Navigating the World of Retail Employee Benefits

Employee benefits play a crucial role in the retail industry, where companies like Walmart strive to provide their employees with comprehensive benefits packages. Health insurance is a vital component of these packages, and it’s essential for employees to understand their options. As one of the largest retailers in the world, Walmart offers its employees a range of health insurance plans, but the question remains: do Walmart employees get health insurance? In this article, we’ll delve into the world of Walmart employee benefits, exploring the health insurance options available to associates and providing a comprehensive guide to help them make informed decisions.

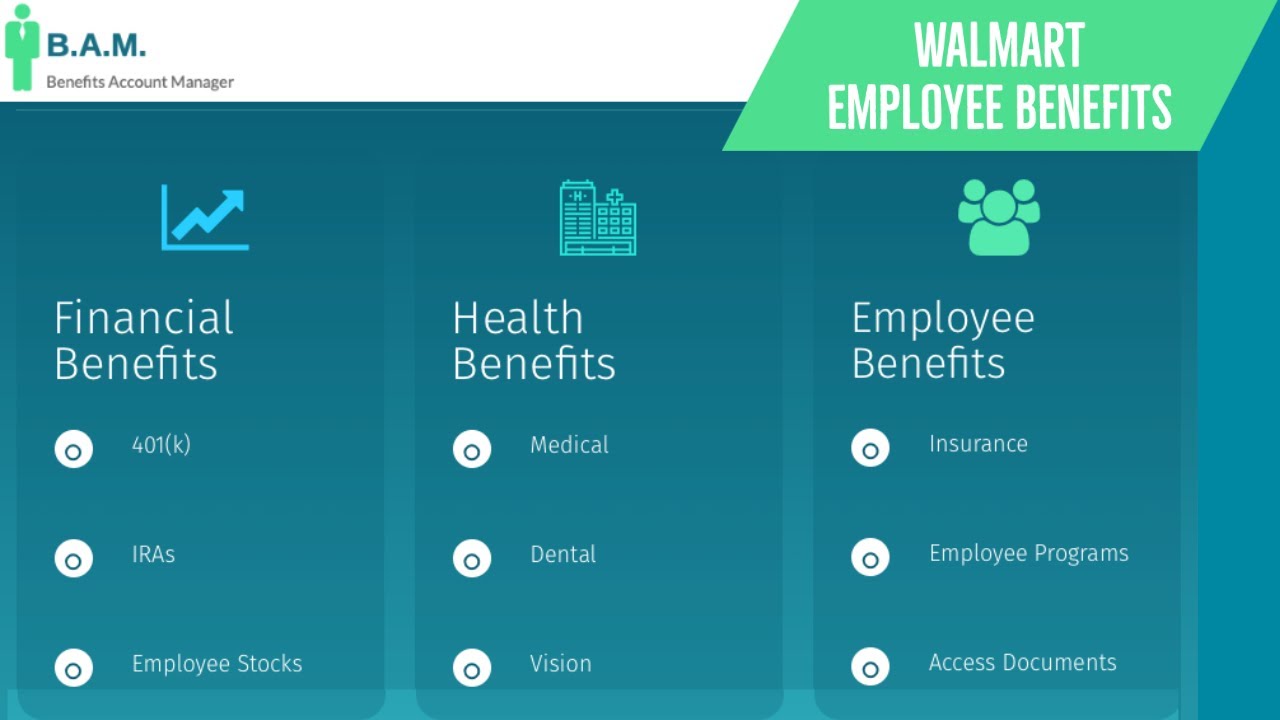

Health insurance is a critical aspect of employee benefits, and Walmart recognizes its importance. The company offers various health insurance plans to its employees, including medical, dental, and vision coverage. These plans are designed to provide associates with access to quality healthcare, helping them maintain their physical and mental well-being. By understanding the health insurance options available, Walmart employees can take control of their benefits and make informed decisions about their healthcare.

As the retail industry continues to evolve, employee benefits have become a key differentiator for companies like Walmart. By offering comprehensive benefits packages, including health insurance, Walmart can attract and retain top talent, improve employee satisfaction, and drive business success. In the following sections, we’ll explore the eligibility criteria for Walmart employees to receive health insurance, the types of plans available, and the enrollment process. We’ll also compare Walmart’s health insurance options to industry standards, providing insights into how the company’s benefits package stacks up against other major retailers.

How to Get Health Insurance as a Walmart Employee

So, do Walmart employees get health insurance? The answer is yes. Walmart offers its employees a range of health insurance plans, designed to provide access to quality healthcare. To be eligible for health insurance, Walmart employees must meet certain criteria, including working a minimum number of hours per week and completing a waiting period. The waiting period typically ranges from 30 to 90 days, depending on the employee’s start date and job classification.

Walmart employees can choose from several health insurance plans, including the Associate Choice Plan, the Associate Plus Plan, and the High Deductible Health Plan (HDHP). Each plan offers different levels of coverage, deductibles, and out-of-pocket costs. Employees can enroll in a health insurance plan during the annual open enrollment period or within 30 days of becoming eligible.

To enroll in a health insurance plan, Walmart employees can follow these steps:

- Log in to the Walmart Benefits website or mobile app

- Review the available health insurance plans and their corresponding costs

- Select the desired plan and coverage level

- Enroll in the plan and set up premium payments

It’s essential for Walmart employees to carefully review their health insurance options and choose a plan that meets their individual needs. Employees can also contact the Walmart Benefits Center or a benefits representative for assistance with the enrollment process.

By understanding the eligibility criteria and enrollment process, Walmart employees can take the first step towards securing health insurance coverage. In the next section, we’ll delve into the details of Walmart’s health insurance plans, including the different types of coverage, deductibles, and out-of-pocket costs.

Understanding Walmart’s Health Insurance Options

Walmart offers its employees a range of health insurance plans, each with its own unique features and benefits. The plans are designed to provide employees with access to quality healthcare, while also being mindful of their budget and individual needs. In this section, we’ll delve into the details of Walmart’s health insurance plans, including the different types of coverage, deductibles, and out-of-pocket costs.

Walmart’s health insurance plans can be broadly categorized into three main types: the Associate Choice Plan, the Associate Plus Plan, and the High Deductible Health Plan (HDHP). Each plan offers different levels of coverage, deductibles, and out-of-pocket costs, allowing employees to choose the plan that best meets their needs.

The Associate Choice Plan is Walmart’s most basic health insurance plan. It offers a moderate level of coverage, with a deductible of $500 for individual coverage and $1,000 for family coverage. The plan also includes a copayment of $20 for doctor visits and a coinsurance of 20% for hospital stays.

The Associate Plus Plan is Walmart’s mid-tier health insurance plan. It offers a higher level of coverage than the Associate Choice Plan, with a deductible of $250 for individual coverage and $500 for family coverage. The plan also includes a copayment of $15 for doctor visits and a coinsurance of 15% for hospital stays.

The High Deductible Health Plan (HDHP) is Walmart’s most comprehensive health insurance plan. It offers a high level of coverage, with a deductible of $1,000 for individual coverage and $2,000 for family coverage. The plan also includes a copayment of $10 for doctor visits and a coinsurance of 10% for hospital stays.

In addition to these plans, Walmart also offers a range of additional benefits, including dental and vision insurance, life insurance, and disability insurance. These benefits can be added to an employee’s health insurance plan, providing a more comprehensive benefits package.

When choosing a health insurance plan, Walmart employees should consider their individual needs and budget. They should also take into account the level of coverage, deductibles, and out-of-pocket costs associated with each plan. By carefully evaluating their options, employees can make informed decisions about their health insurance and choose the plan that best meets their needs.

Additional Benefits for Walmart Employees

In addition to health insurance, Walmart employees may be eligible for a range of other benefits, including dental and vision insurance, life insurance, and disability insurance. These benefits can complement the health insurance options and provide a more comprehensive benefits package.

Dental insurance is an important benefit for Walmart employees, as it can help cover the cost of routine dental care, such as cleanings and fillings, as well as more complex procedures, such as crowns and root canals. Walmart’s dental insurance plan offers a range of coverage options, including a basic plan that covers routine care and a more comprehensive plan that covers additional services.

Vision insurance is another benefit that Walmart employees may be eligible for. This benefit can help cover the cost of eye exams, glasses, and contact lenses. Walmart’s vision insurance plan offers a range of coverage options, including a basic plan that covers routine eye exams and a more comprehensive plan that covers additional services.

Life insurance is a benefit that can provide financial protection for Walmart employees and their families in the event of a death. Walmart’s life insurance plan offers a range of coverage options, including a basic plan that provides a death benefit and a more comprehensive plan that includes additional features, such as accidental death and dismemberment coverage.

Disability insurance is a benefit that can provide financial protection for Walmart employees who become unable to work due to illness or injury. Walmart’s disability insurance plan offers a range of coverage options, including a basic plan that provides partial income replacement and a more comprehensive plan that includes additional features, such as long-term care coverage.

These additional benefits can provide Walmart employees with a more comprehensive benefits package, helping to protect their health, well-being, and financial security. By understanding these benefits and how they work, employees can make informed decisions about their benefits and get the most out of their Walmart benefits package.

It’s worth noting that not all Walmart employees are eligible for these additional benefits, and the specific benefits and coverage options may vary depending on the employee’s location, job classification, and other factors. Employees should check with their HR representative or benefits administrator to determine which benefits they are eligible for and to get more information about the specific benefits and coverage options available to them.

How Walmart’s Health Insurance Compares to Industry Standards

Walmart’s health insurance options are competitive with industry standards, offering a range of benefits and coverage options to its employees. However, the quality and comprehensiveness of health insurance benefits can vary significantly across different retailers and industries.

Compared to other major retailers, Walmart’s health insurance options are generally considered to be above average. According to a survey by the National Retail Federation, Walmart’s health insurance benefits are ranked among the top three in the retail industry, along with those offered by Costco and Target.

One of the key factors that sets Walmart’s health insurance apart from its competitors is the company’s commitment to providing affordable coverage options to its employees. Walmart offers a range of health insurance plans, including a basic plan that provides minimum essential coverage and a more comprehensive plan that offers additional benefits and coverage options.

Another factor that contributes to Walmart’s strong health insurance benefits is the company’s focus on employee wellness and health promotion. Walmart offers a range of wellness programs and services, including fitness classes, health screenings, and disease management programs, to help employees maintain their physical and mental health.

However, Walmart’s health insurance benefits are not without their limitations. Some employees have reported difficulty navigating the company’s benefits enrollment process, and others have expressed concerns about the cost and comprehensiveness of the coverage options.

Overall, Walmart’s health insurance options are competitive with industry standards, offering a range of benefits and coverage options to its employees. However, the company can continue to improve its health insurance benefits by addressing employee concerns and providing more comprehensive and affordable coverage options.

By understanding how Walmart’s health insurance options compare to industry standards, employees can make informed decisions about their benefits and take advantage of the resources and support available to them. Whether you’re a current Walmart employee or considering a career with the company, it’s essential to carefully evaluate the health insurance options and choose the plan that best meets your needs and budget.

Common Questions and Concerns about Walmart Health Insurance

As a Walmart employee, you may have questions and concerns about the company’s health insurance options. In this section, we’ll address some of the most frequently asked questions and provide clear and concise answers to help you navigate the benefits enrollment process.

Is Walmart health insurance good?

Walmart’s health insurance options are considered to be above average compared to other major retailers. The company offers a range of plans, including a basic plan that provides minimum essential coverage and a more comprehensive plan that offers additional benefits and coverage options.

How much does Walmart health insurance cost?

The cost of Walmart health insurance varies depending on the plan you choose and your individual circumstances. However, Walmart offers a range of affordable options, including a basic plan that starts at around $50 per month for individual coverage.

What is the deductible for Walmart health insurance?

The deductible for Walmart health insurance varies depending on the plan you choose. However, the company offers a range of plans with deductibles starting at around $500 for individual coverage.

Can I add my family members to my Walmart health insurance plan?

Yes, Walmart employees can add their family members to their health insurance plan. The company offers a range of family plans, including plans that cover spouses, children, and other dependents.

How do I enroll in Walmart health insurance?

Walmart employees can enroll in health insurance through the company’s benefits enrollment process. This typically takes place during the annual open enrollment period, but employees can also enroll during special enrollment periods or when they experience a qualifying life event.

What if I have pre-existing conditions?

Walmart’s health insurance plans cover pre-existing conditions, including chronic conditions such as diabetes and heart disease. However, the company may require additional documentation or underwriting for certain conditions.

By understanding the answers to these common questions and concerns, Walmart employees can make informed decisions about their health insurance and take advantage of the benefits available to them.

Tips for Maximizing Your Walmart Health Insurance Benefits

To get the most out of Walmart’s health insurance benefits, employees should take an active role in understanding their plan options and utilizing the resources available to them. Here are some tips to help Walmart employees maximize their health insurance benefits:

1. Choose the right plan: With multiple plan options available, it’s essential to choose the one that best fits your needs and budget. Consider factors such as deductibles, copays, and out-of-pocket costs when selecting a plan.

2. Use in-network providers: Using in-network providers can help reduce out-of-pocket costs and ensure that you receive the highest level of coverage. Make sure to check the provider network before seeking medical care.

3. Take advantage of preventive care: Walmart’s health insurance plans cover preventive care services, such as annual physicals and screenings, at no additional cost. Take advantage of these services to stay healthy and detect potential health issues early.

4. Manage out-of-pocket costs: Out-of-pocket costs can add up quickly, so it’s essential to manage them effectively. Consider setting aside a portion of your paycheck each month to cover unexpected medical expenses.

5. Utilize Walmart’s health and wellness programs: Walmart offers various health and wellness programs, such as fitness classes and nutrition counseling, to help employees maintain a healthy lifestyle. Take advantage of these programs to improve your overall health and well-being.

6. Review and adjust your plan annually: Health insurance needs can change over time, so it’s essential to review and adjust your plan annually. Consider changes in your health, income, or family status when selecting a plan.

7. Seek support from Walmart’s benefits team: Walmart’s benefits team is available to answer questions and provide support throughout the benefits enrollment process. Don’t hesitate to reach out to them if you need help navigating your health insurance options.

By following these tips, Walmart employees can maximize their health insurance benefits and take control of their health and well-being. Remember, understanding and utilizing your health insurance benefits is key to getting the most out of your Walmart benefits package. If you’re wondering “do Walmart employees get health insurance,” the answer is yes, and with these tips, you can make the most of it.

Conclusion: Empowering Walmart Employees to Take Control of Their Health Insurance

In conclusion, Walmart employees have access to a range of health insurance options that can provide them with the coverage they need to maintain their health and well-being. By understanding the eligibility criteria, plan options, and enrollment process, employees can make informed decisions about their health insurance and take control of their benefits.

As we’ve seen, Walmart’s health insurance options are competitive with industry standards, and the company offers a range of additional benefits that can complement its health insurance plans. By taking advantage of these benefits, employees can create a comprehensive benefits package that meets their unique needs.

Ultimately, the key to getting the most out of Walmart’s health insurance benefits is to take an active role in understanding and utilizing them. By choosing the right plan, using in-network providers, and managing out-of-pocket costs, employees can maximize their benefits and achieve better health outcomes.

So, to answer the question “do Walmart employees get health insurance,” the answer is yes, and with the right knowledge and strategies, they can get the most out of their benefits. By empowering themselves with the information and resources they need, Walmart employees can take control of their health insurance and create a brighter, healthier future for themselves and their families.

As a Walmart employee, it’s essential to remember that your health insurance benefits are an essential part of your overall compensation package. By understanding and utilizing your benefits, you can protect your health, well-being, and financial security. So, take the time to explore your options, ask questions, and seek support from Walmart’s benefits team. Your health and well-being are worth it.