Understanding California’s Car Insurance Landscape

California, known for its scenic roads and high cost of living, also boasts some of the highest car insurance rates in the country. As a driver in the Golden State, it’s essential to understand the importance of having car insurance and how the state’s insurance market works. In California, drivers are required to carry a minimum of $15,000 in bodily injury liability coverage per person, $30,000 in bodily injury liability coverage per accident, and $5,000 in property damage liability coverage. Failure to carry this minimum coverage can result in fines, license suspension, and even vehicle impoundment.

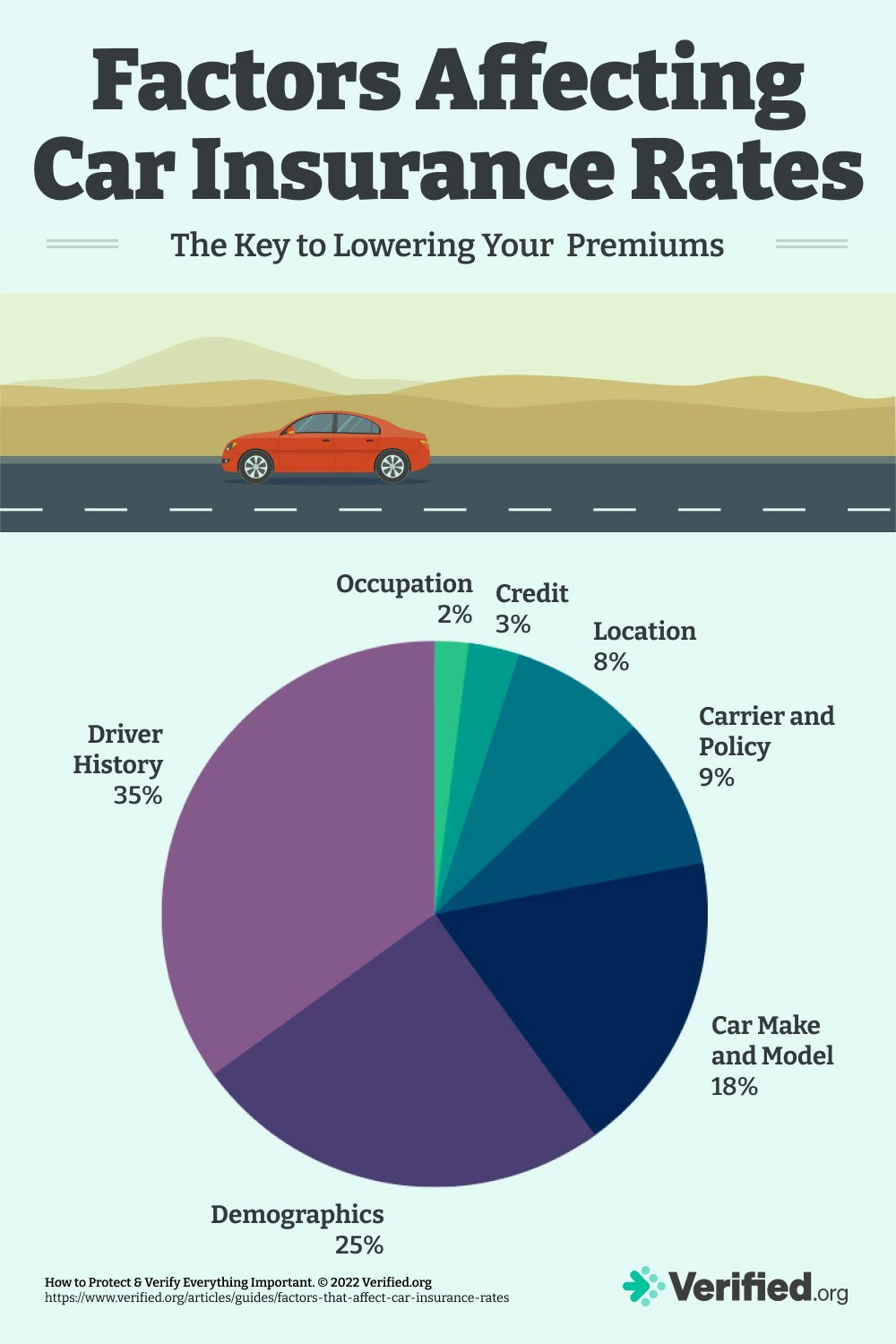

When it comes to determining car insurance rates, California insurers consider a variety of factors, including driving record, age, location, and credit score. Drivers with a clean driving record, good credit, and a safe driving history can expect to pay lower rates. On the other hand, drivers with a history of accidents or tickets, poor credit, or a high-risk occupation may face higher premiums. The cheapest car insurance for California drivers often requires a combination of these factors, making it crucial to shop around and compare rates.

California’s insurance market is highly competitive, with numerous insurers offering a range of coverage options and rates. Some of the top insurers in the state include Geico, Progressive, and State Farm, each offering unique benefits and discounts. By understanding the state’s insurance landscape and how rates are determined, California drivers can make informed decisions when selecting a car insurance policy that meets their needs and budget.

How to Find the Cheapest Car Insurance Rates in California

When it comes to finding the cheapest car insurance for California drivers, there are several strategies to keep in mind. One of the most effective ways to find affordable rates is to shop around and compare quotes from multiple insurers. This can be done by visiting the websites of various insurance companies, such as Geico, Progressive, and State Farm, and requesting quotes based on your specific needs and driver profile.

Another way to find cheap car insurance in California is to take advantage of discounts. Many insurers offer discounts for things like good grades, multi-car policies, and even being a member of certain organizations. For example, some insurers offer a good student discount for drivers who maintain a certain GPA, while others offer a discount for drivers who have completed a defensive driving course.

Some of the most common discounts offered in California include:

- Good student discount: 5-10% off premiums for drivers with good grades

- Multi-car discount: 10-20% off premiums for drivers with multiple vehicles

- Defensive driving course discount: 5-10% off premiums for drivers who complete a defensive driving course

- Low-mileage discount: 5-10% off premiums for drivers who drive fewer than 7,500 miles per year

By taking advantage of these discounts and shopping around for quotes, California drivers can find the cheapest car insurance rates for their needs and budget.

Top Picks for Cheap Car Insurance in California

When it comes to finding the cheapest car insurance for California drivers, several insurance providers stand out for their affordable rates and comprehensive coverage. Here are some top picks for cheap car insurance in California:

Geico: Geico is one of the largest auto insurance providers in the country, and it offers some of the cheapest car insurance rates in California. Geico’s rates are often 10-20% lower than those of its competitors, making it a great option for drivers on a budget.

Progressive: Progressive is another top insurance provider that offers affordable rates in California. Progressive’s rates are often competitive with those of Geico, and it offers a range of discounts for things like good grades, multi-car policies, and defensive driving courses.

State Farm: State Farm is one of the most well-established insurance providers in the country, and it offers a range of affordable car insurance options in California. State Farm’s rates are often slightly higher than those of Geico and Progressive, but it offers a range of discounts and perks that can make it a great value.

Here are some examples of rates for different driver profiles:

- Good driver with good credit: Geico ($120/month), Progressive ($130/month), State Farm ($140/month)

- Driver with one accident: Geico ($180/month), Progressive ($200/month), State Farm ($220/month)

- Driver with poor credit: Geico ($250/month), Progressive ($280/month), State Farm ($300/month)

These rates are just examples, and actual rates may vary depending on a range of factors, including driving record, age, and location. However, they give you an idea of how these top insurance providers stack up in terms of affordability.

The Role of Credit Scores in Determining Car Insurance Rates

Credit scores play a significant role in determining car insurance rates in California. Insurers use credit scores to assess the risk of lending to a particular driver, and those with good credit scores are often rewarded with lower rates. In fact, a study by the California Department of Insurance found that drivers with good credit scores can save up to 20% on their car insurance premiums compared to those with poor credit scores.

So, how do credit scores impact car insurance rates in California? Here’s a breakdown:

- Excellent credit (720+): 10-20% lower rates

- Good credit (660-719): 5-15% lower rates

- Fair credit (620-659): 0-5% lower rates

- Poor credit (580-619): 5-15% higher rates

- Bad credit (500-579): 10-20% higher rates

It’s worth noting that not all insurers use credit scores to determine rates, and some may offer more competitive rates for drivers with good credit. For example, Geico and Progressive offer discounts for drivers with good credit, while State Farm uses a more nuanced approach that takes into account multiple factors, including credit score, driving record, and age.

So, how can you improve your credit score to qualify for lower car insurance rates in California? Here are some tips:

- Make on-time payments: Payment history accounts for 35% of your credit score, so making on-time payments is crucial.

- Keep credit utilization low: Keep your credit utilization ratio below 30% to avoid negatively impacting your credit score.

- Monitor your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date.

- Avoid new credit inquiries: Avoid applying for multiple credit cards or loans in a short period, as this can negatively impact your credit score.

By following these tips and maintaining good credit habits, you can improve your credit score and qualify for lower car insurance rates in California.

California’s Low-Cost Auto Insurance Program

California’s Low-Cost Auto Insurance Program (CLCA) is a state-sponsored program that provides affordable car insurance to low-income drivers. The program was established in 1999 to help make car insurance more accessible to drivers who may not be able to afford it otherwise.

To be eligible for the CLCA program, drivers must meet certain income requirements. For example, a single person with an annual income of $25,000 or less may be eligible for the program. Additionally, drivers must have a valid California driver’s license and own a vehicle that is valued at $25,000 or less.

The CLCA program offers a range of benefits to eligible drivers, including:

- Affordable premiums: CLCA premiums are significantly lower than those offered by private insurers.

- Basic coverage: CLCA policies provide basic coverage, including liability, collision, and comprehensive coverage.

- No broker fees: CLCA policies do not have broker fees, which can save drivers money.

Here are some examples of CLCA premiums:

- Liability-only coverage: $338 per year

- Full coverage: $566 per year

It’s worth noting that the CLCA program is not available to all drivers, and eligibility requirements may vary depending on the driver’s circumstances. However, for low-income drivers who may not be able to afford car insurance otherwise, the CLCA program can be a valuable resource.

Additional Factors That Affect Car Insurance Rates in California

In addition to credit scores, there are several other factors that can impact car insurance rates in California. Understanding these factors can help drivers make informed decisions when shopping for car insurance.

Driving Record: A driver’s record is a significant factor in determining car insurance rates. Drivers with a clean record, free of accidents and tickets, can expect to pay lower rates. On the other hand, drivers with a history of accidents or tickets may face higher premiums.

Age: Age is another factor that can impact car insurance rates. Younger drivers, particularly those under the age of 25, tend to pay higher rates due to their lack of driving experience. Older drivers, particularly those over the age of 65, may also face higher rates due to declining physical abilities.

Location: Where a driver lives can also impact their car insurance rates. Drivers who live in urban areas, such as Los Angeles or San Francisco, tend to pay higher rates due to the increased risk of accidents and theft. Drivers who live in rural areas, on the other hand, may pay lower rates due to the decreased risk of accidents and theft.

Here are some examples of how these factors can impact car insurance rates in California:

- Driving record: 10-20% increase in rates for drivers with a history of accidents or tickets

- Age: 10-20% increase in rates for drivers under the age of 25 or over the age of 65

- Location: 10-20% increase in rates for drivers who live in urban areas

By understanding these factors, drivers can take steps to reduce their car insurance rates. For example, drivers can take a defensive driving course to improve their driving record, or they can consider moving to a rural area to reduce their rates.

How to Bundle and Save on Car Insurance in California

Bundling car insurance with other insurance products, such as home or renters insurance, can be a great way to save money on premiums. Many insurers offer discounts for bundling policies, which can range from 5-20% off the total premium.

Here are some examples of insurers that offer discounts for bundling policies:

- State Farm: 10-20% discount for bundling car and home insurance

- Geico: 5-15% discount for bundling car and renters insurance

- Progressive: 5-10% discount for bundling car and home insurance

By bundling policies, drivers can not only save money on premiums but also simplify their insurance management. For example, drivers can manage all their insurance policies through a single account, making it easier to keep track of payments and policy details.

When bundling policies, it’s essential to consider the following factors:

- Discounts: Check the discounts offered by the insurer for bundling policies.

- Coverage: Ensure that the bundled policies provide adequate coverage for your needs.

- Price: Compare the total premium for the bundled policies with the premiums for individual policies.

By carefully considering these factors, drivers can make informed decisions when bundling policies and save money on their car insurance premiums.

Conclusion: Finding the Best Cheap Car Insurance in California

When it comes to finding the cheapest car insurance for California drivers, there are several factors to consider. From understanding the state’s minimum coverage requirements to taking advantage of discounts and bundling policies, drivers can save money on their car insurance premiums.

In this article, we’ve discussed the importance of having car insurance in California, including the state’s minimum coverage requirements and the consequences of driving without insurance. We’ve also provided tips and strategies for finding affordable car insurance in California, including shopping around, comparing quotes, and taking advantage of discounts.

We’ve reviewed and compared several car insurance providers that offer affordable rates in California, including Geico, Progressive, and State Farm. We’ve also discussed the role of credit scores in determining car insurance rates and provided tips for improving credit scores to qualify for lower rates.

Additionally, we’ve described California’s Low-Cost Auto Insurance Program, which provides affordable coverage to low-income drivers. We’ve also discussed other factors that can impact car insurance rates in California, including driving record, age, and location.

Finally, we’ve explained the benefits of bundling car insurance with other insurance products, such as home or renters insurance. By following these tips and strategies, drivers can find the best cheap car insurance for their needs and budget.

Remember, finding the cheapest car insurance for California drivers requires research and comparison. By shopping around and comparing rates, drivers can save money on their car insurance premiums and ensure they have the coverage they need.