Unlocking the Power of Residual Income: Why It Matters

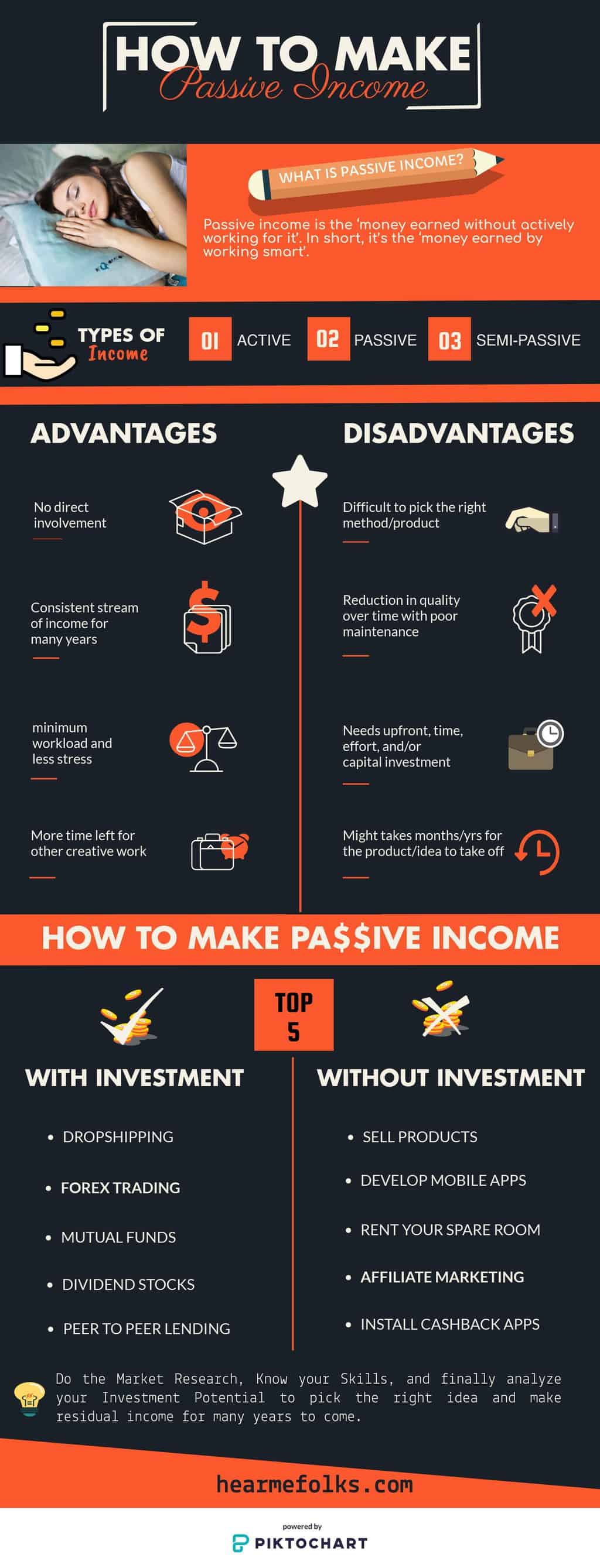

Residual income is a powerful financial tool that can help individuals achieve long-term financial stability and freedom. By generating income through various means, such as investments, real estate, and digital products, individuals can create a steady stream of revenue that can help them achieve their financial goals. One of the most significant benefits of residual income is that it can provide a sense of security and reduce financial stress. When individuals have a reliable source of income, they are better equipped to handle unexpected expenses and financial setbacks.

In addition to providing financial security, residual income can also offer a sense of freedom and flexibility. With a steady stream of income, individuals can pursue their passions and interests without being tied to a traditional 9-to-5 job. This can lead to a more fulfilling and purposeful life, as individuals are able to pursue their goals and dreams without being limited by financial constraints.

Furthermore, residual income can be a key component of a long-term wealth-building strategy. By generating income through various means, individuals can create a snowball effect that can help them build wealth over time. This can be especially powerful when combined with other wealth-building strategies, such as investing and saving.

For those looking to achieve financial freedom, residual income is an essential concept to understand. By creating a steady stream of income, individuals can set themselves up for long-term financial success and achieve their goals. Whether through investing, real estate, or digital products, there are many easy ways to make residual income and start building wealth today.

How to Create a Passive Income Empire: Starting Small

When it comes to building a residual income stream, it’s essential to start small. This approach allows individuals to test the waters, gain experience, and build momentum without taking on excessive risk. One of the easiest ways to get started is by investing in low-risk, low-effort investments such as high-yield savings accounts or peer-to-peer lending.

High-yield savings accounts, for example, offer a safe and stable way to earn interest on deposited funds. While the returns may not be spectacular, they are generally higher than those offered by traditional savings accounts. Additionally, high-yield savings accounts are FDIC-insured, which means that deposits are protected up to $250,000.

Peer-to-peer lending is another option for generating passive income. Platforms like Lending Club and Prosper allow individuals to lend money to borrowers, earning interest on their investment. While there is some risk involved, peer-to-peer lending can provide higher returns than traditional savings accounts or bonds.

Other easy ways to make residual income include investing in index funds or dividend-paying stocks. These investments can provide a steady stream of income over time, with relatively low risk. By starting small and gradually increasing investment amounts, individuals can build a passive income empire that generates significant returns over time.

Remember, building a residual income stream takes time and patience. It’s essential to start small, be consistent, and continually educate oneself on the best strategies for generating passive income. With persistence and dedication, anyone can create a passive income empire that provides financial freedom and security.

Investing in Dividend-Paying Stocks: A Lucrative Residual Income Strategy

Investing in dividend-paying stocks is a popular strategy for generating residual income. By investing in established companies with a history of paying consistent dividends, individuals can create a steady stream of income that can help them achieve their financial goals.

One of the benefits of investing in dividend-paying stocks is the potential for long-term capital appreciation. Many established companies have a history of increasing their dividend payouts over time, which can provide a steady stream of income and the potential for long-term growth.

Some examples of established companies with a history of paying consistent dividends include Coca-Cola, Johnson & Johnson, and Procter & Gamble. These companies have a long history of paying dividends and have consistently increased their dividend payouts over time.

Another benefit of investing in dividend-paying stocks is the relatively low risk involved. Established companies with a history of paying consistent dividends tend to be less volatile than other types of investments, which can make them a more attractive option for individuals looking to generate residual income.

When investing in dividend-paying stocks, it’s essential to do your research and choose companies with a strong track record of paying consistent dividends. Look for companies with a history of increasing their dividend payouts over time and a strong financial position.

By investing in dividend-paying stocks, individuals can create a lucrative residual income stream that can help them achieve their financial goals. With the potential for long-term capital appreciation and relatively low risk, dividend-paying stocks are an attractive option for individuals looking to generate easy ways to make residual income.

Real Estate Investing for Residual Income: Rental Properties and REITs

Real estate investing is a popular strategy for generating residual income. Two common options for real estate investing are rental properties and Real Estate Investment Trusts (REITs). Both options offer the potential for regular income streams and long-term capital appreciation.

Rental properties can provide a steady stream of income through rental payments. By investing in a rental property, individuals can earn a regular income stream and potentially benefit from long-term capital appreciation. However, rental properties also come with management responsibilities and potential maintenance costs.

REITs, on the other hand, offer a more hands-off approach to real estate investing. REITs allow individuals to invest in a diversified portfolio of properties without directly managing them. This can provide a regular income stream and the potential for long-term capital appreciation, without the management responsibilities associated with rental properties.

Some benefits of real estate investing for residual income include the potential for long-term capital appreciation and the ability to leverage financing to increase returns. However, real estate investing also comes with risks, such as market fluctuations and potential vacancies.

To get started with real estate investing for residual income, individuals can consider investing in a REIT or purchasing a rental property. It’s essential to do your research and understand the local market, as well as the potential risks and rewards associated with each option.

By investing in real estate, individuals can create a residual income stream that can help them achieve their financial goals. With the potential for long-term capital appreciation and regular income streams, real estate investing is an attractive option for individuals looking for easy ways to make residual income.

Creating and Selling Digital Products: A Passive Income Goldmine

Creating and selling digital products is a lucrative way to generate residual income. With the rise of online learning and digital consumption, the demand for digital products has never been higher. By creating a digital product, such as an ebook, course, or software, individuals can earn passive income through sales and royalties.

One of the benefits of creating digital products is the potential for high margins. Since digital products don’t require physical storage or shipping, the costs of production and distribution are minimal. This means that individuals can earn a significant portion of the sale price as profit.

Another benefit of creating digital products is the potential for scalability. Once a digital product is created, it can be sold multiple times without incurring additional production costs. This means that individuals can earn passive income from a single product for years to come.

To create a successful digital product, individuals should focus on solving a specific problem or meeting a particular need. This could be a comprehensive guide to a particular topic, a software solution to a common problem, or an online course teaching a valuable skill.

Once a digital product is created, individuals can market it through various channels, such as social media, email marketing, and affiliate marketing. By leveraging these channels, individuals can reach a wide audience and generate significant sales.

Creating and selling digital products is one of the easy ways to make residual income. With the potential for high margins and scalability, digital products offer a lucrative opportunity for individuals to earn passive income and achieve financial freedom.

Affiliate Marketing: Promoting Products for Passive Income

Affiliate marketing is a popular way to generate residual income by promoting products or services from other companies. By joining an affiliate program, individuals can earn a commission on sales generated through their unique referral link.

One of the benefits of affiliate marketing is the potential for high earnings. With the right product and marketing strategy, individuals can earn significant commissions on sales. Additionally, affiliate marketing requires minimal upfront costs, making it an attractive option for those looking to start generating residual income quickly.

To get started with affiliate marketing, individuals can join affiliate programs offered by companies such as Amazon, ClickBank, or Commission Junction. These programs provide access to a wide range of products and services that can be promoted through various marketing channels, such as social media, email marketing, or content marketing.

When selecting an affiliate program, individuals should consider the commission rate, cookie duration, and product relevance. A higher commission rate and longer cookie duration can increase earnings potential, while promoting relevant products can improve conversion rates.

Successful affiliate marketers also focus on building a loyal audience and creating valuable content that resonates with their target market. By providing valuable information and insights, individuals can establish trust with their audience and increase the likelihood of generating sales.

Affiliate marketing is one of the easy ways to make residual income, as it requires minimal upfront costs and can be done with minimal effort. By promoting products or services from other companies, individuals can earn passive income and achieve financial freedom.

Building a Residual Income Stream through Royalties

Earning residual income through royalties is a lucrative way to generate passive income. Royalties are payments made to creators or owners of intellectual property, such as books, music, or inventions, for the use or sale of their work.

Book publishing is one way to earn residual income through royalties. By writing and publishing a book, authors can earn royalties on each sale, providing a steady stream of income over time. Additionally, book publishing can be a relatively low-risk and low-effort way to generate residual income, as the upfront work is done once the book is written and published.

Music licensing is another way to earn residual income through royalties. By creating and licensing music, artists can earn royalties on each use of their music, such as in films, TV shows, or commercials. Music licensing can be a lucrative way to generate residual income, as the music can be used multiple times, generating multiple streams of income.

Patent royalties are also a way to earn residual income through royalties. By inventing and patenting a product or process, inventors can earn royalties on each sale or use of their invention. Patent royalties can be a lucrative way to generate residual income, as the invention can be used multiple times, generating multiple streams of income.

While earning residual income through royalties can be lucrative, it’s essential to understand the benefits and challenges of each option. For example, book publishing requires a significant upfront effort to write and publish the book, while music licensing requires a strong network of industry contacts to secure licensing deals.

By understanding the benefits and challenges of each option, individuals can make informed decisions about which royalty-based residual income stream to pursue. With the potential for high earnings and relatively low risk, earning residual income through royalties is an attractive option for individuals looking for easy ways to make residual income.

Maximizing Your Residual Income Potential: Tips and Strategies

To maximize your residual income potential, it’s essential to diversify your income streams. This can be achieved by investing in a variety of assets, such as dividend-paying stocks, real estate, and digital products. By spreading your investments across different asset classes, you can reduce your risk and increase your potential for long-term growth.

Tax optimization is another crucial strategy for maximizing your residual income potential. By understanding the tax implications of your investments, you can minimize your tax liability and maximize your after-tax returns. This can be achieved by investing in tax-efficient vehicles, such as index funds or real estate investment trusts (REITs).

Ongoing education is also essential for maximizing your residual income potential. By staying up-to-date with the latest investment trends and strategies, you can make informed decisions about your investments and stay ahead of the curve. This can be achieved by reading books, attending seminars, and following industry experts.

Finally, it’s essential to start building your residual income streams today. By taking action and starting small, you can begin to generate passive income and achieve financial freedom. Remember, building wealth takes time and effort, but with the right strategies and mindset, you can achieve your financial goals.

By following these tips and strategies, you can maximize your residual income potential and achieve financial freedom. Whether you’re looking to supplement your income or build wealth over time, residual income streams can provide a steady and reliable source of income. So why wait? Start building your residual income streams today and take the first step towards financial freedom.