How to Navigate the Complex World of Auto Financing

Understanding current auto loan interest rates is crucial for anyone looking to purchase a vehicle. With so many lenders and loan options available, it can be overwhelming to navigate the complex world of auto financing. However, by grasping the basics of auto loan interest rates and how they impact the overall cost of owning a vehicle, individuals can make informed decisions and save money in the long run.

In this article, we will delve into the world of auto loan interest rates, exploring the factors that influence them, the current rate landscape, and providing tips and advice on how to secure the best rate for your needs. Whether you’re a first-time car buyer or a seasoned veteran, this guide will provide you with the knowledge and tools necessary to make an informed decision when it comes to auto financing.

By the end of this article, you will have a comprehensive understanding of current auto loan interest rates and how to use this knowledge to your advantage. You will learn how to compare rates from different lenders, how to improve your credit score to qualify for better rates, and how to avoid common pitfalls that can increase the overall cost of your loan.

So, let’s get started on this journey to understanding current auto loan interest rates and how to navigate the complex world of auto financing. With the right knowledge and tools, you can drive away in your dream car with a loan that fits your budget and financial goals.

What Affects Auto Loan Interest Rates?

Auto loan interest rates are influenced by a combination of factors, including credit score, loan term, and lender type. Understanding these factors is crucial to securing the best current auto loan interest rates. A borrower’s credit score, for example, plays a significant role in determining the interest rate they qualify for. A good credit score can lead to lower interest rates, while a poor credit score can result in higher rates.

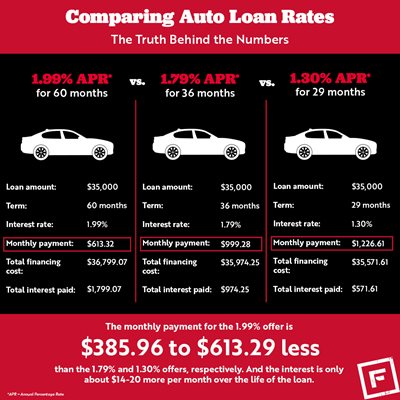

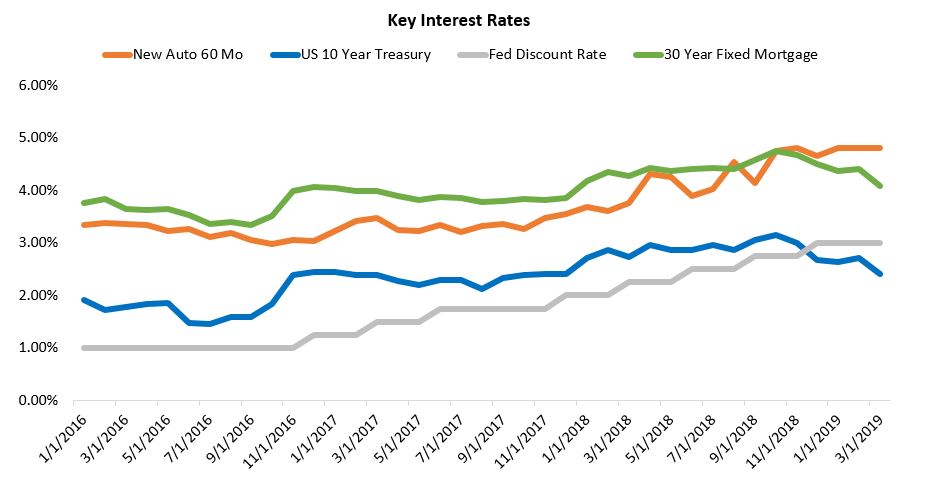

Loan term is another important factor that affects auto loan interest rates. A longer loan term typically results in higher interest rates, while a shorter loan term can lead to lower rates. For instance, a 60-month loan may have a higher interest rate than a 36-month loan. Additionally, the type of lender can also impact interest rates. Banks, credit unions, and online lenders may offer different rates and terms, making it essential to compare rates from multiple lenders.

Other factors that can influence auto loan interest rates include the type of vehicle being financed, the borrower’s income and debt-to-income ratio, and the loan-to-value (LTV) ratio. The LTV ratio is the percentage of the vehicle’s purchase price that is being financed. A lower LTV ratio can result in lower interest rates, while a higher LTV ratio can lead to higher rates.

For example, a borrower with a good credit score and a low LTV ratio may qualify for a lower interest rate than a borrower with a poor credit score and a high LTV ratio. Understanding these factors and how they impact current auto loan interest rates can help borrowers make informed decisions and secure the best rate for their needs.

Current Auto Loan Interest Rates: A Snapshot

As of the latest data available, current auto loan interest rates vary depending on the type of vehicle, credit score, and lender. For new cars, the average interest rate is around 4.5% for borrowers with excellent credit (720+ FICO score). However, rates can range from 3.5% to 6.5% depending on the lender and the borrower’s creditworthiness.

For used cars, the average interest rate is slightly higher, ranging from 4.5% to 7.5%. Borrowers with good credit (660-719 FICO score) can expect to pay around 5.5% interest, while those with fair credit (620-659 FICO score) may pay around 6.5%.

It’s worth noting that current auto loan interest rates can vary significantly depending on the lender. Banks and credit unions tend to offer more competitive rates, while online lenders may offer more flexible terms. Additionally, some lenders may offer special promotions or discounts for certain types of vehicles or borrowers.

Here is a rough breakdown of current auto loan interest rates by credit score range:

- Excellent credit (720+ FICO score): 3.5% – 5.5%

- Good credit (660-719 FICO score): 4.5% – 6.5%

- Fair credit (620-659 FICO score): 5.5% – 7.5%

- Poor credit (580-619 FICO score): 6.5% – 8.5%

- Bad credit (500-579 FICO score): 7.5% – 9.5%

Keep in mind that these are general estimates and actual rates may vary depending on the lender and the borrower’s individual circumstances.

How to Get the Best Auto Loan Interest Rate

To secure the best current auto loan interest rates, it’s essential to take a proactive approach. Here are some actionable steps you can take to get a better rate:

1. Improve your credit score: Your credit score plays a significant role in determining the interest rate you qualify for. By improving your credit score, you can increase your chances of getting a lower interest rate. Check your credit report, pay off outstanding debts, and make on-time payments to boost your credit score.

2. Compare lender rates: Don’t settle for the first lender you come across. Compare rates from multiple lenders, including banks, credit unions, and online lenders. This will give you a better idea of the going rate and help you find the best deal.

3. Consider alternative lenders: Alternative lenders, such as online lenders and peer-to-peer lenders, may offer more competitive rates than traditional lenders. However, be sure to carefully review their terms and conditions before making a decision.

4. Choose a shorter loan term: A shorter loan term typically results in a lower interest rate. If you can afford the higher monthly payments, consider opting for a shorter loan term to save money on interest.

5. Negotiate with the lender: If you’re not happy with the interest rate offered by the lender, don’t be afraid to negotiate. Ask if they can offer a better rate or if they have any promotions or discounts available.

By following these steps, you can increase your chances of securing the best current auto loan interest rates and saving money on your car loan.

Auto Loan Interest Rates by Lender: A Comparison

When it comes to current auto loan interest rates, different lenders offer varying rates and terms. Here’s a comparison of auto loan interest rates from various lenders, including banks, credit unions, and online lenders:

Banks: Banks typically offer competitive auto loan interest rates, especially for borrowers with good credit. For example, Bank of America offers auto loan rates starting at 4.5% APR, while Wells Fargo offers rates starting at 4.75% APR.

Credit Unions: Credit unions are member-owned cooperatives that often offer more favorable auto loan interest rates than banks. For example, Navy Federal Credit Union offers auto loan rates starting at 4.25% APR, while Alliant Credit Union offers rates starting at 4.5% APR.

Online Lenders: Online lenders, such as LightStream and Capital One, offer auto loan rates that are often more competitive than those offered by traditional lenders. For example, LightStream offers auto loan rates starting at 4.25% APR, while Capital One offers rates starting at 4.5% APR.

Here’s a summary of the pros and cons of each lender type:

- Banks: Pros – wide availability, competitive rates; Cons – may have stricter credit requirements

- Credit Unions: Pros – more favorable rates, member benefits; Cons – may have limited availability

- Online Lenders: Pros – competitive rates, easy application process; Cons – may have higher fees

When comparing auto loan interest rates from different lenders, be sure to consider the pros and cons of each lender type and carefully review their terms and conditions.

Understanding the Fine Print: Auto Loan Terms and Conditions

When reviewing auto loan terms and conditions, it’s essential to carefully examine the fine print to avoid common pitfalls that can increase the overall cost of the loan. Here are some key terms and conditions to look out for:

Repayment terms: Make sure you understand the repayment schedule, including the monthly payment amount, interest rate, and loan term. Be aware of any penalties for early repayment or late payments.

Fees: Check for any fees associated with the loan, such as origination fees, title fees, and registration fees. These fees can add up quickly, so it’s essential to factor them into your overall cost calculation.

Penalties: Understand the penalties for defaulting on the loan, including late payment fees, repossession fees, and damage to your credit score.

Warranty and maintenance requirements: Check if the lender requires you to maintain a certain level of insurance coverage or follow specific maintenance schedules. Failure to comply with these requirements can result in penalties or even loan default.

When negotiating auto loan terms and conditions, it’s essential to be aware of your rights and responsibilities as a borrower. Here are some tips to help you negotiate better terms:

- Ask about any promotions or discounts that may be available

- Negotiate the interest rate and repayment terms

- Request a waiver of any fees or penalties

- Ensure you understand all the terms and conditions before signing the loan agreement

By carefully reviewing auto loan terms and conditions and negotiating better terms, you can save money over the life of the loan and avoid common pitfalls that can increase the overall cost of the loan.

Case Study: How to Save Money with a Competitive Auto Loan Rate

Let’s consider a real-life example of how securing a competitive auto loan interest rate can save money over the life of the loan. Meet Sarah, a 30-year-old marketing manager who is looking to purchase a new car. She has a good credit score of 720 and is looking to finance a $25,000 car with a 5-year loan term.

Sarah shops around and compares auto loan interest rates from various lenders. She finds that Bank A is offering a 5-year loan with an interest rate of 4.5% APR, while Bank B is offering a 5-year loan with an interest rate of 4.25% APR. She also considers an online lender, Lender C, which is offering a 5-year loan with an interest rate of 4.0% APR.

By choosing the loan with the lowest interest rate, Sarah can save $500 over the life of the loan. Here’s a breakdown of the calculations:

- Bank A: 5-year loan, 4.5% APR, monthly payment of $456, total interest paid of $3,044

- Bank B: 5-year loan, 4.25% APR, monthly payment of $446, total interest paid of $2,744

- Lender C: 5-year loan, 4.0% APR, monthly payment of $436, total interest paid of $2,444

As you can see, securing a competitive auto loan interest rate can save Sarah $500 over the life of the loan. This example illustrates the importance of shopping around and comparing rates from multiple lenders to find the best deal.

Conclusion: Finding the Best Auto Loan Interest Rate for Your Needs

Securing the best auto loan interest rate requires a combination of understanding the factors that influence rates, knowing the current auto loan interest rates, and taking proactive steps to improve your credit score and negotiate with lenders. By following the tips and advice outlined in this article, individuals can make informed decisions and save money over the life of their loan.

It is essential to remember that current auto loan interest rates can vary significantly depending on the lender, loan term, and credit score. By comparing rates from different lenders and considering alternative options, such as credit unions or online lenders, individuals can find the best rate for their situation.

Additionally, carefully reviewing auto loan terms and conditions is crucial to avoid common pitfalls and negotiate better terms. By understanding the fine print, individuals can ensure they are getting the best deal possible.

Ultimately, finding the best auto loan interest rate requires patience, research, and a willingness to take action. By staying informed and taking proactive steps, individuals can secure a competitive rate and save money over the life of their loan. With the right knowledge and tools, anyone can navigate the complex world of auto financing and drive away in their dream car with confidence.