Understanding the Basics of Corporate Entities: C Corp vs S Corp

A C corporation (C corp) and an S corporation (S corp) are two of the most common types of corporate entities in the United States. While both offer liability protection and tax benefits, they differ in their definitions, advantages, and disadvantages. Understanding these differences is crucial for business owners to make informed decisions about their company’s structure.

A C corp is a traditional corporation that is taxed on its profits at the corporate level. This means that the corporation pays taxes on its income, and then the shareholders pay taxes again on the dividends they receive. C corps are often used by large, publicly traded companies, as they offer the ability to raise capital through the sale of stock. The history of C corps dates back to the late 19th century, when the first corporations were formed in the United States. The purpose of a C corp is to provide a separate legal entity from its owners, offering liability protection and tax benefits.

An S corp, on the other hand, is a pass-through entity, meaning that the corporation’s income is only taxed at the individual level. This avoids the double taxation that occurs with C corps. S corps are often used by small businesses and family-owned companies, as they offer flexibility in ownership structure and tax benefits. The S corp was introduced in 1958 as a way to provide small businesses with the same liability protection as C corps, but with more favorable tax treatment.

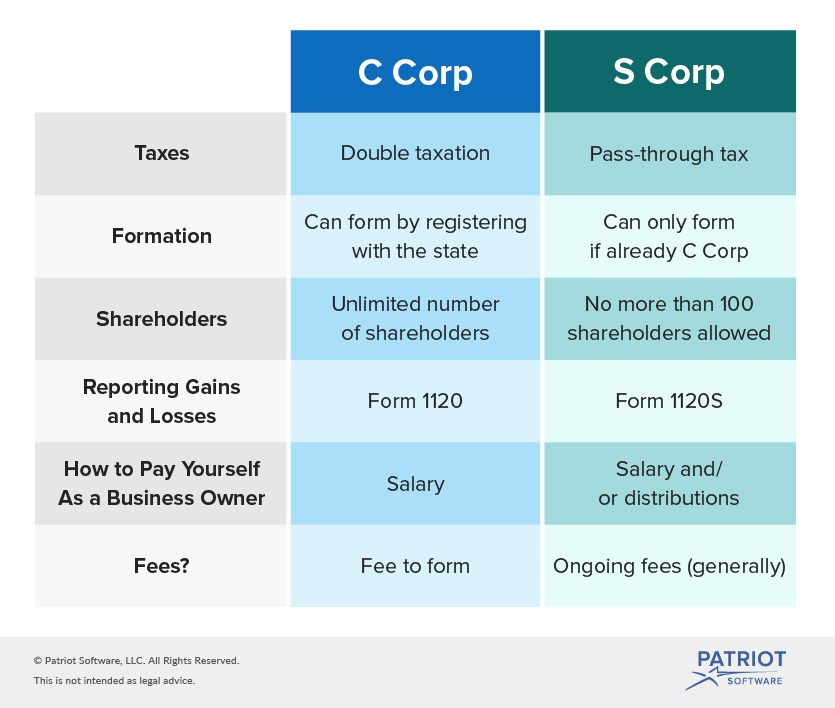

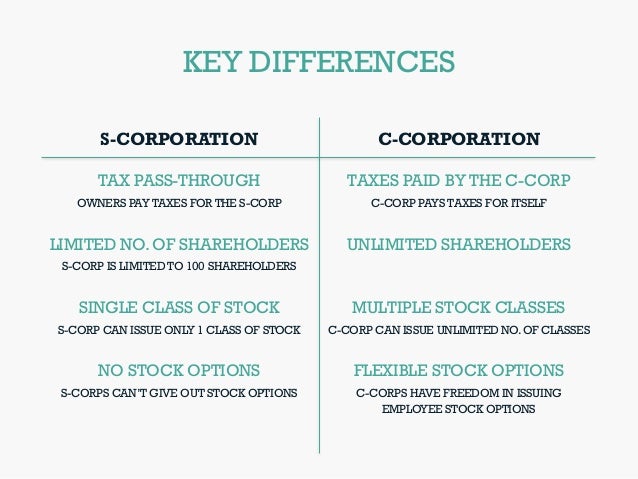

The advantages of a C corp include the ability to raise capital through the sale of stock, as well as the ability to deduct business expenses on the corporate tax return. However, the double taxation of C corps can be a significant disadvantage. The advantages of an S corp include pass-through taxation, which avoids double taxation, as well as flexibility in ownership structure. However, S corps are limited to 100 shareholders, and all shareholders must be U.S. citizens or resident aliens.

In conclusion, C corps and S corps are two distinct types of corporate entities, each with their own advantages and disadvantages. Understanding these differences is crucial for business owners to make informed decisions about their company’s structure. By considering factors such as tax implications, ownership structure, and liability protection, business owners can choose the entity type that best suits their needs.

How to Determine Which Entity is Best for Your Business: C Corp vs S Corp

When deciding between a C corp and an S corp, there are several key factors to consider. These factors include tax implications, ownership structure, and liability protection. By carefully evaluating these factors, business owners can make an informed decision about which entity type is best for their company.

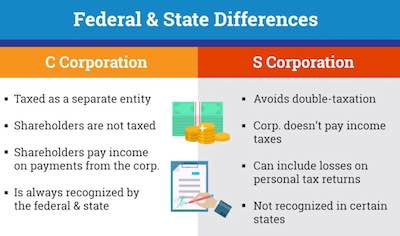

Tax implications are a critical consideration when choosing between a C corp and an S corp. C corps are subject to double taxation, meaning that the corporation pays taxes on its profits, and then the shareholders pay taxes again on the dividends they receive. In contrast, S corps are pass-through entities, meaning that the corporation’s income is only taxed at the individual level. This can result in significant tax savings for S corp shareholders.

Ownership structure is another important factor to consider. C corps can have an unlimited number of shareholders, and shareholders can be individuals, corporations, or other entities. S corps, on the other hand, are limited to 100 shareholders, and all shareholders must be U.S. citizens or resident aliens. Additionally, S corps are restricted from having multiple classes of stock, which can limit their ability to raise capital.

Liability protection is also an important consideration. Both C corps and S corps offer liability protection, meaning that the shareholders’ personal assets are protected in the event of a lawsuit or other liability. However, C corps may offer more comprehensive liability protection, as they are generally considered to be more formal and structured than S corps.

Examples of businesses that may be well-suited for a C corp include large, publicly traded companies, companies that plan to raise capital through the sale of stock, and companies that have a complex ownership structure. Examples of businesses that may be well-suited for an S corp include small businesses, family-owned companies, and companies that want to avoid double taxation.

In addition to these factors, business owners should also consider their company’s specific needs and goals. For example, if a company plans to raise capital through the sale of stock, a C corp may be a better choice. On the other hand, if a company wants to avoid double taxation and has a simple ownership structure, an S corp may be a better choice.

Ultimately, the decision between a C corp and an S corp depends on a variety of factors, including tax implications, ownership structure, and liability protection. By carefully evaluating these factors and considering their company’s specific needs and goals, business owners can make an informed decision about which entity type is best for their company.

Taxation: A Key Differentiator Between C Corps and S Corps

One of the most significant differences between C corps and S corps is the way they are taxed. C corps are subject to double taxation, meaning that the corporation pays taxes on its profits, and then the shareholders pay taxes again on the dividends they receive. This can result in a significant tax burden for C corp shareholders.

In contrast, S corps are pass-through entities, meaning that the corporation’s income is only taxed at the individual level. This means that S corp shareholders only pay taxes on their share of the corporation’s profits, and not on the corporation’s profits as a whole. This can result in significant tax savings for S corp shareholders.

The tax implications of C corps and S corps can have a significant impact on a business’s bottom line. For example, if a C corp has a profit of $100,000, the corporation will pay taxes on that profit, and then the shareholders will pay taxes again on the dividends they receive. This can result in a total tax burden of 40% or more, depending on the tax rates applicable to the corporation and its shareholders.

In contrast, if an S corp has a profit of $100,000, the corporation will not pay taxes on that profit. Instead, the shareholders will pay taxes on their share of the corporation’s profits, at their individual tax rates. This can result in a significantly lower tax burden for S corp shareholders, especially if they are in a lower tax bracket than the corporation.

It’s worth noting that the Tax Cuts and Jobs Act (TCJA) has had a significant impact on the taxation of C corps and S corps. The TCJA lowered the corporate tax rate to 21%, which can make C corps more attractive to some businesses. However, the TCJA also limited the state and local tax (SALT) deduction, which can make S corps more attractive to businesses that are subject to high state and local taxes.

Ultimately, the tax implications of C corps and S corps will depend on the specific circumstances of each business. Business owners should consult with a tax professional to determine which entity type is best for their business, based on their individual tax situation and goals.

In addition to the tax implications, business owners should also consider the other differences between C corps and S corps, such as ownership structure, liability protection, and management requirements. By carefully evaluating these factors, business owners can make an informed decision about which entity type is best for their business.

Ownership and Control: Understanding the Differences Between C Corps and S Corps

When it comes to ownership and control, C corps and S corps have distinct structures that can impact decision-making and management. Understanding these differences is crucial for business owners to determine which entity type is best for their company.

C corps have a more formal ownership structure, with shareholders, directors, and officers playing distinct roles. Shareholders own the corporation and elect the board of directors, who are responsible for making major decisions. Officers, such as the CEO and CFO, are responsible for the day-to-day operations of the corporation. This structure allows for a clear separation of powers and can provide a high level of accountability.

S corps, on the other hand, have a more flexible ownership structure. Shareholders can also serve as directors and officers, and there are no restrictions on the number of shareholders or their roles. This structure can provide more autonomy for business owners, but can also lead to conflicts of interest and a lack of accountability.

The role of shareholders is also different between C corps and S corps. In a C corp, shareholders have limited liability and are not personally responsible for the corporation’s debts. In an S corp, shareholders have limited liability, but may be personally responsible for certain debts, such as payroll taxes.

The board of directors plays a critical role in both C corps and S corps. In a C corp, the board is responsible for making major decisions, such as electing officers and approving major transactions. In an S corp, the board may have more limited powers, but is still responsible for overseeing the corporation’s operations.

Officers, such as the CEO and CFO, play a key role in both C corps and S corps. They are responsible for the day-to-day operations of the corporation and may have significant decision-making authority. However, in a C corp, officers may have more limited powers than in an S corp, where they may have more autonomy.

Ultimately, the ownership and control structure of a C corp or S corp will depend on the specific needs and goals of the business. Business owners should carefully consider these factors when deciding which entity type is best for their company.

In addition to the ownership and control structure, business owners should also consider the tax implications, liability protection, and management requirements of C corps and S corps. By carefully evaluating these factors, business owners can make an informed decision about which entity type is best for their business.

Liability Protection: A Critical Consideration in the C Corp vs S Corp Debate

One of the most important considerations when deciding between a C corp and an S corp is liability protection. Both entity types offer liability protection, but there are key differences in the level of protection offered and the circumstances under which it applies.

C corps offer a high level of liability protection, shielding shareholders, directors, and officers from personal liability for the corporation’s debts and obligations. This means that if the corporation is sued or incurs debt, the individuals involved in the corporation are generally not personally responsible for paying those debts.

S corps also offer liability protection, but it is not as comprehensive as that offered by C corps. Shareholders, directors, and officers of an S corp are generally not personally responsible for the corporation’s debts and obligations, but there are some exceptions. For example, if an S corp shareholder or officer personally guarantees a loan or commits a tort, they may be personally liable for the resulting debt or damages.

The concept of piercing the corporate veil is also relevant to liability protection. This occurs when a court ignores the corporate entity and holds the shareholders, directors, or officers personally liable for the corporation’s debts or obligations. This can happen if the corporation is found to be a sham or if the individuals involved in the corporation have commingled personal and corporate assets.

Liability protection is a critical consideration for businesses that operate in high-risk industries or that have significant assets to protect. For example, a business that operates in the construction industry may want to consider forming a C corp to protect its shareholders and officers from personal liability in the event of an accident or lawsuit.

On the other hand, a business that operates in a low-risk industry and has few assets to protect may not need the same level of liability protection. In this case, an S corp may be a more suitable choice, as it offers more flexibility in terms of ownership structure and taxation.

Ultimately, the level of liability protection offered by a C corp or S corp will depend on the specific circumstances of the business. Business owners should carefully consider their liability protection needs and consult with a professional advisor to determine the best course of action for their specific business needs.

Conversion and Termination: What You Need to Know About C Corps and S Corps

As a business owner, it’s essential to understand the process of converting from one entity type to another, as well as the procedures for terminating a C corp or S corp. This knowledge can help you make informed decisions about your business and avoid potential pitfalls.

Converting from a C corp to an S corp is a relatively straightforward process. To convert, the corporation must file Form 2553 with the IRS and meet certain eligibility requirements, such as having no more than 100 shareholders and only one class of stock. The conversion must also be approved by the corporation’s shareholders.

Converting from an S corp to a C corp is also possible, but it’s a more complex process. To convert, the corporation must file Form 1120 with the IRS and meet certain eligibility requirements, such as having a minimum number of shareholders and a certain level of assets. The conversion must also be approved by the corporation’s shareholders.

Terminating a C corp or S corp is also a complex process that requires careful consideration. To terminate a C corp, the corporation must file Form 1120 with the IRS and meet certain eligibility requirements, such as having no assets or liabilities. The termination must also be approved by the corporation’s shareholders.

Terminating an S corp is similar to terminating a C corp, but there are some additional requirements. To terminate an S corp, the corporation must file Form 1120S with the IRS and meet certain eligibility requirements, such as having no assets or liabilities. The termination must also be approved by the corporation’s shareholders.

The potential implications of converting or terminating a C corp or S corp are significant. For example, converting from a C corp to an S corp can result in significant tax savings, but it may also limit the corporation’s ability to raise capital. Terminating a C corp or S corp can result in significant tax liabilities, but it may also provide an opportunity to restructure the business and avoid potential pitfalls.

Ultimately, the decision to convert or terminate a C corp or S corp should be made after careful consideration of the potential implications. Business owners should consult with a professional advisor to determine the best course of action for their specific business needs.

In addition to the conversion and termination process, business owners should also consider the tax implications of these actions. For example, converting from a C corp to an S corp may result in significant tax savings, but it may also trigger certain tax liabilities. Terminating a C corp or S corp may also result in significant tax liabilities, but it may also provide an opportunity to restructure the business and avoid potential pitfalls.

Real-World Examples: C Corps and S Corps in Action

To illustrate the key concepts and takeaways from this article, let’s consider some real-world examples of businesses that have successfully utilized C corps and S corps.

Example 1: Apple Inc. (C Corp)

Apple Inc. is a well-known example of a successful C corp. As a C corp, Apple is able to raise capital through the sale of stock, which has enabled the company to invest in research and development and expand its operations globally. Apple’s C corp structure also provides liability protection for its shareholders, which is important for a company that operates in a highly competitive and litigious industry.

Example 2: Patagonia (S Corp)

Patagonia is a successful outdoor apparel company that has chosen to operate as an S corp. As an S corp, Patagonia is able to pass corporate income, losses, and tax deductions through to its shareholders, which can provide tax benefits. Patagonia’s S corp structure also allows the company to maintain a high level of control and flexibility, which is important for a company that values environmental responsibility and sustainability.

Example 3: Amazon (C Corp)

Amazon is a highly successful e-commerce company that has chosen to operate as a C corp. As a C corp, Amazon is able to raise capital through the sale of stock, which has enabled the company to invest in new technologies and expand its operations globally. Amazon’s C corp structure also provides liability protection for its shareholders, which is important for a company that operates in a highly competitive and rapidly changing industry.

Example 4: REI (S Corp)

REI is a successful outdoor retailer that has chosen to operate as an S corp. As an S corp, REI is able to pass corporate income, losses, and tax deductions through to its shareholders, which can provide tax benefits. REI’s S corp structure also allows the company to maintain a high level of control and flexibility, which is important for a company that values customer service and community involvement.

These examples illustrate the different ways in which C corps and S corps can be used to achieve business goals. By considering the advantages and disadvantages of each entity type, business owners can make informed decisions about which structure is best for their company.

Conclusion: Making an Informed Decision Between a C Corp and an S Corp

Choosing the right business structure is a critical decision that can have significant implications for your company’s success. When deciding between a C corp and an S corp, it’s essential to consider the key factors discussed in this article, including tax implications, ownership structure, liability protection, and conversion and termination procedures.

By understanding the advantages and disadvantages of each entity type, you can make an informed decision that aligns with your business goals and objectives. It’s also important to consult with a professional advisor to determine the best course of action for your specific business needs.

In conclusion, the decision between a C corp and an S corp depends on various factors, including the size and complexity of your business, your tax situation, and your ownership structure. By carefully evaluating these factors and considering the key differences between C corps and S corps, you can make an informed decision that sets your business up for success.

Remember, choosing the right business structure is just the first step in building a successful company. It’s essential to continue to monitor and adapt your business structure as your company grows and evolves.

By following the guidance outlined in this article, you can make an informed decision between a C corp and an S corp and set your business up for long-term success.