What is Early Direct Deposit and How Does it Work?

Early direct deposit is a payment processing system that allows employees to receive their paychecks up to 2 days earlier than traditional direct deposit methods. This innovative technology has revolutionized the way people manage their finances, providing improved cash flow and reduced financial stress. By leveraging the power of early direct deposit, individuals can take control of their financial lives and make the most of their hard-earned money.

So, how does early direct deposit work? In traditional direct deposit systems, payroll funds are typically deposited into an employee’s account on the scheduled payday. However, with early direct deposit, the funds are deposited up to 2 days earlier, giving employees faster access to their money. This is made possible through advanced payment processing systems that enable employers to initiate payroll payments earlier, allowing employees to receive their funds sooner.

The benefits of early direct deposit are numerous. For one, it provides employees with improved cash flow, enabling them to pay bills, cover expenses, and make purchases without having to wait for their traditional payday. This can be especially helpful for individuals who live paycheck to paycheck or have irregular income. Additionally, early direct deposit can help reduce financial stress, as employees can better manage their finances and avoid costly overdraft fees.

Furthermore, early direct deposit can also promote financial stability and responsibility. By receiving their paychecks earlier, employees can prioritize their expenses, create budgets, and make informed financial decisions. This can lead to improved credit scores, reduced debt, and increased savings over time.

In today’s fast-paced digital age, early direct deposit is a game-changer for employees and employers alike. By embracing this innovative technology, individuals can take control of their finances, reduce stress, and achieve greater financial stability. Whether you’re an employee looking to improve your cash flow or an employer seeking to enhance your payroll processes, early direct deposit is definitely worth considering.

How to Get Your Paycheck 2 Days Early with Direct Deposit

To set up early direct deposit, employees typically need to meet certain eligibility criteria, such as having a valid bank account and being employed by a company that offers early direct deposit. The process of setting up early direct deposit varies depending on the payroll service or bank used by the employer. However, most payroll services and banks offer a straightforward setup process that can be completed online or through a mobile app.

Popular payroll services that offer early direct deposit include Gusto and QuickBooks. These services allow employers to initiate payroll payments earlier, enabling employees to receive their paychecks up to 2 days earlier than traditional direct deposit methods. To set up early direct deposit with Gusto or QuickBooks, employees typically need to provide their bank account information and confirm their eligibility for early direct deposit.

Here’s a step-by-step guide to setting up early direct deposit with Gusto:

1. Log in to your Gusto account and navigate to the “Payroll” tab.

2. Click on “Early Direct Deposit” and select the bank account you want to use for early direct deposit.

3. Confirm your eligibility for early direct deposit and review the terms and conditions.

4. Click “Save” to complete the setup process.

Similarly, to set up early direct deposit with QuickBooks, employees can follow these steps:

1. Log in to your QuickBooks account and navigate to the “Payroll” tab.

2. Click on “Early Direct Deposit” and select the bank account you want to use for early direct deposit.

3. Confirm your eligibility for early direct deposit and review the terms and conditions.

4. Click “Save” to complete the setup process.

Once the setup process is complete, employees can start receiving their paychecks up to 2 days earlier than traditional direct deposit methods. This can help improve cash flow, reduce financial stress, and provide greater financial stability.

Benefits of Receiving Your Paycheck Early: Why It Matters

Receiving your paycheck 2 days early with direct deposit can have a significant impact on your financial stability and well-being. One of the most significant benefits is improved cash flow. By receiving your paycheck earlier, you can pay bills, cover expenses, and make purchases without having to wait for your traditional payday. This can help reduce financial stress and anxiety, allowing you to focus on more important things.

Another benefit of early direct deposit is reduced overdraft fees. When you receive your paycheck earlier, you can avoid overdrafting your account and incurring costly fees. This can save you money and help you avoid financial pitfalls. Additionally, early direct deposit can help you build savings and achieve long-term financial goals. By receiving your paycheck earlier, you can set aside money for savings, investments, and other financial goals.

Real-life examples of how early direct deposit can make a positive impact on one’s finances are numerous. For instance, consider a person who receives their paycheck on the 15th of every month. With early direct deposit, they can receive their paycheck on the 13th, giving them two extra days to pay bills, cover expenses, and make purchases. This can help them avoid late fees, overdrafts, and other financial pitfalls.

Another example is a person who uses early direct deposit to build savings. By receiving their paycheck earlier, they can set aside money for savings and investments, helping them achieve long-term financial goals. This can include saving for a down payment on a house, paying off debt, or building an emergency fund.

In addition to improved cash flow, reduced overdraft fees, and increased savings, early direct deposit can also provide greater financial flexibility. By receiving your paycheck earlier, you can take advantage of sales, discounts, and other financial opportunities that may not be available later in the month. This can help you save money, build wealth, and achieve financial stability.

Overall, receiving your paycheck 2 days early with direct deposit can have a significant impact on your financial stability and well-being. By improving cash flow, reducing overdraft fees, and increasing savings, early direct deposit can help you achieve long-term financial goals and build a brighter financial future.

Early Direct Deposit vs. Traditional Direct Deposit: What’s the Difference?

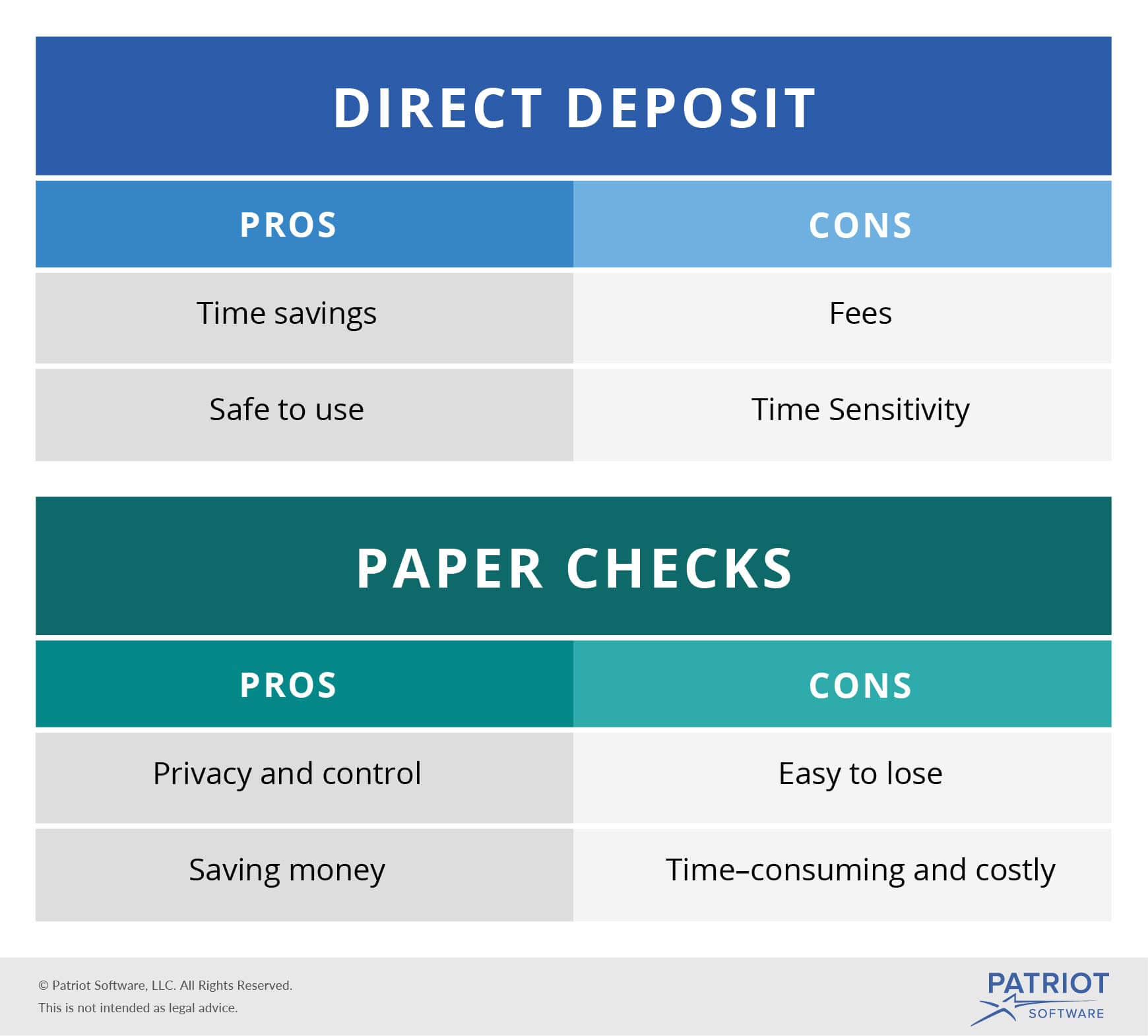

When it comes to receiving your paycheck, you have two options: traditional direct deposit and early direct deposit. While both methods allow you to receive your paycheck electronically, there are some key differences between the two. In this section, we’ll explore the differences between early direct deposit and traditional direct deposit, including timing, fees, and requirements.

Timing is one of the main differences between early direct deposit and traditional direct deposit. With traditional direct deposit, your paycheck is typically deposited into your account on the scheduled payday. However, with early direct deposit, your paycheck is deposited up to 2 days earlier than traditional direct deposit methods. This can be a big advantage for people who need access to their money as soon as possible.

Another difference between early direct deposit and traditional direct deposit is fees. Some banks and credit unions may charge fees for early direct deposit, while others may not. It’s essential to check with your bank or credit union to see if they charge any fees for early direct deposit. Traditional direct deposit, on the other hand, typically does not come with any fees.

Requirements are also different between early direct deposit and traditional direct deposit. To be eligible for early direct deposit, you typically need to have a valid bank account and meet certain eligibility criteria set by your employer or bank. Traditional direct deposit, on the other hand, typically only requires a valid bank account.

So, which method is better? It depends on your individual needs and circumstances. If you need access to your money as soon as possible, early direct deposit may be the better option. However, if you’re looking to avoid fees and don’t mind waiting until the scheduled payday, traditional direct deposit may be the better choice.

Ultimately, the decision between early direct deposit and traditional direct deposit comes down to your personal preferences and financial needs. By understanding the differences between the two methods, you can make an informed decision that works best for you.

In addition to the differences mentioned above, early direct deposit and traditional direct deposit also have different advantages and disadvantages. Early direct deposit, for example, can provide improved cash flow and reduced financial stress. However, it may also come with fees and require certain eligibility criteria. Traditional direct deposit, on the other hand, is typically free and easy to set up, but may not provide the same level of convenience as early direct deposit.

By weighing the advantages and disadvantages of each method, you can make a decision that works best for your financial situation.

Popular Banks and Credit Unions that Offer Early Direct Deposit

Several popular banks and credit unions offer early direct deposit, making it easier for employees to receive their paychecks up to 2 days earlier than traditional direct deposit methods. Here are some of the most popular institutions that offer early direct deposit:

Chase Bank: Chase offers early direct deposit to its customers, allowing them to receive their paychecks up to 2 days earlier than traditional direct deposit methods. To be eligible, customers must have a Chase checking account and meet certain requirements.

Bank of America: Bank of America also offers early direct deposit to its customers, providing them with faster access to their paychecks. Customers must have a Bank of America checking account and meet certain eligibility criteria to qualify for early direct deposit.

Navy Federal Credit Union: Navy Federal Credit Union offers early direct deposit to its members, allowing them to receive their paychecks up to 2 days earlier than traditional direct deposit methods. Members must have a Navy Federal checking account and meet certain requirements to be eligible.

Other banks and credit unions that offer early direct deposit include Wells Fargo, Citi, and US Bank. It’s essential to check with your bank or credit union to see if they offer early direct deposit and what the specific requirements and benefits are.

When choosing a bank or credit union for early direct deposit, it’s crucial to consider the fees, customer support, and mobile app functionality. Some institutions may charge fees for early direct deposit, while others may not. Additionally, customer support and mobile app functionality can vary significantly between institutions.

By researching and comparing the different early direct deposit programs offered by banks and credit unions, employees can make an informed decision that meets their financial needs and preferences.

In addition to the institutions mentioned above, there are many other banks and credit unions that offer early direct deposit. It’s essential to do your research and compare the different programs to find the one that best suits your needs.

Early direct deposit can provide numerous benefits, including improved cash flow, reduced financial stress, and increased savings. By taking advantage of early direct deposit, employees can take control of their finances and achieve greater financial stability.

How to Choose the Best Early Direct Deposit Service for Your Needs

With so many early direct deposit services available, it can be overwhelming to choose the best one for your needs. Here are some tips and considerations to help you make an informed decision:

Fees: One of the most important factors to consider when choosing an early direct deposit service is fees. Some services may charge a fee for early direct deposit, while others may not. Be sure to check the fees associated with each service and choose the one that best fits your budget.

Customer Support: Another important factor to consider is customer support. Look for a service that offers 24/7 customer support, either by phone, email, or live chat. This will ensure that you can get help whenever you need it.

Mobile App Functionality: If you’re always on the go, you’ll want to choose a service that offers a mobile app with robust functionality. Look for an app that allows you to check your account balance, view your transaction history, and transfer funds on the go.

Security: Security is a top priority when it comes to early direct deposit. Look for a service that uses encryption and other security measures to protect your personal and financial information.

Reviews and Research: Finally, be sure to read reviews and do your research before selecting an early direct deposit service. Look for reviews from other customers to get a sense of their experiences with the service. You can also check out ratings from reputable sources such as the Better Business Bureau or Consumer Reports.

Some popular early direct deposit services to consider include Gusto, QuickBooks, and ADP. Each of these services offers a range of features and benefits, so be sure to do your research and choose the one that best fits your needs.

By considering these factors and doing your research, you can choose the best early direct deposit service for your needs and take control of your finances.

Remember, early direct deposit is a convenient and secure way to receive your paycheck up to 2 days earlier than traditional direct deposit methods. By choosing the right service and following these tips, you can make the most of this benefit and achieve greater financial stability.

Common FAQs About Early Direct Deposit

Early direct deposit is a convenient and secure way to receive your paycheck up to 2 days earlier than traditional direct deposit methods. However, you may have some questions about how it works and what to expect. Here are some frequently asked questions about early direct deposit:

Q: Is early direct deposit safe and secure?

A: Yes, early direct deposit is a safe and secure way to receive your paycheck. The process uses encryption and other security measures to protect your personal and financial information.

Q: How do I set up early direct deposit?

A: To set up early direct deposit, you will need to provide your employer with your bank account information and confirm your eligibility for early direct deposit. Your employer will then initiate the early direct deposit process, and you will receive your paycheck up to 2 days earlier than traditional direct deposit methods.

Q: What are the fees associated with early direct deposit?

A: Some employers or banks may charge a fee for early direct deposit, while others may not. Be sure to check with your employer or bank to see if there are any fees associated with early direct deposit.

Q: Can I cancel early direct deposit if I change my mind?

A: Yes, you can cancel early direct deposit if you change your mind. Simply contact your employer or bank and request to cancel the early direct deposit service.

Q: How do I know if I am eligible for early direct deposit?

A: To be eligible for early direct deposit, you typically need to have a valid bank account and meet certain requirements set by your employer or bank. Check with your employer or bank to see if you are eligible for early direct deposit.

By understanding the answers to these frequently asked questions, you can make an informed decision about whether early direct deposit is right for you.

Remember, early direct deposit is a convenient and secure way to receive your paycheck up to 2 days earlier than traditional direct deposit methods. By taking advantage of this benefit, you can improve your cash flow, reduce financial stress, and achieve greater financial stability.

Conclusion: Take Control of Your Finances with Early Direct Deposit

In conclusion, early direct deposit is a convenient and secure way to receive your paycheck up to 2 days earlier than traditional direct deposit methods. By taking advantage of this benefit, you can improve your cash flow, reduce financial stress, and achieve greater financial stability.

As we’ve discussed in this article, early direct deposit offers a range of benefits, including improved financial stability, reduced overdraft fees, and increased savings. By receiving your paycheck earlier, you can take control of your finances and make the most of your hard-earned money.

If you’re interested in setting up early direct deposit, we encourage you to visit your bank or credit union’s website to learn more. Many institutions offer early direct deposit programs, and the specific requirements and benefits may vary depending on the institution.

By taking the first step towards setting up early direct deposit, you can take control of your finances and achieve greater financial stability. Don’t wait any longer to start enjoying the benefits of early direct deposit – sign up today and start receiving your paycheck up to 2 days earlier!

Remember, early direct deposit is a convenient and secure way to receive your paycheck. By taking advantage of this benefit, you can improve your financial stability and achieve greater peace of mind.

So why wait? Take control of your finances today by setting up early direct deposit. Visit your bank or credit union’s website to learn more and start enjoying the benefits of early direct deposit.