Understanding the Importance of Cost of Living Calculations

Calculating your cost of living is a crucial step in making informed decisions about your personal finance, relocation, and overall quality of life. A cost of living calculator, such as Sperling’s, can help you determine the expenses associated with living in a particular area, enabling you to plan and budget accordingly. By using a reliable cost of living calculator, you can avoid financial surprises and make smart decisions about your money.

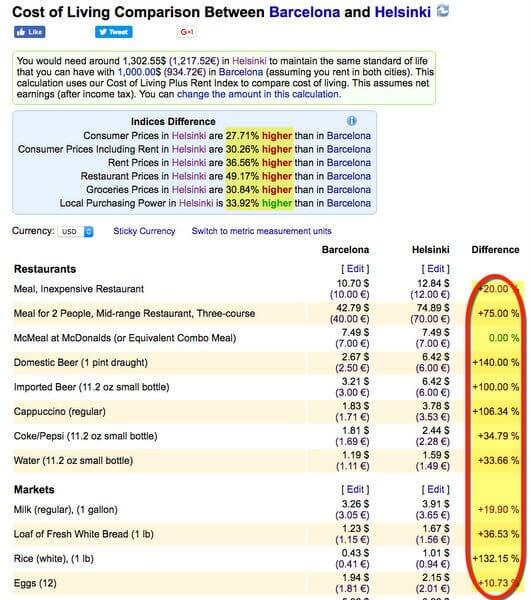

For instance, if you’re considering relocating to a new city for work or personal reasons, a cost of living calculator can help you determine whether your salary will cover the expenses of living in that area. You can compare the cost of living in different cities and make an informed decision about which location is best for you. Additionally, a cost of living calculator can help you identify areas where you can cut back on expenses and allocate your resources more efficiently.

Furthermore, a cost of living calculator can also help you understand the impact of inflation on your expenses. By tracking changes in the cost of living index, you can adjust your budget accordingly and ensure that your purchasing power is not eroded by inflation. This is particularly important for individuals who are living on a fixed income or have limited financial resources.

In conclusion, calculating your cost of living is an essential step in managing your personal finances effectively. By using a reliable cost of living calculator, such as Sperling’s, you can make informed decisions about your money and achieve your long-term financial goals. Whether you’re relocating to a new city, planning for retirement, or simply trying to make ends meet, a cost of living calculator can provide you with the insights and information you need to succeed.

How to Choose the Right Cost of Living Calculator for Your Needs

When selecting a cost of living calculator, it’s essential to consider several factors to ensure you choose the right tool for your needs. One of the most critical factors is the types of expenses to track. A reliable cost of living calculator, such as Sperling’s, should allow you to input data on various expenses, including housing, transportation, food, and healthcare costs.

Another factor to consider is the level of detail required. Some cost of living calculators may provide a general estimate of expenses, while others may offer a more detailed breakdown of costs. If you’re looking for a precise calculation of your cost of living, you may want to choose a calculator that provides a more detailed analysis.

Accuracy is also a crucial factor to consider when selecting a cost of living calculator. Look for a calculator that uses reliable data sources and provides accurate estimates of expenses. Sperling’s cost of living calculator, for example, uses data from the Council for Community and Economic Research to provide accurate estimates of expenses.

In addition to these factors, you should also consider the user interface and ease of use of the calculator. A user-friendly calculator can make it easier to input data and interpret results. Look for a calculator that provides clear instructions and offers a simple, intuitive interface.

Finally, consider the reputation and credibility of the calculator’s provider. A reputable provider, such as Sperling’s, can provide a reliable and accurate cost of living calculator that meets your needs. By considering these factors, you can choose the right cost of living calculator for your needs and make informed decisions about your personal finance and relocation plans.

Breaking Down the Components of a Cost of Living Calculator

A cost of living calculator, such as Sperling’s, typically consists of several components that are used to calculate the overall cost of living index. These components include housing, transportation, food, and healthcare costs, among others.

Housing costs, for example, are a significant component of the cost of living calculator. This includes the cost of rent or mortgage payments, property taxes, and insurance. The calculator will take into account the average cost of housing in a particular area and compare it to the national average.

Transportation costs are another important component of the cost of living calculator. This includes the cost of owning and maintaining a vehicle, as well as public transportation costs. The calculator will consider the average cost of transportation in a particular area and compare it to the national average.

Food costs are also a significant component of the cost of living calculator. This includes the cost of groceries, dining out, and other food-related expenses. The calculator will take into account the average cost of food in a particular area and compare it to the national average.

Healthcare costs are another important component of the cost of living calculator. This includes the cost of medical care, health insurance, and other healthcare-related expenses. The calculator will consider the average cost of healthcare in a particular area and compare it to the national average.

Once the calculator has gathered data on these components, it will use a formula to calculate the overall cost of living index. This index is a numerical value that represents the relative cost of living in a particular area compared to the national average. The index is usually expressed as a percentage, with 100% representing the national average.

For example, if the cost of living index for a particular area is 120%, it means that the cost of living in that area is 20% higher than the national average. This information can be useful for individuals who are considering relocating to a new area and want to know how their cost of living will be affected.

Using Sperling’s Cost of Living Calculator: A Step-by-Step Guide

Sperling’s cost of living calculator is a powerful tool that can help you determine the cost of living in a particular area. Here’s a step-by-step guide on how to use the calculator:

Step 1: Input Your Data

To start using the calculator, you’ll need to input your data. This includes your income, expenses, and location. You can choose to input your data manually or use the calculator’s pre-populated data.

Step 2: Select Your Locations

Once you’ve input your data, you’ll need to select the locations you want to compare. You can choose up to three locations to compare the cost of living.

Step 3: Choose Your Expenses

The calculator will ask you to choose the expenses you want to include in your calculation. This includes housing, transportation, food, and healthcare costs, among others.

Step 4: Get Your Results

Once you’ve input your data and selected your locations and expenses, the calculator will provide you with your results. This includes a detailed breakdown of the cost of living in each location, as well as a comparison of the costs.

Step 5: Interpret Your Results

Once you have your results, you’ll need to interpret them. This includes understanding the cost of living index, comparing costs between locations, and identifying areas for budgeting adjustments.

Features and Benefits of Sperling’s Cost of Living Calculator

Sperling’s cost of living calculator has several features and benefits that make it a powerful tool for determining the cost of living. These include:

A comprehensive database of cost of living data

A user-friendly interface that makes it easy to input data and get results

A detailed breakdown of the cost of living in each location

A comparison of costs between locations

Identification of areas for budgeting adjustments

By following these steps and using Sperling’s cost of living calculator, you can get a accurate and comprehensive picture of the cost of living in a particular area. This can help you make informed decisions about relocation, budgeting, and financial planning.

Interpreting Your Cost of Living Results: What Do the Numbers Mean?

Once you have used a cost of living calculator, such as Sperling’s, to determine the cost of living in a particular area, you will need to interpret the results. This includes understanding the cost of living index, comparing costs between locations, and identifying areas for budgeting adjustments.

The cost of living index is a numerical value that represents the relative cost of living in a particular area compared to the national average. A cost of living index of 100 represents the national average, while a value above 100 indicates a higher cost of living and a value below 100 indicates a lower cost of living.

For example, if the cost of living index for a particular area is 120, it means that the cost of living in that area is 20% higher than the national average. This information can be useful for individuals who are considering relocating to a new area and want to know how their cost of living will be affected.

In addition to understanding the cost of living index, you will also want to compare costs between locations. This can help you identify areas where the cost of living is higher or lower than average, and make informed decisions about relocation or budgeting.

For example, if you are considering relocating from a city with a high cost of living to a city with a lower cost of living, you may be able to reduce your expenses and improve your overall quality of life. On the other hand, if you are relocating to a city with a higher cost of living, you may need to adjust your budget accordingly to ensure that you can afford the increased expenses.

Finally, you will want to identify areas for budgeting adjustments based on your cost of living results. This may include reducing expenses in certain areas, such as housing or transportation, or increasing income to offset the costs of living in a particular area.

By interpreting your cost of living results and making informed decisions based on the data, you can take control of your finances and improve your overall quality of life.

Common Mistakes to Avoid When Using a Cost of Living Calculator

When using a cost of living calculator, such as Sperling’s, it’s essential to avoid common mistakes that can lead to inaccurate results or misinformed decisions. Here are some mistakes to watch out for:

Underestimating Expenses

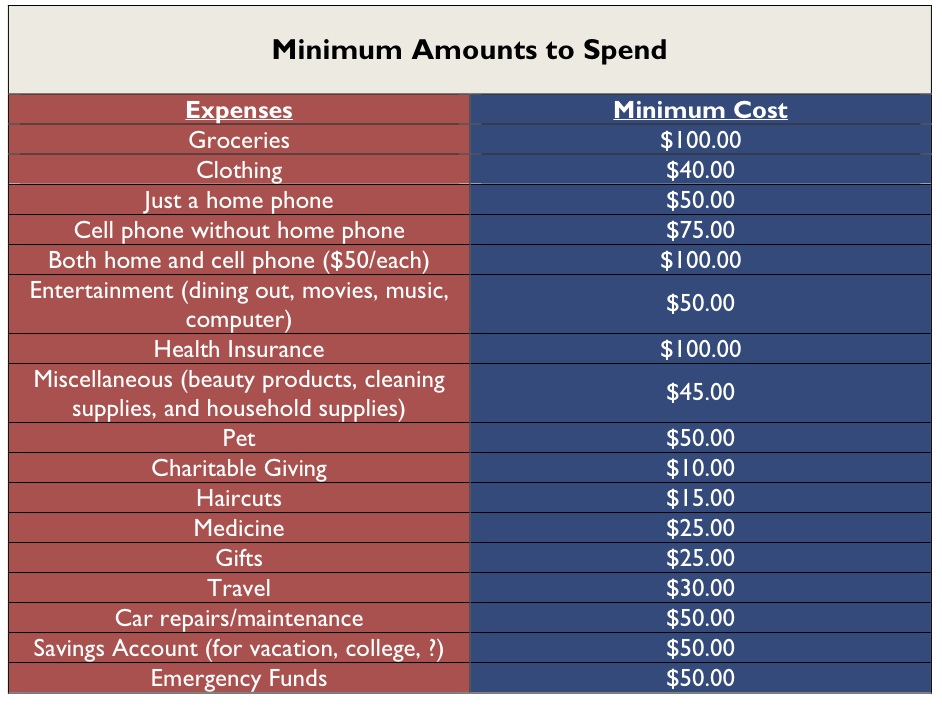

One of the most common mistakes is underestimating expenses. This can happen when you don’t account for all the costs associated with living in a particular area. For example, you might forget to include expenses like transportation, food, or entertainment. To avoid this mistake, make sure to include all the relevant expenses in your calculation.

Neglecting to Account for Lifestyle Factors

Another mistake is neglecting to account for lifestyle factors that can affect your cost of living. For example, if you have a large family, you may need to consider the cost of childcare or education. Similarly, if you have a pet, you’ll need to factor in the cost of pet care. By considering these lifestyle factors, you can get a more accurate picture of your cost of living.

Misinterpreting Results

Finally, it’s essential to avoid misinterpreting the results from your cost of living calculator. For example, you might assume that a lower cost of living index means that an area is automatically more affordable. However, this might not be the case. You need to consider other factors like job opportunities, education, and healthcare when making your decision.

By avoiding these common mistakes, you can use a cost of living calculator like Sperling’s to make informed decisions about your finances and lifestyle. Remember to always double-check your inputs, consider all relevant expenses, and interpret your results carefully.

Real-Life Applications of Cost of Living Calculators: Success Stories and Lessons Learned

Cost of living calculators, such as Sperling’s, have been used by numerous individuals and families to make informed decisions about relocation, budgeting, and financial planning. Here are some real-life examples of how these calculators have helped people achieve their goals:

Example 1: Relocating for a Job

John, a software engineer, was offered a job in a new city. Before making the move, he used Sperling’s cost of living calculator to determine the cost of living in the new city compared to his current location. He discovered that the cost of living in the new city was 20% higher than his current location. Armed with this information, John was able to negotiate a higher salary to offset the increased cost of living.

Example 2: Budgeting for Retirement

Mary, a retiree, was planning to move to a new state to be closer to her family. She used Sperling’s cost of living calculator to determine the cost of living in the new state compared to her current location. She discovered that the cost of living in the new state was 15% lower than her current location. With this information, Mary was able to adjust her budget and make informed decisions about her retirement planning.

Example 3: Financial Planning for a Family

David, a father of two, was planning to move his family to a new city for a job opportunity. He used Sperling’s cost of living calculator to determine the cost of living in the new city compared to his current location. He discovered that the cost of living in the new city was 10% higher than his current location. With this information, David was able to adjust his budget and make informed decisions about his family’s financial planning.

These examples demonstrate the value of using a cost of living calculator, such as Sperling’s, to make informed decisions about relocation, budgeting, and financial planning. By using these calculators, individuals and families can gain a better understanding of the cost of living in different locations and make informed decisions that meet their needs and goals.

Maximizing Your Budget: Tips for Reducing Your Cost of Living

Reducing your cost of living can have a significant impact on your overall financial well-being. By implementing a few simple strategies, you can save money on housing, transportation, and food expenses, and allocate those funds towards more important goals. Here are some practical tips for reducing your cost of living:

1. Downsize Your Housing

One of the most significant expenses for many people is housing. Consider downsizing to a smaller home or apartment, or exploring alternative housing options such as shared housing or community land trusts.

2. Optimize Your Transportation

Transportation costs can add up quickly, especially if you live in an area with high parking fees or traffic congestion. Consider using public transportation, carpooling, or biking or walking to work.

3. Plan Your Meals

Food expenses can be a significant portion of your budget. Consider meal planning, using coupons, and shopping at discount grocery stores to reduce your food expenses.

4. Reduce Your Energy Consumption

Energy consumption can be a significant expense, especially if you live in an area with high energy costs. Consider reducing your energy consumption by using energy-efficient appliances, turning off lights and electronics when not in use, and using power strips to eliminate standby power consumption.

5. Review and Adjust Your Budget Regularly

Finally, it’s essential to regularly review and adjust your budget to ensure that you’re on track to meet your financial goals. Consider using a budgeting app or spreadsheet to track your expenses and make adjustments as needed.

By implementing these strategies, you can reduce your cost of living and allocate those funds towards more important goals, such as saving for retirement or paying off debt. Remember to regularly review and adjust your budget to ensure that you’re on track to meet your financial goals.