Understanding the Importance of Savings Accounts

Savings accounts are a fundamental component of personal finance, providing individuals with a secure and accessible way to manage their money. Having a savings account is essential for achieving long-term financial goals, such as building an emergency fund, paying off debt, and investing in the future. By understanding the benefits of savings accounts, individuals can make informed decisions about their financial well-being.

One of the primary advantages of savings accounts is the ability to earn interest on deposited funds. This means that individuals can grow their savings over time, without having to take on excessive risk. Additionally, savings accounts provide a safe and liquid place to store money, allowing individuals to access their funds when needed.

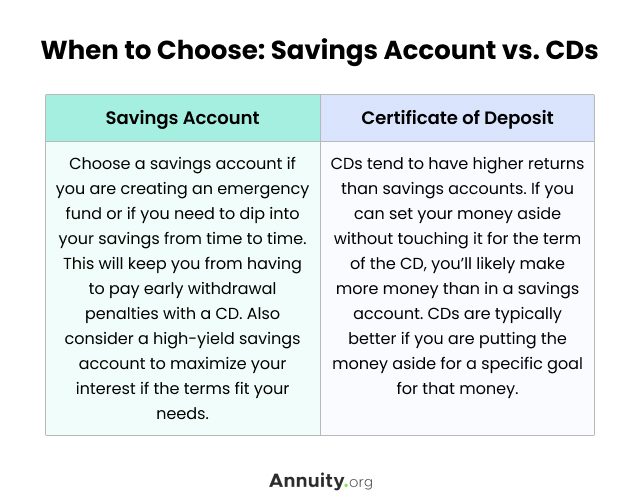

With the numerous types of savings accounts available, individuals can choose the one that best suits their needs. From traditional savings accounts to high-yield savings accounts, money market savings accounts, and certificates of deposit (CDs), there are various options to consider. Each type of account has its unique features and benefits, making it essential to understand the differences before making a decision.

For instance, traditional savings accounts are ideal for those who want easy access to their money and a low-risk investment option. High-yield savings accounts, on the other hand, offer higher interest rates, making them suitable for individuals who want to grow their savings over time. Money market savings accounts provide a hybrid option, combining competitive interest rates with limited check-writing privileges.

By exploring the different types of savings accounts, individuals can make informed decisions about their financial future. Whether it’s building an emergency fund, saving for a specific goal, or investing in a long-term strategy, savings accounts provide a foundation for achieving financial stability and security.

How to Choose the Best Savings Account for Your Needs

With the numerous types of savings accounts available, selecting the right one can be overwhelming. To make an informed decision, it’s essential to consider several key factors that align with your financial goals and needs. When evaluating different types of savings accounts, consider the following factors to ensure you choose the best option for your money.

Interest rates are a crucial factor to consider when selecting a savings account. Look for accounts that offer competitive interest rates, which can help your savings grow over time. Additionally, be aware of any conditions that may affect the interest rate, such as minimum balance requirements or promotional periods.

Fees can also impact your savings, so it’s essential to understand the fee structure associated with your account. Look for accounts with low or no fees, including maintenance fees, overdraft fees, and ATM fees. Some accounts may also offer fee waivers or rebates, which can help minimize costs.

Minimum balance requirements are another factor to consider when choosing a savings account. Some accounts may require a minimum balance to avoid maintenance fees or to earn interest. Consider your financial situation and choose an account with a minimum balance requirement that aligns with your needs.

Mobile banking capabilities are also an essential consideration in today’s digital age. Look for accounts that offer mobile banking apps, online banking, and other digital tools that make it easy to manage your account on-the-go. This can include features such as mobile deposit, bill pay, and account alerts.

By considering these factors, you can choose a savings account that meets your unique needs and helps you achieve your financial goals. Whether you’re looking for a low-risk option, a high-yield account, or a specialized account for a specific goal, there’s a savings account out there that’s right for you.

Traditional Savings Accounts: A Low-Risk Option

Traditional savings accounts are a popular choice for individuals who want a low-risk option for their savings. These accounts are typically offered by banks and credit unions, and they provide a safe and liquid place to store money. One of the primary benefits of traditional savings accounts is their liquidity, which means that individuals can access their money when needed.

Traditional savings accounts are also known for their low risk, which makes them an attractive option for those who are risk-averse. These accounts are typically insured by the FDIC or NCUA, which means that deposits are protected up to a certain amount. This provides an added layer of security and peace of mind for individuals who are saving for the future.

Another benefit of traditional savings accounts is their ease of use. These accounts can be managed online, by phone, or in person, making it easy to deposit and withdraw funds. Additionally, traditional savings accounts often come with a debit card or checks, which can be used to make purchases or pay bills.

While traditional savings accounts may not offer the highest interest rates, they are a stable and secure option for individuals who want to save for the future. They are also a good option for those who are just starting to save, as they provide a foundation for building an emergency fund and achieving long-term financial goals.

When considering traditional savings accounts, it’s essential to compare rates and terms from different banks and credit unions. This can help individuals find the best option for their needs and ensure that they are getting the most out of their savings. By choosing a traditional savings account, individuals can take the first step towards building a secure financial future.

High-Yield Savings Accounts: Earn More Interest on Your Savings

High-yield savings accounts are a type of savings account that offers a higher interest rate compared to traditional savings accounts. These accounts are designed to help individuals earn more interest on their savings, making them an attractive option for those who want to grow their savings over time.

One of the primary benefits of high-yield savings accounts is their competitive interest rates. These accounts often offer interest rates that are significantly higher than traditional savings accounts, which can help individuals earn more interest on their savings. Additionally, high-yield savings accounts often come with low fees, which can help individuals save even more.

Another benefit of high-yield savings accounts is their flexibility. These accounts often come with flexible withdrawal options, which can make it easy to access funds when needed. Additionally, high-yield savings accounts can be managed online, by phone, or in person, making it easy to deposit and withdraw funds.

High-yield savings accounts are also a low-risk option, which makes them an attractive choice for individuals who are risk-averse. These accounts are typically insured by the FDIC or NCUA, which means that deposits are protected up to a certain amount. This provides an added layer of security and peace of mind for individuals who are saving for the future.

When considering high-yield savings accounts, it’s essential to compare rates and terms from different banks and credit unions. This can help individuals find the best option for their needs and ensure that they are getting the most out of their savings. By choosing a high-yield savings account, individuals can take advantage of competitive interest rates and low fees, making it easier to achieve their long-term financial goals.

High-yield savings accounts are just one of the many different types of savings accounts available. By understanding the features and benefits of these accounts, individuals can make informed decisions about their savings and choose the best option for their needs.

Money Market Savings Accounts: A Hybrid Option

Money market savings accounts are a type of savings account that offers a combination of competitive interest rates and limited check-writing privileges. These accounts are designed to provide individuals with a low-risk option for their savings, while also offering the flexibility to write checks or use a debit card.

One of the primary benefits of money market savings accounts is their competitive interest rates. These accounts often offer interest rates that are higher than traditional savings accounts, making them an attractive option for individuals who want to earn more interest on their savings. Additionally, money market savings accounts often come with low fees, which can help individuals save even more.

Another benefit of money market savings accounts is their limited check-writing privileges. These accounts often come with a limited number of checks or debit card transactions per month, which can help individuals avoid overspending and stay within their budget. Additionally, money market savings accounts often require a minimum balance to avoid fees, which can help individuals keep their savings intact.

Money market savings accounts are also a low-risk option, which makes them an attractive choice for individuals who are risk-averse. These accounts are typically insured by the FDIC or NCUA, which means that deposits are protected up to a certain amount. This provides an added layer of security and peace of mind for individuals who are saving for the future.

When considering money market savings accounts, it’s essential to compare rates and terms from different banks and credit unions. This can help individuals find the best option for their needs and ensure that they are getting the most out of their savings. By choosing a money market savings account, individuals can take advantage of competitive interest rates and limited check-writing privileges, making it easier to achieve their long-term financial goals.

Money market savings accounts are just one of the many different types of savings accounts available. By understanding the features and benefits of these accounts, individuals can make informed decisions about their savings and choose the best option for their needs.

Certificates of Deposit (CDs): Time-Deposited Savings Options

Certificates of Deposit (CDs) are a type of savings account that offers a fixed interest rate for a specific period of time. These accounts are designed to provide individuals with a low-risk option for their savings, while also offering a higher interest rate than traditional savings accounts.

One of the primary benefits of CDs is their fixed interest rate. This means that individuals can earn a guaranteed rate of return on their savings, without having to worry about fluctuations in the market. Additionally, CDs are typically insured by the FDIC or NCUA, which means that deposits are protected up to a certain amount.

Another benefit of CDs is their low risk. These accounts are designed to be a safe and secure option for individuals who want to save for the future. By locking in a fixed interest rate for a specific period of time, individuals can avoid the risk of market fluctuations and earn a guaranteed rate of return.

CDs are also available in a range of terms, from a few months to several years. This means that individuals can choose a term that aligns with their financial goals and needs. For example, a short-term CD may be a good option for individuals who need to save for a specific goal, such as a down payment on a house. A longer-term CD may be a better option for individuals who want to save for retirement or other long-term goals.

When considering CDs, it’s essential to compare rates and terms from different banks and credit unions. This can help individuals find the best option for their needs and ensure that they are getting the most out of their savings. By choosing a CD, individuals can take advantage of a fixed interest rate and low risk, making it easier to achieve their long-term financial goals.

CDs are just one of the many different types of savings accounts available. By understanding the features and benefits of these accounts, individuals can make informed decisions about their savings and choose the best option for their needs.

Online Savings Accounts: Convenient and Accessible

Online savings accounts are a type of savings account that can be managed entirely online. These accounts are designed to provide individuals with a convenient and accessible way to save money, without the need to visit a physical bank branch.

One of the primary benefits of online savings accounts is their ease of use. These accounts can be managed from anywhere with an internet connection, making it easy to deposit and withdraw funds, check account balances, and transfer money between accounts.

Another benefit of online savings accounts is their mobile banking capabilities. Many online savings accounts come with mobile banking apps, which allow individuals to manage their accounts on-the-go. This can include features such as mobile deposit, bill pay, and account alerts.

Online savings accounts also offer competitive interest rates, which can help individuals earn more interest on their savings. Additionally, these accounts often come with low fees, which can help individuals save even more.

When considering online savings accounts, it’s essential to compare rates and terms from different banks and credit unions. This can help individuals find the best option for their needs and ensure that they are getting the most out of their savings. By choosing an online savings account, individuals can take advantage of convenience, accessibility, and competitive interest rates, making it easier to achieve their long-term financial goals.

Online savings accounts are just one of the many different types of savings accounts available. By understanding the features and benefits of these accounts, individuals can make informed decisions about their savings and choose the best option for their needs.

Specialty Savings Accounts: Options for Specific Goals

Specialty savings accounts are designed to help individuals save for specific goals, such as Christmas, vacation, or education expenses. These accounts are typically offered by banks and credit unions, and they provide a unique way to save for specific purposes.

Christmas clubs are a type of specialty savings account that allows individuals to save for holiday expenses throughout the year. These accounts typically offer a fixed interest rate and a specific savings period, which can help individuals stay on track with their holiday savings goals.

Vacation accounts are another type of specialty savings account that allows individuals to save for travel expenses. These accounts often offer competitive interest rates and flexible withdrawal options, which can help individuals save for their dream vacation.

Youth savings accounts are a type of specialty savings account designed for minors. These accounts typically offer a low minimum balance requirement and a competitive interest rate, which can help young people learn the importance of saving and develop good financial habits.

Other types of specialty savings accounts may include accounts for specific expenses, such as a down payment on a house or a wedding. These accounts can provide a unique way to save for specific goals and can help individuals stay focused on their financial objectives.

When considering specialty savings accounts, it’s essential to compare rates and terms from different banks and credit unions. This can help individuals find the best option for their specific needs and ensure that they are getting the most out of their savings. By choosing a specialty savings account, individuals can take advantage of a unique way to save for specific goals and achieve their financial objectives.

:max_bytes(150000):strip_icc()/how-to-open-a-high-yield-savings-account-4770631-final-c7f448b5c0bc48658a3c6a4c7afa0a3d.jpg)