Understanding Burlington’s Payment Frequency

For employees of Burlington, knowing when to expect a paycheck is crucial for managing finances effectively. One of the most common questions asked by Burlington employees is whether the company pays its employees weekly or bi-weekly. Understanding the payment frequency is essential for budgeting, saving, and making informed financial decisions. In this article, we will delve into Burlington’s pay schedule, exploring the company’s payment terms, pay periods, and any relevant details that might affect employee paychecks.

Burlington, like many other retailers, has a complex payroll system that can be confusing for new employees. The company’s payment frequency is not immediately apparent, and employees may need to dig through their employee handbook or contact HR to find out when they can expect their paychecks. However, knowing whether Burlington pays weekly or bi-weekly can make a significant difference in an employee’s financial planning.

For instance, employees who are paid bi-weekly may need to adjust their budgeting and saving strategies to accommodate the longer pay period. On the other hand, employees who are paid weekly may have more flexibility in their finances, but may also need to be more mindful of their spending habits. By understanding Burlington’s payment frequency, employees can better manage their finances and make informed decisions about their money.

In the following sections, we will explore Burlington’s payroll policy in more detail, including how to determine your pay schedule, the difference between weekly and bi-weekly pay, and tips for managing your finances on a bi-weekly pay schedule. Whether you are a new employee or a seasoned veteran, understanding Burlington’s pay schedule is essential for achieving financial stability and success.

How to Determine Your Pay Schedule at Burlington

If you’re a new employee at Burlington, you may be wondering how to find out your pay schedule. Determining your pay schedule is crucial for managing your finances effectively and avoiding any potential issues with your paychecks. Fortunately, there are several ways to find out your pay schedule at Burlington.

One of the easiest ways to determine your pay schedule is to check your employee handbook. The handbook should outline the company’s payroll policy, including the pay frequency and pay periods. If you don’t have a copy of the handbook, you can request one from HR or access it online through the company’s intranet.

Another way to find out your pay schedule is to contact HR directly. You can reach out to the HR department via phone or email and ask about your pay schedule. They should be able to provide you with the information you need, including the pay frequency and pay periods.

Alternatively, you can review your pay stubs to determine your pay schedule. Your pay stubs should indicate the pay period and the date of payment. By reviewing your pay stubs, you can get an idea of when you can expect to receive your paychecks.

It’s also a good idea to ask your supervisor or manager about your pay schedule. They may be able to provide you with more information about the company’s payroll policy and help you understand how it affects your paychecks.

By following these steps, you should be able to determine your pay schedule at Burlington. Remember to always check your pay stubs and employee handbook to ensure that you’re getting paid correctly and on time. If you have any questions or concerns about your pay schedule, don’t hesitate to reach out to HR or your supervisor for assistance.

Burlington’s Payroll Policy: What You Need to Know

Burlington’s payroll policy is designed to ensure that employees are paid accurately and on time. The company’s payment terms and pay periods are outlined in the employee handbook and are also available on the company’s intranet. According to Burlington’s payroll policy, employees are paid on a bi-weekly schedule, with pay periods ending on every other Saturday.

The company’s pay schedule is based on a 26-pay-period calendar, with pay dates occurring every other Friday. This means that employees can expect to receive their paychecks every other week, with the exact date of payment depending on the pay period. Burlington’s payroll policy also outlines the procedures for handling errors or discrepancies with paychecks, including how to report issues and what to expect in terms of resolution.

In addition to the bi-weekly pay schedule, Burlington’s payroll policy also includes provisions for paid time off, holidays, and other benefits. Employees are eligible for paid time off after a certain period of service, and the company observes all major holidays. Burlington’s payroll policy is designed to be fair and equitable, with the goal of ensuring that employees are paid accurately and on time.

It’s worth noting that Burlington’s payroll policy may vary depending on the location and type of employment. For example, employees working in certain states or in specific roles may be subject to different pay schedules or benefits. However, the company’s overall payroll policy is designed to be consistent and fair, with the goal of providing employees with a stable and secure income.

By understanding Burlington’s payroll policy, employees can better manage their finances and plan for the future. Whether you’re a new employee or a seasoned veteran, it’s essential to know how the company’s pay schedule works and what to expect in terms of payment. By following the guidelines outlined in this article, you can ensure that you’re getting paid accurately and on time, and that you’re taking advantage of all the benefits that Burlington has to offer.

Weekly vs Bi-Weekly Pay: What’s the Difference?

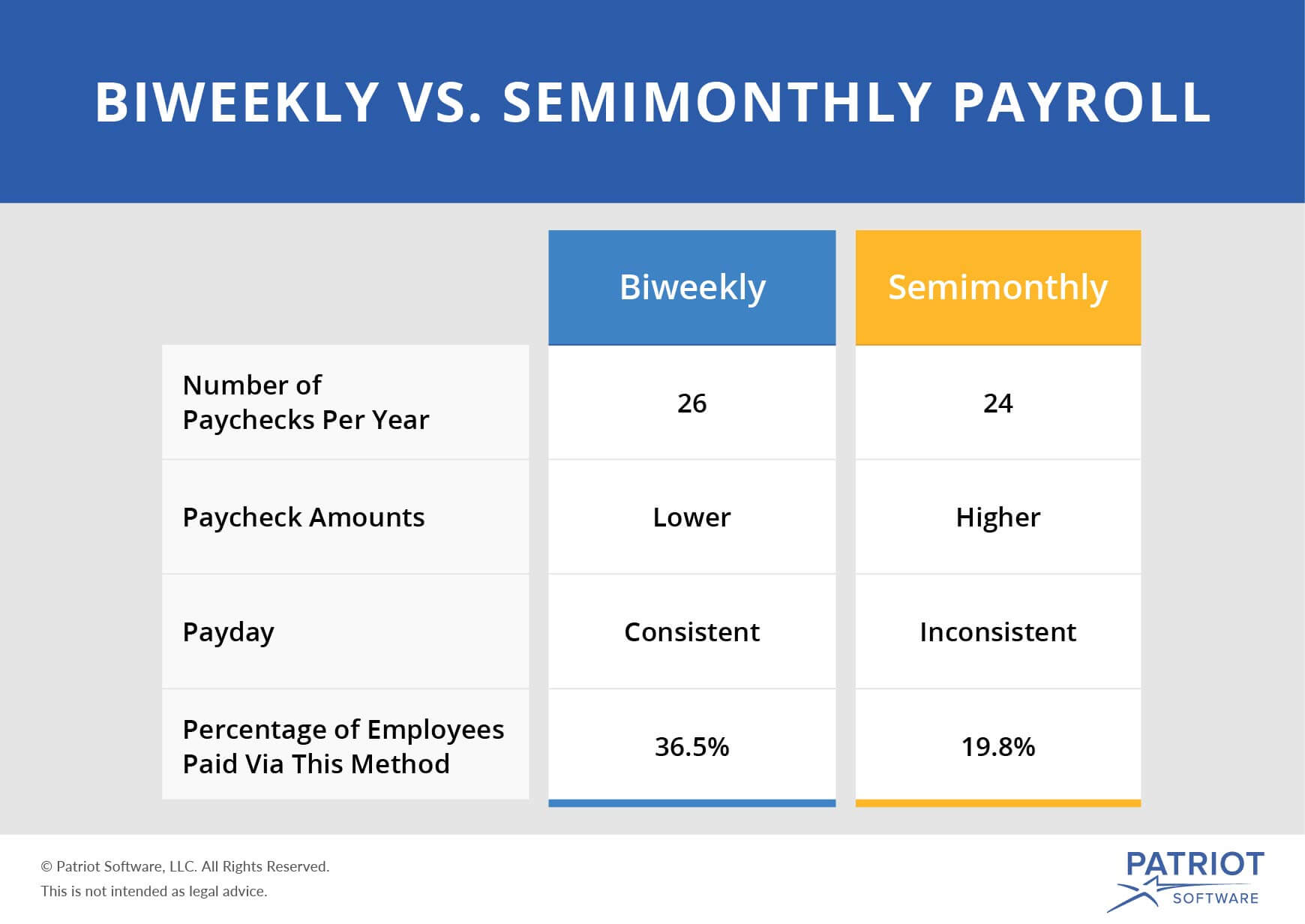

When it comes to pay schedules, there are two main options: weekly and bi-weekly. While both options have their pros and cons, it’s essential to understand the differences between them, especially if you’re wondering “does Burlington pay weekly or bi-weekly?”

A weekly pay schedule means that employees are paid every week, usually on the same day of the week. This can be beneficial for employees who need to budget and plan their finances on a weekly basis. However, it can also lead to a higher administrative burden for employers, as they need to process payroll more frequently.

On the other hand, a bi-weekly pay schedule means that employees are paid every other week, usually on the same day of the week. This can be beneficial for employers, as it reduces the administrative burden of processing payroll. However, it can also lead to a longer period between paychecks for employees, which can impact their financial planning and budgeting.

In terms of financial planning and budgeting, a bi-weekly pay schedule can be more challenging for employees. Since paychecks are less frequent, employees need to plan and budget their finances over a longer period. However, this can also lead to a more stable financial situation, as employees are less likely to overspend or make impulse purchases.

Ultimately, the choice between a weekly and bi-weekly pay schedule depends on the specific needs and circumstances of the employer and employees. Burlington, for example, pays its employees on a bi-weekly schedule, which can impact their financial planning and budgeting. By understanding the differences between weekly and bi-weekly pay schedules, employees can better manage their finances and plan for the future.

It’s worth noting that some employers may offer flexible pay schedules or alternative payment arrangements, such as daily or monthly pay. However, these options are less common and may not be available to all employees. By understanding the pros and cons of different pay schedules, employees can make informed decisions about their financial planning and budgeting.

How Burlington’s Pay Schedule Compares to Industry Standards

Burlington’s pay schedule is just one aspect of the company’s overall compensation package. But how does it compare to industry standards? In this section, we’ll take a closer look at how Burlington’s pay schedule stacks up against other retailers and companies in the same sector.

According to industry reports, the majority of retailers pay their employees on a bi-weekly schedule. This is because bi-weekly pay schedules can help reduce administrative costs and improve cash flow. However, some retailers may pay their employees on a weekly or monthly schedule, depending on their specific needs and circumstances.

Burlington’s bi-weekly pay schedule is consistent with industry standards. In fact, many major retailers, including Target and Walmart, also pay their employees on a bi-weekly schedule. However, some retailers, such as Costco and Trader Joe’s, pay their employees on a weekly schedule.

It’s worth noting that pay schedules can vary widely depending on the specific industry and company. For example, companies in the tech industry may be more likely to pay their employees on a monthly schedule, while companies in the retail industry may be more likely to pay their employees on a bi-weekly schedule.

Ultimately, the key takeaway is that Burlington’s pay schedule is consistent with industry standards. However, it’s always a good idea to research and compare pay schedules across different companies and industries to get a better sense of what’s typical and what’s not.

By understanding how Burlington’s pay schedule compares to industry standards, employees can gain a better understanding of their compensation package and make more informed decisions about their financial planning and budgeting.

Tips for Managing Your Finances on a Bi-Weekly Pay Schedule

Managing your finances on a bi-weekly pay schedule can be challenging, but with the right strategies, you can stay on top of your finances and achieve your financial goals. Here are some tips to help you manage your finances effectively on a bi-weekly pay schedule:

First, create a budget that accounts for your bi-weekly pay schedule. Make sure to include all your income and expenses, including your paychecks, bills, and savings goals. You can use a budgeting app or spreadsheet to make it easier to track your finances.

Next, prioritize your expenses and make sure to pay your bills on time. Since you’re paid bi-weekly, you’ll need to make sure you have enough money set aside to cover your expenses until your next paycheck. Consider setting up automatic payments for your bills to ensure you never miss a payment.

Another tip is to save a portion of your paycheck each time you’re paid. Since you’re paid bi-weekly, you’ll have two paychecks per month. Consider setting aside a portion of each paycheck in a savings account or emergency fund.

Finally, consider using the 50/30/20 rule to allocate your income. This means that 50% of your income should go towards necessary expenses like bills and groceries, 30% towards discretionary spending, and 20% towards saving and debt repayment.

By following these tips, you can effectively manage your finances on a bi-weekly pay schedule and achieve your financial goals. Remember to stay disciplined, prioritize your expenses, and save a portion of your paycheck each time you’re paid.

Additionally, consider taking advantage of Burlington’s employee benefits, such as their 401(k) matching program or employee discounts. These benefits can help you save money and achieve your long-term financial goals.

Common Questions About Burlington’s Pay Schedule

As an employee of Burlington, you may have questions or concerns about the company’s pay schedule. Here are some common questions and answers to help you better understand Burlington’s pay schedule:

Q: Does Burlington pay weekly or bi-weekly?

A: Burlington pays its employees bi-weekly, with pay periods ending on every other Saturday.

Q: How do I know when I’ll receive my paycheck?

A: You can check your employee handbook or contact HR to find out when you’ll receive your paycheck. You can also review your pay stubs to see when your pay periods end and when you can expect to receive your paycheck.

Q: What if I have an error or discrepancy with my paycheck?

A: If you have an error or discrepancy with your paycheck, contact HR or payroll immediately. They will work with you to resolve the issue and ensure that you receive the correct amount of pay.

Q: Can I change my pay schedule?

A: No, Burlington’s pay schedule is set and cannot be changed. However, you can talk to HR or payroll about any concerns or questions you may have about your pay schedule.

Q: How does Burlington’s pay schedule compare to other retailers?

A: Burlington’s pay schedule is consistent with industry standards. Many retailers pay their employees bi-weekly, although some may pay weekly or monthly.

By understanding the answers to these common questions, you can better navigate Burlington’s pay schedule and ensure that you’re getting paid correctly and on time.

Conclusion: Understanding Burlington’s Pay Schedule

In conclusion, understanding Burlington’s pay schedule is crucial for employees to manage their finances effectively. By knowing whether Burlington pays its employees weekly or bi-weekly, employees can better plan their budget, save money, and make informed financial decisions.

As we’ve discussed in this article, Burlington pays its employees bi-weekly, with pay periods ending on every other Saturday. This pay schedule is consistent with industry standards, and employees can expect to receive their paychecks on a regular basis.

By following the tips and advice outlined in this article, employees can manage their finances effectively on a bi-weekly pay schedule. This includes creating a budget, prioritizing expenses, saving money, and managing finances effectively.

Additionally, employees should be aware of common questions and concerns about Burlington’s pay schedule, including what to do if there are errors or discrepancies with paychecks.

By understanding Burlington’s pay schedule and how it impacts their financial well-being, employees can take control of their finances and achieve their financial goals.

Remember, knowing whether Burlington pays its employees weekly or bi-weekly is just the first step in managing your finances effectively. By taking the time to understand the company’s pay schedule and how it impacts your finances, you can make informed decisions and achieve financial stability.