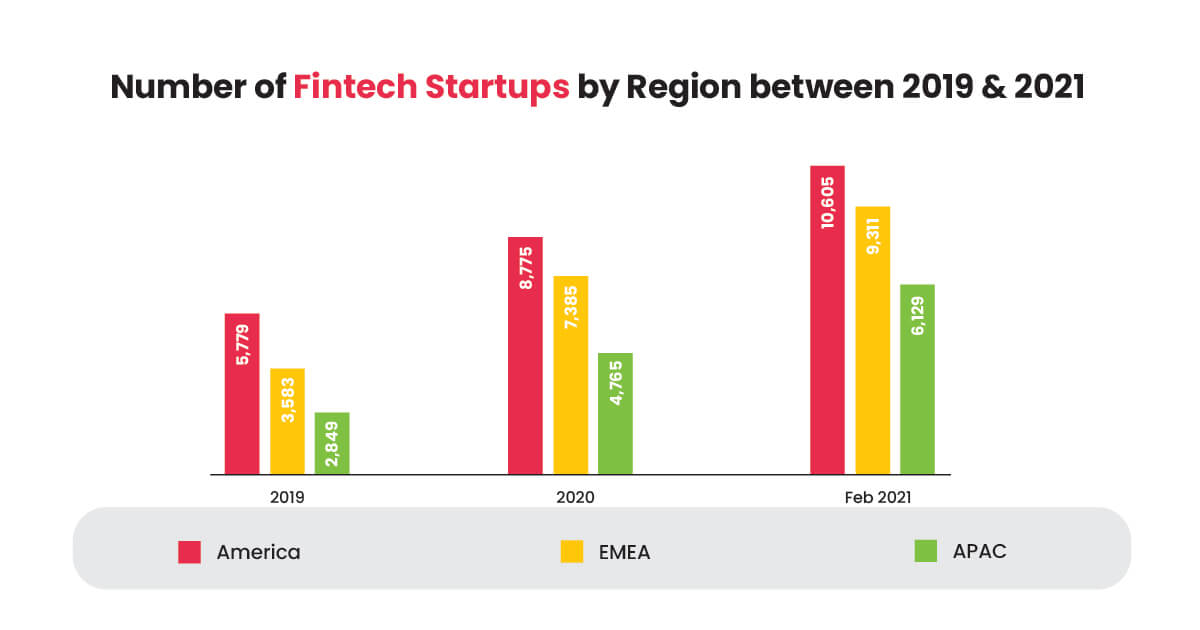

Unlocking the Power of Fintech for New Businesses

Fintech, short for financial technology, has revolutionized the way startups manage their financial operations. By leveraging innovative technologies, fintech solutions can help startups streamline their financial processes, reduce costs, and improve efficiency. In today’s fast-paced business environment, fintech for startups has become an essential tool for success. With the rise of digital payments, online lending, and automated accounting, fintech has made it possible for startups to access financial services that were previously unavailable to them.

One of the primary benefits of fintech for startups is its ability to simplify financial management. By automating tasks such as invoicing, expense tracking, and financial reporting, fintech solutions can help startups save time and reduce errors. Additionally, fintech platforms can provide startups with real-time financial insights, enabling them to make informed decisions about their business.

Fintech has also made it possible for startups to access capital more easily. Online lending platforms, for example, can provide startups with quick and easy access to funding, without the need for traditional banking channels. This has been particularly beneficial for startups that may not have an established credit history or may not meet the traditional lending criteria.

Furthermore, fintech has enabled startups to improve their cash flow management. By providing real-time visibility into their financial situation, fintech solutions can help startups identify areas where they can optimize their cash flow. This can be particularly beneficial for startups that may have irregular income or expenses.

Overall, fintech has the potential to transform the way startups manage their financial operations. By providing innovative solutions to traditional financial challenges, fintech can help startups save time, reduce costs, and improve efficiency. As the fintech industry continues to evolve, it is likely that we will see even more innovative solutions emerge, further revolutionizing the way startups manage their finances.

How to Choose the Right Fintech Solutions for Your Startup

With the numerous fintech solutions available in the market, selecting the right one for your startup can be a daunting task. However, by considering a few key factors, you can make an informed decision that meets your business needs. When evaluating fintech solutions, scalability is a crucial factor to consider. Your fintech solution should be able to grow with your business, adapting to changing needs and volumes.

Security is another critical aspect to consider when choosing a fintech solution. Your startup’s financial data is sensitive, and you need to ensure that it is protected from unauthorized access and cyber threats. Look for fintech solutions that have robust security measures in place, such as encryption, firewalls, and access controls.

Integration with existing systems is also essential when selecting a fintech solution. Your fintech solution should be able to seamlessly integrate with your existing accounting, payment, and other financial systems. This will help to minimize disruptions and ensure a smooth transition.

Additionally, consider the user experience and interface of the fintech solution. Your startup’s employees should be able to easily navigate the system, and it should provide real-time visibility into financial data. A user-friendly interface will also help to reduce errors and improve efficiency.

Finally, consider the cost of the fintech solution and its potential return on investment. While cost is an important factor, it should not be the only consideration. Evaluate the potential benefits of the fintech solution, such as improved efficiency, reduced costs, and increased revenue.

By considering these factors, you can choose a fintech solution that meets your startup’s specific needs and helps to drive business growth. Remember, the right fintech solution can help your startup to streamline financial operations, reduce costs, and improve efficiency.

The Benefits of Digital Payments for Startups

Digital payments have revolutionized the way startups manage their financial transactions. With the rise of fintech, digital payments have become a norm for many startups, offering a range of benefits that traditional payment methods cannot match. One of the primary advantages of digital payments for startups is the reduced transaction fees. Traditional payment methods, such as credit cards and checks, often come with high transaction fees that can eat into a startup’s profit margins.

Digital payments, on the other hand, offer lower transaction fees, making it possible for startups to save money on every transaction. Additionally, digital payments offer increased convenience, allowing startups to make and receive payments quickly and easily. This can help to improve cash flow management, as startups can receive payments in real-time, rather than waiting for days or weeks for checks to clear.

Digital payments also offer improved security, reducing the risk of fraud and identity theft. With traditional payment methods, startups are vulnerable to fraud and identity theft, which can result in significant financial losses. Digital payments, on the other hand, use advanced security measures, such as encryption and tokenization, to protect sensitive financial information.

Furthermore, digital payments offer startups the ability to track and manage their financial transactions in real-time. This can help to improve financial reporting and analysis, allowing startups to make informed decisions about their business. With digital payments, startups can also automate many of their financial tasks, such as invoicing and expense tracking, freeing up time and resources to focus on other areas of the business.

Overall, digital payments offer a range of benefits for startups, from reduced transaction fees to improved security and convenience. By adopting digital payments, startups can streamline their financial operations, reduce costs, and improve efficiency. As fintech continues to evolve, it is likely that we will see even more innovative digital payment solutions emerge, further transforming the way startups manage their financial transactions.

Streamlining Accounting and Bookkeeping with Fintech

Accounting and bookkeeping are essential tasks for any startup, but they can be time-consuming and prone to errors. Fintech solutions can help streamline these tasks, freeing up time and resources for more strategic activities. One of the key benefits of fintech for startups is automated invoicing. With fintech solutions, startups can automate the invoicing process, reducing the risk of errors and ensuring that payments are received on time.

Expense tracking is another area where fintech can make a significant impact. Fintech solutions can help startups track expenses in real-time, making it easier to manage cash flow and make informed financial decisions. Additionally, fintech solutions can provide startups with real-time financial reporting, enabling them to make data-driven decisions about their business.

Fintech solutions can also help startups simplify their accounting and bookkeeping tasks by integrating with existing systems. For example, fintech solutions can integrate with accounting software, such as QuickBooks or Xero, to provide a seamless and automated accounting experience. This can help reduce errors and improve financial accuracy.

Furthermore, fintech solutions can provide startups with advanced financial analytics and insights. With fintech solutions, startups can gain a deeper understanding of their financial performance, identifying areas for improvement and opportunities for growth. This can help startups make more informed financial decisions and drive business growth.

Overall, fintech solutions can help startups streamline their accounting and bookkeeping tasks, freeing up time and resources for more strategic activities. By automating tasks, providing real-time financial reporting, and integrating with existing systems, fintech solutions can help startups improve their financial management and drive business growth.

Managing Risk and Compliance in Fintech for Startups

Risk management and compliance are critical components of fintech for startups. As fintech solutions become increasingly complex, startups must ensure that they are managing risk and complying with regulatory requirements. One of the primary risks associated with fintech is data security. Startups must ensure that their fintech solutions are secure and that sensitive financial data is protected from unauthorized access.

Regulatory requirements are another key consideration for fintech startups. Startups must comply with a range of regulations, including anti-money laundering (AML) and know-your-customer (KYC) regulations. Failure to comply with these regulations can result in significant fines and reputational damage.

Fraud prevention is also a critical component of risk management in fintech for startups. Startups must implement robust fraud prevention measures to protect against unauthorized transactions and other types of financial crime.

To manage risk and compliance, fintech startups can implement a range of measures, including risk assessments, compliance programs, and employee training. Startups can also leverage technology, such as artificial intelligence and machine learning, to detect and prevent financial crime.

Additionally, fintech startups can work with regulatory bodies and industry associations to stay up-to-date on the latest regulatory requirements and best practices. By prioritizing risk management and compliance, fintech startups can build trust with their customers and stakeholders, and establish themselves as leaders in the fintech industry.

Overall, managing risk and compliance is essential for fintech startups. By implementing robust risk management and compliance measures, startups can protect themselves and their customers from financial crime, and establish themselves as trusted and reputable players in the fintech industry.

Real-World Examples of Fintech in Action for Startups

There are many examples of fintech in action for startups, demonstrating the potential of fintech to transform financial operations and drive business growth. One example is the use of digital payment systems by e-commerce startups. By integrating digital payment systems into their platforms, e-commerce startups can provide customers with a seamless and convenient payment experience, reducing cart abandonment rates and increasing sales.

Another example is the use of fintech for accounting and bookkeeping by startups. Fintech solutions such as QuickBooks and Xero provide startups with automated accounting and bookkeeping tools, enabling them to streamline financial operations and reduce errors. This can help startups to improve financial accuracy and make more informed business decisions.

Additionally, fintech is being used by startups to manage risk and compliance. Fintech solutions such as risk management platforms and compliance software provide startups with the tools they need to manage risk and comply with regulatory requirements. This can help startups to reduce the risk of financial crime and reputational damage.

For example, a fintech startup called Stripe provides online payment processing solutions for e-commerce businesses. Stripe’s platform enables businesses to accept payments online and manage their financial operations in a seamless and efficient manner. By using Stripe’s platform, e-commerce businesses can reduce the risk of payment failures and improve their overall financial performance.

Another example is a fintech startup called TransferWise, which provides international money transfer services for individuals and businesses. TransferWise’s platform enables users to send and receive money across borders in a fast and cost-effective manner. By using TransferWise’s platform, individuals and businesses can reduce the cost of international money transfers and improve their overall financial efficiency.

These examples demonstrate the potential of fintech to transform financial operations and drive business growth for startups. By leveraging fintech solutions, startups can improve their financial efficiency, reduce costs, and increase revenue.

Overcoming Common Challenges in Fintech Adoption for Startups

While fintech can offer numerous benefits for startups, there are also common challenges that can arise during the adoption process. One of the most significant challenges is integration issues. Fintech solutions may require integration with existing systems, which can be time-consuming and costly. To overcome this challenge, startups can work with fintech providers to ensure seamless integration and provide adequate training to employees.

Another challenge is employee training. Fintech solutions can be complex, and employees may require training to use them effectively. To overcome this challenge, startups can provide comprehensive training programs for employees, including online tutorials, workshops, and one-on-one training sessions.

Change management is also a common challenge in fintech adoption for startups. Fintech solutions can require significant changes to business processes and operations, which can be difficult for employees to adapt to. To overcome this challenge, startups can establish a clear change management plan, including communication strategies, training programs, and incentives for employees to adopt new processes.

Additionally, startups may face challenges related to data security and compliance. Fintech solutions can require the collection and storage of sensitive financial data, which must be protected from unauthorized access. To overcome this challenge, startups can implement robust data security measures, including encryption, firewalls, and access controls.

Finally, startups may face challenges related to scalability. Fintech solutions may need to be scaled up or down to meet changing business needs, which can be difficult to achieve. To overcome this challenge, startups can work with fintech providers to ensure that solutions are scalable and can adapt to changing business needs.

By understanding these common challenges and taking steps to overcome them, startups can ensure a successful fintech adoption process and reap the benefits of fintech for their business.

Future-Proofing Your Startup’s Financial Operations with Fintech

The future of fintech for startups is exciting and rapidly evolving. Emerging trends, technologies, and innovations are transforming the financial landscape, and startups must be prepared to adapt and innovate to remain competitive. One of the key trends shaping the future of fintech is the use of artificial intelligence (AI) and machine learning (ML) to automate financial processes and improve decision-making.

Another trend is the increasing use of blockchain technology to provide secure, transparent, and efficient financial transactions. Blockchain technology has the potential to revolutionize the way startups manage their financial operations, from payment processing to accounting and bookkeeping.

Additionally, the use of cloud-based fintech solutions is becoming increasingly popular among startups. Cloud-based solutions provide startups with scalability, flexibility, and cost savings, making it easier for them to manage their financial operations and focus on growth and innovation.

The Internet of Things (IoT) is also expected to play a significant role in the future of fintech for startups. IoT devices can provide startups with real-time data and insights, enabling them to make more informed financial decisions and improve their overall financial performance.

Furthermore, the use of mobile payments and digital wallets is becoming increasingly popular among startups. Mobile payments and digital wallets provide startups with a convenient and secure way to manage their financial transactions, reducing the need for cash and improving their overall financial efficiency.

Finally, the future of fintech for startups will be shaped by the increasing use of data analytics and business intelligence. Data analytics and business intelligence will enable startups to gain deeper insights into their financial operations, identify areas for improvement, and make more informed financial decisions.

By embracing these emerging trends, technologies, and innovations, startups can future-proof their financial operations and remain competitive in a rapidly changing financial landscape.