How to Choose the Best Credit Card for Your Digital Purchases

Online shopping has become an integral part of modern life, with millions of people around the world turning to the internet to purchase everything from groceries to gadgets. However, with the rise of online shopping comes the need for a reliable and secure payment method. This is where a credit card for online shopping comes in – a vital tool for anyone who regularly makes digital purchases. In this article, we will explore the importance of having a suitable credit card for online shopping and provide a comprehensive guide to selecting the perfect card for your online transactions.

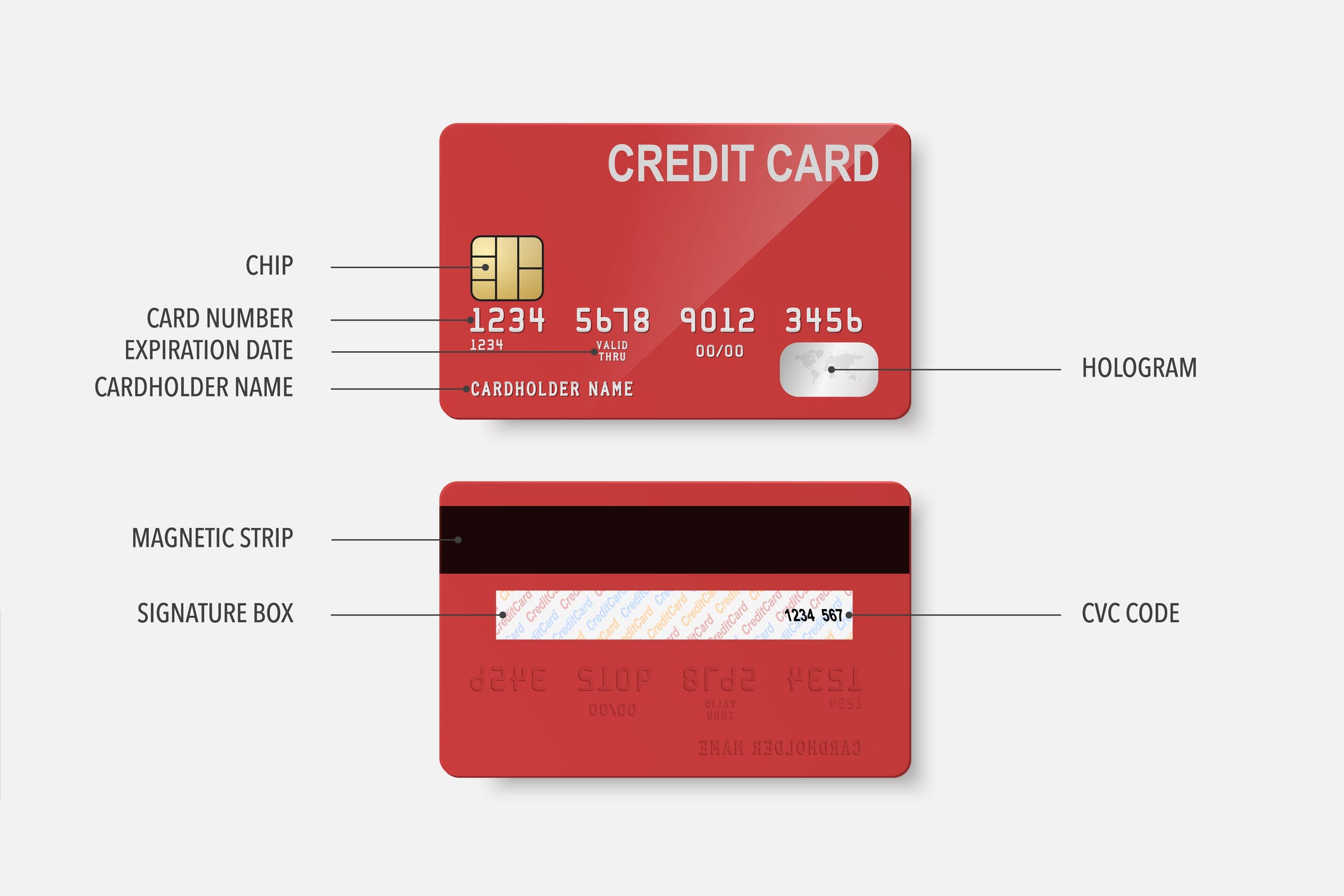

Having a credit card for online shopping offers numerous benefits, including rewards, security, and convenience. Rewards programs can provide cashback or points on digital purchases, allowing cardholders to earn rewards on their online spending. Security features, such as chip technology and tokenization, can protect cardholders from fraud and unauthorized transactions. Additionally, credit cards for online shopping often offer convenience features, such as easy checkout processes and purchase protection.

When choosing a credit card for online shopping, it’s essential to consider several factors. Look for a card that offers a rewards program that aligns with your online shopping habits. For example, if you frequently shop on Amazon, look for a card that offers cashback or points on Amazon purchases. Additionally, consider the card’s security features and convenience benefits. A card with robust security features and a user-friendly online platform can provide peace of mind and make online shopping easier.

In the following sections, we will delve deeper into the key features of a great online shopping credit card, review popular options, and provide tips on how to maximize your rewards and stay safe while shopping online. By the end of this article, you will have a comprehensive understanding of how to choose the best credit card for your digital purchases and be well on your way to making the most of your online shopping experience.

Understanding the Key Features of a Great Online Shopping Credit Card

When it comes to choosing a credit card for online shopping, there are several key features to look for. A great online shopping credit card should offer a combination of benefits that enhance the online shopping experience, including rewards, security, and convenience. In this section, we will explore the essential features to look for in a credit card for online shopping.

One of the most important features to look for in a credit card for online shopping is zero foreign transaction fees. This feature is particularly useful for online shoppers who frequently make purchases from international retailers. With zero foreign transaction fees, cardholders can avoid paying extra fees on their international purchases, saving them money in the long run.

Purchase protection is another essential feature to look for in a credit card for online shopping. This feature provides cardholders with protection against defective or stolen items, giving them peace of mind when making online purchases. Look for a credit card that offers purchase protection for a minimum of 90 days, and ideally up to a year or more.

Rewards programs are also a key feature to look for in a credit card for online shopping. A great rewards program should offer cashback or points on digital purchases, allowing cardholders to earn rewards on their online spending. Look for a credit card that offers a rewards program that aligns with your online shopping habits, such as cashback on Amazon purchases or points on travel bookings.

Other features to look for in a credit card for online shopping include chip technology, tokenization, and zero-liability policies. These features provide an additional layer of security and protection against fraud and unauthorized transactions. Look for a credit card that offers these features to ensure a safe and secure online shopping experience.

By considering these key features, online shoppers can find a credit card that meets their needs and enhances their online shopping experience. In the next section, we will review popular credit cards that excel in online shopping, highlighting their benefits, drawbacks, and ideal user profiles.

The Top Credit Cards for Online Shopping: A Review of Popular Options

When it comes to choosing a credit card for online shopping, there are many options available. In this section, we will review some of the top credit cards for online shopping, highlighting their benefits, drawbacks, and ideal user profiles.

One of the top credit cards for online shopping is the Chase Sapphire Preferred. This card offers a rewards program that provides 2X points on travel and dining purchases, as well as a 60,000-point bonus after spending $4,000 in the first 3 months. The card also offers purchase protection, trip cancellation insurance, and travel assistance. With a $95 annual fee, this card is ideal for frequent online shoppers who want to earn rewards on their purchases.

Another top credit card for online shopping is the Capital One Quicksilver Cash Rewards. This card offers a rewards program that provides unlimited 1.5% cashback on all purchases, with no rotating categories or spending limits. The card also offers a $150 bonus after spending $500 in the first 3 months, as well as a 0% intro APR for 15 months. With no annual fee, this card is ideal for online shoppers who want to earn cashback on their purchases without paying a fee.

The Citi Double Cash Card is another top credit card for online shopping. This card offers a rewards program that provides 2% cashback on all purchases, with no rotating categories or spending limits. The card also offers a 0% intro APR for 18 months, as well as a balance transfer fee of 3% or $5, whichever is greater. With no annual fee, this card is ideal for online shoppers who want to earn cashback on their purchases and pay off their balance over time.

Other top credit cards for online shopping include the Discover it Cash Back, the Bank of America Cash Rewards, and the Wells Fargo Propel. Each of these cards offers a unique rewards program and benefits, so it’s essential to compare them and choose the one that best fits your online shopping needs.

When choosing a credit card for online shopping, it’s essential to consider your individual needs and preferences. Look for a card that offers a rewards program that aligns with your online shopping habits, as well as benefits such as purchase protection and travel assistance. By choosing the right credit card for online shopping, you can earn rewards, save money, and enjoy a more secure and convenient online shopping experience.

Maximizing Your Rewards: How to Get the Most Out of Your Online Shopping Credit Card

When using a credit card for online shopping, it’s essential to maximize your rewards earnings to get the most out of your card. In this section, we will provide tips and strategies for maximizing rewards earnings on online purchases.

One way to maximize rewards earnings is to use shopping portals. Shopping portals are websites that offer rewards or cashback on purchases made through their platform. By using a shopping portal, you can earn additional rewards on top of what you would earn with your credit card. For example, if you use a shopping portal that offers 5% cashback on purchases, and you also earn 2% cashback with your credit card, you can earn a total of 7% cashback on your purchase.

Another way to maximize rewards earnings is to take advantage of sign-up bonuses. Many credit cards offer sign-up bonuses for new cardholders, which can be a great way to earn rewards quickly. For example, if you sign up for a credit card that offers a 50,000-point bonus after spending $3,000 in the first 3 months, you can earn a significant amount of rewards just for meeting the spending requirement.

Leveraging category-specific rewards programs is also a great way to maximize rewards earnings. Many credit cards offer rewards programs that provide higher rewards earnings in specific categories, such as travel or dining. By using a credit card that offers a category-specific rewards program, you can earn higher rewards earnings on purchases in those categories.

Additionally, you can also maximize rewards earnings by using a credit card that offers a rewards program with no rotating categories or spending limits. This type of rewards program allows you to earn rewards on all purchases, without having to worry about rotating categories or spending limits.

By following these tips and strategies, you can maximize your rewards earnings and get the most out of your credit card for online shopping. Remember to always read the terms and conditions of your credit card agreement to understand the rewards program and how to maximize your earnings.

Staying Safe While Shopping Online: Credit Card Security Features to Look For

When it comes to online shopping, security is a top priority. A credit card for online shopping with robust security features can provide peace of mind and protect against potential threats. In this section, we’ll explore the essential security features to look for in a credit card, ensuring a safe and secure online shopping experience.

One of the most critical security features to look for is chip technology. Also known as EMV (Europay, Mastercard, and Visa) technology, this feature uses a small microchip to store and process data, making it more difficult for hackers to access sensitive information. When shopping online, look for a credit card that uses chip technology to add an extra layer of security to your transactions.

Tokenization is another security feature that can help protect your credit card information. This process replaces your actual credit card number with a unique token, making it impossible for hackers to access your sensitive information. Many credit cards for online shopping offer tokenization, so be sure to look for this feature when selecting a card.

Zero-liability policies are also essential for online shopping security. This feature ensures that you’re not held responsible for unauthorized transactions, providing an added layer of protection against fraud. When shopping online, look for a credit card that offers zero-liability protection to safeguard your finances.

In addition to these features, it’s essential to monitor your credit card activity regularly. Keep an eye on your statements and report any suspicious transactions to your credit card issuer immediately. By being vigilant and using a credit card with robust security features, you can enjoy a safe and secure online shopping experience.

When selecting a credit card for online shopping, consider the following security features:

- Chip technology (EMV)

- Tokenization

- Zero-liability policies

- Regular security updates and patches

- Two-factor authentication

By prioritizing security and choosing a credit card with these features, you can enjoy a safe and secure online shopping experience. Remember to always monitor your credit card activity and report any suspicious transactions to your credit card issuer to ensure your financial protection.

Avoiding Common Pitfalls: How to Use Your Credit Card Responsibly for Online Shopping

Using a credit card for online shopping can be a convenient and rewarding experience, but it’s essential to use it responsibly to avoid common pitfalls. Irresponsible credit card use can lead to overspending, debt, and damage to your credit score. In this section, we’ll provide guidance on how to use your credit card responsibly for online shopping.

Avoiding overspending is crucial when using a credit card for online shopping. It’s easy to get caught up in the excitement of online shopping and make impulse purchases, but this can quickly lead to debt. To avoid overspending, set a budget for your online purchases and stick to it. Make a list of the items you need to purchase and avoid browsing online stores for non-essential items.

Making timely payments is also essential when using a credit card for online shopping. Late payments can result in interest charges, fees, and damage to your credit score. Set up automatic payments or reminders to ensure you never miss a payment. Paying your balance in full each month can also help you avoid interest charges and save money.

Monitoring your credit score is also important when using a credit card for online shopping. Your credit score can affect your ability to obtain credit in the future, so it’s essential to keep it healthy. Check your credit report regularly to ensure there are no errors or unauthorized transactions. You can request a free credit report from each of the three major credit reporting agencies once a year.

Additionally, be aware of the interest rates and fees associated with your credit card. High interest rates and fees can quickly add up and lead to debt. Look for a credit card with a low interest rate and minimal fees. Consider a credit card with a 0% introductory APR or a balance transfer offer to save money on interest.

Finally, keep your credit card information secure when shopping online. Avoid using public computers or public Wi-Fi to make online purchases, and never share your credit card information with others. Use a secure browser and look for the “https” prefix in the URL to ensure the website is secure.

By following these tips, you can use your credit card responsibly for online shopping and avoid common pitfalls. Remember to always prioritize your financial security and make informed decisions when using your credit card.

Best practices for responsible credit card use for online shopping:

- Set a budget and stick to it

- Make timely payments

- Monitor your credit score

- Be aware of interest rates and fees

- Keep your credit card information secure

By following these best practices, you can enjoy the benefits of using a credit card for online shopping while maintaining your financial security.

Comparing Credit Card Offers: A Step-by-Step Guide to Finding the Best Card for Your Needs

With so many credit card options available, it can be overwhelming to choose the best one for your online shopping needs. To make an informed decision, it’s essential to compare credit card offers carefully. In this section, we’ll provide a step-by-step guide to help you evaluate credit card offers and find the perfect card for your digital purchases.

Step 1: Evaluate Interest Rates

Interest rates can significantly impact the cost of your credit card. Look for a credit card with a low interest rate, especially if you plan to carry a balance. Consider a credit card with a 0% introductory APR or a low ongoing APR.

Step 2: Assess Fees

Fees can add up quickly, so it’s essential to understand the fees associated with your credit card. Look for a credit card with minimal fees, such as no annual fee, no foreign transaction fee, and no late fee.

Step 3: Examine Rewards Programs

Rewards programs can be a significant benefit of using a credit card for online shopping. Look for a credit card that offers rewards in categories that align with your spending habits, such as cashback, points, or travel miles.

Step 4: Consider Introductory Promotions

Introductory promotions can be a great way to earn rewards or save money on interest. Look for credit cards with sign-up bonuses, 0% introductory APRs, or other promotional offers.

Step 5: Evaluate Credit Card Benefits

Credit card benefits can provide additional value and protection. Look for credit cards with benefits such as purchase protection, return protection, and travel insurance.

Step 6: Read Reviews and Check Ratings

Reading reviews and checking ratings can provide valuable insights into a credit card’s performance. Look for credit cards with high ratings and positive reviews from reputable sources.

To help you compare credit card offers, we’ve created a worksheet that you can use to evaluate different credit cards. Simply fill in the information for each credit card and compare the results.

Credit Card Comparison Worksheet:

| Credit Card | Interest Rate | Fees | Rewards Program | Introductory Promotions | Credit Card Benefits | Ratings |

|---|---|---|---|---|---|---|

| Credit Card 1 | 12.99% | $0 annual fee | 2% cashback on online purchases | 0% introductory APR for 12 months | Purchase protection, return protection | 4.5/5 stars |

| Credit Card 2 | 15.99% | $95 annual fee | 3% cashback on online purchases | Sign-up bonus of 50,000 points | Travel insurance, concierge service | 4.2/5 stars |

By following these steps and using the credit card comparison worksheet, you can make an informed decision and find the best credit card for your online shopping needs.

Conclusion: Finding the Perfect Credit Card for Your Online Shopping Needs

Choosing the right credit card for online shopping is crucial to maximizing rewards, ensuring security, and enjoying a convenient shopping experience. Throughout this article, we’ve provided a comprehensive guide to help you select the perfect credit card for your digital purchases.

We’ve discussed the essential features to look for in a credit card for online shopping, including zero foreign transaction fees, purchase protection, and rewards programs that offer cashback or points on digital purchases. We’ve also reviewed popular credit cards that excel in online shopping, such as the Chase Sapphire Preferred, Capital One Quicksilver Cash Rewards, and Citi Double Cash Card.

In addition, we’ve offered tips and strategies for maximizing rewards earnings on online purchases, including using shopping portals, taking advantage of sign-up bonuses, and leveraging category-specific rewards programs. We’ve also emphasized the importance of credit card security features for online shopping, such as chip technology, tokenization, and zero-liability policies.

Furthermore, we’ve provided guidance on responsible credit card use for online shopping, including advice on avoiding overspending, making timely payments, and monitoring credit scores. We’ve also created a step-by-step guide to comparing credit card offers, including evaluating interest rates, fees, rewards programs, and introductory promotions.

By following the guidance provided in this article, you can find the perfect credit card for your online shopping needs. Remember to always prioritize your financial security and make informed decisions when using your credit card. With the right credit card, you can enjoy a safe, convenient, and rewarding online shopping experience.

In conclusion, choosing the right credit card for online shopping is a crucial decision that can impact your financial security and shopping experience. By considering the essential features, rewards programs, security features, and responsible use guidelines outlined in this article, you can make an informed decision and find the perfect credit card for your digital purchases.

Start your search for the perfect credit card for online shopping today and enjoy a safe, convenient, and rewarding online shopping experience.