How to Get the Lowest VA Mortgage Interest Rates

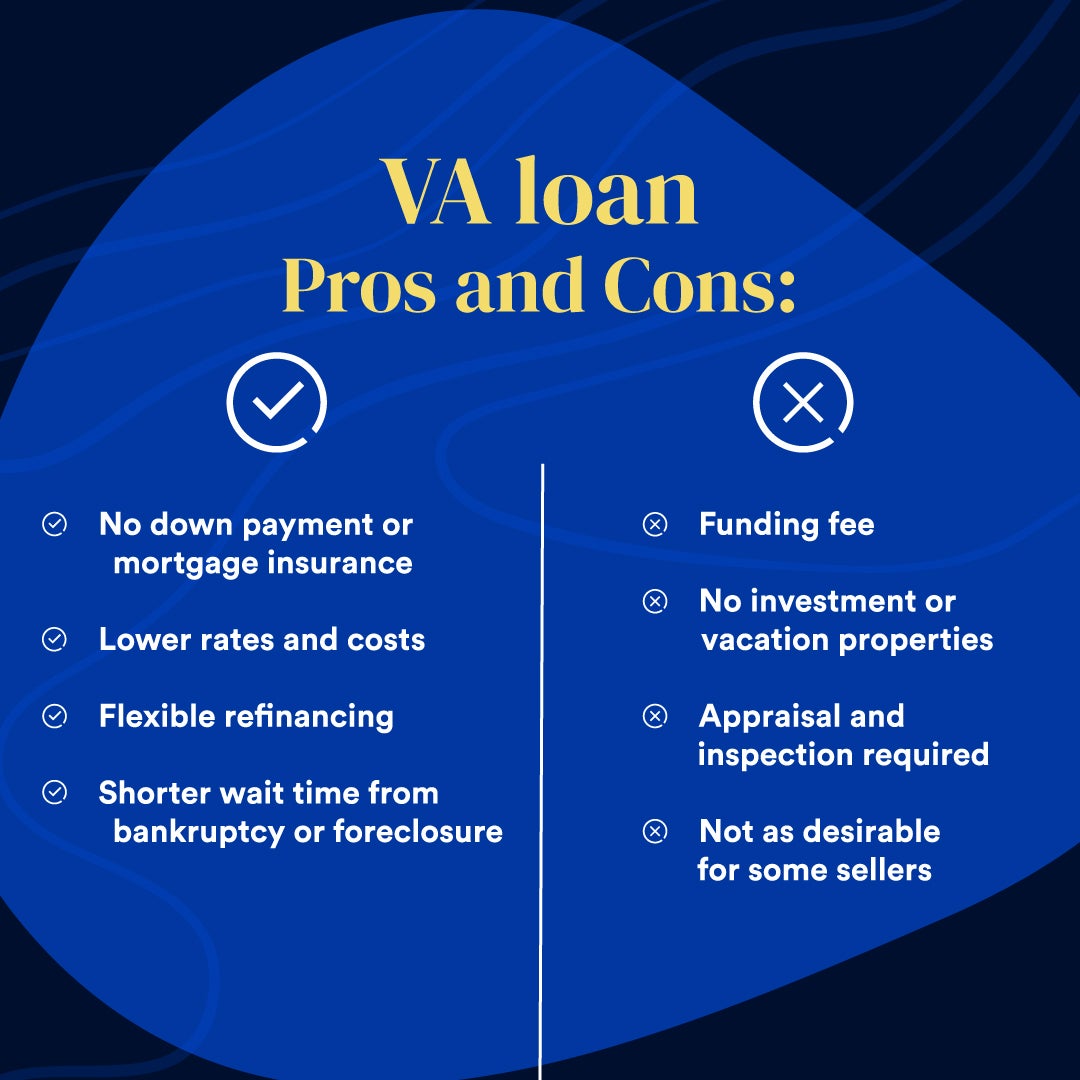

Securing the best VA mortgage interest rates is crucial for veterans, active-duty military personnel, and surviving spouses who want to purchase or refinance a home. With the right rate, homeowners can save thousands of dollars on monthly payments and reduce their overall homeownership costs. In this article, we will provide valuable insights and practical tips on how to get the lowest VA mortgage interest rates, helping you make an informed decision when choosing a mortgage lender.

VA mortgage interest rates are influenced by various factors, including the borrower’s credit score, loan amount, and debt-to-income ratio. Understanding these factors is essential to qualify for the best rates. Additionally, the current market trends and economic conditions play a significant role in determining VA mortgage interest rates. By staying informed about the current VA mortgage interest rates and market trends, borrowers can make a more informed decision when choosing a mortgage lender.

According to recent data, the current VA mortgage interest rates for 30-year fixed-rate mortgages are around 3.5%, while 15-year fixed-rate mortgages are around 3.0%. However, these rates can vary depending on the lender, loan amount, and borrower’s credit score. For example, borrowers with excellent credit scores (760+) may qualify for rates as low as 3.25%, while those with lower credit scores (620-639) may qualify for rates around 3.75%.

To get the lowest VA mortgage interest rates, it’s essential to shop around and compare rates from different lenders. Borrowers can also consider working with a mortgage broker who can help them navigate the process and find the best rates. Furthermore, improving credit scores and reducing debt can also help borrowers qualify for better rates.

In the following sections, we will delve deeper into the world of VA mortgage interest rates, providing valuable insights and practical tips on how to qualify for the best rates, compare lenders, and lock in the best rate for your dream home.

Understanding VA Mortgage Interest Rates: What You Need to Know

VA mortgage interest rates are influenced by a combination of factors, including the borrower’s credit score, loan amount, debt-to-income ratio, and the current market trends. Understanding how these factors interact is essential to securing the best VA mortgage interest rates. In this section, we will delve into the world of VA mortgage interest rates, explaining how they are determined and the key factors that influence them.

VA mortgage interest rates are determined by the lender, and they can vary depending on the lender’s policies and the borrower’s qualifications. The current market trends, including the federal funds rate and the 10-year Treasury yield, also play a significant role in determining VA mortgage interest rates. Additionally, the type of VA mortgage, whether it’s a fixed-rate or adjustable-rate mortgage, can also impact the interest rate.

Fixed-rate VA mortgages offer a fixed interest rate for the entire term of the loan, typically 15 or 30 years. This type of mortgage provides stability and predictability, as the borrower’s monthly payments will remain the same for the entire term. Adjustable-rate VA mortgages, on the other hand, offer a lower initial interest rate that can adjust periodically based on market conditions. This type of mortgage can provide lower monthly payments in the short term, but it also carries the risk of increasing payments if interest rates rise.

The current VA mortgage interest rates for fixed-rate mortgages are around 3.5% for 30-year loans and 3.0% for 15-year loans. However, these rates can vary depending on the lender, loan amount, and borrower’s credit score. For example, borrowers with excellent credit scores (760+) may qualify for rates as low as 3.25%, while those with lower credit scores (620-639) may qualify for rates around 3.75%.

Understanding the factors that influence VA mortgage interest rates is crucial to securing the best rates. By staying informed about the current market trends and lender policies, borrowers can make a more informed decision when choosing a VA mortgage lender. In the next section, we will discuss the current VA mortgage interest rates in more detail, including the average rates for 30-year and 15-year fixed-rate mortgages.

Current VA Mortgage Interest Rates: What to Expect

As of the current market, VA mortgage interest rates are highly competitive, with average rates for 30-year fixed-rate mortgages ranging from 3.25% to 3.75%. For 15-year fixed-rate mortgages, the average rates range from 2.75% to 3.25%. However, these rates can vary depending on the lender, loan amount, credit score, and other factors.

For example, borrowers with excellent credit scores (760+) may qualify for rates as low as 3.0% for 30-year fixed-rate mortgages, while those with lower credit scores (620-639) may qualify for rates around 3.5%. Additionally, the loan amount can also impact the interest rate, with larger loan amounts typically resulting in higher interest rates.

It’s also important to note that VA mortgage interest rates can vary depending on the lender and the specific loan program. Some lenders may offer more competitive rates than others, and some loan programs may have more favorable terms. For instance, the VA’s Interest Rate Reduction Refinance Loan (IRRRL) program offers highly competitive rates for borrowers who want to refinance their existing VA mortgage.

To give you a better idea of what to expect, here are some current VA mortgage interest rates from top lenders:

USAA: 3.25% (30-year fixed), 2.75% (15-year fixed)

Quicken Loans: 3.375% (30-year fixed), 2.875% (15-year fixed)

Wells Fargo: 3.5% (30-year fixed), 3.0% (15-year fixed)

These rates are subject to change and may not reflect the actual rates offered by these lenders. However, they do give you an idea of what to expect in the current market.

In the next section, we will discuss the importance of comparing VA mortgage lenders to find the best rates. We will also provide tips on how to evaluate lenders and choose the best one for your needs.

How to Qualify for the Best VA Mortgage Rates

To qualify for the best VA mortgage rates, borrowers must meet the eligibility requirements set by the Department of Veterans Affairs (VA). These requirements include a minimum credit score, a debt-to-income ratio, and military service requirements.

The minimum credit score required for a VA mortgage is 620, although some lenders may have stricter requirements. Borrowers with higher credit scores, typically 760 or higher, may qualify for the best VA mortgage rates. To improve credit scores, borrowers can pay off outstanding debts, reduce credit utilization, and monitor their credit reports for errors.

The debt-to-income ratio is another important factor in qualifying for a VA mortgage. The VA recommends that borrowers have a debt-to-income ratio of 41% or less, although some lenders may have stricter requirements. Borrowers can reduce their debt-to-income ratio by paying off outstanding debts, increasing their income, or reducing their expenses.

In addition to credit score and debt-to-income ratio, borrowers must also meet the military service requirements set by the VA. These requirements include:

Active-duty military personnel with at least 90 days of service

Veterans with an honorable discharge

Reserve and National Guard members with at least 6 years of service

Surviving spouses of veterans who died in service or as a result of a service-related injury

By meeting these eligibility requirements, borrowers can qualify for the best VA mortgage rates and take advantage of the benefits offered by the VA mortgage program.

In the next section, we will discuss the importance of comparing VA mortgage lenders to find the best rates. We will also provide tips on how to evaluate lenders and choose the best one for your needs.

Comparing VA Mortgage Lenders: Who Offers the Best Rates?

Comparing VA mortgage lenders is crucial to finding the best rates and terms for your home loan. With so many lenders offering VA mortgages, it can be overwhelming to choose the right one. In this section, we will provide an overview of top VA mortgage lenders, including their current rates, fees, and terms.

Some of the top VA mortgage lenders include:

USAA: Known for their competitive rates and excellent customer service, USAA is a top choice for VA mortgage borrowers. Current rates: 3.25% (30-year fixed), 2.75% (15-year fixed)

Quicken Loans: Quicken Loans is one of the largest mortgage lenders in the country, and they offer a wide range of VA mortgage products. Current rates: 3.375% (30-year fixed), 2.875% (15-year fixed)

Wells Fargo: Wells Fargo is another large lender that offers VA mortgages with competitive rates and terms. Current rates: 3.5% (30-year fixed), 3.0% (15-year fixed)

When comparing VA mortgage lenders, it’s essential to consider not only the interest rate but also the fees and terms. Look for lenders that offer low fees, flexible repayment terms, and excellent customer service.

In addition to comparing rates and fees, it’s also important to evaluate the lender’s reputation and customer reviews. Look for lenders with high ratings from organizations such as the Better Business Bureau and Consumer Financial Protection Bureau.

By comparing VA mortgage lenders and choosing the right one for your needs, you can secure the best rates and terms for your home loan. In the next section, we will discuss the current market trends and predictions for future VA mortgage interest rates.

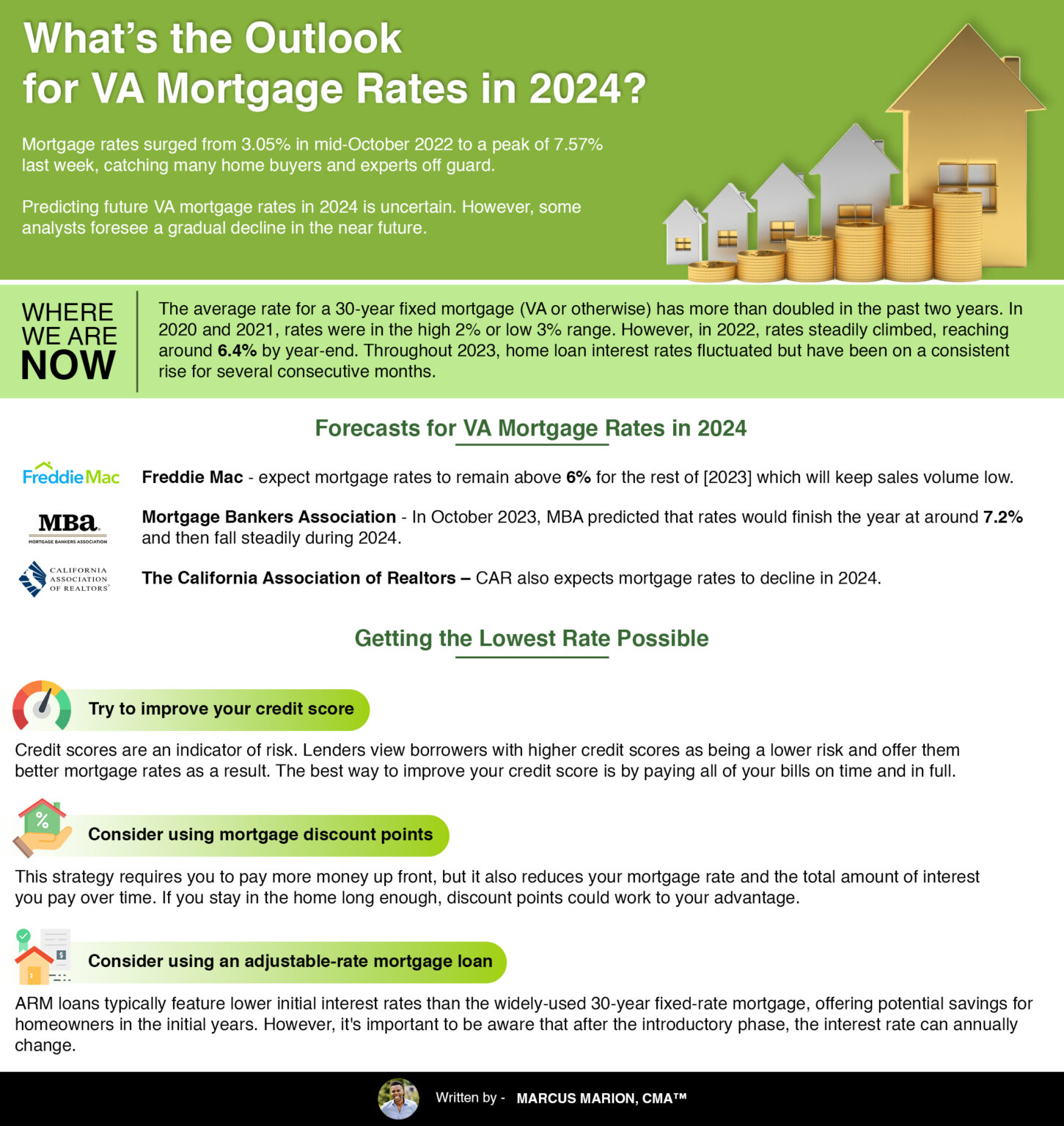

VA Mortgage Rate Predictions: What’s on the Horizon

The current VA mortgage interest rates are influenced by a variety of economic factors, including inflation, employment rates, and the overall state of the economy. To predict future VA mortgage interest rates, it’s essential to analyze these factors and understand their impact on the mortgage market.

Currently, the economy is experiencing a period of low inflation, with the Consumer Price Index (CPI) increasing at a rate of 2.3% over the past 12 months. This low inflation rate has contributed to the current low VA mortgage interest rates. However, if inflation were to rise, it could lead to higher interest rates.

Employment rates are also a crucial factor in determining VA mortgage interest rates. The current unemployment rate is at a historic low of 3.6%, which has contributed to the strong economy and low interest rates. However, if employment rates were to decline, it could lead to higher interest rates.

Another factor that could impact VA mortgage interest rates is the Federal Reserve‘s monetary policy. The Federal Reserve has been gradually increasing the federal funds rate over the past few years, which has contributed to the current low interest rates. However, if the Federal Reserve were to continue increasing the federal funds rate, it could lead to higher interest rates.

Based on these factors, it’s difficult to predict exactly what will happen to VA mortgage interest rates in the future. However, it’s likely that rates will remain relatively low in the short term, with some fluctuations based on economic conditions.

Here are some predictions for future VA mortgage interest rates:

Short-term (next 6-12 months): Rates are likely to remain relatively low, with some fluctuations based on economic conditions.

Mid-term (next 1-2 years): Rates may increase slightly as the economy continues to grow and inflation rises.

Long-term (next 5-10 years): Rates may continue to rise as the economy grows and inflation increases, but they are likely to remain relatively low compared to historical rates.

In the next section, we will discuss the process of locking in a VA mortgage interest rate, including the benefits of rate locks and how to negotiate with lenders.

How to Lock in the Best VA Mortgage Rate

Locking in a VA mortgage interest rate can be a great way to secure a competitive rate and protect yourself from potential rate increases. In this section, we will explain the process of locking in a VA mortgage interest rate, including the benefits of rate locks and how to negotiate with lenders.

A rate lock is a guarantee from the lender that they will provide a specific interest rate for a certain period of time, usually 30 or 60 days. This can give you peace of mind and protect you from potential rate increases while you are in the process of buying or refinancing a home.

There are several benefits to locking in a VA mortgage interest rate, including:

Protection from rate increases: By locking in a rate, you can protect yourself from potential rate increases that may occur while you are in the process of buying or refinancing a home.

Predictable monthly payments: With a locked-in rate, you can predict your monthly payments and budget accordingly.

Increased negotiating power: By locking in a rate, you may have more negotiating power with the lender, as you can threaten to walk away if they do not meet your terms.

To lock in a VA mortgage interest rate, you will typically need to provide the lender with some basic information, such as your credit score, income, and loan amount. The lender will then provide you with a rate lock agreement that outlines the terms of the lock, including the interest rate, loan amount, and lock period.

When negotiating with lenders, it’s essential to shop around and compare rates and terms from multiple lenders. This can help you find the best deal and ensure that you are getting a competitive rate.

Here are some tips for negotiating with lenders:

Be prepared: Make sure you have all the necessary documents and information before negotiating with the lender.

Shop around: Compare rates and terms from multiple lenders to find the best deal.

Be flexible: Be open to different loan options and terms, and be willing to negotiate.

In the next section, we will summarize the key takeaways from the article and encourage readers to take action and start their journey to homeownership with a competitive VA mortgage rate.

Conclusion: Getting the Best VA Mortgage Rate for Your Dream Home

In conclusion, securing the best VA mortgage rate is crucial for veterans and active-duty military personnel looking to achieve their dream of homeownership. By understanding the current VA mortgage interest rates, qualifying for the best rates, and comparing lenders, homebuyers can save thousands of dollars in interest payments over the life of the loan. With the current VA mortgage interest rates at historic lows, now is an excellent time to take advantage of these competitive rates. By following the tips and strategies outlined in this article, homebuyers can navigate the VA mortgage process with confidence and secure a competitive rate that fits their budget and financial goals. Whether you’re a first-time homebuyer or a seasoned homeowner, getting the best VA mortgage rate can make all the difference in achieving long-term financial stability and success.