Understanding the Basics of Traditional IRAs and 401k Plans

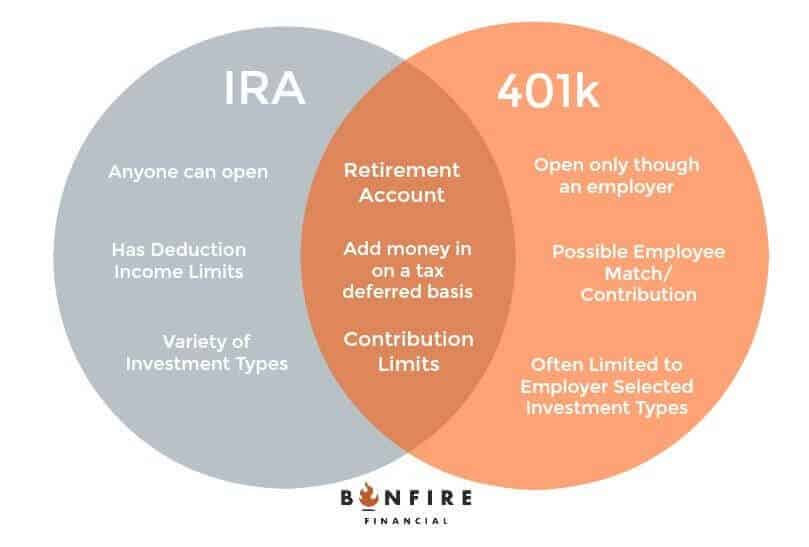

Traditional IRAs and 401k plans are two popular retirement savings options that offer tax benefits and help individuals build a nest egg for their golden years. While both plans share some similarities, they have distinct differences in terms of eligibility, contribution limits, and tax benefits. In this section, we’ll delve into the fundamental differences between Traditional IRAs and 401k plans, providing a comprehensive overview of how these plans work and their purpose in retirement savings.

A Traditional IRA, or Individual Retirement Account, is a self-directed retirement plan that allows individuals to contribute a portion of their income to a tax-deferred account. Contributions to a Traditional IRA are tax-deductible, and the funds grow tax-free until withdrawal. In contrast, a 401k plan is an employer-sponsored retirement plan that allows employees to contribute a portion of their salary to a tax-deferred account. Employers may also match a portion of the employee’s contributions, providing an added incentive to save for retirement.

One key difference between Traditional IRAs and 401k plans is eligibility. Anyone with earned income can contribute to a Traditional IRA, while 401k plans are typically offered through an employer. Additionally, Traditional IRAs have income limits on deductibility, while 401k plans have no income limits on contributions. However, 401k plans do have contribution limits, which are set by the IRS and adjusted annually for inflation.

Both Traditional IRAs and 401k plans offer tax benefits, but the type of benefit differs. Traditional IRAs offer tax-deductible contributions, while 401k plans offer tax-deferred growth. This means that contributions to a Traditional IRA reduce taxable income, while contributions to a 401k plan reduce take-home pay. At withdrawal, Traditional IRA funds are taxed as ordinary income, while 401k funds are taxed as ordinary income, but may be subject to penalties for early withdrawal.

Now that we’ve covered the basics of Traditional IRAs and 401k plans, you may be wondering if you can contribute to both plans. The answer is yes, but there are some limitations and restrictions to consider. In the next section, we’ll explore the possibilities and limitations of contributing to both a Traditional IRA and a 401k plan.

Can You Contribute to Both a Traditional IRA and a 401k? The Answer May Surprise You

One of the most common questions regarding retirement savings is whether it’s possible to contribute to both a Traditional IRA and a 401k plan. The answer is yes, but there are some limitations and restrictions to consider. In this section, we’ll explore the possibilities and limitations of contributing to both a Traditional IRA and a 401k plan.

According to the IRS, there is no rule that prohibits individuals from contributing to both a Traditional IRA and a 401k plan. However, there are some restrictions on deductibility and contribution limits that apply. For example, if you’re eligible for a 401k plan through your employer, your ability to deduct Traditional IRA contributions may be limited or phased out depending on your income level.

To determine if you can contribute to both a Traditional IRA and a 401k plan, you’ll need to consider your income level, filing status, and employer-sponsored plan participation. If you’re single and have a modified adjusted gross income (MAGI) below $68,000, you may be able to deduct your Traditional IRA contributions in full. However, if your MAGI is above $78,000, you may not be able to deduct any of your Traditional IRA contributions.

Additionally, if you’re participating in a 401k plan through your employer, you may be able to contribute to a Traditional IRA, but your contributions may not be deductible. In this case, you may want to consider contributing to a Roth IRA instead, which allows you to contribute after-tax dollars and withdraw the funds tax-free in retirement.

It’s also important to note that contribution limits apply to both Traditional IRAs and 401k plans. For 2022, the contribution limit for Traditional IRAs is $6,000, or $7,000 if you’re 50 or older. The contribution limit for 401k plans is $19,500, or $26,000 if you’re 50 or older. If you’re contributing to both a Traditional IRA and a 401k plan, you’ll need to ensure that you’re not exceeding these limits.

In summary, while it is possible to contribute to both a Traditional IRA and a 401k plan, there are some limitations and restrictions to consider. By understanding these rules and limitations, you can maximize your retirement savings and create a more secure financial future.

How to Contribute to a Traditional IRA and a 401k: A Step-by-Step Guide

Now that we’ve covered the basics of Traditional IRAs and 401k plans, it’s time to dive into the step-by-step process of contributing to both plans. In this section, we’ll provide a comprehensive guide on how to set up accounts, determine contribution limits, and manage investments.

Step 1: Determine Your Eligibility

Before you can start contributing to a Traditional IRA and a 401k plan, you need to determine if you’re eligible. Check with your employer to see if they offer a 401k plan and if you’re eligible to participate. You can also check with the IRS to see if you’re eligible to contribute to a Traditional IRA.

Step 2: Set Up Your Accounts

Once you’ve determined your eligibility, it’s time to set up your accounts. You can set up a Traditional IRA account with a financial institution, such as a bank or investment firm. You can also set up a 401k account through your employer. Make sure to choose a reputable financial institution and carefully review the fees and investment options.

Step 3: Determine Your Contribution Limits

The next step is to determine your contribution limits. The contribution limit for Traditional IRAs is $6,000 in 2022, or $7,000 if you’re 50 or older. The contribution limit for 401k plans is $19,500 in 2022, or $26,000 if you’re 50 or older. You can contribute to both plans, but you need to ensure that you’re not exceeding the contribution limits.

Step 4: Manage Your Investments

Once you’ve set up your accounts and determined your contribution limits, it’s time to manage your investments. You can choose from a variety of investment options, such as stocks, bonds, and mutual funds. Make sure to carefully review the fees and investment options before making a decision.

Step 5: Monitor and Adjust Your Contributions

Finally, it’s essential to monitor and adjust your contributions regularly. You can adjust your contribution amounts, investment options, and account settings as needed. Make sure to review your accounts regularly to ensure that you’re on track to meet your retirement goals.

By following these steps, you can contribute to both a Traditional IRA and a 401k plan and maximize your retirement savings. Remember to carefully review the fees and investment options, and make adjustments as needed to ensure that you’re on track to meet your retirement goals.

Benefits of Combining Traditional IRA and 401k Contributions

Combining Traditional IRA and 401k contributions can provide several benefits for individuals looking to maximize their retirement savings. By contributing to both plans, individuals can take advantage of increased retirement savings, tax advantages, and diversification of investments.

One of the primary benefits of combining Traditional IRA and 401k contributions is increased retirement savings. By contributing to both plans, individuals can save more money for retirement, which can provide a more comfortable and secure financial future. Additionally, contributing to both plans can help individuals reach their retirement goals faster, as they can take advantage of compound interest and tax benefits.

Another benefit of combining Traditional IRA and 401k contributions is tax advantages. Contributions to Traditional IRAs are tax-deductible, which can help reduce taxable income. Additionally, the funds in a Traditional IRA grow tax-free, which means that individuals won’t have to pay taxes on the investment gains until they withdraw the funds in retirement. Similarly, 401k plans offer tax benefits, as contributions are made before taxes, which can reduce taxable income.

Diversification of investments is another benefit of combining Traditional IRA and 401k contributions. By contributing to both plans, individuals can invest in a variety of assets, such as stocks, bonds, and mutual funds. This can help spread risk and increase potential returns, as different assets perform well in different market conditions.

Furthermore, combining Traditional IRA and 401k contributions can provide flexibility in retirement. By having multiple sources of income in retirement, individuals can create a more sustainable and comfortable financial future. Additionally, having multiple sources of income can provide a hedge against inflation, as individuals can adjust their income streams to keep pace with rising costs.

In conclusion, combining Traditional IRA and 401k contributions can provide several benefits for individuals looking to maximize their retirement savings. By taking advantage of increased retirement savings, tax advantages, and diversification of investments, individuals can create a more secure and comfortable financial future.

Income Limits and Eligibility: What You Need to Know

When it comes to contributing to a Traditional IRA and a 401k plan, there are certain income limits and eligibility requirements that you need to be aware of. In this section, we’ll break down the income limits and eligibility requirements for both plans, and provide guidance on how to determine if you’re eligible and how to navigate any restrictions.

Traditional IRA Income Limits

The income limits for Traditional IRA contributions vary based on your filing status and modified adjusted gross income (MAGI). For the 2022 tax year, the income limits for Traditional IRA contributions are as follows:

* Single filers with a MAGI below $68,000 can deduct their full Traditional IRA contribution. * Single filers with a MAGI between $68,000 and $78,000 can deduct a partial Traditional IRA contribution. * Single filers with a MAGI above $78,000 cannot deduct their Traditional IRA contribution.

401k Plan Eligibility

To be eligible to contribute to a 401k plan, you must be an employee of a company that offers a 401k plan. Additionally, you must meet certain age and service requirements, which vary depending on the plan. Typically, you must be at least 21 years old and have completed one year of service with the company to be eligible to contribute to a 401k plan.

Income Limits for 401k Plan Contributions

There are no income limits for 401k plan contributions, but there are limits on how much you can contribute to a 401k plan each year. For the 2022 tax year, the contribution limit for 401k plans is $19,500, or $26,000 if you’re 50 or older.

Navigating Income Limits and Eligibility Restrictions

If you’re unsure about your eligibility to contribute to a Traditional IRA or 401k plan, or if you’re unsure about the income limits that apply to you, it’s a good idea to consult with a financial advisor or tax professional. They can help you navigate the rules and regulations surrounding these plans and ensure that you’re making the most of your retirement savings opportunities.

Investment Options and Strategies for Traditional IRAs and 401k Plans

When it comes to investing in a Traditional IRA and a 401k plan, there are a variety of options and strategies to consider. In this section, we’ll discuss the different investment options available for both plans, as well as some strategies for managing your investments.

Traditional IRA Investment Options

Traditional IRAs offer a range of investment options, including:

* Stocks: You can invest in individual stocks or stock mutual funds. * Bonds: You can invest in government or corporate bonds. * Mutual Funds: You can invest in a variety of mutual funds, including index funds and actively managed funds. * ETFs: You can invest in exchange-traded funds (ETFs), which offer flexibility and diversification. * Real Estate: You can invest in real estate investment trusts (REITs) or real estate mutual funds.

401k Plan Investment Options

401k plans also offer a range of investment options, including:

* Stocks: You can invest in individual stocks or stock mutual funds. * Bonds: You can invest in government or corporate bonds. * Mutual Funds: You can invest in a variety of mutual funds, including index funds and actively managed funds. * Target Date Funds: You can invest in target date funds, which automatically adjust their asset allocation based on your retirement date. * Employer Stock: You can invest in your employer’s stock, if offered.

Investment Strategies

When it comes to managing your investments in a Traditional IRA and a 401k plan, there are several strategies to consider:

* Asset Allocation: You can allocate your investments across different asset classes, such as stocks, bonds, and real estate. * Risk Management: You can manage risk by diversifying your investments and adjusting your asset allocation based on market conditions. * Investment Selection: You can select investments that align with your retirement goals and risk tolerance. * Rebalancing: You can rebalance your investments periodically to ensure that your asset allocation remains aligned with your goals.

By understanding the investment options and strategies available for Traditional IRAs and 401k plans, you can make informed decisions about your retirement savings and create a more secure financial future.

Common Mistakes to Avoid When Contributing to a Traditional IRA and 401k

When contributing to a Traditional IRA and a 401k plan, there are several common mistakes to avoid. In this section, we’ll discuss some of the most common errors and provide guidance on how to avoid them.

Over-Contributing

One of the most common mistakes is over-contributing to a Traditional IRA or 401k plan. This can result in penalties and fines, so it’s essential to ensure that you’re not exceeding the contribution limits. For the 2022 tax year, the contribution limit for Traditional IRAs is $6,000, or $7,000 if you’re 50 or older. The contribution limit for 401k plans is $19,500, or $26,000 if you’re 50 or older.

Under-Contributing

Another common mistake is under-contributing to a Traditional IRA or 401k plan. This can result in missed opportunities for retirement savings and tax benefits. To avoid under-contributing, consider setting up automatic contributions to your Traditional IRA or 401k plan.

Not Monitoring Investment Performance

Failing to monitor investment performance is another common mistake. This can result in poor investment returns and a reduced retirement savings. To avoid this mistake, consider regularly reviewing your investment portfolio and rebalancing as needed.

Not Taking Advantage of Employer Matching

If your employer offers a 401k plan with matching contributions, not taking advantage of this benefit is a common mistake. Employer matching contributions can significantly boost your retirement savings, so be sure to contribute enough to maximize the match.

Not Considering Fees and Expenses

Failing to consider fees and expenses is another common mistake. Fees and expenses can significantly reduce your retirement savings, so be sure to carefully review the fees associated with your Traditional IRA or 401k plan.

By avoiding these common mistakes, you can maximize your retirement savings and create a more secure financial future.

Conclusion: Maximizing Your Retirement Savings with Traditional IRA and 401k Contributions

Maximizing retirement savings requires a strategic approach, and combining Traditional IRA and 401k contributions can be a powerful way to achieve this goal. By understanding the basics of each plan, navigating eligibility and contribution limits, and avoiding common mistakes, individuals can make the most of their retirement savings. The benefits of contributing to both a Traditional IRA and a 401k plan are clear: increased retirement savings, tax advantages, and diversification of investments. While there may be income limits and eligibility requirements to consider, the potential rewards make it well worth the effort. By following the step-by-step guide outlined in this article and staying informed about investment options and strategies, individuals can take control of their retirement savings and set themselves up for long-term financial success. Whether you’re just starting out or nearing retirement, the question “can I contribute to Traditional IRA and 401k” is an important one to answer, and the answer is a resounding yes. By combining these two powerful retirement savings tools, you can create a brighter financial future and enjoy the retirement you deserve.