Understanding How Credit Card Interest Works

Credit card interest can be a complex and confusing topic, but understanding how it works is crucial to managing your debt effectively. At its core, credit card interest is a fee charged by the credit card issuer for borrowing money. The interest rate is typically expressed as an annual percentage rate (APR), which can vary depending on the credit card issuer, your credit score, and other factors.

There are several types of interest rates associated with credit cards, including the APR, introductory APR, and promotional APR. The APR is the standard interest rate charged on your credit card balance, while the introductory APR is a lower interest rate offered for a limited time, usually 6-12 months. The promotional APR is a special interest rate offered for specific purchases, such as balance transfers or purchases made during a promotional period.

When you carry a balance on your credit card, interest is charged on that balance, and the interest is added to the principal amount. This can create a cycle of debt that can be difficult to escape. For example, if you have a credit card balance of $1,000 and an APR of 18%, you’ll be charged $180 in interest over the course of a year, bringing your total balance to $1,180.

Using a credit card interest calculator monthly can help you understand how much interest you’re paying and make informed decisions about your debt. By inputting your credit card details, including the balance, APR, and payment amount, you can see how much interest you’ll pay over time and explore different payment scenarios to find the best strategy for paying off your debt.

For instance, if you have a credit card balance of $2,000 and an APR of 20%, you can use a credit card interest calculator monthly to see how much interest you’ll pay over the course of a year. Let’s say you want to pay off the balance in 12 months. The calculator will show you that you’ll pay approximately $400 in interest over the course of the year, bringing your total payments to $2,400. By using a credit card interest calculator monthly, you can adjust your payment plan to pay off the principal balance faster and reduce the amount of interest you pay.

In the next section, we’ll explore the benefits of using a credit card interest calculator monthly to manage your debt and create a budget.

Why You Need a Monthly Interest Calculator for Your Credit Card

Managing credit card debt can be a daunting task, but using a monthly interest calculator can help you take control of your finances and make informed decisions. One of the primary benefits of using a monthly interest calculator is avoiding surprise interest charges. By inputting your credit card details, including the balance, APR, and payment amount, you can see exactly how much interest you’ll pay each month and make adjustments to your payment plan accordingly.

Another significant advantage of using a monthly interest calculator is creating a budget. By understanding how much interest you’ll pay each month, you can factor that into your budget and make sure you have enough money set aside to cover your credit card payments. This can help you avoid late fees, overdrafts, and other financial pitfalls.

Using a monthly interest calculator can also help you pay off your debt faster. By exploring different payment scenarios, you can see how making extra payments or paying more than the minimum payment each month can impact your debt. This can help you create a plan to pay off your debt quickly and efficiently, saving you money in interest charges over time.

In addition to these benefits, using a monthly interest calculator can also help you make informed decisions about your credit card usage. By seeing how much interest you’ll pay on different purchases, you can make more informed decisions about whether to use your credit card or opt for a different payment method.

For example, let’s say you’re considering using your credit card to make a large purchase, such as a new TV. By using a monthly interest calculator, you can see how much interest you’ll pay on that purchase over time, and decide whether it’s worth it. You may find that it’s better to save up and pay cash for the TV, or explore other financing options that don’t involve credit card debt.

Overall, using a monthly interest calculator is an essential tool for managing credit card debt and making informed financial decisions. By avoiding surprise interest charges, creating a budget, and paying off debt faster, you can take control of your finances and achieve financial stability.

How to Use a Credit Card Interest Calculator to Save Money

Using a credit card interest calculator is a straightforward process that can help you save money on interest charges and pay off your debt faster. Here’s a step-by-step guide on how to use a credit card interest calculator:

Step 1: Gather Your Credit Card Information

To get started, you’ll need to gather your credit card information, including the balance, APR, and minimum payment due. You can find this information on your credit card statement or by logging into your online account.

Step 2: Input Your Credit Card Details

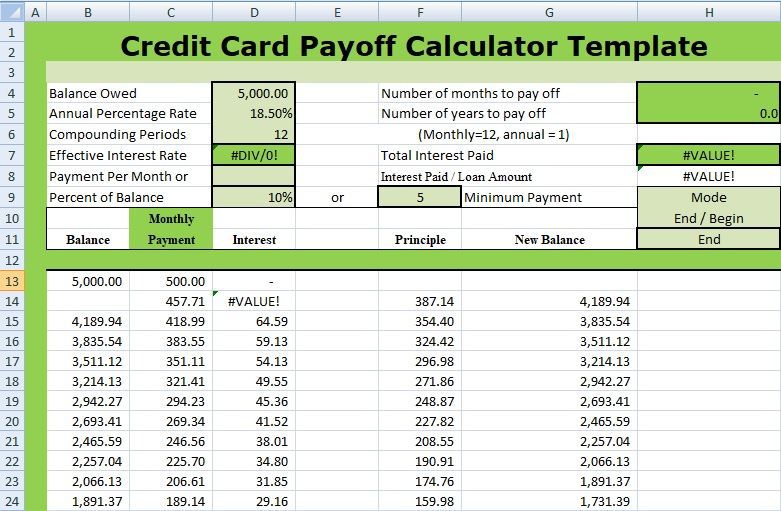

Once you have your credit card information, input it into the credit card interest calculator. This will typically include the balance, APR, and minimum payment due. Some calculators may also ask for additional information, such as the payment frequency and the number of payments you want to make.

Step 3: Calculate Your Interest Charges

After inputting your credit card details, the calculator will calculate your interest charges based on the APR and balance. This will give you an idea of how much interest you’ll pay over time and help you understand the impact of different payment scenarios.

Step 4: Explore Different Payment Scenarios

One of the most powerful features of a credit card interest calculator is the ability to explore different payment scenarios. By adjusting the payment amount, frequency, and duration, you can see how different payment plans will impact your debt and interest charges.

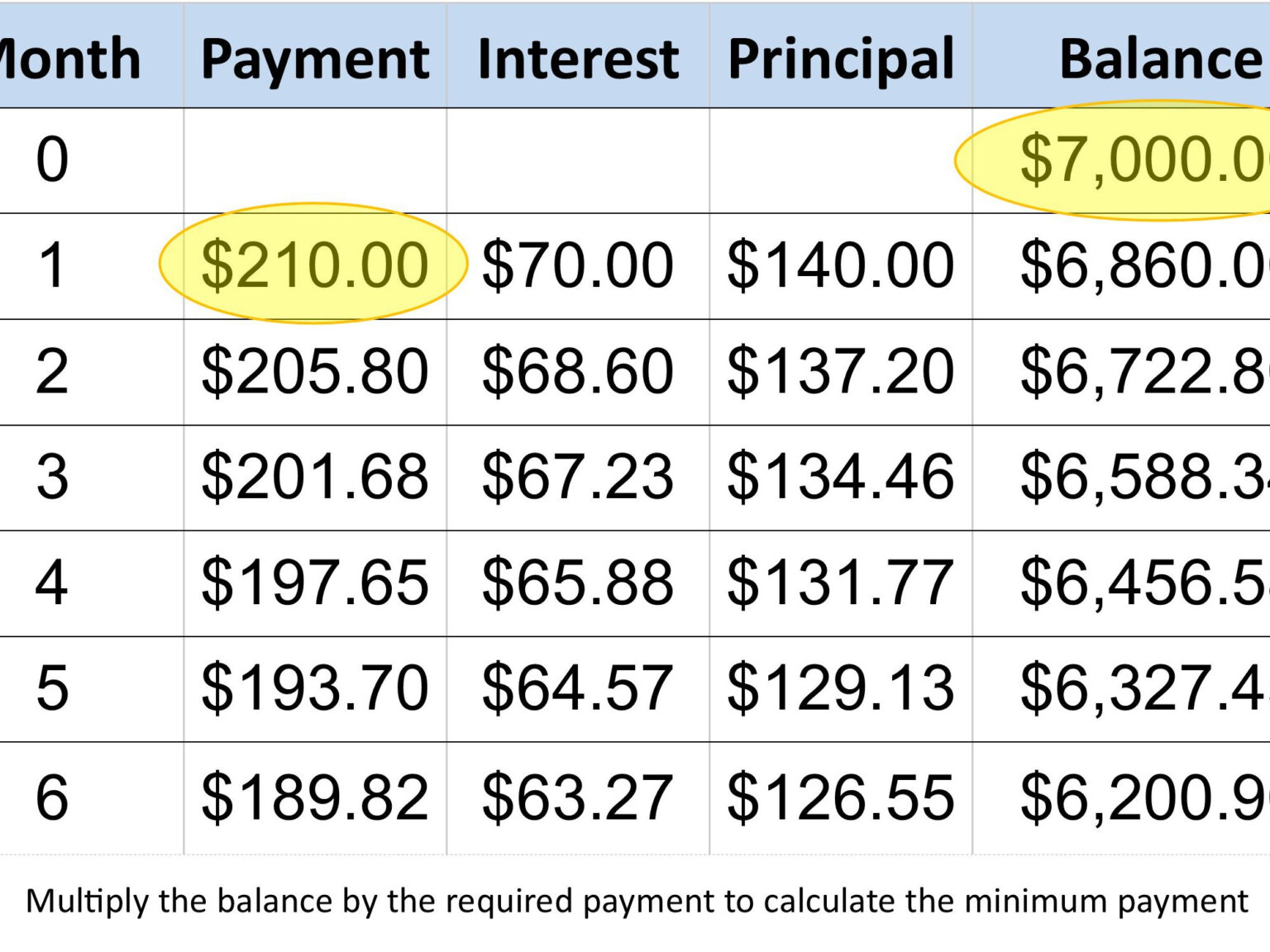

For example, let’s say you have a credit card balance of $2,000 and an APR of 18%. By using a credit card interest calculator, you can see how making different payment amounts will impact your debt. If you make the minimum payment of $50 per month, you’ll pay a total of $4,311 over 10 years, including $2,311 in interest charges. However, if you increase the payment amount to $100 per month, you’ll pay a total of $2,919 over 5 years, including $919 in interest charges.

Step 5: Adjust Your Payment Plan

Based on the results of the calculator, you can adjust your payment plan to pay off your debt faster and save money on interest charges. This may involve making larger payments, increasing the payment frequency, or exploring other payment options.

By following these steps and using a credit card interest calculator, you can take control of your credit card debt and make informed decisions about your finances.

Top Credit Card Interest Calculators for Monthly Planning

There are many credit card interest calculators available online and through mobile apps, each with their own features, pros, and cons. Here are some of the top credit card interest calculators for monthly planning:

NerdWallet’s Credit Card Payoff Calculator: This calculator allows users to input their credit card balance, APR, and payment amount to see how long it will take to pay off their debt. It also provides a breakdown of the total interest paid and the total amount paid.

Bankrate’s Credit Card Calculator: This calculator provides a comprehensive breakdown of credit card costs, including interest charges, fees, and rewards. It also allows users to compare different credit cards and see how much they can save by switching to a different card.

Credit Karma’s Credit Card Calculator: This calculator provides a personalized credit card recommendation based on the user’s credit score and financial goals. It also allows users to input their credit card balance and APR to see how long it will take to pay off their debt.

Payoff’s Credit Card Calculator: This calculator provides a detailed breakdown of credit card costs, including interest charges, fees, and rewards. It also allows users to input their credit card balance and APR to see how long it will take to pay off their debt.

These are just a few examples of the many credit card interest calculators available. When choosing a calculator, consider the following factors:

Accuracy: Look for a calculator that provides accurate and up-to-date information about credit card interest rates and fees.

Ease of use: Choose a calculator that is easy to use and provides a clear and concise breakdown of credit card costs.

Features: Consider a calculator that provides additional features, such as credit card recommendations and budgeting tools.

Reviews: Read reviews from other users to get a sense of the calculator’s effectiveness and any potential drawbacks.

By using a credit card interest calculator, you can take control of your credit card debt and make informed decisions about your finances.

Case Study: How a Monthly Interest Calculator Helped Pay Off Debt

Meet Sarah, a 30-year-old marketing specialist who had accumulated $5,000 in credit card debt over the past year. She had been making minimum payments on her credit card, but was struggling to make progress on paying off the principal balance. Sarah was feeling overwhelmed and stressed about her debt, and wasn’t sure how to get back on track.

That’s when Sarah discovered a monthly interest calculator online. She input her credit card details, including the balance, APR, and minimum payment due, and was shocked to see how much interest she was paying each month. The calculator showed her that she would take over 5 years to pay off her debt, and would end up paying over $10,000 in interest charges.

Armed with this new information, Sarah created a plan to pay off her debt faster. She increased her monthly payment by $500, and began making bi-weekly payments instead of monthly payments. She also cut back on unnecessary expenses and allocated the extra funds towards her debt.

Using the monthly interest calculator, Sarah was able to track her progress and see how her new payment plan was impacting her debt. She was able to pay off her debt in just 2 years, and saved over $5,000 in interest charges.

Sarah’s experience is a great example of how a monthly interest calculator can help individuals take control of their credit card debt. By providing a clear and accurate picture of the debt, the calculator empowered Sarah to make informed decisions about her finances and create a plan to pay off her debt faster.

The key takeaways from Sarah’s case study are:

1. Understanding the true cost of credit card debt is crucial to making informed decisions about your finances.

2. A monthly interest calculator can provide a clear and accurate picture of your debt, and help you identify areas for improvement.

3. Creating a plan to pay off debt faster can save you thousands of dollars in interest charges over time.

4. Making bi-weekly payments instead of monthly payments can help you pay off your debt faster and save money on interest charges.

By following these tips and using a monthly interest calculator, you can take control of your credit card debt and achieve financial stability.

Tips for Getting the Most Out of Your Credit Card Interest Calculator

To maximize the benefits of a credit card interest calculator, it’s essential to use it regularly and make adjustments to your payment plan as needed. Here are some expert tips to help you get the most out of your credit card interest calculator:

1. Regularly Review Your Credit Card Statements

Make sure to review your credit card statements regularly to ensure that your payments are being applied correctly and that you’re not being charged any unnecessary fees. Use your credit card interest calculator to see how your payments are impacting your debt and make adjustments as needed.

2. Adjust Your Payment Plan

If you find that you’re not making progress on paying off your debt, consider adjusting your payment plan. Use your credit card interest calculator to see how increasing your payment amount or frequency can impact your debt. You may be able to pay off your debt faster and save money on interest charges.

3. Avoid New Purchases

While it can be tempting to make new purchases on your credit card, it’s essential to avoid doing so while you’re trying to pay off debt. Use your credit card interest calculator to see how new purchases can impact your debt and make a plan to avoid making new purchases until your debt is paid off.

4. Consider Consolidating Debt

If you have multiple credit cards with high balances and high interest rates, consider consolidating your debt into a single loan with a lower interest rate. Use your credit card interest calculator to see how consolidating your debt can impact your payments and interest charges.

5. Monitor Your Credit Score

Your credit score can have a significant impact on the interest rates you’re offered on credit cards and other loans. Use your credit card interest calculator to see how your credit score can impact your interest rates and make a plan to improve your credit score over time.

By following these tips and using a credit card interest calculator regularly, you can take control of your credit card debt and make progress towards financial stability.

Common Mistakes to Avoid When Using a Credit Card Interest Calculator

While a credit card interest calculator can be a powerful tool for managing credit card debt, there are several common mistakes to avoid when using one. Here are some of the most common pitfalls to watch out for:

Neglecting to Account for Fees

Many credit cards come with fees, such as late payment fees, balance transfer fees, and foreign transaction fees. When using a credit card interest calculator, make sure to account for these fees, as they can add up quickly and impact your debt repayment plan.

Ignoring Credit Score Implications

Your credit score can have a significant impact on the interest rates you’re offered on credit cards and other loans. When using a credit card interest calculator, make sure to consider the potential impact of your credit score on your debt repayment plan.

Failing to Review Terms and Conditions

Before using a credit card interest calculator, make sure to review the terms and conditions of your credit card agreement. This can help you understand any potential fees, interest rates, and repayment terms that may impact your debt repayment plan.

Not Considering Alternative Repayment Options

When using a credit card interest calculator, make sure to consider alternative repayment options, such as debt consolidation or balance transfer. These options may be able to save you money on interest charges and help you pay off your debt faster.

Not Regularly Reviewing and Adjusting Your Plan

Finally, make sure to regularly review and adjust your debt repayment plan when using a credit card interest calculator. This can help you stay on track and make sure you’re making progress towards paying off your debt.

By avoiding these common mistakes, you can get the most out of your credit card interest calculator and make progress towards paying off your debt.

Take Control of Your Credit Card Debt with a Monthly Interest Calculator

Managing credit card debt can be a daunting task, but with the right tools and strategies, it’s possible to take control of your finances and achieve financial stability. A monthly interest calculator is a powerful tool that can help you understand your credit card debt and make informed decisions about your payments.

By using a monthly interest calculator, you can see exactly how much interest you’re paying on your credit card debt and how long it will take to pay off your balance. This information can help you create a plan to pay off your debt faster and save money on interest charges.

In addition to helping you understand your credit card debt, a monthly interest calculator can also help you avoid surprise interest charges and create a budget that works for you. By regularly reviewing your credit card statements and adjusting your payment plan as needed, you can stay on top of your debt and make progress towards financial stability.

The potential savings from using a monthly interest calculator are significant. By paying off your credit card debt faster, you can save money on interest charges and reduce your financial stress. Additionally, by creating a budget and sticking to it, you can avoid overspending and make progress towards your long-term financial goals.

In conclusion, a monthly interest calculator is a valuable tool for anyone looking to manage their credit card debt and achieve financial stability. By providing a clear and accurate picture of your credit card debt, a monthly interest calculator can help you make informed decisions about your payments and create a plan to pay off your debt faster.

Don’t let credit card debt hold you back from achieving your financial goals. Take control of your debt today with a monthly interest calculator and start building a brighter financial future.