Understanding PayPal’s Pay in 4: A Flexible Payment Option

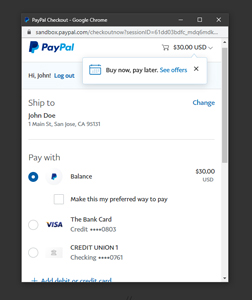

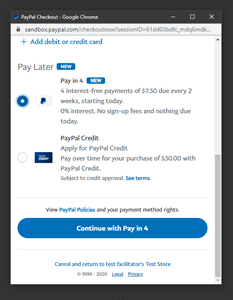

PayPal’s Pay in 4 is a flexible payment option that allows consumers to split their purchases into four interest-free payments. This service is designed to provide buyers with more control over their finances and help them manage their expenses more effectively. With Pay in 4, consumers can make a purchase and pay for it in four equal installments, due every two weeks. This payment plan is interest-free, meaning that consumers will not be charged any interest or fees as long as they make their payments on time.

PayPal’s Pay in 4 is a convenient and secure way to make purchases online or in-store. The service is available to eligible PayPal users, and it can be used to make purchases from millions of merchants worldwide. To use Pay in 4, consumers simply need to select the Pay in 4 option at checkout and follow the prompts to complete their purchase. The first payment will be due immediately, and the remaining three payments will be due every two weeks thereafter.

One of the key benefits of PayPal’s Pay in 4 is that it allows consumers to make purchases without having to pay the full amount upfront. This can be especially helpful for consumers who need to make a large purchase but do not have the funds available to pay for it all at once. By splitting the purchase into four interest-free payments, consumers can make their purchase more manageable and avoid having to pay interest or fees.

However, to qualify for PayPal’s Pay in 4, consumers will need to meet certain eligibility requirements, including having a good credit score. The credit score needed for PayPal Pay in 4 is not publicly disclosed, but it is generally recommended that consumers have a credit score of at least 600 to be eligible for the service. Consumers with poor credit may not be eligible for Pay in 4, or they may be required to make a down payment or pay a higher interest rate.

Overall, PayPal’s Pay in 4 is a flexible and convenient payment option that can help consumers manage their finances more effectively. By splitting purchases into four interest-free payments, consumers can make their purchases more manageable and avoid having to pay interest or fees. However, it is essential for consumers to understand the eligibility requirements and terms and conditions of the service before using it.

How to Qualify for PayPal’s Pay in 4: Credit Score Requirements

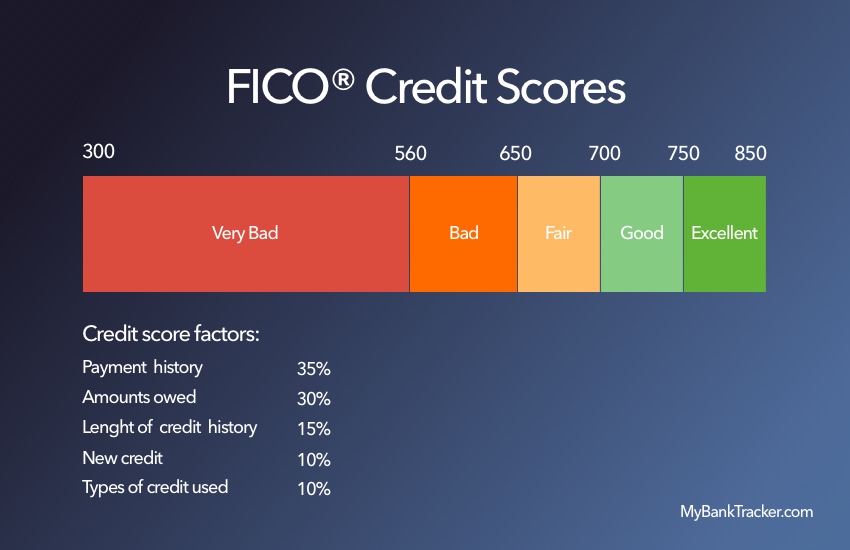

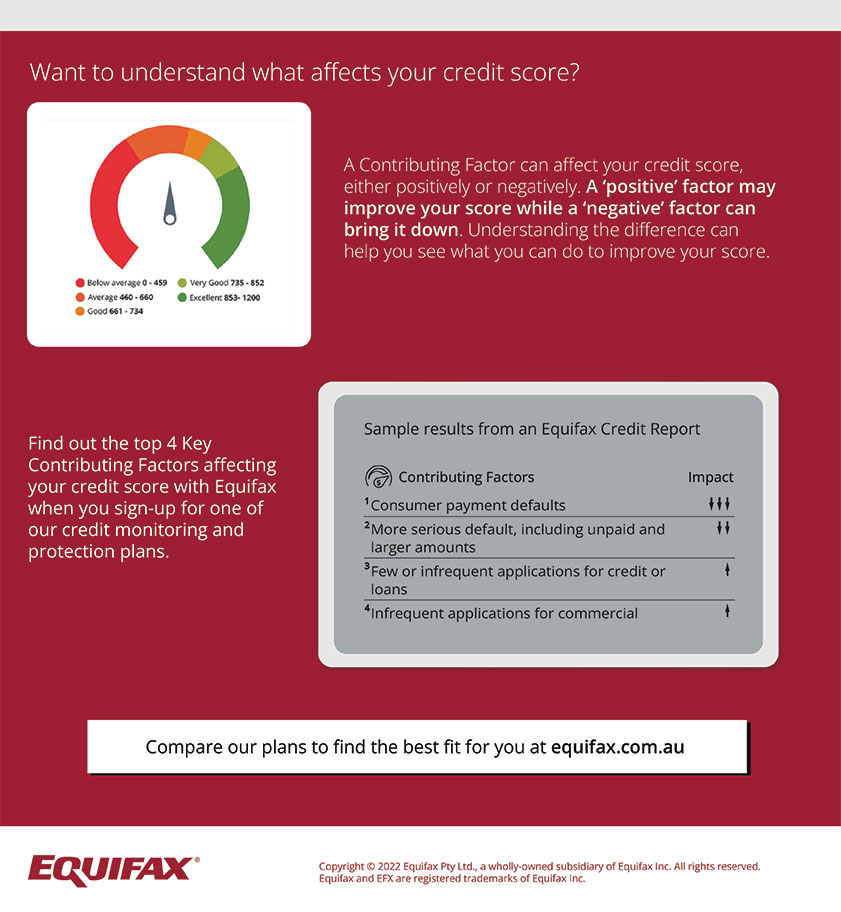

To qualify for PayPal’s Pay in 4, consumers must meet certain credit score requirements. While PayPal does not publicly disclose the exact credit score needed for Pay in 4, it is generally recommended that consumers have a credit score of at least 600 to be eligible for the service. This is because PayPal uses a combination of credit scoring models, including FICO and VantageScore, to evaluate a consumer’s creditworthiness.

When evaluating credit scores, PayPal considers a range of factors, including payment history, credit utilization, credit age, and credit mix. Consumers with a good credit score, typically above 700, are more likely to be eligible for Pay in 4. However, consumers with poor credit, typically below 600, may not be eligible for the service or may be required to make a down payment or pay a higher interest rate.

It’s worth noting that PayPal’s credit score requirements may vary depending on the consumer’s location, income, and other factors. Additionally, PayPal may use alternative credit scoring models, such as those that consider non-traditional credit data, to evaluate a consumer’s creditworthiness.

Consumers who are unsure about their credit score or eligibility for Pay in 4 can check their credit report and score for free on various websites, such as Credit Karma or Credit Sesame. They can also contact PayPal’s customer support to inquire about their eligibility for the service.

It’s essential for consumers to understand that the credit score needed for PayPal Pay in 4 is just one factor in the eligibility process. PayPal also considers other factors, such as income, employment history, and debt-to-income ratio, to determine a consumer’s creditworthiness.

By understanding the credit score requirements for PayPal’s Pay in 4, consumers can take steps to improve their credit score and increase their chances of qualifying for the service. This can include paying bills on time, reducing debt, and monitoring credit reports to ensure accuracy.

What Affects Your Credit Score: A Brief Overview

Credit scores are a crucial factor in determining eligibility for PayPal’s Pay in 4. But what exactly affects credit scores? In this section, we’ll provide a brief overview of the key factors that influence credit scores, helping readers understand how their credit score is calculated.

Payment history is one of the most significant factors affecting credit scores. This includes information about past payments, such as late payments, accounts sent to collections, and bankruptcies. A good payment history can significantly boost credit scores, while a poor payment history can negatively impact them.

Credit utilization is another critical factor. This refers to the amount of credit used compared to the amount of credit available. Keeping credit utilization below 30% can help maintain a healthy credit score. High credit utilization can indicate to lenders that a borrower is overextending themselves and may struggle to make payments.

Credit age is also an essential factor. This refers to the length of time a credit account has been open. A longer credit history can positively impact credit scores, as it demonstrates a borrower’s ability to manage credit over time.

Credit mix is the final factor. This refers to the variety of credit types used, such as credit cards, loans, and mortgages. A diverse credit mix can help improve credit scores, as it demonstrates a borrower’s ability to manage different types of credit.

Understanding these factors can help readers take control of their credit scores and improve their chances of qualifying for PayPal’s Pay in 4. By maintaining a good payment history, keeping credit utilization low, and monitoring credit reports, readers can work towards achieving a healthy credit score.

It’s worth noting that credit scores are not the only factor considered when applying for PayPal’s Pay in 4. Other factors, such as income and employment history, may also be taken into account. However, a good credit score can significantly improve the chances of approval.

By understanding what affects credit scores, readers can take the first step towards improving their credit health and unlocking the benefits of PayPal’s Pay in 4.

Improving Your Credit Score for PayPal’s Pay in 4

Improving your credit score can significantly increase your chances of qualifying for PayPal’s Pay in 4. By following these tips and strategies, you can work towards achieving a healthy credit score and unlocking the benefits of this flexible payment option.

One of the most effective ways to improve your credit score is to pay your bills on time. Late payments can negatively impact your credit score, so it’s essential to make timely payments on all your debts. Set up payment reminders or automate your payments to ensure you never miss a payment.

Reducing debt is another crucial step in improving your credit score. High levels of debt can indicate to lenders that you’re overextending yourself and may struggle to make payments. Focus on paying down high-interest debts first, and consider consolidating debts into a single, lower-interest loan.

Monitoring your credit reports is also essential for improving your credit score. Check your reports regularly to ensure they’re accurate and up-to-date. Dispute any errors or inaccuracies you find, and work to resolve any outstanding issues.

Additionally, consider the following tips to improve your credit score:

- Avoid applying for multiple credit cards or loans in a short period, as this can negatively impact your credit score.

- Keep credit utilization below 30% to demonstrate responsible credit behavior.

- Don’t close old accounts, as this can negatively impact your credit age and credit mix.

- Consider becoming an authorized user on someone else’s credit account to benefit from their good credit habits.

By following these tips and strategies, you can work towards improving your credit score and increasing your chances of qualifying for PayPal’s Pay in 4. Remember, a good credit score is just one factor in the eligibility process, but it can significantly improve your chances of approval.

It’s also important to note that improving your credit score takes time and effort. Don’t expect overnight results, but instead, focus on making long-term changes to your credit habits. With patience and persistence, you can achieve a healthy credit score and unlock the benefits of PayPal’s Pay in 4.

Alternative Options for Those with Poor Credit

While PayPal’s Pay in 4 is a great option for those with good credit, it may not be available to those with poor credit. Fortunately, there are alternative payment options available that can help individuals with poor credit make purchases and manage their finances.

One alternative option is other buy now, pay later services. These services, such as Klarna and Affirm, offer similar payment plans to PayPal’s Pay in 4, but may have more lenient credit requirements. These services can be a good option for those who need to make a purchase but don’t have the cash upfront.

Credit cards are another alternative option for those with poor credit. While credit cards can be a more expensive option than PayPal’s Pay in 4, they can provide a way for individuals to make purchases and build credit. Look for credit cards that offer low interest rates and fees, and make sure to read the terms and conditions carefully before applying.

Personal loans are another option for those with poor credit. Personal loans can provide a lump sum of money that can be used to make a purchase or pay off debt. Look for personal loans with low interest rates and fees, and make sure to read the terms and conditions carefully before applying.

It’s also worth considering credit-builder loans, which are specifically designed for individuals with poor credit. These loans can help individuals build credit by making regular payments, and can be a good option for those who need to make a purchase or pay off debt.

When considering alternative payment options, it’s essential to read the terms and conditions carefully and understand the fees and interest rates involved. Make sure to compare different options and choose the one that best fits your needs and budget.

Remember, having poor credit doesn’t mean you’re out of options. By exploring alternative payment options and taking steps to improve your credit score, you can unlock the benefits of PayPal’s Pay in 4 and other financial services.

Using PayPal’s Pay in 4 Responsibly: Best Practices

Using PayPal’s Pay in 4 responsibly is crucial to avoid potential pitfalls and make the most of this flexible payment option. By following best practices, you can ensure that you’re using Pay in 4 in a way that benefits your financial situation.

One of the most important best practices is to make timely payments. Missing payments can result in late fees and negative impacts on your credit score. Set up payment reminders or automate your payments to ensure you never miss a payment.

Avoiding overspending is another crucial best practice. Pay in 4 can make it easy to overspend, as you’re not paying the full amount upfront. However, this can lead to debt and financial difficulties. Make sure to only use Pay in 4 for purchases that you can afford and that fit within your budget.

Understanding the terms and conditions of Pay in 4 is also essential. Take the time to read and understand the fine print, including the interest rates, fees, and repayment terms. This will help you avoid any surprises or unexpected costs.

Additionally, consider the following best practices when using Pay in 4:

- Only use Pay in 4 for essential purchases, such as groceries or household items.

- Avoid using Pay in 4 for discretionary purchases, such as dining out or entertainment.

- Make sure to have a budget in place and stick to it.

- Monitor your credit score and report regularly to ensure that Pay in 4 is not negatively impacting your credit.

By following these best practices, you can use PayPal’s Pay in 4 responsibly and make the most of this flexible payment option. Remember, Pay in 4 is a tool to help you manage your finances, not a way to accumulate debt.

It’s also important to note that Pay in 4 is not a substitute for good financial habits. Make sure to prioritize saving, budgeting, and investing in your financial future.

Common Mistakes to Avoid When Using PayPal’s Pay in 4

While PayPal’s Pay in 4 can be a convenient and flexible payment option, there are common mistakes to avoid when using the service. By being aware of these potential pitfalls, you can ensure that you’re using Pay in 4 responsibly and avoiding any negative consequences.

One of the most common mistakes to avoid is missing payments. Missing payments can result in late fees and negative impacts on your credit score. Make sure to set up payment reminders or automate your payments to ensure you never miss a payment.

Accumulating debt is another mistake to avoid. Pay in 4 can make it easy to overspend, as you’re not paying the full amount upfront. However, this can lead to debt and financial difficulties. Make sure to only use Pay in 4 for essential purchases and avoid accumulating debt.

Not reading the fine print is another mistake to avoid. Take the time to read and understand the terms and conditions of Pay in 4, including the interest rates, fees, and repayment terms. This will help you avoid any surprises or unexpected costs.

Additionally, consider the following common mistakes to avoid when using Pay in 4:

- Not monitoring your credit score and report regularly.

- Not making timely payments.

- Not understanding the interest rates and fees associated with Pay in 4.

- Not avoiding overspending and accumulating debt.

By avoiding these common mistakes, you can use PayPal’s Pay in 4 responsibly and make the most of this flexible payment option. Remember, Pay in 4 is a tool to help you manage your finances, not a way to accumulate debt.

It’s also important to note that Pay in 4 is not a substitute for good financial habits. Make sure to prioritize saving, budgeting, and investing in your financial future.

Conclusion: Unlocking the Benefits of PayPal’s Pay in 4

In conclusion, PayPal’s Pay in 4 is a flexible payment option that can provide consumers with more control over their finances. By understanding how Pay in 4 works, the credit score requirements, and the best practices for using the service, consumers can unlock the benefits of this payment option and make the most of their purchases.

Remember, Pay in 4 is not just a payment option, but a tool to help consumers manage their finances responsibly. By making timely payments, avoiding overspending, and understanding the terms and conditions of the service, consumers can use Pay in 4 to their advantage and achieve their financial goals.

Whether you’re looking to make a large purchase or simply want to spread out the cost of a smaller purchase, Pay in 4 can be a great option. With its flexibility and convenience, Pay in 4 can help consumers make the most of their purchases and achieve their financial goals.

So, if you’re looking for a flexible payment option that can help you manage your finances responsibly, consider using PayPal’s Pay in 4. With its benefits and best practices in mind, you can unlock the full potential of this payment option and make the most of your purchases.

By following the tips and strategies outlined in this article, you can increase your chances of qualifying for Pay in 4 and make the most of this flexible payment option. Remember to always use Pay in 4 responsibly and make timely payments to avoid any negative consequences.

In summary, PayPal’s Pay in 4 is a great payment option for consumers who want to manage their finances responsibly and make the most of their purchases. By understanding how Pay in 4 works and using it responsibly, consumers can unlock the benefits of this payment option and achieve their financial goals.