Understanding the Basics of Car Loan Interest Rates

Car loan interest rates are a crucial aspect of the car buying process, as they can significantly impact the total cost of owning a vehicle. To calculate car loan interest rate, it’s essential to understand the basics of how interest rates work. In this section, we’ll delve into the world of car loan interest rates, exploring the different types of interest rates, how they’re calculated, and the factors that affect them.

There are two primary types of car loan interest rates: fixed and variable. A fixed interest rate remains the same throughout the loan term, while a variable interest rate can fluctuate based on market conditions. Understanding the difference between these two types of interest rates is vital to making informed decisions when calculating car loan interest rates.

The interest rate on a car loan is calculated as a percentage of the loan amount, and it’s usually expressed as an annual percentage rate (APR). The APR takes into account the interest rate, fees, and other charges associated with the loan. To calculate car loan interest rate, lenders use a formula that considers the loan amount, interest rate, loan term, and other factors.

Several factors can affect car loan interest rates, including the borrower’s credit score, loan term, and type of vehicle being financed. A good credit score can lead to lower interest rates, while a poor credit score can result in higher rates. Additionally, longer loan terms can increase the total interest paid over the life of the loan.

When calculating car loan interest rates, it’s essential to consider the total cost of ownership, including the loan amount, interest rate, and other expenses such as insurance, fuel, and maintenance. By understanding the basics of car loan interest rates, borrowers can make informed decisions and avoid costly mistakes.

How to Calculate Your Car Loan Interest Rate: A Step-by-Step Guide

Calculating your car loan interest rate is a crucial step in determining the total cost of owning a vehicle. To calculate car loan interest rate, you’ll need to understand the formula and have access to the right tools. In this section, we’ll provide a step-by-step guide on how to calculate car loan interest rates, including examples and online tools that can be used.

The formula to calculate car loan interest rate is: Interest Rate = (Loan Amount x Rate x Time) / 100. Where:

- Loan Amount is the total amount borrowed

- Rate is the annual interest rate (in decimal form)

- Time is the loan term (in years)

For example, let’s say you borrow $20,000 at an annual interest rate of 6% for 5 years. Using the formula, the interest rate would be: Interest Rate = ($20,000 x 0.06 x 5) / 100 = $6,000.

There are also online tools available that can help you calculate car loan interest rates, such as car loan calculators and spreadsheets. These tools can save you time and effort, and provide you with a more accurate calculation.

Some popular online tools for calculating car loan interest rates include:

- Car loan calculators: These tools allow you to input the loan amount, interest rate, and loan term, and provide you with the total interest paid and monthly payments.

- Spreadsheets: These tools allow you to create a customized spreadsheet to calculate car loan interest rates, and provide you with a detailed breakdown of the costs.

Understanding how to calculate car loan interest rates is essential to making informed decisions when buying a car. By using the formula and online tools, you can determine the total cost of owning a vehicle and make a more informed decision.

The Impact of Credit Score on Car Loan Interest Rates

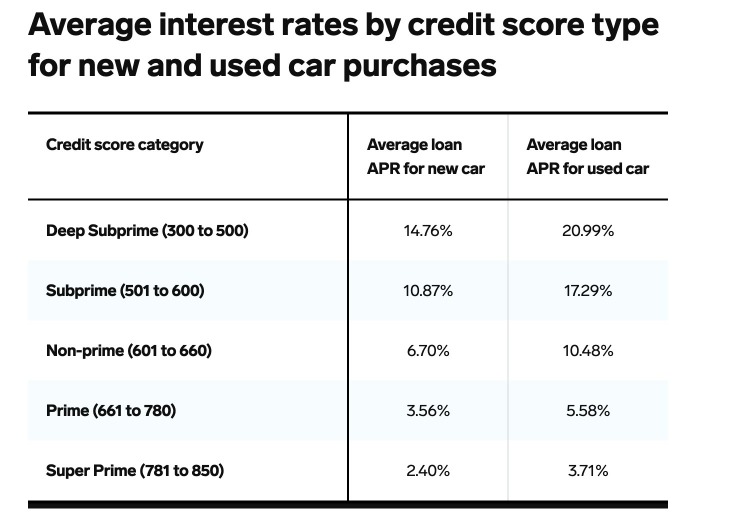

Credit score plays a significant role in determining the interest rate on a car loan. A good credit score can lead to lower interest rates, while a poor credit score can result in higher interest rates. This is because lenders view borrowers with good credit scores as less risky and more likely to repay the loan on time.

A credit score is a three-digit number that represents an individual’s creditworthiness. It is calculated based on their credit history, payment history, and other factors. In the United States, credit scores range from 300 to 850, with higher scores indicating better credit.

When applying for a car loan, lenders typically use credit scores to determine the interest rate. Borrowers with excellent credit scores (720 and above) can qualify for the lowest interest rates, while those with poor credit scores (620 and below) may be charged higher interest rates.

For example, a borrower with a credit score of 750 may qualify for an interest rate of 4.5% on a $20,000 car loan, while a borrower with a credit score of 600 may be charged an interest rate of 7.5%. This difference in interest rates can result in significant savings over the life of the loan.

To give you a better idea, here’s a breakdown of how credit scores can affect car loan interest rates:

| Credit Score | Interest Rate |

|---|---|

| 720 and above | 4.5% – 5.5% |

| 660-719 | 5.5% – 6.5% |

| 620-659 | 6.5% – 7.5% |

| 580-619 | 7.5% – 8.5% |

| 500-579 | 8.5% – 9.5% |

| Below 500 | 9.5% – 10.5% |

As you can see, a good credit score can make a significant difference in the interest rate you qualify for. If you’re planning to apply for a car loan, it’s essential to check your credit score and work on improving it if necessary.

Here are some tips to improve your credit score:

- Make on-time payments: Payment history accounts for 35% of your credit score, so making timely payments is crucial.

- Keep credit utilization low: Keep your credit utilization ratio below 30% to show lenders you can manage your debt responsibly.

- Monitor your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date.

- Avoid new credit inquiries: Applying for multiple credit cards or loans in a short period can negatively affect your credit score.

By following these tips and maintaining a good credit score, you can qualify for lower interest rates on your car loan and save money over the life of the loan.

Comparing Car Loan Interest Rates: What to Look for

When shopping for a car loan, it’s essential to compare interest rates from different lenders to find the best deal. Comparing rates can help you save money on interest payments and ensure you’re getting a fair deal. In this section, we’ll discuss the importance of comparing car loan interest rates and provide a checklist of factors to consider when comparing rates.

Why Compare Car Loan Interest Rates?

Comparing car loan interest rates can help you:

- Save money on interest payments: Even a small difference in interest rates can result in significant savings over the life of the loan.

- Get a better loan term: Comparing rates can help you find a loan with a longer or shorter term, depending on your needs.

- Avoid hidden fees: Some lenders may charge hidden fees, such as origination fees or prepayment penalties. Comparing rates can help you avoid these fees.

Checklist for Comparing Car Loan Interest Rates

When comparing car loan interest rates, consider the following factors:

- APR (Annual Percentage Rate): The APR includes the interest rate, fees, and other charges. Look for the lowest APR to ensure you’re getting the best deal.

- Loan term: Consider the length of the loan and how it affects your monthly payments and total interest paid.

- Fees: Look for lenders with low or no fees, such as origination fees, prepayment penalties, or late payment fees.

- Repayment terms: Consider the repayment terms, including the monthly payment amount and the total interest paid over the life of the loan.

- Lender reputation: Research the lender’s reputation and read reviews from other customers to ensure you’re working with a reputable lender.

Where to Compare Car Loan Interest Rates

You can compare car loan interest rates from various lenders, including:

- Banks: Traditional banks offer car loans with competitive interest rates and terms.

- Credit unions: Credit unions are member-owned financial cooperatives that offer car loans with favorable terms and rates.

- Online lenders: Online lenders offer car loans with competitive rates and terms, often with faster application and approval processes.

- Dealerships: Dealerships may offer financing options with competitive rates and terms, but be sure to compare rates from other lenders to ensure you’re getting the best deal.

Tools for Comparing Car Loan Interest Rates

There are several online tools and resources available to help you compare car loan interest rates, including:

- Car loan calculators: Online calculators can help you calculate your monthly payments and total interest paid based on different interest rates and loan terms.

- Rate comparison websites: Websites like Bankrate, NerdWallet, and LendingTree allow you to compare car loan interest rates from multiple lenders.

- Lender websites: Many lenders offer online tools and resources to help you compare rates and terms.

By comparing car loan interest rates and considering the factors outlined above, you can find the best deal and save money on your car loan.

Car Loan Interest Rate Scenarios: Real-Life Examples

To illustrate the impact of different interest rates on car loan payments, let’s consider some real-life scenarios. We’ll use a car loan calculator to calculate the monthly payments and total interest paid for each scenario.

Scenario 1: $20,000 Car Loan with a 5-Year Term

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 4.5% | $377 | $2,441 |

| 5.5% | $404 | $3,141 |

| 6.5% | $433 | $3,841 |

As you can see, a 1% increase in interest rate can result in a $27 increase in monthly payment and $700 more in total interest paid over the life of the loan.

Scenario 2: $30,000 Car Loan with a 7-Year Term

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 5.0% | $433 | $4,311 |

| 6.0% | $471 | $5,511 |

| 7.0% | $512 | $6,711 |

In this scenario, a 1% increase in interest rate can result in a $38 increase in monthly payment and $1,200 more in total interest paid over the life of the loan.

Scenario 3: $40,000 Car Loan with a 10-Year Term

| Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|

| 6.0% | $444 | $7,441 |

| 7.0% | $491 | $9,141 |

| 8.0% | $541 | $10,841 |

In this scenario, a 1% increase in interest rate can result in a $47 increase in monthly payment and $1,700 more in total interest paid over the life of the loan.

These scenarios illustrate the importance of calculating car loan interest rates and considering the impact of different interest rates on your monthly payments and total interest paid. By using a car loan calculator and comparing rates from different lenders, you can make informed decisions and save money on your car loan.

Negotiating Car Loan Interest Rates: Tips and Strategies

Negotiating car loan interest rates can be a daunting task, but it’s essential to get the best deal possible. By understanding how to negotiate, you can save money on your car loan and make your monthly payments more manageable. In this section, we’ll provide tips and strategies for negotiating car loan interest rates with lenders.

Know Your Credit Score

Your credit score plays a significant role in determining the interest rate you’ll qualify for. Knowing your credit score and understanding how it affects your interest rate can give you leverage when negotiating with lenders. If you have a good credit score, you can use it to negotiate a lower interest rate.

Research and Compare Rates

Researching and comparing rates from different lenders can help you find the best deal. Look for lenders that offer competitive rates and terms, and use this information to negotiate with other lenders. You can also use online tools and resources to compare rates and find the best deals.

Use Competing Offers

If you receive a competing offer from another lender, you can use it to negotiate a better rate with your preferred lender. This can be a powerful tool in getting the best deal possible. Be sure to provide the competing offer to your lender and ask them to match or beat it.

Negotiate the Loan Term

The loan term can also be negotiated. If you’re looking for a longer loan term, you may be able to negotiate a lower interest rate. However, keep in mind that a longer loan term can result in more interest paid over the life of the loan.

Be Willing to Walk Away

If you’re not happy with the interest rate or terms offered by a lender, be willing to walk away. This shows the lender that you’re not desperate, and they may be more willing to negotiate. Remember, it’s essential to prioritize your financial goals and not settle for a deal that’s not in your best interest.

Additional Tips

- Be polite and professional when negotiating with lenders.

- Ask questions and seek clarification on any terms or conditions you don’t understand.

- Don’t be afraid to negotiate – it’s a normal part of the car loan process.

- Consider working with a car loan broker or financial advisor to help you negotiate the best deal.

By following these tips and strategies, you can effectively negotiate car loan interest rates and get the best deal possible. Remember to stay informed, do your research, and prioritize your financial goals. With the right approach, you can save money on your car loan and make your monthly payments more manageable.

Car Loan Interest Rate Trends: What to Expect in the Future

The car loan interest rate landscape is constantly evolving, influenced by economic conditions, government policies, and technological advancements. Understanding these trends can help you make informed decisions when calculating car loan interest rates and planning your financial future.

Economic Conditions

The state of the economy plays a significant role in determining car loan interest rates. In times of economic growth, interest rates tend to rise, while in times of recession, they tend to fall. Currently, the economy is experiencing a period of growth, which has led to a rise in interest rates.

Government Policies

Government policies, such as monetary policy and regulations, can also impact car loan interest rates. For example, the Federal Reserve’s decision to raise interest rates can lead to an increase in car loan interest rates. Additionally, regulations such as the Dodd-Frank Act can affect the way lenders operate and the interest rates they offer.

Technological Advancements

Technological advancements, such as online lending platforms and digital banking, are changing the way car loans are originated and serviced. These advancements can lead to increased competition among lenders, which can result in lower interest rates and better terms for borrowers.

Future Trends

Based on current trends, here are some potential future developments in car loan interest rates:

- Increased use of alternative credit scoring models, which can lead to more accurate risk assessments and lower interest rates for borrowers.

- Greater adoption of digital lending platforms, which can increase competition and lead to lower interest rates and better terms.

- More emphasis on sustainability and environmental considerations, which can lead to the development of green car loans and lower interest rates for eco-friendly vehicles.

Preparing for the Future

To prepare for future trends in car loan interest rates, it’s essential to:

- Monitor economic conditions and government policies, which can impact interest rates.

- Stay informed about technological advancements and their potential impact on the car loan market.

- Consider working with a financial advisor or car loan broker to help you navigate the complex car loan landscape.

By understanding current trends and preparing for future developments, you can make informed decisions when calculating car loan interest rates and planning your financial future.

Conclusion: Taking Control of Your Car Loan Interest Rate

In conclusion, understanding and managing car loan interest rates is crucial for making informed financial decisions. By calculating car loan interest rates, comparing rates from different lenders, and negotiating with lenders, you can save money on your car loan and make your monthly payments more manageable.

Remember, a good credit score, a longer loan term, and a lower interest rate can all contribute to lower monthly payments and less interest paid over the life of the loan. Additionally, staying informed about current trends and future developments in the car loan market can help you prepare for changes and make the most of your financial situation.

By taking control of your car loan interest rate, you can:

- Save money on interest payments

- Make your monthly payments more manageable

- Improve your credit score

- Take advantage of better loan terms and rates

Don’t let car loan interest rates control your finances. Take the first step today by calculating your car loan interest rate and exploring your options. With the right knowledge and tools, you can make informed decisions and take control of your financial future.

By following the tips and strategies outlined in this article, you can:

- Calculate your car loan interest rate with confidence

- Compare rates from different lenders and find the best deal

- Negotiate with lenders to get a better rate

- Stay informed about current trends and future developments in the car loan market

Take control of your car loan interest rate today and start saving money on your car loan. With the right knowledge and tools, you can make informed decisions and achieve your financial goals.