What is Equity Crowdfunding and How Does it Work?

Equity crowdfunding is a revolutionary funding method that allows startups to raise capital from a large number of people, typically through online platforms. This innovative approach to fundraising has gained significant traction in recent years, providing startups with an alternative to traditional funding methods, such as venture capital and angel investors. By leveraging the power of the crowd, startups can now access a vast pool of potential investors, increasing their chances of securing the funding they need to grow and succeed.

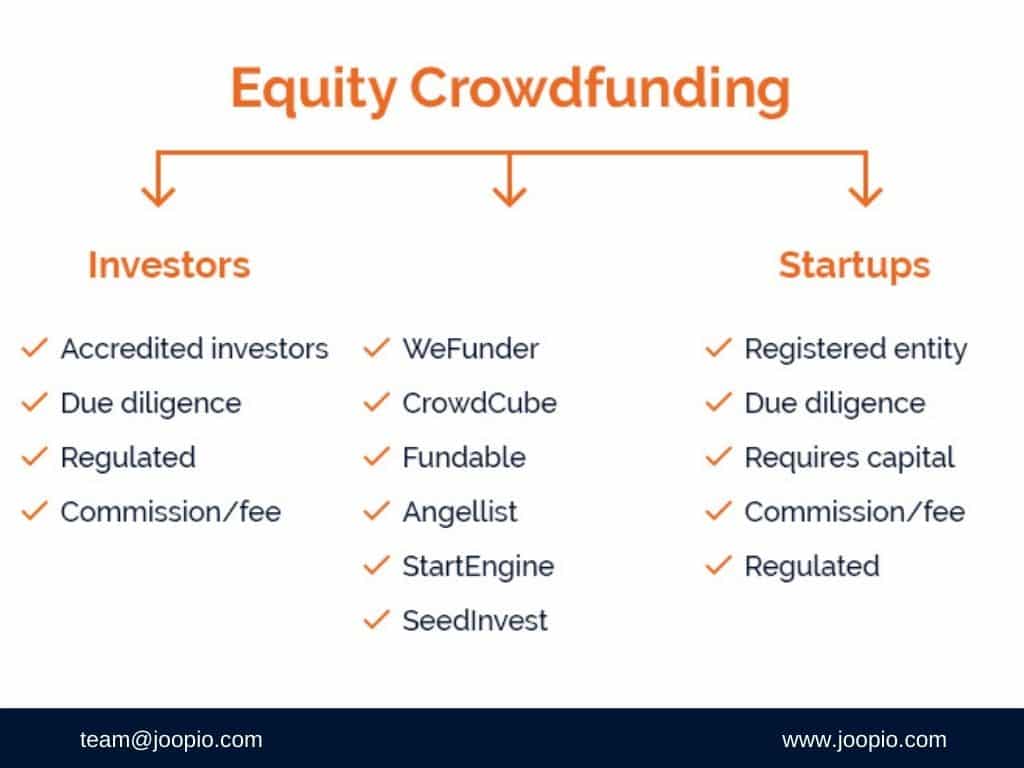

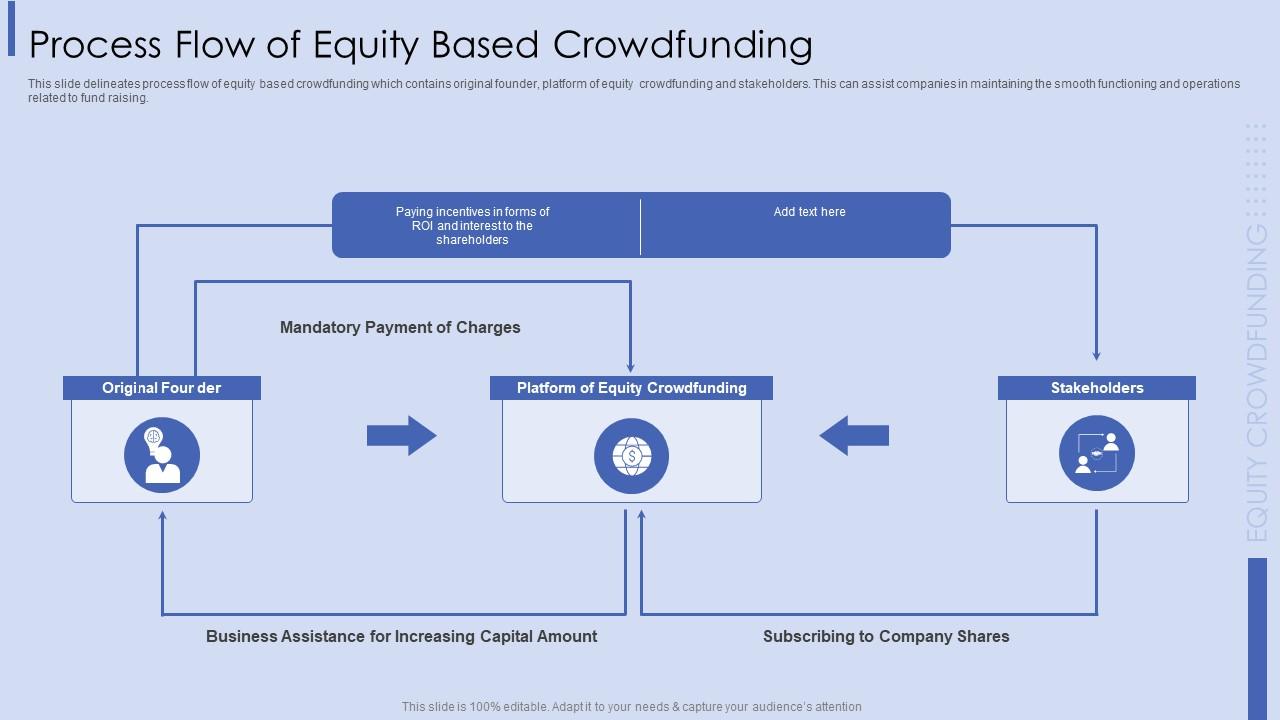

At its core, equity crowdfunding involves the sale of shares or equity in a company to a large number of investors, typically in exchange for a financial investment. This approach allows startups to tap into a diverse range of investors, from individual investors to institutional investors, and provides them with the opportunity to build a community of supporters who are invested in their success.

The benefits of equity crowdfunding for startups are numerous. For one, it provides increased accessibility to funding, allowing startups to raise capital from a large number of people, rather than relying on a small group of investors. Additionally, equity crowdfunding enables startups to build a community of supporters, who can provide valuable feedback, guidance, and advocacy. This approach also allows startups to maintain control and ownership of their company, rather than sacrificing equity to traditional investors.

Equity crowdfunding platforms, such as Seedrs, Crowdcube, and AngelList, have emerged as key players in the startup funding ecosystem. These platforms provide a secure and regulated environment for startups to raise capital, and offer a range of tools and services to support the fundraising process. By leveraging these platforms, startups can access a large pool of potential investors, and benefit from the expertise and guidance of experienced fundraising professionals.

As the startup funding landscape continues to evolve, equity crowdfunding is likely to play an increasingly important role. By providing startups with a flexible and accessible funding option, equity crowdfunding is helping to democratize access to capital, and level the playing field for entrepreneurs and small businesses. Whether you’re a startup looking to raise capital, or an investor looking to support innovative businesses, equity crowdfunding is definitely worth exploring.

Why Startups are Turning to Equity Crowdfunding for Funding

Traditional funding methods, such as venture capital and angel investors, have long been the primary sources of capital for startups. However, these methods can be challenging to access, especially for early-stage companies or those with unproven business models. As a result, many startups are turning to equity crowdfunding as a viable alternative. Equity crowdfunding for startups offers a unique opportunity to raise capital from a large number of people, typically through online platforms. This approach has gained popularity in recent years, with numerous success stories of startups that have used equity crowdfunding to raise significant amounts of capital.

One of the primary reasons startups are drawn to equity crowdfunding is the increased accessibility it offers. Unlike traditional funding methods, which often require personal connections or a proven track record, equity crowdfunding platforms provide a level playing field for all startups. This democratization of funding allows companies to focus on developing their products and services, rather than spending valuable time and resources on securing funding.

Another significant advantage of equity crowdfunding for startups is the ability to build a community of engaged investors. By leveraging social media and online platforms, startups can create a buzz around their campaign, attracting potential investors and customers alike. This community-driven approach can lead to a loyal following, providing valuable feedback and support throughout the startup’s journey.

Furthermore, equity crowdfunding platforms often provide additional resources and support services, such as mentorship programs, networking events, and marketing assistance. These resources can be invaluable for startups, helping them to refine their business strategy, build their brand, and ultimately achieve their funding goals.

Success stories of startups that have used equity crowdfunding to raise capital are plentiful. For example, companies like BrewDog, a UK-based craft brewery, and Monzo, a digital bank, have both used equity crowdfunding to raise millions of dollars in funding. These examples demonstrate the potential of equity crowdfunding to support innovative businesses and help them achieve their growth ambitions.

In conclusion, equity crowdfunding for startups offers a unique combination of accessibility, community engagement, and resource support. As the startup landscape continues to evolve, it is likely that equity crowdfunding will play an increasingly important role in the funding ecosystem. By understanding the benefits and opportunities of equity crowdfunding, startups can make informed decisions about their funding strategy and unlock the capital they need to succeed.

How to Prepare Your Startup for Equity Crowdfunding Success

Preparing a startup for equity crowdfunding success requires careful planning, strategic thinking, and a solid understanding of the process. To increase the chances of a successful campaign, startups should focus on developing a solid business plan, creating a persuasive pitch, and building a strong online presence.

A well-crafted business plan is essential for any startup, and it’s especially crucial for equity crowdfunding. The plan should outline the company’s mission, goals, and financial projections, as well as provide a detailed overview of the products or services offered. A clear and concise business plan will help potential investors understand the startup’s vision and potential for growth.

A persuasive pitch is also vital for equity crowdfunding success. The pitch should be engaging, informative, and concise, highlighting the startup’s unique value proposition and competitive advantage. It’s essential to tailor the pitch to the target audience, using language and terminology that resonates with potential investors. A well-crafted pitch will help build trust and credibility with investors, increasing the chances of securing funding.

A strong online presence is critical for equity crowdfunding, as it provides a platform for startups to showcase their brand, products, and services. A professional website, social media accounts, and engaging content are all essential for building a strong online presence. Startups should also leverage email marketing, influencer partnerships, and other digital marketing strategies to reach a wider audience and build a community of potential investors.

In addition to these key elements, startups should also focus on building a robust financial model, developing a comprehensive marketing strategy, and establishing a strong network of advisors and mentors. A robust financial model will help startups to accurately forecast revenue, manage cash flow, and make informed decisions about funding. A comprehensive marketing strategy will help startups to reach a wider audience, build brand awareness, and drive traffic to their website.

Establishing a strong network of advisors and mentors is also crucial for equity crowdfunding success. Advisors and mentors can provide valuable guidance, support, and introductions to potential investors. They can also help startups to refine their business plan, pitch, and online presence, increasing the chances of a successful campaign.

By focusing on these key areas, startups can increase their chances of success with equity crowdfunding for startups. A well-prepared startup is more likely to attract investors, build a strong community, and secure the funding needed to drive growth and expansion.

Some of the key metrics to track when preparing for equity crowdfunding include website traffic, social media engagement, email open rates, and conversion rates. By monitoring these metrics, startups can refine their strategy, make data-driven decisions, and optimize their campaign for success.

Ultimately, preparing a startup for equity crowdfunding success requires careful planning, strategic thinking, and a solid understanding of the process. By focusing on these key areas, startups can increase their chances of success, build a strong community, and secure the funding needed to drive growth and expansion.

Choosing the Right Equity Crowdfunding Platform for Your Startup

With the rise of equity crowdfunding, numerous platforms have emerged to facilitate the process of raising capital from a large number of people. Choosing the right platform is crucial for startups, as it can significantly impact the success of their equity crowdfunding campaign. In this article, we will discuss the different types of equity crowdfunding platforms available, including Seedrs, Crowdcube, and AngelList, and explain the factors to consider when choosing a platform.

Seedrs is one of the most popular equity crowdfunding platforms in the UK, with a strong focus on supporting startups and early-stage businesses. The platform offers a range of features, including a large investor network, flexible funding options, and a user-friendly interface. Seedrs also provides a range of support services, including marketing and PR assistance, to help startups succeed.

Crowdcube is another well-established equity crowdfunding platform, with a strong track record of supporting successful campaigns. The platform offers a range of features, including a large investor network, flexible funding options, and a user-friendly interface. Crowdcube also provides a range of support services, including marketing and PR assistance, to help startups succeed.

AngelList is a US-based equity crowdfunding platform that focuses on supporting startups and early-stage businesses. The platform offers a range of features, including a large investor network, flexible funding options, and a user-friendly interface. AngelList also provides a range of support services, including marketing and PR assistance, to help startups succeed.

When choosing an equity crowdfunding platform, there are several factors to consider. Fees are an important consideration, as they can eat into the funds raised. Investor reach is also crucial, as a larger investor network can increase the chances of success. Support services, such as marketing and PR assistance, can also be valuable in helping startups succeed.

Another important factor to consider is the platform’s reputation and track record. A platform with a strong reputation and a history of successful campaigns can increase the chances of success. It’s also important to consider the platform’s fees and charges, as well as its investor network and support services.

In addition to these factors, startups should also consider the platform’s flexibility and adaptability. A platform that can adapt to changing market conditions and investor needs can increase the chances of success. It’s also important to consider the platform’s customer support and service, as well as its user interface and experience.

Ultimately, choosing the right equity crowdfunding platform is crucial for startups. By considering the factors outlined above, startups can increase their chances of success and achieve their funding goals. Whether it’s Seedrs, Crowdcube, or AngelList, the right platform can provide the support and resources needed to succeed in the competitive world of equity crowdfunding for startups.

By understanding the different types of equity crowdfunding platforms available and the factors to consider when choosing a platform, startups can make informed decisions and increase their chances of success. With the right platform and a solid understanding of the equity crowdfunding process, startups can raise the capital they need to drive growth and expansion.

Building a Strong Investor Network through Equity Crowdfunding

Building a strong investor network is crucial for startups looking to raise capital through equity crowdfunding. A robust network of investors can provide the necessary funding, support, and guidance to help startups achieve their goals. In this article, we will discuss the importance of building a strong investor network through equity crowdfunding and provide tips on how to do so.

Engaging with potential investors is a critical step in building a strong investor network. Startups should leverage social media, email marketing, and other digital channels to reach out to potential investors and build relationships. This can include sharing updates on the startup’s progress, providing insights into the market, and showcasing the team’s expertise.

Providing regular updates is also essential for building trust and credibility with investors. Startups should keep investors informed about their progress, milestones achieved, and any challenges faced. This can be done through regular email updates, blog posts, or social media updates.

Offering incentives for investment is another effective way to build a strong investor network. Startups can offer rewards, discounts, or exclusive access to products or services to investors who contribute to their campaign. This can help to motivate investors to participate and increase the chances of success.

Building a strong investor network requires a long-term approach. Startups should focus on building relationships with investors, rather than just seeking funding. This can involve attending industry events, conferences, and networking sessions to connect with potential investors.

Equity crowdfunding platforms can also play a crucial role in building a strong investor network. Platforms like Seedrs, Crowdcube, and AngelList provide a range of tools and resources to help startups connect with investors and build relationships. Startups should leverage these platforms to reach a wider audience and build a strong investor network.

Measuring the success of an equity crowdfunding campaign is also essential for building a strong investor network. Startups should track key metrics, such as funds raised, investor engagement, and campaign reach, to understand the effectiveness of their campaign and make data-driven decisions.

By building a strong investor network, startups can increase their chances of success with equity crowdfunding for startups. A robust network of investors can provide the necessary funding, support, and guidance to help startups achieve their goals and drive growth.

In addition to building a strong investor network, startups should also focus on creating a compelling pitch, developing a solid business plan, and building a strong online presence. By combining these elements, startups can increase their chances of success with equity crowdfunding and achieve their funding goals.

Ultimately, building a strong investor network is critical for startups looking to raise capital through equity crowdfunding. By engaging with potential investors, providing regular updates, and offering incentives for investment, startups can build a robust network of investors and increase their chances of success.

Managing the Equity Crowdfunding Process: Tips and Best Practices

Managing the equity crowdfunding process requires careful planning, execution, and monitoring. Startups must set realistic targets, create a marketing strategy, and handle investor inquiries to ensure a successful campaign. In this article, we will provide tips and best practices for managing the equity crowdfunding process.

Setting realistic targets is crucial for a successful equity crowdfunding campaign. Startups must determine how much capital they need to raise and set a realistic target based on their business plan and financial projections. This will help to ensure that the campaign is achievable and that investors are not deterred by an overly ambitious target.

Creating a marketing strategy is also essential for a successful equity crowdfunding campaign. Startups must develop a plan to reach potential investors, build a community of supporters, and promote their campaign. This can include social media marketing, email marketing, content marketing, and paid advertising.

Handling investor inquiries is another critical aspect of managing the equity crowdfunding process. Startups must be prepared to answer questions from potential investors, provide updates on their progress, and address any concerns or issues that may arise. This can be done through regular email updates, social media updates, and live webinars or Q&A sessions.

Equity crowdfunding platforms can also provide valuable support and resources to help startups manage the process. Platforms like Seedrs, Crowdcube, and AngelList offer a range of tools and services, including marketing support, investor relations, and campaign management.

Monitoring and evaluating the campaign’s progress is also essential for managing the equity crowdfunding process. Startups must track key metrics, such as funds raised, investor engagement, and campaign reach, to understand the effectiveness of their campaign and make data-driven decisions.

By following these tips and best practices, startups can effectively manage the equity crowdfunding process and increase their chances of success. A well-managed campaign can help to build a strong investor network, raise the necessary capital, and drive growth and expansion.

In addition to these tips, startups should also focus on building a strong online presence, developing a solid business plan, and creating a persuasive pitch. By combining these elements, startups can increase their chances of success with equity crowdfunding for startups and achieve their funding goals.

Ultimately, managing the equity crowdfunding process requires careful planning, execution, and monitoring. By setting realistic targets, creating a marketing strategy, and handling investor inquiries, startups can ensure a successful campaign and achieve their funding goals.

By understanding the tips and best practices outlined in this article, startups can effectively manage the equity crowdfunding process and increase their chances of success. With the right approach, startups can raise the capital they need to drive growth and expansion, and achieve their business goals.

Regulatory Considerations for Equity Crowdfunding in Your Country

Equity crowdfunding is a rapidly growing industry, with new platforms and regulations emerging all the time. However, the regulatory landscape for equity crowdfunding can be complex and varies significantly from country to country. In this article, we will discuss the regulatory considerations for equity crowdfunding in different countries, including the rules and regulations that govern crowdfunding platforms and investor participation.

In the United States, equity crowdfunding is regulated by the Securities and Exchange Commission (SEC). The SEC has established rules and guidelines for crowdfunding platforms, including the requirement for platforms to register with the SEC and to provide investors with certain disclosures. The SEC also has rules in place to protect investors, such as limits on the amount of money that can be invested in a single campaign.

In the United Kingdom, equity crowdfunding is regulated by the Financial Conduct Authority (FCA). The FCA has established rules and guidelines for crowdfunding platforms, including the requirement for platforms to be authorized and to provide investors with certain disclosures. The FCA also has rules in place to protect investors, such as limits on the amount of money that can be invested in a single campaign.

In Australia, equity crowdfunding is regulated by the Australian Securities and Investments Commission (ASIC). ASIC has established rules and guidelines for crowdfunding platforms, including the requirement for platforms to be licensed and to provide investors with certain disclosures. ASIC also has rules in place to protect investors, such as limits on the amount of money that can be invested in a single campaign.

It’s essential for startups to understand the regulatory considerations for equity crowdfunding in their country before launching a campaign. This includes understanding the rules and regulations that govern crowdfunding platforms, as well as the requirements for investor participation. By understanding the regulatory landscape, startups can ensure that their campaign is compliant with all relevant laws and regulations.

Equity crowdfunding platforms also have a critical role to play in ensuring compliance with regulatory requirements. Platforms must ensure that they are registered and authorized with the relevant regulatory bodies, and that they provide investors with the necessary disclosures and protections. By working with a reputable and compliant platform, startups can ensure that their campaign is successful and that they are able to raise the capital they need.

Ultimately, the regulatory considerations for equity crowdfunding are complex and vary significantly from country to country. However, by understanding the rules and regulations that govern crowdfunding platforms and investor participation, startups can ensure that their campaign is compliant and successful. With the right approach, startups can raise the capital they need to drive growth and expansion, and achieve their business goals.

By considering the regulatory considerations for equity crowdfunding, startups can ensure that their campaign is successful and that they are able to raise the capital they need. With the right approach, startups can achieve their business goals and drive growth and expansion.

Measuring the Success of Your Equity Crowdfunding Campaign

Measuring the success of an equity crowdfunding campaign is crucial to understanding the effectiveness of the campaign and making data-driven decisions for future fundraising efforts. In this article, we will provide advice on how to measure the success of an equity crowdfunding campaign, including tracking key metrics, such as funds raised, investor engagement, and campaign reach.

Funds raised is one of the most obvious metrics to track when measuring the success of an equity crowdfunding campaign. This includes the total amount of money raised, as well as the number of investors who participated in the campaign. By tracking funds raised, startups can understand the effectiveness of their campaign and make adjustments for future fundraising efforts.

Investor engagement is another important metric to track when measuring the success of an equity crowdfunding campaign. This includes metrics such as the number of investors who visited the campaign page, the number of investors who invested, and the average investment amount. By tracking investor engagement, startups can understand the level of interest in their campaign and make adjustments to improve engagement.

Campaign reach is also an important metric to track when measuring the success of an equity crowdfunding campaign. This includes metrics such as the number of people who viewed the campaign page, the number of social media shares, and the number of press mentions. By tracking campaign reach, startups can understand the level of awareness and interest in their campaign and make adjustments to improve reach.

Equity crowdfunding platforms also provide a range of metrics and analytics to help startups measure the success of their campaign. These metrics may include the number of investors, the amount of money raised, and the campaign’s conversion rate. By leveraging these metrics, startups can gain a deeper understanding of their campaign’s performance and make data-driven decisions to improve future fundraising efforts.

Ultimately, measuring the success of an equity crowdfunding campaign requires a comprehensive approach that takes into account a range of metrics and analytics. By tracking funds raised, investor engagement, and campaign reach, startups can gain a deeper understanding of their campaign’s performance and make data-driven decisions to improve future fundraising efforts.

By understanding the metrics and analytics that are available, startups can make informed decisions about their equity crowdfunding campaign and improve their chances of success. With the right approach, startups can raise the capital they need to drive growth and expansion, and achieve their business goals.

Equity crowdfunding for startups is a rapidly evolving field, and measuring the success of a campaign requires a deep understanding of the metrics and analytics that are available. By leveraging the metrics and analytics outlined in this article, startups can gain a deeper understanding of their campaign’s performance and make data-driven decisions to improve future fundraising efforts.

By tracking the right metrics and analytics, startups can measure the success of their equity crowdfunding campaign and make informed decisions about future fundraising efforts. With the right approach, startups can achieve their business goals and drive growth and expansion.