Understanding the Importance of Mortgage Affordability

Calculating how much mortgage you can afford is a crucial step in the home buying process. It’s essential to determine your mortgage affordability before starting your home search to avoid financial strain and potential long-term consequences. Overextending yourself financially can lead to difficulties in making mortgage payments, which can negatively impact your credit score and overall financial stability.

On the other hand, finding a comfortable mortgage payment can provide peace of mind and help you achieve your long-term financial goals. By understanding how much mortgage you can afford, you can create a sustainable home buying budget that takes into account your income, debt, credit score, and other monthly expenses. This, in turn, can help you make informed decisions when selecting a mortgage and avoid costly mistakes.

Moreover, calculating your mortgage affordability can also help you identify areas for improvement in your financial situation. For instance, you may need to work on improving your credit score or reducing your debt to increase your chances of getting approved for a mortgage. By taking the time to assess your financial situation and determine your mortgage affordability, you can set yourself up for success in the home buying process.

So, how do you calculate how much mortgage you can afford? The process involves considering several factors, including your income, debt, credit score, and other monthly expenses. By using a mortgage affordability calculator or consulting with a lender or financial advisor, you can get a better understanding of your mortgage options and create a personalized plan for achieving your home buying goals.

Remember, calculating your mortgage affordability is not a one-time task. It’s essential to regularly review and adjust your budget to ensure that you’re on track to meet your financial goals. By doing so, you can create a sustainable home buying budget that sets you up for long-term success and helps you achieve your dreams of homeownership.

How to Calculate Your Mortgage Affordability: A Simple Formula

To calculate how much mortgage you can afford, you’ll need to consider several factors, including your income, debt, credit score, and other monthly expenses. A simple formula to determine mortgage affordability is to calculate your debt-to-income (DTI) ratio. This ratio is calculated by dividing your total monthly debt payments by your gross income.

For example, let’s say you have a gross income of $5,000 per month and your total monthly debt payments are $2,000. Your DTI ratio would be 40% ($2,000 ÷ $5,000). This means that 40% of your gross income is going towards debt payments.

In addition to your DTI ratio, you’ll also need to consider your credit score and other monthly expenses, such as property taxes, insurance, and maintenance. A good credit score can help you qualify for better interest rates and terms, while high monthly expenses can impact your ability to afford a mortgage.

Here’s a step-by-step guide to calculating your mortgage affordability:

1. Determine your gross income: Start by calculating your gross income, which is your income before taxes and other deductions.

2. Calculate your total monthly debt payments: Add up all of your monthly debt payments, including credit cards, student loans, and other debts.

3. Calculate your DTI ratio: Divide your total monthly debt payments by your gross income.

4. Consider your credit score: A good credit score can help you qualify for better interest rates and terms.

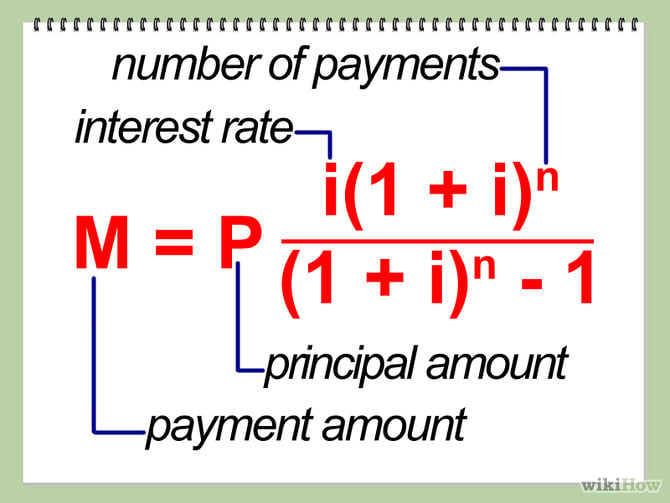

5. Calculate your mortgage payment: Use a mortgage calculator or consult with a lender to determine how much mortgage you can afford based on your income, debt, and credit score.

By following these steps, you can get a better understanding of how much mortgage you can afford and create a personalized plan for achieving your home buying goals.

Remember, calculating your mortgage affordability is not a one-time task. It’s essential to regularly review and adjust your budget to ensure that you’re on track to meet your financial goals.

Assessing Your Finances: Income, Debt, and Credit Score

When determining mortgage affordability, it’s essential to assess your finances, including your income, debt, and credit score. Your income plays a significant role in calculating how much mortgage you can afford, as it affects your ability to make monthly mortgage payments.

To evaluate your income, consider the following factors:

1. Gross income: Calculate your gross income, which is your income before taxes and other deductions.

2. Net income: Calculate your net income, which is your income after taxes and other deductions.

3. Income stability: Consider the stability of your income, including any fluctuations or irregularities.

In addition to income, your debt and credit score also impact your mortgage affordability. High levels of debt can reduce your credit score and increase your debt-to-income ratio, making it more challenging to qualify for a mortgage.

To improve your credit score and reduce debt, consider the following tips:

1. Pay off high-interest debt: Focus on paying off high-interest debt, such as credit card balances, to reduce your debt-to-income ratio.

2. Make on-time payments: Make all payments on time, including credit card payments, loan payments, and utility bills.

3. Monitor your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date.

4. Avoid new credit inquiries: Avoid applying for new credit cards or loans, as this can negatively impact your credit score.

By assessing your income, debt, and credit score, you can get a better understanding of your mortgage affordability and make informed decisions when applying for a mortgage.

Remember, calculating how much mortgage you can afford is not just about your income; it’s also about your debt and credit score. By taking the time to evaluate your finances, you can create a personalized plan for achieving your home buying goals.

The 28/36 Rule: A Guideline for Mortgage Affordability

The 28/36 rule is a widely accepted guideline for determining mortgage affordability. This rule suggests that housing costs should not exceed 28% of your gross income, and total debt payments should not exceed 36%.

The 28% rule applies to your housing costs, including your mortgage payment, property taxes, and insurance. This means that if you earn $5,000 per month, your housing costs should not exceed $1,400 ($5,000 x 0.28).

The 36% rule applies to your total debt payments, including your mortgage payment, credit card debt, student loans, and other debt obligations. This means that if you earn $5,000 per month, your total debt payments should not exceed $1,800 ($5,000 x 0.36).

Using the 28/36 rule can help you determine how much mortgage you can afford and ensure that you’re not overextending yourself financially. By keeping your housing costs and total debt payments within these guidelines, you can create a sustainable home buying budget and reduce your risk of financial stress.

For example, let’s say you earn $5,000 per month and you’re considering purchasing a home with a mortgage payment of $1,200 per month. Your property taxes and insurance would add an additional $300 per month, bringing your total housing costs to $1,500 per month. This would be 30% of your gross income, which is above the recommended 28% threshold.

In this scenario, you may need to consider reducing your mortgage payment or exploring other options, such as a longer loan term or a lower-priced home. By using the 28/36 rule, you can make informed decisions about your mortgage affordability and create a home buying budget that works for you.

Remember, the 28/36 rule is just a guideline, and your individual circumstances may vary. It’s essential to consider all of your financial obligations and expenses when determining how much mortgage you can afford.

Additional Costs to Consider: Property Taxes, Insurance, and Maintenance

When calculating how much mortgage you can afford, it’s essential to consider additional costs associated with homeownership, including property taxes, insurance, and maintenance. These costs can significantly impact your mortgage affordability and overall financial situation.

Property taxes are a significant expense for homeowners, and they can vary widely depending on the location and value of the property. On average, property taxes range from 0.5% to 2% of the property’s value per year. For example, if you purchase a $300,000 home, your annual property taxes could range from $1,500 to $6,000.

Homeowners insurance is another essential cost to consider. This type of insurance protects you against losses due to damage or destruction of your home. The cost of homeowners insurance varies depending on factors such as the value of your home, location, and risk of natural disasters.

Maintenance costs are also a significant consideration for homeowners. These costs can include repairs, replacements, and upgrades to your home’s systems and structures. On average, homeowners can expect to spend 1% to 3% of their home’s value per year on maintenance costs.

When calculating your mortgage affordability, it’s essential to factor in these additional costs. You can use online mortgage calculators or consult with a lender or financial advisor to get a better understanding of how these costs will impact your mortgage payment.

For example, let’s say you’re considering purchasing a $300,000 home with a mortgage payment of $1,500 per month. Your property taxes might be $3,000 per year, and your homeowners insurance might be $800 per year. Your maintenance costs might be $2,000 per year. These additional costs would increase your total monthly expenses by $583 ($3,000 + $800 + $2,000 / 12 months).

By considering these additional costs, you can create a more accurate picture of your mortgage affordability and make informed decisions about your home buying budget.

Remember, calculating how much mortgage you can afford is not just about your income and debt; it’s also about considering all the additional costs associated with homeownership.

Using Online Mortgage Calculators: A Convenient Tool

Online mortgage calculators are a convenient tool to help determine mortgage affordability. These calculators can provide a quick and easy way to estimate how much mortgage you can afford based on your income, debt, credit score, and other monthly expenses.

There are many online mortgage calculators available, and they can be found on websites such as NerdWallet, Zillow, and Bankrate. These calculators typically ask for information such as your income, debt, credit score, and desired mortgage term. They then provide an estimate of how much mortgage you can afford and what your monthly payments might be.

Using an online mortgage calculator can be beneficial in several ways. Firstly, it can provide a quick and easy way to estimate how much mortgage you can afford, which can help you determine whether you are ready to start the home buying process. Secondly, it can help you compare different mortgage options and determine which one is best for you. Finally, it can provide a sense of what your monthly payments might be, which can help you plan your finances.

However, it’s essential to keep in mind that online mortgage calculators are only a tool, and they should not be relied upon as the sole means of determining mortgage affordability. It’s crucial to consult with a lender or financial advisor to get personalized guidance on mortgage affordability and to ensure that you are making an informed decision.

Some reputable online resources for mortgage calculators include:

NerdWallet’s Mortgage Calculator: This calculator provides a comprehensive estimate of how much mortgage you can afford based on your income, debt, credit score, and other monthly expenses.

Zillow’s Mortgage Calculator: This calculator provides an estimate of how much mortgage you can afford and what your monthly payments might be. It also allows you to compare different mortgage options and determine which one is best for you.

Bankrate’s Mortgage Calculator: This calculator provides an estimate of how much mortgage you can afford and what your monthly payments might be. It also allows you to compare different mortgage options and determine which one is best for you.

By using an online mortgage calculator and consulting with a lender or financial advisor, you can get a better understanding of how much mortgage you can afford and make informed decisions about your home buying budget.

Consulting with a Lender or Financial Advisor: Expert Guidance

While online mortgage calculators and self-assessment can provide a good starting point for determining mortgage affordability, consulting with a lender or financial advisor can provide expert guidance and personalized advice.

A lender or financial advisor can help you navigate the complex process of determining mortgage affordability and provide guidance on how to create a sustainable home buying budget. They can also help you understand the various mortgage options available and determine which one is best for your financial situation.

Some benefits of consulting with a lender or financial advisor include:

Personalized guidance: A lender or financial advisor can provide personalized guidance and advice based on your individual financial situation.

Expert knowledge: Lenders and financial advisors have extensive knowledge of the mortgage industry and can provide expert advice on how to navigate the process.

Access to multiple mortgage options: Lenders and financial advisors often have access to multiple mortgage options and can help you determine which one is best for your financial situation.

Help with budgeting: A lender or financial advisor can help you create a sustainable home buying budget and provide guidance on how to manage your finances.

When consulting with a lender or financial advisor, be prepared to provide financial information, such as your income, debt, credit score, and other monthly expenses. This will help them provide personalized guidance and advice.

Some questions to ask a lender or financial advisor include:

What is the best mortgage option for my financial situation?

How can I create a sustainable home buying budget?

What are the benefits and drawbacks of different mortgage options?

How can I improve my credit score to qualify for better mortgage rates?

By consulting with a lender or financial advisor, you can get expert guidance and personalized advice on how to determine mortgage affordability and create a sustainable home buying budget.

Creating a Sustainable Home Buying Budget: Long-Term Considerations

Creating a sustainable home buying budget requires considering long-term factors that can impact your mortgage affordability. These factors include changes in income, expenses, and interest rates.

Changes in income can significantly impact your mortgage affordability. For example, if you expect a promotion or a raise in the near future, you may be able to afford a larger mortgage payment. On the other hand, if you expect a reduction in income, you may need to adjust your budget accordingly.

Expenses can also impact your mortgage affordability. For example, if you have high monthly expenses, such as car payments or student loans, you may need to adjust your budget to accommodate these expenses.

Interest rates can also impact your mortgage affordability. For example, if interest rates are expected to rise in the near future, you may want to consider locking in a lower interest rate now.

To create a sustainable home buying budget, consider the following tips:

1. Review and adjust your budget regularly: Regularly review your budget to ensure that you are on track to meet your financial goals.

2. Consider long-term factors: Consider long-term factors, such as changes in income, expenses, and interest rates, when creating your budget.

3. Prioritize needs over wants: Prioritize your needs over your wants when creating your budget.

4. Build an emergency fund: Build an emergency fund to cover unexpected expenses and ensure that you can continue to make your mortgage payments.

5. Consider working with a financial advisor: Consider working with a financial advisor to get personalized guidance on creating a sustainable home buying budget.

By following these tips, you can create a sustainable home buying budget that takes into account long-term considerations and ensures that you can afford your mortgage payments.

Remember, calculating how much mortgage you can afford is not just about your income and debt; it’s also about considering long-term factors that can impact your mortgage affordability.