Unlocking the Secrets of Turo’s Rental Process

Turo, a peer-to-peer car sharing platform, has revolutionized the way people rent cars. With a vast array of unique vehicles and competitive pricing, Turo has become a popular choice for travelers and car enthusiasts alike. However, one question that often arises is: does Turo run your credit? In this article, we will delve into the world of Turo’s rental process and provide guidance on how to rent a car on the platform without negatively impacting your credit score.

For those who are new to Turo, the platform allows car owners to list their vehicles for rent, while travelers can browse and book their desired ride. But before you start browsing, it’s essential to understand how Turo’s rental process works and what information is required from users. This knowledge will not only help you navigate the platform with confidence but also ensure a smooth and secure rental experience.

As you prepare to rent a car on Turo, you may wonder whether the platform runs credit checks on its users. The answer is yes, but don’t worry – Turo only performs a soft credit inquiry, which does not affect your credit score. This soft inquiry is a preliminary step to verify your identity and ensure that you’re eligible to rent a car on the platform.

So, what does this mean for you? In simple terms, a soft credit inquiry is a gentle probe into your credit history, which doesn’t leave a mark on your credit report. This is in contrast to a hard credit inquiry, which can temporarily lower your credit score. By performing a soft credit inquiry, Turo can verify your creditworthiness without impacting your credit score.

Now that we’ve addressed the question of whether Turo runs your credit, let’s move on to the next step: preparing for a Turo rental. In the following sections, we’ll provide tips and advice on how to prepare for a Turo rental without negatively impacting your credit score. We’ll also explore Turo’s guest requirements and eligibility criteria, as well as offer guidance for Turo hosts on managing their credit score.

What is Turo and How Does it Work?

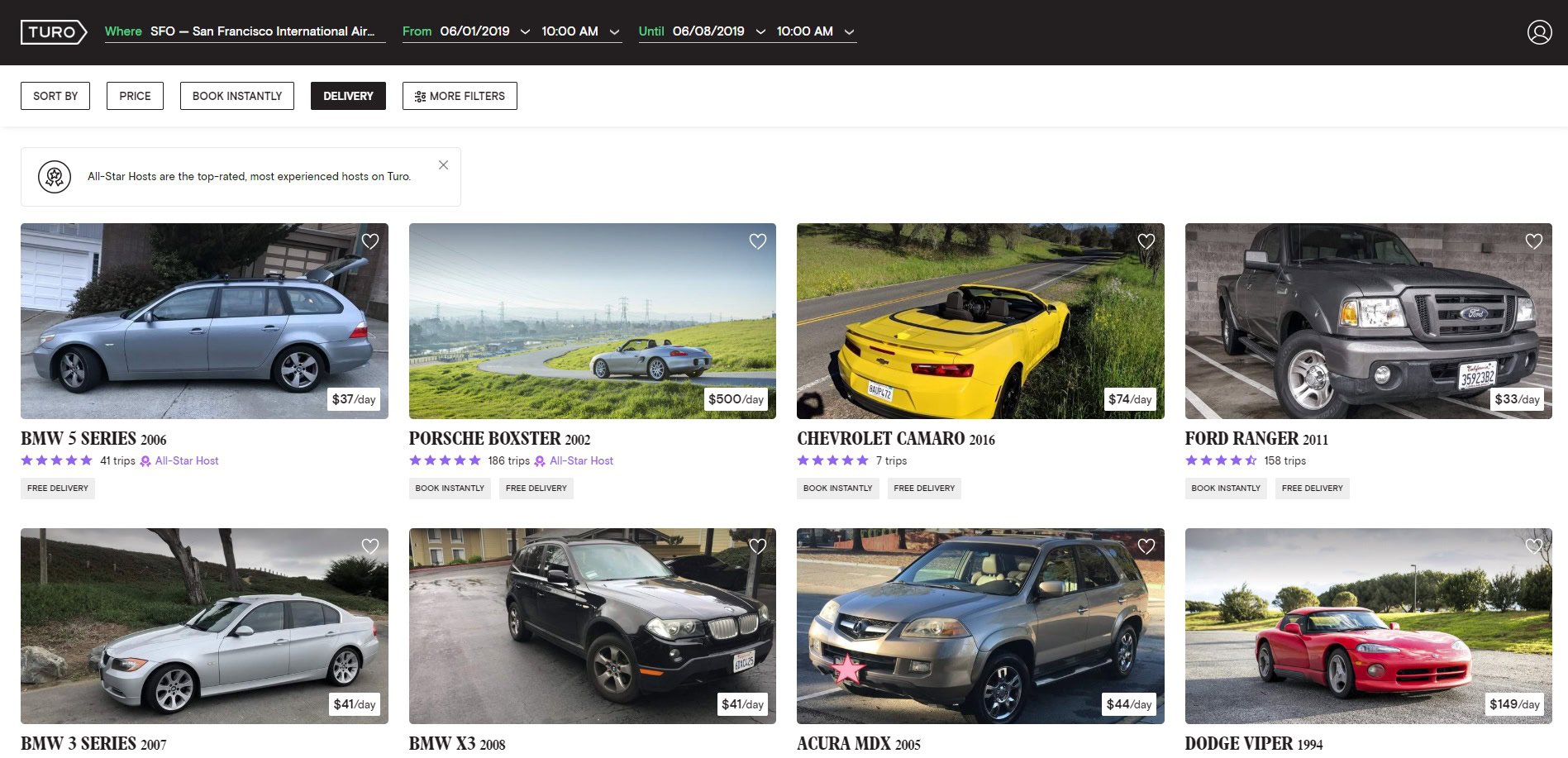

Turo is a peer-to-peer car sharing platform that connects car owners with travelers and car enthusiasts. The platform allows hosts to list their vehicles for rent, while guests can browse and book their desired ride. With a vast array of unique vehicles and competitive pricing, Turo has become a popular choice for those looking for an alternative to traditional car rental companies.

So, how does Turo work? The process is straightforward. Hosts create a listing for their vehicle, including details such as the make and model, year, and rental price. Guests can then browse the listings and book a vehicle that suits their needs. Once a booking is made, Turo handles the payment and provides support for both the host and guest.

One of the benefits of using Turo is the unique vehicle options available. From classic cars to luxury vehicles, Turo offers a wide range of cars that can’t be found on traditional car rental platforms. Additionally, Turo’s competitive pricing makes it an attractive option for those looking to save money on car rentals.

Another advantage of Turo is the flexibility it offers. Guests can choose from a variety of rental periods, from a few days to several weeks, and can even select from different types of vehicles, such as SUVs, trucks, and vans. This flexibility makes Turo an ideal choice for road trips, business travel, and other occasions where a car is needed.

As a peer-to-peer platform, Turo relies on its community of hosts and guests to ensure a safe and secure rental experience. To achieve this, Turo has implemented various measures, including a rating system and a secure payment process. These measures help to build trust within the community and ensure that both hosts and guests have a positive experience.

Does Turo Run a Credit Check on Hosts and Guests?

One of the most common questions asked by potential Turo users is: does Turo run a credit check on hosts and guests? The answer is yes, but it’s not as straightforward as a traditional credit check. Turo performs a soft credit inquiry on both hosts and guests, which is a preliminary step to verify their identity and creditworthiness.

A soft credit inquiry is different from a hard credit inquiry, which is typically used by lenders to evaluate creditworthiness. A soft credit inquiry does not affect credit scores and is not visible to lenders. It’s a gentle probe into a person’s credit history, which provides Turo with a snapshot of their creditworthiness.

So, what does Turo look for during a soft credit inquiry? The platform checks for any red flags, such as bankruptcies, foreclosures, or collections. This information helps Turo to assess the risk of lending a vehicle to a guest or allowing a host to list their vehicle on the platform.

It’s worth noting that Turo’s soft credit inquiry is not a guarantee of approval. The platform uses a combination of factors, including credit history, driving record, and other verification documents, to determine eligibility. If a guest or host is declined, they will receive an email explaining the reason for the decline.

Now that we’ve addressed the question of whether Turo runs a credit check, let’s move on to the next step: understanding what information Turo collects for verification purposes. In the next section, we’ll explore the types of information Turo collects from users and how it’s used to ensure a safe and secure rental experience.

What Information Does Turo Collect for Verification Purposes?

Turo collects various types of information from users for verification purposes, including driver’s license, insurance, and vehicle registration. This information is used to ensure a safe and secure rental experience for both hosts and guests.

For hosts, Turo requires a valid driver’s license, vehicle registration, and proof of insurance. This information is used to verify the host’s identity and ensure that they are authorized to rent out their vehicle. Additionally, Turo may also collect information about the host’s vehicle, such as the make, model, and year, to ensure that it meets the platform’s safety and quality standards.

For guests, Turo requires a valid driver’s license, proof of insurance, and a credit card or other payment method. This information is used to verify the guest’s identity and ensure that they are eligible to rent a vehicle on the platform. Additionally, Turo may also collect information about the guest’s driving history and creditworthiness to determine their eligibility for certain vehicles or rental periods.

Turo uses this information to ensure that both hosts and guests are trustworthy and reliable. By verifying the identity and credentials of users, Turo can reduce the risk of accidents, damage, or other issues that may arise during a rental. This helps to create a safe and secure environment for all users on the platform.

In the next section, we’ll explore how to prepare for a Turo rental without negatively impacting your credit score. We’ll provide tips and advice on how to check your credit report, pay off outstanding debts, and avoid unnecessary credit inquiries.

How to Prepare for a Turo Rental Without Affecting Your Credit

Before renting a car on Turo, it’s essential to prepare yourself to avoid any potential negative impacts on your credit score. Here are some tips to help you prepare:

First, check your credit report to ensure there are no errors or inaccuracies. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Review your report carefully and dispute any errors you find.

Next, pay off any outstanding debts or collections. This will help improve your credit utilization ratio and reduce the risk of negative marks on your credit report. Make sure to pay all bills on time and avoid late payments, which can also harm your credit score.

Avoid applying for multiple credit cards or loans in the months leading up to your Turo rental. This can result in multiple hard credit inquiries, which can temporarily lower your credit score. Instead, focus on maintaining a good credit history and avoiding unnecessary credit inquiries.

Finally, make sure you have a valid driver’s license, insurance, and a credit card or other payment method. Turo requires this information to verify your identity and ensure that you’re eligible to rent a vehicle on the platform.

By following these tips, you can prepare for a Turo rental without negatively impacting your credit score. Remember, Turo’s soft credit inquiry will not affect your credit score, but it’s still essential to maintain good credit habits to ensure a smooth and secure rental experience.

Turo’s Guest Requirements and Eligibility Criteria

To ensure a safe and responsible rental experience, Turo has established certain guest requirements and eligibility criteria. These criteria are designed to protect both hosts and guests, and to ensure that all rentals are conducted in a fair and respectful manner.

Age Requirements: Turo requires that all guests be at least 21 years old to rent a vehicle. This is to ensure that guests have a valid driver’s license and are able to assume responsibility for the vehicle during the rental period.

License Requirements: Guests must have a valid driver’s license to rent a vehicle on Turo. The license must be issued by the guest’s state or country of residence, and must be valid for the entire rental period.

Insurance Requirements: Turo requires that all guests have valid insurance coverage to rent a vehicle. This can include personal auto insurance, credit card insurance, or other forms of coverage. Guests must provide proof of insurance to Turo before the rental period begins.

Eligibility Criteria: Turo also has certain eligibility criteria that guests must meet to rent a vehicle. These criteria include a valid credit card or other payment method, a valid driver’s license, and a clean driving record. Guests who do not meet these criteria may be ineligible to rent a vehicle on Turo.

By establishing these guest requirements and eligibility criteria, Turo is able to ensure a safe and responsible rental experience for all users. Guests who meet these criteria can rent a vehicle on Turo with confidence, knowing that they are protected by the platform’s policies and procedures.

Managing Your Credit Score as a Turo Host

As a Turo host, maintaining a good credit score is crucial to ensure that you can continue to rent out your vehicle on the platform. A good credit score can also benefit you in the long run, as it can help you to qualify for better interest rates and terms on loans and credit cards.

So, how can you manage your credit score as a Turo host? Here are some tips:

First, make sure to pay your bills on time. Late payments can negatively impact your credit score, so it’s essential to make timely payments on all of your debts.

Second, keep your credit utilization ratio low. This means that you should keep your credit card balances low compared to your credit limits. Aim to use less than 30% of your available credit to show lenders that you can manage your debt responsibly.

Third, monitor your credit report regularly. You can request a free credit report from each of the three major credit reporting agencies (Experian, TransUnion, and Equifax) once a year. Review your report carefully and dispute any errors you find.

Finally, avoid applying for too many credit cards or loans in a short period. This can negatively impact your credit score, as it can indicate to lenders that you are taking on too much debt.

By following these tips, you can maintain a good credit score as a Turo host and enjoy the benefits of renting out your vehicle on the platform.

Conclusion: Renting on Turo with Confidence

In conclusion, renting a car on Turo can be a great way to explore new places and enjoy a unique car sharing experience. While there may be concerns about credit checks, Turo’s soft credit inquiry process ensures that your credit score will not be negatively impacted.

By following the tips and advice outlined in this article, you can prepare for a Turo rental without affecting your credit score. Remember to check your credit report, pay off outstanding debts, and avoid unnecessary credit inquiries.

Turo’s guest requirements and eligibility criteria are in place to ensure a safe and responsible rental experience. By meeting these criteria, you can enjoy a hassle-free rental experience and explore the world with confidence.

As a Turo host, managing your credit score is crucial to ensure that you can continue to rent out your vehicle on the platform. By maintaining a good credit history and avoiding negative marks, you can benefit from better interest rates and terms on loans and credit cards.

With Turo’s unique car sharing platform, you can enjoy a wide range of vehicle options and competitive pricing. Whether you’re a guest or a host, Turo’s platform offers a convenient and secure way to rent or share a car.

So why not give Turo a try? With its user-friendly platform and commitment to safety and security, you can rent a car on Turo with confidence and enjoy a unique car sharing experience.