Understanding the Risks of Not Having Pet Insurance

As a responsible pet owner, it’s essential to consider the potential risks of not having pet insurance. Without it, you may be faced with unexpected veterinary bills that can be financially devastating. According to the American Pet Products Association (APPA), the average cost of a veterinary visit can range from $500 to $1,000 or more, depending on the type of care required. Moreover, chronic conditions or severe illnesses can lead to ongoing expenses that may be difficult to manage without financial assistance.

For instance, if your pet is diagnosed with a chronic condition such as diabetes or arthritis, the cost of treatment and management can quickly add up. Without pet insurance, you may be forced to make difficult decisions about your pet’s care, such as choosing between treatment options or sacrificing other essential expenses to cover veterinary bills. This can lead to emotional distress and a decreased quality of life for both you and your pet.

Furthermore, not having pet insurance can also limit your ability to provide the best possible care for your pet. Without financial assistance, you may be forced to opt for less expensive treatment options or delay necessary care, which can negatively impact your pet’s health and well-being. By investing in pet insurance, you can ensure that your pet receives the necessary care and attention they need, without breaking the bank.

So, do you need pet insurance? The answer is yes, especially if you want to protect your pet’s health and well-being, as well as your own financial stability. By understanding the risks of not having pet insurance, you can make an informed decision about whether it’s right for you and your furry friend.

How to Determine If Pet Insurance Is Necessary for Your Pet

Deciding whether pet insurance is necessary for your pet can be a daunting task. However, by considering a few key factors, you can make an informed decision that’s right for you and your furry friend. So, do you need pet insurance? Let’s break it down.

First, consider your pet’s age. As pets get older, they’re more likely to develop chronic health issues, which can be costly to treat. If your pet is approaching middle age or is already a senior, pet insurance may be a wise investment.

Next, think about your pet’s health. If your pet has a pre-existing condition or is prone to certain health issues, pet insurance can help cover the costs of treatment and management. Additionally, if your pet is at risk for certain health issues due to their breed or genetics, pet insurance can provide financial protection.

Lifestyle is also an important factor to consider. If you have a busy schedule or travel frequently, pet insurance can provide peace of mind knowing that your pet is protected in case of an emergency. Similarly, if you live in an area with high veterinary costs, pet insurance can help offset the expenses.

Another factor to consider is your financial situation. If you have a limited budget or are unsure about your ability to cover unexpected veterinary expenses, pet insurance can provide a safety net.

Finally, consider the type of care you want to provide for your pet. If you want to ensure that your pet receives the best possible care, regardless of the cost, pet insurance can help make that a reality.

By considering these factors, you can determine whether pet insurance is necessary for your pet. Remember, pet insurance is not a one-size-fits-all solution, and what works for one pet owner may not work for another. By taking the time to assess your pet’s needs and your own financial situation, you can make an informed decision that’s right for you and your furry friend.

The Benefits of Pet Insurance: More Than Just Financial Protection

Pet insurance offers a wide range of benefits that go beyond just financial protection. While it’s true that pet insurance can help cover unexpected veterinary bills, it also provides access to better care, reduced stress, and increased peace of mind.

One of the most significant benefits of pet insurance is the ability to provide your pet with the best possible care, regardless of the cost. With pet insurance, you can focus on getting your pet the treatment they need, rather than worrying about the financial implications. This can lead to better health outcomes and a longer, healthier life for your pet.

Pet insurance can also reduce stress and anxiety for pet owners. When you know that your pet is protected in case of an emergency, you can enjoy a greater sense of peace of mind. This can be especially important for pet owners who are deeply attached to their pets and want to ensure that they receive the best possible care.

In addition to these benefits, pet insurance can also provide access to preventative care and wellness services. Many pet insurance policies include coverage for routine care, such as vaccinations and dental cleanings, which can help prevent health problems from developing in the first place.

Furthermore, pet insurance can also provide a sense of security and stability for pet owners. When you know that your pet is protected, you can feel more confident and secure in your ability to provide for their needs. This can be especially important for pet owners who are on a limited budget or who are unsure about their ability to cover unexpected veterinary expenses.

So, do you need pet insurance? If you want to provide your pet with the best possible care, reduce stress and anxiety, and enjoy a greater sense of peace of mind, then the answer is yes. Pet insurance is more than just financial protection – it’s a way to ensure that your pet receives the care they need, when they need it.

Types of Pet Insurance: Which One Is Right for You?

When it comes to pet insurance, there are several types of policies to choose from, each with its own unique benefits and drawbacks. Understanding the different types of pet insurance can help you make an informed decision about which one is right for you and your furry friend.

Accident-only pet insurance is a type of policy that covers unexpected accidents or injuries, such as broken bones or poisoning. This type of policy is often less expensive than comprehensive coverage, but it may not provide the same level of protection.

Wellness pet insurance, on the other hand, covers routine care and preventative services, such as vaccinations and dental cleanings. This type of policy can help prevent health problems from developing in the first place, and can be a good option for pet owners who want to prioritize their pet’s health and wellbeing.

Comprehensive pet insurance is the most comprehensive type of policy, covering both accidents and illnesses, as well as wellness services. This type of policy provides the highest level of protection, but it may also be the most expensive.

Other types of pet insurance policies include chronic condition coverage, which covers ongoing health issues, and senior pet insurance, which is designed specifically for older pets.

When choosing a pet insurance policy, it’s essential to consider your pet’s individual needs and circumstances. For example, if your pet has a pre-existing condition, you may want to choose a policy that covers chronic conditions. If you have a senior pet, you may want to choose a policy that is specifically designed for older pets.

Ultimately, the type of pet insurance policy that is right for you will depend on your individual circumstances and priorities. By understanding the different types of pet insurance policies available, you can make an informed decision about which one is best for you and your furry friend.

So, do you need pet insurance? If you want to provide your pet with the best possible care and protection, the answer is yes. By choosing the right type of pet insurance policy, you can ensure that your pet receives the care they need, when they need it.

What to Look for in a Pet Insurance Policy

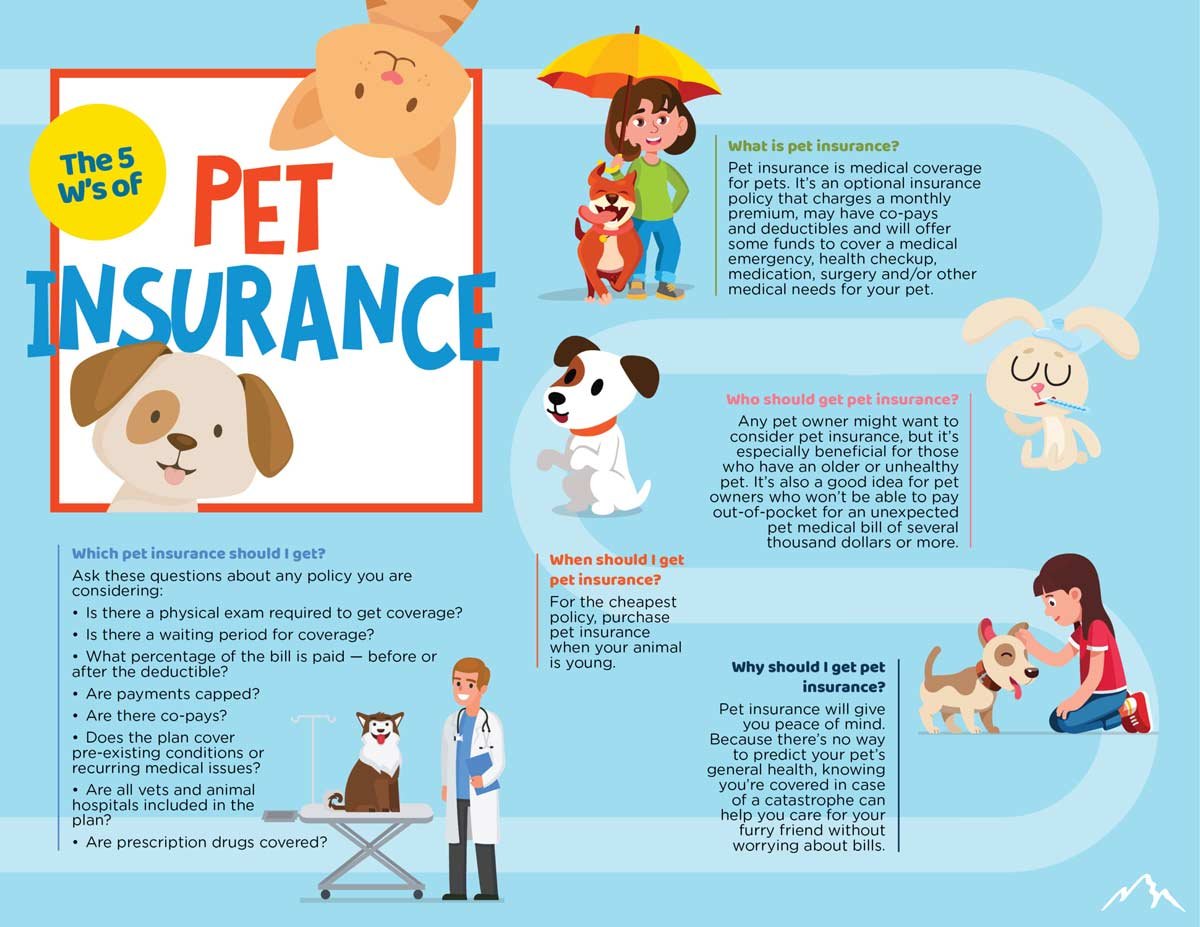

When selecting a pet insurance policy, there are several factors to consider to ensure that you’re getting the best coverage for your furry friend. Here are some key things to look for in a pet insurance policy:

Coverage limits: Make sure to check the coverage limits of the policy, including the maximum amount that the insurance company will pay per year and per condition. This will help you understand what’s covered and what’s not.

Deductibles: Check the deductible amount, which is the amount you’ll need to pay out-of-pocket before the insurance company starts paying. Some policies may have a higher deductible, but lower premiums.

Pre-existing condition exclusions: If your pet has a pre-existing condition, make sure to check if the policy excludes coverage for that condition. Some policies may have a waiting period before coverage kicks in for pre-existing conditions.

Co-payments: Check if the policy requires co-payments, which are the amount you’ll need to pay for each vet visit or treatment.

Network of veterinarians: Check if the policy has a network of veterinarians that you can use. Some policies may have a limited network, while others may allow you to use any veterinarian.

Claims process: Check the claims process, including how to file a claim and how long it takes to get reimbursed.

Customer service: Check the customer service of the insurance company, including their phone number, email, and online chat support.

Reviews and ratings: Check the reviews and ratings of the insurance company from other pet owners to get an idea of their reputation and level of service.

By considering these factors, you can make an informed decision about which pet insurance policy is right for you and your furry friend. Remember, the goal of pet insurance is to provide financial protection and peace of mind, so make sure to choose a policy that meets your needs and budget.

So, do you need pet insurance? If you want to provide your pet with the best possible care and protection, the answer is yes. By choosing the right pet insurance policy, you can ensure that your pet receives the care they need, when they need it.

Real-Life Examples: How Pet Insurance Saved the Day

Pet insurance can be a lifesaver in emergency situations, providing financial protection and peace of mind for pet owners. Here are some real-life examples of how pet insurance helped pet owners in emergency situations:

Case Study 1: Max, the Golden Retriever

Max, a 3-year-old Golden Retriever, was diagnosed with a severe case of pancreatitis. His owner, Sarah, was devastated by the news and worried about the cost of treatment. Fortunately, Sarah had invested in a comprehensive pet insurance policy, which covered 80% of the treatment costs. Max received the necessary care and made a full recovery.

Testimonial: “I was so grateful to have pet insurance when Max got sick. It was a huge financial burden off my shoulders, and I was able to focus on getting him the best care possible.” – Sarah

Case Study 2: Whiskers, the Cat

Whiskers, a 10-year-old cat, was involved in a car accident and suffered severe injuries. Her owner, John, was shocked by the news and worried about the cost of treatment. Fortunately, John had invested in an accident-only pet insurance policy, which covered 90% of the treatment costs. Whiskers received the necessary care and made a full recovery.

Testimonial: “I was so relieved to have pet insurance when Whiskers got hurt. It was a huge financial burden off my shoulders, and I was able to focus on getting her the best care possible.” – John

These real-life examples demonstrate the importance of pet insurance in emergency situations. By investing in a pet insurance policy, pet owners can ensure that their furry friends receive the necessary care and attention, without breaking the bank.

So, do you need pet insurance? If you want to provide your pet with the best possible care and protection, the answer is yes. By investing in a pet insurance policy, you can ensure that your pet receives the care they need, when they need it.

Common Misconceptions About Pet Insurance Debunked

There are several common misconceptions about pet insurance that may be holding you back from investing in a policy. Let’s take a closer look at some of these misconceptions and set the record straight.

Misconception 1: Pet insurance is too expensive

While it’s true that pet insurance can be a significant investment, it’s often a small price to pay compared to the cost of unexpected veterinary bills. In fact, many pet insurance policies can be customized to fit your budget and needs.

Misconception 2: Pet insurance is only necessary for older pets

This couldn’t be further from the truth. Pet insurance is essential for pets of all ages, as accidents and illnesses can happen at any time. In fact, many pet insurance policies offer discounts for younger pets.

Misconception 3: Pet insurance is not necessary for healthy pets

Even healthy pets can get sick or injured, and pet insurance can provide financial protection and peace of mind. In fact, many pet insurance policies offer wellness coverage, which can help prevent health problems from developing in the first place.

Misconception 4: Pet insurance is a waste of money

This is simply not true. Pet insurance can provide significant financial protection and peace of mind, and can even help save your pet’s life in emergency situations.

By understanding the facts about pet insurance, you can make an informed decision about whether it’s right for you and your furry friend. So, do you need pet insurance? If you want to provide your pet with the best possible care and protection, the answer is yes.

Conclusion: Is Pet Insurance Right for You?

In conclusion, pet insurance can be a valuable investment for pet owners who want to provide their furry friends with the best possible care and protection. By understanding the potential financial risks of not having pet insurance, assessing your pet’s needs, and selecting the right type of coverage, you can make an informed decision about whether pet insurance is right for you.

Remember, pet insurance is not just about financial protection; it’s also about providing your pet with access to better care, reducing stress, and increasing peace of mind. By investing in a pet insurance policy, you can ensure that your pet receives the care they need, when they need it.

So, do you need pet insurance? If you want to provide your pet with the best possible care and protection, the answer is yes. By following the steps outlined in this article, you can make an informed decision about whether pet insurance is right for you and your furry friend.

Ultimately, the decision to invest in pet insurance is a personal one that depends on your individual circumstances and priorities. However, by understanding the benefits and options available, you can make a decision that’s right for you and your pet.

By investing in pet insurance, you can provide your pet with the care and protection they deserve, and enjoy a stronger, healthier relationship with your furry friend.