What is Cash App and How Does it Work?

Cash App is a popular mobile payment service that allows users to send, receive, and invest money using their smartphones. Developed by Square, Inc., Cash App has gained a significant following in recent years due to its user-friendly interface, low fees, and innovative features. Unlike traditional banking methods, Cash App provides a more convenient and accessible way to manage finances on-the-go.

One of the key benefits of Cash App is its ability to facilitate instant transactions between users. With the app, users can send and receive money instantly, eliminating the need for traditional banking methods that often involve lengthy processing times. Additionally, Cash App offers a range of features that make it an attractive option for those looking for a mobile payment solution, including the ability to invest in stocks, buy and sell Bitcoin, and even file taxes.

Cash App’s growing user base is a testament to its popularity and effectiveness. With millions of active users, the app has become a staple in the mobile payment market. Its success can be attributed to its ease of use, low fees, and innovative features that cater to the needs of modern users. As the demand for mobile payment solutions continues to grow, Cash App is well-positioned to remain a leading player in the market.

For those looking to take advantage of Cash App’s features, including the cash app sign up bonus, it’s essential to understand how the app works and what benefits it offers. By providing a comprehensive mobile payment solution, Cash App has established itself as a trusted and reliable option for users. Whether you’re looking to send money to friends, invest in stocks, or simply manage your finances, Cash App is an excellent choice.

With its user-friendly interface and innovative features, Cash App has revolutionized the way people manage their finances. As the app continues to grow in popularity, it’s likely that we’ll see even more features and benefits added in the future. For now, Cash App remains an excellent option for those looking for a convenient and accessible mobile payment solution.

How to Get Started with Cash App and Claim Your Bonus

Signing up for Cash App is a straightforward process that can be completed in a few simple steps. To get started, users can download the Cash App from the App Store or Google Play Store, depending on their device. Once the app is downloaded, users can create an account by providing some basic information, such as their name, email address, and phone number.

After creating an account, users will need to link a bank account or debit card to their Cash App account. This can be done by navigating to the “Add Bank” or “Add Card” section of the app and following the prompts. Users will need to provide their bank account or debit card information, including the account number and routing number, to complete the linking process.

Once a bank account or debit card is linked, users can start using their Cash App account to send and receive money. To qualify for the cash app sign up bonus, users will typically need to complete a specific task, such as sending a certain amount of money to a friend or family member, or making a purchase using their Cash App account.

It’s essential to note that the requirements for qualifying for the sign-up bonus may vary depending on the user’s location and the specific promotion being offered. Users should carefully review the terms and conditions of the promotion to ensure they understand what is required to qualify for the bonus.

In addition to the sign-up bonus, Cash App also offers a range of other features and benefits, including the ability to invest in stocks, buy and sell Bitcoin, and even file taxes. By taking advantage of these features, users can maximize their earnings and make the most of their Cash App account.

Overall, signing up for Cash App and claiming the sign-up bonus is a simple and straightforward process. By following the steps outlined above, users can start using their Cash App account and taking advantage of the app’s many features and benefits.

Understanding Cash App’s Sign-Up Bonus Structure

Cash App’s sign-up bonus is a promotional offer designed to incentivize new users to join the platform. The bonus is typically a one-time payment made to the user’s Cash App account after they complete a specific task, such as sending a certain amount of money to a friend or family member, or making a purchase using their Cash App account.

The amount of the sign-up bonus can vary depending on the promotion and the user’s location. In some cases, the bonus may be a fixed amount, such as $5 or $10, while in other cases it may be a percentage of the user’s first transaction. For example, Cash App may offer a 10% bonus on the user’s first $100 transaction.

Compared to other mobile payment services, Cash App’s sign-up bonus is relatively competitive. For example, Venmo offers a $5 bonus for new users who complete a specific task, while Zelle offers a $10 bonus for users who send a certain amount of money to a friend or family member. However, Cash App’s bonus is often more generous, especially for users who complete multiple tasks or make larger transactions.

It’s essential to note that Cash App’s sign-up bonus comes with some conditions and requirements. For example, users may need to complete a specific task within a certain timeframe, such as 30 days, to qualify for the bonus. Additionally, the bonus may be subject to certain restrictions, such as a minimum transaction amount or a specific type of transaction.

Despite these conditions, Cash App’s sign-up bonus is a valuable incentive for new users to join the platform. By understanding the bonus structure and requirements, users can maximize their earnings and make the most of their Cash App account. Whether you’re looking to send money to friends, make purchases, or invest in stocks, Cash App’s sign-up bonus is a great way to get started.

Overall, Cash App’s sign-up bonus is a competitive and attractive offer that can help new users get started with the platform. By providing a clear understanding of the bonus structure and requirements, users can make informed decisions about how to use their Cash App account and maximize their earnings.

Maximizing Your Earnings with Cash App’s Rewards Program

Cash App’s rewards program is designed to help users earn cash back, discounts, and other incentives on their transactions. By understanding how the rewards program works, users can maximize their earnings and make the most of their Cash App account.

One way to earn rewards with Cash App is by using the app’s cash back feature. This feature allows users to earn a percentage of their transaction amount back as cash, which can be redeemed for future purchases or transferred to a bank account. For example, users can earn 5% cash back on purchases made at certain retailers, such as coffee shops or restaurants.

Another way to earn rewards with Cash App is by participating in the app’s referral program. This program allows users to earn a bonus for referring friends and family to the app. For example, users can earn a $5 bonus for each friend who signs up for Cash App and completes a specific task, such as sending a certain amount of money to a friend or family member.

Cash App also offers a range of other rewards and incentives, including discounts on certain purchases and exclusive offers from partner retailers. For example, users can earn a 10% discount on purchases made at certain retailers, such as clothing stores or home goods stores.

To maximize their earnings with Cash App’s rewards program, users should make sure to read and understand the terms and conditions of each offer. This includes understanding the requirements for earning rewards, such as minimum transaction amounts or specific purchase types. Users should also make sure to keep track of their rewards balances and redeem their rewards before they expire.

Overall, Cash App’s rewards program is a great way for users to earn cash back, discounts, and other incentives on their transactions. By understanding how the program works and taking advantage of the various rewards and incentives available, users can maximize their earnings and make the most of their Cash App account.

In addition to the rewards program, Cash App also offers a range of other features and benefits, including the ability to invest in stocks, buy and sell Bitcoin, and even file taxes. By taking advantage of these features and benefits, users can make the most of their Cash App account and achieve their financial goals.

Cash App vs. Other Mobile Payment Services: A Comparison

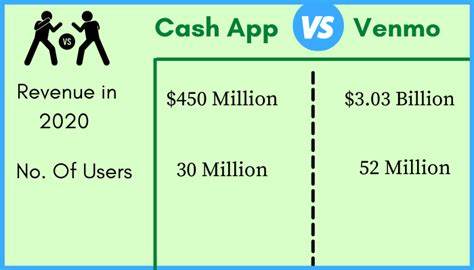

When it comes to mobile payment services, there are several options available, each with their own unique features and benefits. In this section, we’ll compare Cash App to other popular mobile payment services, including Venmo, Zelle, and PayPal.

One of the main differences between Cash App and other mobile payment services is its fee structure. Cash App does not charge fees for most transactions, including sending and receiving money, while Venmo and PayPal charge fees for certain types of transactions. Zelle, on the other hand, does not charge fees for most transactions, but may charge fees for certain types of transfers.

Another key difference is the transfer limit. Cash App has a relatively high transfer limit of $7,500 per week, while Venmo and PayPal have lower transfer limits of $2,999 and $10,000 per week, respectively. Zelle has a transfer limit of $1,000 per day.

User experience is also an important consideration when choosing a mobile payment service. Cash App has a user-friendly interface and is easy to navigate, while Venmo and PayPal have more complex interfaces that may be overwhelming for some users. Zelle has a simple and intuitive interface, but may not offer as many features as Cash App.

In terms of security, all four mobile payment services offer robust security measures, including encryption and two-factor authentication. However, Cash App has an additional layer of security with its “Cash Card” feature, which allows users to add a physical debit card to their account.

Finally, it’s worth noting that Cash App offers a unique feature called “Investing” which allows users to invest in stocks and Bitcoin, this feature is not available on Venmo, Zelle or PayPal.

Overall, while each mobile payment service has its own strengths and weaknesses, Cash App’s combination of low fees, high transfer limits, and user-friendly interface make it a popular choice among users. Additionally, its unique features such as investing and cash card make it a great option for those looking for a more comprehensive mobile payment service.

Common Questions and Concerns About Cash App’s Sign-Up Bonus

As with any financial product or service, there are likely to be questions and concerns about Cash App’s sign-up bonus. In this section, we’ll address some of the most common questions and concerns that users may have.

One of the most common questions about Cash App’s sign-up bonus is: “What are the eligibility requirements for the bonus?” To be eligible for the bonus, users must meet certain requirements, such as being a new user, completing a specific task, and meeting certain age and residency requirements.

Another common question is: “How long does it take to receive the bonus?” The bonus is typically credited to the user’s account within a few days of completing the required task. However, the exact timing may vary depending on the user’s location and the specific promotion.

Some users may also be concerned about the tax implications of the bonus. In general, the bonus is considered taxable income and must be reported on the user’s tax return. However, the specific tax implications may vary depending on the user’s individual circumstances.

Additionally, some users may be wondering if the bonus can be combined with other promotions or offers. In general, the bonus cannot be combined with other promotions or offers, but there may be certain exceptions. Users should carefully review the terms and conditions of the promotion to understand any potential limitations or restrictions.

Finally, some users may be concerned about the security of their personal and financial information when using Cash App. Cash App takes the security of its users’ information very seriously and has implemented a range of measures to protect against unauthorized access and use.

By addressing these common questions and concerns, we hope to provide users with a better understanding of Cash App’s sign-up bonus and how it works. If you have any further questions or concerns, please don’t hesitate to contact us.

Real-Life Examples of Cash App Sign-Up Bonus Success Stories

While the idea of earning a sign-up bonus may seem too good to be true, many users have successfully claimed their Cash App sign-up bonus and have gone on to use the app to manage their finances and earn rewards. In this section, we’ll share some real-life examples of Cash App sign-up bonus success stories.

One user, who wished to remain anonymous, reported earning a $100 sign-up bonus after completing the required task of sending $50 to a friend. “I was skeptical at first, but the process was easy and the bonus was credited to my account within a few days,” they said.

Another user, who goes by the username “CashAppPro” on social media, reported earning a $200 sign-up bonus after completing a series of tasks, including linking a bank account and making a purchase using the app. “I’ve been using Cash App for a few months now and have earned a total of $500 in rewards,” they said.

These success stories demonstrate that the Cash App sign-up bonus is a real and achievable reward for users who complete the required tasks. By following the steps outlined in this article and taking advantage of the app’s rewards features, users can earn cash back, discounts, and other incentives that can help them manage their finances and achieve their financial goals.

It’s worth noting that these success stories are not unique and many users have reported similar experiences with the Cash App sign-up bonus. By sharing these stories, we hope to provide inspiration and motivation for others to take advantage of the app’s rewards features and start earning cash back and discounts today.

In addition to these success stories, we’ve also gathered some tips and advice from users who have successfully claimed their Cash App sign-up bonus. These tips include:

- Make sure to read and understand the terms and conditions of the sign-up bonus before completing the required tasks.

- Use the app regularly to earn cash back and discounts on your purchases.

- Take advantage of the app’s rewards features, such as the cash back program and the investing feature.

By following these tips and taking advantage of the app’s rewards features, users can maximize their earnings and make the most of their Cash App experience.

Conclusion: Is Cash App’s Sign-Up Bonus Worth It?

After exploring the features, benefits, and requirements of Cash App’s sign-up bonus, it’s clear that this incentive can be a valuable addition to users’ financial lives. With the potential to earn a significant bonus, users can kick-start their mobile payment journey and experience the convenience and flexibility that Cash App offers.

While the bonus structure and requirements may vary, the overall value proposition of Cash App’s sign-up bonus is undeniable. By following the step-by-step guide and understanding the terms and conditions, users can maximize their earnings and make the most of the app’s rewards features.

Compared to other mobile payment services, Cash App’s sign-up bonus is competitive and offers a unique opportunity for users to earn rewards. However, it’s essential to weigh the pros and cons of each service and consider individual needs and preferences.

Ultimately, Cash App’s sign-up bonus is worth considering for anyone looking to explore mobile payment options. With its user-friendly interface, robust features, and attractive rewards program, Cash App is an excellent choice for those seeking a convenient and rewarding payment experience.

By signing up for Cash App and claiming the bonus, users can experience the benefits of mobile payments firsthand and discover a new way to manage their finances. Whether you’re a seasoned user or new to mobile payments, Cash App’s sign-up bonus is an opportunity not to be missed.

In conclusion, Cash App’s sign-up bonus is a valuable incentive that can enhance users’ financial lives. With its competitive bonus structure, user-friendly interface, and robust features, Cash App is an excellent choice for anyone looking to explore mobile payment options. By understanding the terms and conditions and maximizing earnings, users can make the most of this opportunity and experience the benefits of Cash App for themselves.