Why Small Businesses Need a Reliable Credit Card Solution

Managing finances is a significant challenge for small businesses, and cash flow management is a critical aspect of this process. A credit card can be a valuable tool in alleviating these issues, providing a convenient and flexible way to manage expenses, build credit, and earn rewards. For small businesses, a credit card can help separate personal and business expenses, making it easier to track spending and stay organized.

In addition to these benefits, a credit card can also provide a safety net for unexpected expenses or financial shortfalls. By having a credit card, small businesses can ensure they have access to funds when needed, reducing the risk of financial difficulties. Furthermore, many credit cards offer rewards programs, such as cashback or points, which can be redeemed for travel, merchandise, or other business expenses.

When used responsibly, a credit card can be a powerful financial tool for small businesses. By making timely payments and keeping credit utilization low, small businesses can establish a positive credit history, which can lead to better loan terms, lower interest rates, and increased access to credit. In fact, a credit card can be an essential component of a small business’s financial strategy, providing a flexible and convenient way to manage finances and achieve long-term goals.

For small businesses, finding the right credit card is crucial. With so many options available, it’s essential to consider factors such as interest rates, fees, credit limits, and rewards programs. By choosing a credit card that aligns with their financial needs and goals, small businesses can maximize the benefits of credit card use and minimize the risks. Whether it’s building credit, earning rewards, or managing expenses, a credit card can be a valuable asset for small businesses, helping them achieve financial stability and success.

How to Choose the Best Credit Card for Your Small Business

Selecting the right credit card for a small business can be a daunting task, with numerous options available in the market. To make an informed decision, it’s essential to consider several factors, including interest rates, fees, credit limits, and rewards programs. By evaluating these factors, small businesses can choose a credit card that aligns with their financial needs and goals.

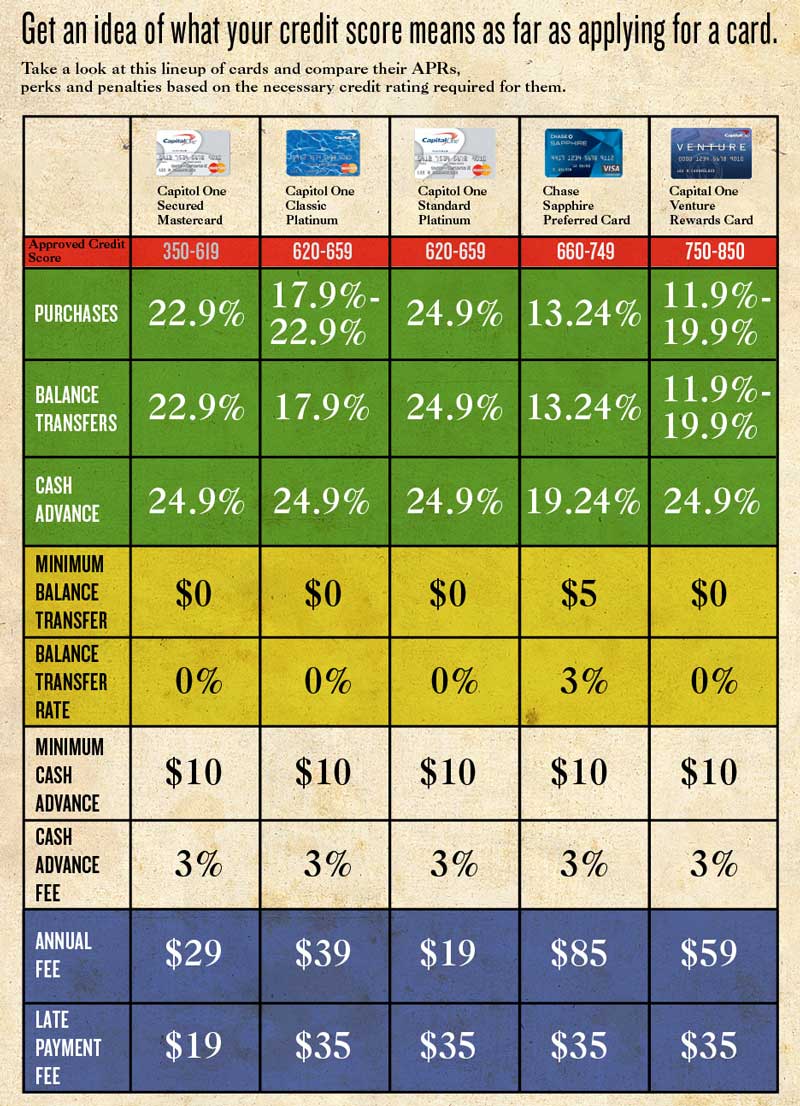

Interest rates are a critical consideration when choosing a credit card for a small business. Look for cards with competitive interest rates, and consider the type of interest rate offered, such as fixed or variable. Additionally, check if the card offers an introductory APR period, which can provide significant savings on interest charges.

Fees are another important factor to consider when selecting a credit card for a small business. Look for cards with minimal fees, such as annual fees, late fees, and foreign transaction fees. Some credit cards may also offer fee waivers or discounts for certain services, such as employee cards or purchase protection.

Credit limits are also a crucial consideration when choosing a credit card for a small business. Ensure the card offers a sufficient credit limit to meet your business needs, and consider the credit limit increase options available. Some credit cards may offer automatic credit limit increases or require a manual request.

Rewards programs are a valuable benefit for small businesses, offering cashback, points, or travel rewards on purchases. Consider the type of rewards program offered, such as flat-rate cashback or category-specific rewards. Also, check the rewards redemption process, including any restrictions or limitations.

Popular credit cards for small businesses include the Chase Ink Business Preferred and the Capital One Spark Cash. The Chase Ink Business Preferred offers a generous rewards program, with 3X points on travel and select business categories, and a 100,000-point bonus after spending $15,000 in the first 3 months. The Capital One Spark Cash offers unlimited 2% cashback on all purchases, with no rotating categories or spending limits.

When evaluating credit cards for a small business, consider the specific needs and financial goals of your business. By choosing a credit card that aligns with your business needs, you can maximize the benefits of credit card use and minimize the risks. Whether it’s building credit, earning rewards, or managing expenses, a credit card can be a valuable tool for small businesses.

Understanding Credit Card Fees and Interest Rates

Credit cards for small businesses often come with various fees and interest rates that can impact the overall cost of using the card. Understanding these fees and interest rates is crucial to minimize costs and maximize the benefits of using a credit card for small businesses.

Annual fees are a common type of fee associated with credit cards for small businesses. These fees can range from $50 to $500 or more, depending on the card and its benefits. Some credit cards may offer fee waivers or discounts for certain services, such as employee cards or purchase protection.

Late fees are another type of fee that can be incurred when payments are not made on time. These fees can range from $25 to $38 or more, depending on the card and the payment history. To avoid late fees, it’s essential to make payments on time and set up automatic payments or reminders.

Foreign transaction fees are a type of fee that can be incurred when making purchases abroad. These fees can range from 1% to 3% or more, depending on the card and the transaction. To avoid foreign transaction fees, consider using a credit card that does not charge these fees or look for cards with low or no foreign transaction fees.

Interest rates are another critical factor to consider when using a credit card for small businesses. Interest rates can range from 12% to 25% or more, depending on the card and the creditworthiness of the business. To avoid interest charges, consider paying balances in full each month or making multiple payments throughout the month.

To minimize fees and interest rates, consider the following tips:

- Choose a credit card with low or no annual fees.

- Make payments on time to avoid late fees.

- Use a credit card with no foreign transaction fees or low fees.

- Pay balances in full each month to avoid interest charges.

- Consider using a credit card with a 0% introductory APR period.

By understanding the fees and interest rates associated with credit cards for small businesses, entrepreneurs can make informed decisions and minimize costs. Remember to always read the terms and conditions of the credit card agreement and ask questions if you’re unsure about any fees or interest rates.

Maximizing Rewards and Benefits for Your Small Business

Rewards programs are a valuable benefit for small businesses using credit cards. By choosing a credit card with a rewards program that aligns with their business needs, small businesses can earn cashback, points, or travel rewards on purchases. These rewards can be redeemed for statement credits, gift cards, or other business expenses.

Cashback rewards are a popular option for small businesses, offering a percentage of the purchase amount back as a reward. For example, the Chase Ink Business Preferred offers 3% cashback on purchases in select categories, such as travel and dining. The Capital One Spark Cash offers unlimited 2% cashback on all purchases, with no rotating categories or spending limits.

Points rewards are another option for small businesses, offering points that can be redeemed for travel, merchandise, or other business expenses. For example, the American Express Business Gold Card offers 4X points on purchases in select categories, such as air travel and advertising. The Citi Double Cash Card offers 2% cashback on all purchases, with no rotating categories or spending limits.

Travel rewards are also a popular option for small businesses, offering points or miles that can be redeemed for travel expenses. For example, the Chase Sapphire Preferred offers 2X points on travel and dining purchases, with a 60,000-point bonus after spending $4,000 in the first 3 months. The Barclays Arrival Plus offers 2X miles on all purchases, with a 70,000-mile bonus after spending $5,000 in the first 90 days.

To maximize rewards and benefits, consider the following tips:

- Choose a credit card with a rewards program that aligns with your business needs.

- Use the credit card for all business purchases to earn rewards.

- Pay balances in full each month to avoid interest charges.

- Redeem rewards regularly to maximize their value.

- Consider using a credit card with a 0% introductory APR period to avoid interest charges.

By maximizing rewards and benefits, small businesses can get the most out of their credit card use and improve their financial performance. Remember to always read the terms and conditions of the credit card agreement and ask questions if you’re unsure about any rewards or benefits.

Building Business Credit with a Credit Card

Establishing a positive credit history is crucial for small businesses to access credit and loans at favorable interest rates. A credit card can be a valuable tool in building business credit, as it allows small businesses to demonstrate creditworthiness and improve their credit scores over time.

To build business credit with a credit card, it’s essential to use the card responsibly. This means making payments on time, keeping credit utilization low, and avoiding negative marks on the credit report. By demonstrating responsible credit behavior, small businesses can establish a positive credit history and improve their credit scores.

Here are some tips for building business credit with a credit card:

- Make payments on time: Payment history is a critical factor in determining credit scores. Make sure to pay the credit card bill on time, every time.

- Keep credit utilization low: Keep the credit utilization ratio low by keeping the balance low compared to the credit limit. Aim to use less than 30% of the available credit.

- Avoid negative marks: Avoid negative marks on the credit report by avoiding late payments, collections, and other negative credit behaviors.

- Monitor credit reports: Monitor the credit reports regularly to ensure they are accurate and up-to-date.

By following these tips, small businesses can build a positive credit history and improve their credit scores over time. This can help them access credit and loans at favorable interest rates, which can be a valuable asset for growing and expanding the business.

Some popular credit cards for building business credit include:

- Chase Ink Business Preferred: This card offers a 100,000-point bonus after spending $15,000 in the first 3 months and has a 0% introductory APR period.

- Capital One Spark Cash: This card offers unlimited 2% cashback on all purchases and has a 0% introductory APR period.

- American Express Business Gold Card: This card offers 4X points on purchases in select categories and has a 0% introductory APR period.

By choosing the right credit card and using it responsibly, small businesses can build a positive credit history and improve their credit scores over time.

Managing Credit Card Debt and Avoiding Financial Pitfalls

While credit cards can be a valuable tool for small businesses, they can also lead to financial pitfalls if not used responsibly. Overspending, late payments, and high-interest debt can all have negative consequences for a small business’s financial health.

To avoid these financial pitfalls, it’s essential to use credit cards responsibly and manage debt effectively. Here are some strategies for managing credit card debt and avoiding financial pitfalls:

- Make timely payments: Late payments can result in late fees and negative marks on the credit report. Make sure to pay the credit card bill on time, every time.

- Keep credit utilization low: Keep the credit utilization ratio low by keeping the balance low compared to the credit limit. Aim to use less than 30% of the available credit.

- Avoid overspending: Avoid overspending by setting a budget and sticking to it. Make sure to prioritize essential expenses over discretionary ones.

- Consider debt consolidation: If you have multiple credit cards with high balances, consider consolidating them into a single loan with a lower interest rate.

- Use balance transfer: If you have a credit card with a 0% introductory APR, consider transferring the balance from a higher-interest credit card to take advantage of the lower interest rate.

- Seek credit counseling: If you’re struggling to manage credit card debt, consider seeking credit counseling from a reputable credit counseling agency.

By following these strategies, small businesses can avoid financial pitfalls and manage credit card debt effectively. Remember, responsible credit card use is key to maintaining a healthy financial situation.

Some popular credit cards for small businesses that offer debt management tools and resources include:

- Chase Ink Business Preferred: This card offers a 0% introductory APR period and a balance transfer feature.

- Capital One Spark Cash: This card offers a 0% introductory APR period and a balance transfer feature.

- American Express Business Gold Card: This card offers a 0% introductory APR period and a balance transfer feature.

By choosing the right credit card and using it responsibly, small businesses can avoid financial pitfalls and maintain a healthy financial situation.

Real-Life Examples of Small Businesses Using Credit Cards Successfully

Many small businesses have successfully used credit cards to manage finances, build credit, and earn rewards. Here are a few examples:

Example 1: Sarah’s Bakery

Sarah’s Bakery is a small business that uses a credit card to manage its finances. The business uses a Chase Ink Business Preferred credit card to earn rewards on purchases, such as 3X points on travel and select business categories. Sarah’s Bakery also uses the credit card to build its credit history, making timely payments and keeping credit utilization low.

Example 2: John’s Landscaping

John’s Landscaping is a small business that uses a credit card to manage its finances. The business uses a Capital One Spark Cash credit card to earn cashback rewards on purchases, such as 2% cashback on all purchases. John’s Landscaping also uses the credit card to build its credit history, making timely payments and keeping credit utilization low.

Example 3: Emily’s Boutique

Emily’s Boutique is a small business that uses a credit card to manage its finances. The business uses an American Express Business Gold Card to earn rewards on purchases, such as 4X points on purchases in select categories. Emily’s Boutique also uses the credit card to build its credit history, making timely payments and keeping credit utilization low.

These examples demonstrate how small businesses can successfully use credit cards to manage finances, build credit, and earn rewards. By choosing the right credit card and using it responsibly, small businesses can achieve their financial goals and grow their business.

When using a credit card for small businesses, it’s essential to consider the specific needs and financial goals of the business. By choosing a credit card that aligns with these needs and goals, small businesses can maximize the benefits of credit card use and minimize the risks.

Conclusion: Finding the Right Credit Card for Your Small Business

In conclusion, finding the right credit card for a small business is crucial for managing finances, building credit, and earning rewards. By considering the specific needs and financial goals of the business, small business owners can choose a credit card that aligns with their goals and helps them achieve financial success.

When selecting a credit card for a small business, it’s essential to consider factors such as interest rates, fees, credit limits, and rewards programs. By choosing a credit card that offers a competitive interest rate, low fees, and a rewards program that aligns with the business’s spending habits, small business owners can maximize the benefits of credit card use and minimize the risks.

Additionally, small business owners should consider the importance of building business credit and how a credit card can help establish a positive credit history. By using a credit card responsibly and making timely payments, small business owners can demonstrate creditworthiness and improve their credit scores over time.

Finally, small business owners should be aware of the potential financial pitfalls associated with credit card use, such as overspending, late payments, and high-interest debt. By being mindful of these risks and taking steps to avoid them, small business owners can use credit cards responsibly and achieve financial success.

By following the tips and guidelines outlined in this article, small business owners can find the right credit card for their business and use it to achieve financial success. Remember to always consider your specific needs and financial goals when selecting a credit card, and to use the card responsibly to maximize the benefits and minimize the risks.