive summary that effectively communicates your business plan and vision to potential investors.

When writing an executive summary, it’s essential to keep in mind that investors are busy and have limited time to review your business plan. Therefore, your executive summary should be brief, typically no more than one to two pages, and should focus on the most critical information about your business. This includes your business model, target market, competitive advantage, and financial projections.

A good executive summary should also be clear and concise, avoiding technical jargon and complex terminology. Use simple language and focus on the key points that will grab the attention of potential investors. Additionally, make sure to use a formal tone and avoid using the first-person tense, as this can come across as unprofessional.

Another critical aspect of an executive summary is to make sure it is well-organized and easy to follow. Use headings and subheadings to break up the text and make it easier to scan. This will also help to highlight the key points of your business plan and make it easier for investors to quickly understand your vision.

When it comes to the content of your executive summary, there are several key points to include. First, provide an overview of your business model, including your products or services, target market, and competitive advantage. Next, outline your financial projections, including your revenue growth, expenses, and cash flow. Finally, highlight your management team and their relevant experience and expertise.

By following these tips and best practices, you can create a compelling executive summary that grabs the attention of potential investors and persuades them to read on. Remember to keep it brief, clear, and concise, and focus on the key points that will make your business stand out. With a well-written executive summary, you can increase your chances of securing funding and achieving your business goals.

In addition to a well-written executive summary, a solid business plan funding request should also include a detailed financial projections section, a strong management team section, and a thorough market analysis. By including these components, you can provide potential investors with a comprehensive understanding of your business and its potential for growth and returns.

Creating a Realistic and Detailed Financial Projections Section

A well-crafted financial projections section is a crucial component of a business plan funding request. It provides potential investors with a clear understanding of your business’s potential for growth and returns, and helps to build credibility and trust. In this section, we’ll offer guidance on how to develop accurate and comprehensive financial projections that will help investors understand your business’s potential.

When creating your financial projections section, it’s essential to start with a clear understanding of your business model and revenue streams. This will help you to develop realistic and accurate projections that reflect your business’s potential for growth. You should also consider your expenses, including fixed and variable costs, and develop a comprehensive expense forecast.

Revenue projections are a critical component of your financial projections section. You should develop a detailed revenue forecast that outlines your projected revenue growth over a specific period, typically 3-5 years. This should include a breakdown of your revenue streams, including sales, services, and any other sources of revenue.

Expense forecasts are also essential, as they help to provide a comprehensive understanding of your business’s costs. You should develop a detailed expense forecast that outlines your projected expenses over a specific period, including fixed and variable costs. This should include a breakdown of your expenses, including salaries, rent, marketing, and any other costs associated with running your business.

Cash flow statements are another critical component of your financial projections section. They provide a clear understanding of your business’s cash inflows and outflows, and help to identify any potential cash flow problems. You should develop a comprehensive cash flow statement that outlines your projected cash inflows and outflows over a specific period.

When developing your financial projections section, it’s essential to use realistic and conservative assumptions. You should avoid making overly optimistic projections, as this can damage your credibility and trust with potential investors. Instead, focus on developing realistic and achievable projections that reflect your business’s potential for growth and returns.

By following these tips and best practices, you can create a comprehensive and realistic financial projections section that will help to build credibility and trust with potential investors. Remember to use realistic and conservative assumptions, and focus on developing accurate and comprehensive projections that reflect your business’s potential for growth and returns.

A well-crafted financial projections section is just one component of a successful business plan funding request. By combining this with a clear and concise executive summary, a strong management team section, and a thorough market analysis, you can increase your chances of securing funding and achieving your business goals.

Developing a Strong Management Team Section that Inspires Confidence

A well-crafted management team section is a crucial component of a business plan funding request. It provides potential investors with a clear understanding of your team’s skills, expertise, and track record of success, and helps to build credibility and trust. In this section, we’ll discuss the importance of showcasing a strong and experienced management team in your business plan, and provide advice on how to highlight your team’s strengths.

When developing your management team section, it’s essential to start with a clear understanding of your team’s strengths and weaknesses. You should identify the key members of your team, including their roles, responsibilities, and relevant experience. This will help you to create a comprehensive and accurate picture of your team’s capabilities.

One of the most important aspects of your management team section is to highlight your team’s relevant experience and expertise. You should provide specific examples of your team’s achievements and successes, and explain how their skills and expertise will help to drive your business forward. This will help to build credibility and trust with potential investors, and demonstrate your team’s ability to execute your business plan.

Another critical aspect of your management team section is to showcase your team’s leadership and management skills. You should provide examples of your team’s leadership experience, including their ability to motivate and inspire others, and their track record of success in managing teams and projects. This will help to demonstrate your team’s ability to lead and manage your business, and build confidence with potential investors.

When presenting your management team section, it’s essential to use a clear and concise format. You should use headings and subheadings to break up the text, and provide a brief summary of each team member’s experience and expertise. This will help to make your management team section easy to read and understand, and provide a clear picture of your team’s strengths and capabilities.

By following these tips and best practices, you can create a strong and effective management team section that inspires confidence with potential investors. Remember to highlight your team’s relevant experience and expertise, showcase your team’s leadership and management skills, and use a clear and concise format to present your team’s information.

A well-crafted management team section is just one component of a successful business plan funding request. By combining this with a clear and concise executive summary, a comprehensive financial projections section, and a thorough market analysis, you can increase your chances of securing funding and achieving your business goals.

How to Use Market Analysis to Demonstrate Your Business’s Potential for Growth

Conducting thorough market research and analysis is a crucial step in demonstrating your business’s potential for growth and competitiveness in the market. A well-crafted market analysis section can help to build credibility and trust with potential investors, and provide a clear understanding of your business’s potential for success. In this section, we’ll explain the importance of conducting thorough market research and analysis, and provide guidance on how to use this information to demonstrate your business’s potential for growth.

When conducting market research and analysis, it’s essential to start with a clear understanding of your target market. You should identify your target audience, including their demographics, needs, and preferences. This will help you to develop a comprehensive understanding of your market and identify opportunities for growth.

One of the most important aspects of market research and analysis is to identify your competitors and assess their strengths and weaknesses. You should analyze their market share, revenue, and growth rate, and identify areas where you can differentiate your business and gain a competitive advantage. This will help you to develop a comprehensive understanding of your competitive landscape and identify opportunities for growth.

Another critical aspect of market research and analysis is to assess the overall market size and growth potential. You should analyze the market trends, including the growth rate, market size, and potential for expansion. This will help you to develop a comprehensive understanding of your market’s potential for growth and identify opportunities for expansion.

When presenting your market analysis section, it’s essential to use a clear and concise format. You should use headings and subheadings to break up the text, and provide a brief summary of your market research and analysis. This will help to make your market analysis section easy to read and understand, and provide a clear picture of your business’s potential for growth.

By following these tips and best practices, you can create a comprehensive and effective market analysis section that demonstrates your business’s potential for growth and competitiveness in the market. Remember to conduct thorough market research and analysis, identify your competitors and assess their strengths and weaknesses, and assess the overall market size and growth potential.

A well-crafted market analysis section is just one component of a successful business plan funding request. By combining this with a clear and concise executive summary, a comprehensive financial projections section, and a strong management team section, you can increase your chances of securing funding and achieving your business goals.

Tips for Submitting a Winning Funding Request: What Investors Look for in a Business Plan

When submitting a business plan funding request, it’s essential to understand what investors are looking for in a business plan. A well-crafted business plan can make all the difference in securing funding, and a poorly written plan can lead to rejection. In this section, we’ll provide tips and advice on how to submit a successful funding request, including how to tailor your business plan to your target investors, how to follow up with investors, and how to be prepared to answer common questions and address concerns.

One of the most important things to consider when submitting a funding request is to tailor your business plan to your target investors. Different investors have different priorities and focus areas, so it’s essential to understand what they are looking for in a business plan. Research your target investors and understand their investment criteria, and make sure your business plan addresses their specific needs and concerns.

Another critical aspect of submitting a funding request is to follow up with investors. After submitting your business plan, it’s essential to follow up with investors to ensure they have received your plan and to answer any questions they may have. This will help to build a relationship with investors and increase your chances of securing funding.

When preparing to submit a funding request, it’s also essential to be prepared to answer common questions and address concerns. Investors will typically have questions about your business plan, such as your revenue projections, market size, and competitive landscape. Be prepared to answer these questions and provide additional information to support your business plan.

In addition to these tips, it’s also essential to make sure your business plan is well-written and free of errors. A poorly written plan can lead to rejection, so make sure to proofread your plan multiple times and have others review it as well.

By following these tips and advice, you can increase your chances of submitting a successful funding request and securing the funding you need to grow your business. Remember to tailor your business plan to your target investors, follow up with investors, and be prepared to answer common questions and address concerns.

A well-crafted business plan funding request is just one component of a successful funding strategy. By combining this with a solid business plan, a strong management team, and a clear understanding of your market, you can increase your chances of securing funding and achieving your business goals.

Common Mistakes to Avoid When Crafting a Business Plan Funding Request

When crafting a business plan funding request, there are several common mistakes that entrepreneurs make that can lead to rejection. In this section, we’ll discuss some of the most common mistakes and provide guidance on how to avoid them and increase your chances of success.

One of the most common mistakes is a lack of clarity in the business plan. Investors need to be able to quickly and easily understand your business plan and vision, so it’s essential to make sure your plan is clear and concise. Avoid using technical jargon or complex terminology that may be difficult for investors to understand.

Another common mistake is unrealistic projections. Investors want to see realistic and achievable projections that are based on solid market research and analysis. Avoid making overly optimistic projections that may be difficult to achieve, as this can lead to skepticism and rejection.

Poor presentation is also a common mistake. Investors are busy and have limited time to review your business plan, so it’s essential to make sure your plan is well-presented and easy to read. Use headings and subheadings to break up the text, and make sure your plan is free of errors and typos.

Not having a strong management team is also a common mistake. Investors want to see a strong and experienced management team that has the skills and expertise to execute the business plan. Make sure to highlight your team’s strengths and achievements, and provide a clear explanation of how your team will drive the business forward.

Not having a clear understanding of the market is also a common mistake. Investors want to see a clear understanding of the market and the competitive landscape, so make sure to conduct thorough market research and analysis. Provide a clear explanation of your target market, and how you plan to differentiate your business from the competition.

By avoiding these common mistakes, you can increase your chances of success and secure the funding you need to grow your business. Remember to keep your business plan clear and concise, make realistic projections, present your plan well, have a strong management team, and have a clear understanding of the market.

A well-crafted business plan funding request is just one component of a successful funding strategy. By combining this with a solid business plan, a strong management team, and a clear understanding of the market, you can increase your chances of securing funding and achieving your business goals.