Unlocking the Power of Digital Transformation in PCB

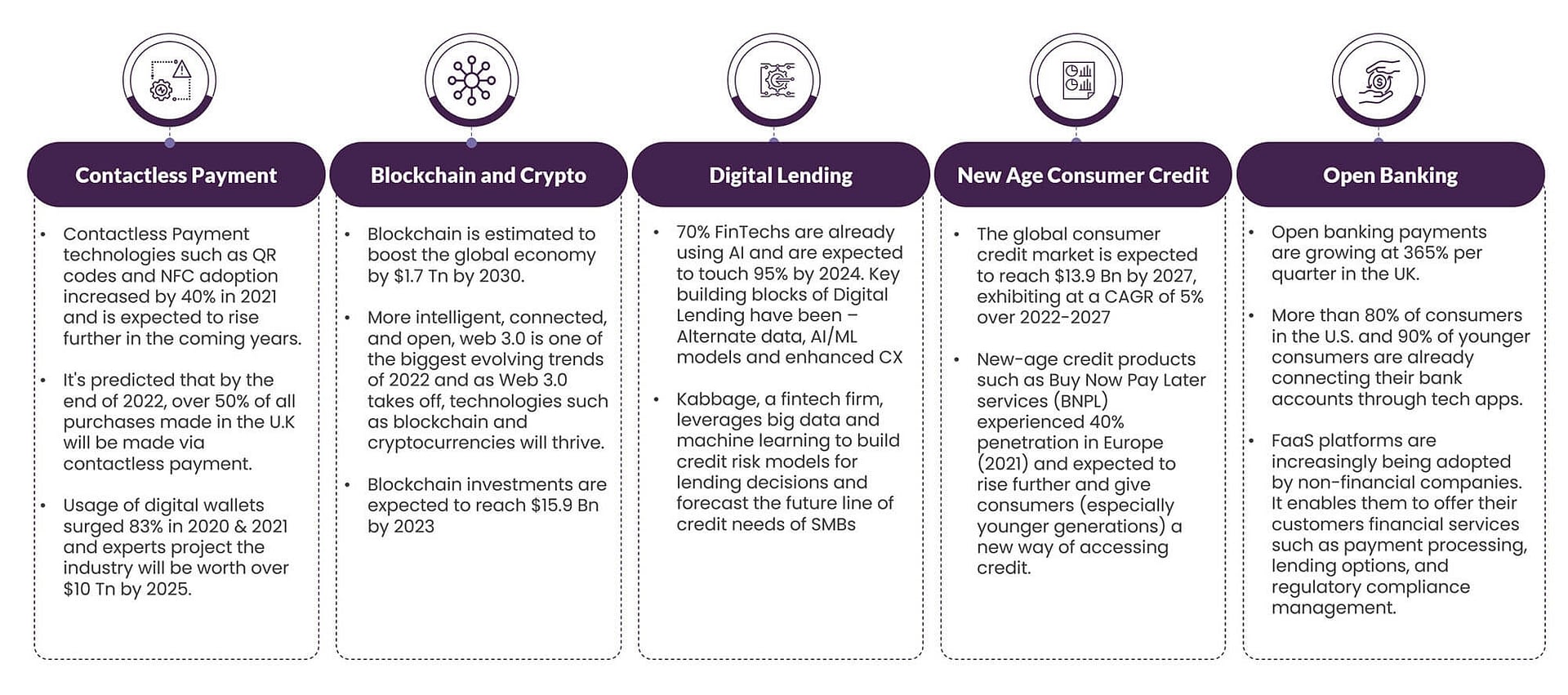

The payment card banking industry is undergoing a significant transformation, driven by the increasing demand for digital services and the need for improved customer experience. To stay competitive, Payment Card Banks (PCBs) must adopt fintech innovation strategies that enable them to provide secure, efficient, and user-friendly services. Fintech solutions, such as mobile payments, real-time transactions, and open banking, offer PCBs the opportunity to enhance their services and improve customer satisfaction.

However, the adoption of fintech innovation strategies for PCB is not without its challenges. PCBs must navigate complex regulatory requirements, ensure the security and integrity of their systems, and balance the need for innovation with the need for stability and reliability. Despite these challenges, the benefits of fintech innovation for PCBs are clear. By leveraging emerging technologies and innovative solutions, PCBs can improve their operational efficiency, reduce costs, and enhance their competitiveness in the market.

One of the key drivers of fintech innovation in PCB is the increasing demand for digital services. Consumers are increasingly expecting to be able to manage their finances and make payments using digital channels, such as mobile apps and online platforms. PCBs that fail to meet this demand risk losing customers to more innovative competitors. By adopting fintech innovation strategies, PCBs can provide their customers with the digital services they expect, while also improving their own operational efficiency and reducing costs.

In addition to improving customer experience and operational efficiency, fintech innovation strategies for PCB can also enhance security and reduce the risk of fraud. Emerging technologies, such as blockchain and artificial intelligence, offer PCBs the opportunity to improve their risk management and security protocols, while also reducing the complexity and cost of their systems.

Overall, the adoption of fintech innovation strategies for PCB is critical for the long-term success and competitiveness of Payment Card Banks. By leveraging emerging technologies and innovative solutions, PCBs can improve their operational efficiency, enhance their customer experience, and reduce their risk exposure. As the payment card banking industry continues to evolve, it is likely that fintech innovation will play an increasingly important role in shaping the future of PCBs.

How to Leverage Emerging Technologies for Enhanced Security and Efficiency

Emerging technologies such as blockchain, artificial intelligence, and biometrics are transforming the payment card banking industry. These technologies offer Payment Card Banks (PCBs) the opportunity to enhance security, improve efficiency, and reduce costs. By leveraging these technologies, PCBs can stay ahead of the competition and provide their customers with innovative and secure services.

Blockchain technology, for example, offers PCBs a secure and transparent way to process transactions. By using blockchain, PCBs can reduce the risk of fraud and improve the speed and efficiency of transaction processing. Artificial intelligence (AI) can also be used to improve security and efficiency in PCB. AI-powered systems can analyze vast amounts of data to identify potential security threats and prevent fraudulent activity.

Biometric authentication is another emerging technology that is being used in PCB to enhance security. Biometric authentication uses unique physical characteristics, such as fingerprints or facial recognition, to verify identities and prevent unauthorized access. This technology offers PCBs a secure and convenient way to authenticate customers and prevent fraudulent activity.

Several PCB companies have already successfully implemented emerging technologies to enhance security and efficiency. For example, some PCBs have implemented blockchain-based systems to process transactions, while others have used AI-powered systems to improve security and prevent fraudulent activity. These implementations have resulted in significant cost savings and improved customer satisfaction.

However, the implementation of emerging technologies in PCB also presents several challenges. PCBs must ensure that these technologies are integrated into their existing systems and processes, and that they comply with relevant regulations and industry standards. Additionally, PCBs must also ensure that their customers are educated about the benefits and risks of these technologies.

Overall, emerging technologies such as blockchain, AI, and biometrics offer PCBs the opportunity to enhance security, improve efficiency, and reduce costs. By leveraging these technologies, PCBs can stay ahead of the competition and provide their customers with innovative and secure services. As the payment card banking industry continues to evolve, it is likely that emerging technologies will play an increasingly important role in shaping the future of PCBs.

The Rise of Mobile Payments: Strategies for PCB Companies to Stay Ahead

The growth of mobile payments is transforming the payment card banking industry. Mobile payments offer consumers a convenient and secure way to make transactions, and Payment Card Banks (PCBs) must adapt to this shift to remain competitive. Fintech innovation strategies for PCB companies must include the development of mobile payment apps and partnerships with fintech providers to stay ahead in the market.

Mobile payments are becoming increasingly popular, with many consumers using their mobile devices to make transactions. This trend is driven by the convenience and security offered by mobile payments. Mobile payment apps, such as Apple Pay and Google Pay, offer consumers a secure and convenient way to make transactions, and PCBs must develop similar apps to remain competitive.

Partnerships with fintech providers are also essential for PCBs to stay ahead in the mobile payments market. Fintech providers offer PCBs the opportunity to leverage their expertise and technology to develop innovative mobile payment solutions. For example, some fintech providers offer PCBs the ability to integrate their mobile payment apps with other financial services, such as account management and bill payment.

PCBs that fail to adapt to the growth of mobile payments risk losing customers to more innovative competitors. To stay ahead, PCBs must develop mobile payment apps that offer consumers a secure and convenient way to make transactions. PCBs must also partner with fintech providers to leverage their expertise and technology and stay ahead in the market.

Several PCB companies have already successfully adapted to the growth of mobile payments. For example, some PCBs have developed mobile payment apps that offer consumers a secure and convenient way to make transactions. Others have partnered with fintech providers to leverage their expertise and technology and stay ahead in the market.

Overall, the growth of mobile payments is transforming the payment card banking industry, and PCBs must adapt to this shift to remain competitive. Fintech innovation strategies for PCB companies must include the development of mobile payment apps and partnerships with fintech providers to stay ahead in the market.

Real-Time Payments: The Future of Transaction Processing in PCB

Real-time payments are revolutionizing the way Payment Card Banks (PCBs) process transactions. With the ability to process transactions in real-time, PCBs can provide their customers with faster and more secure payment services. Fintech innovation strategies for PCB companies must include the implementation of real-time payment systems to stay competitive in the market.

Real-time payment systems offer several benefits to PCBs, including faster transaction processing, improved security, and increased customer satisfaction. With real-time payments, customers can receive their payments immediately, reducing the need for cash and checks. Additionally, real-time payments can help reduce the risk of fraud and errors, as transactions are processed and settled in real-time.

However, implementing real-time payment systems also presents several challenges for PCBs. One of the main challenges is the need for significant investments in technology and infrastructure. PCBs must also ensure that their systems are secure and compliant with relevant regulations and industry standards.

Fintech solutions can help facilitate the implementation of real-time payment systems in PCB. For example, fintech providers can offer PCBs the technology and expertise needed to develop and implement real-time payment systems. Additionally, fintech solutions can help PCBs integrate their real-time payment systems with other financial services, such as account management and bill payment.

Several PCB companies have already successfully implemented real-time payment systems. For example, some PCBs have developed real-time payment apps that allow customers to make payments in real-time. Others have partnered with fintech providers to leverage their expertise and technology and implement real-time payment systems.

Overall, real-time payments are the future of transaction processing in PCB. Fintech innovation strategies for PCB companies must include the implementation of real-time payment systems to stay competitive in the market. By leveraging fintech solutions, PCBs can provide their customers with faster and more secure payment services, while also improving their own operational efficiency and reducing costs.

Open Banking and APIs: Unlocking New Opportunities for PCB Innovation

Open banking and APIs are revolutionizing the payment card banking industry by enabling innovation and improving customer experience. Fintech innovation strategies for PCB companies must include the use of open banking and APIs to stay competitive in the market. Open banking allows third-party providers to access bank data and create new services, while APIs enable the integration of different systems and services.

The use of open banking and APIs offers several benefits to PCB companies, including improved customer experience, increased innovation, and reduced costs. By allowing third-party providers to access bank data, open banking enables the creation of new services and products that can improve customer experience. APIs also enable the integration of different systems and services, reducing the complexity and cost of developing new services.

Several PCB companies have already successfully implemented open banking and APIs. For example, some PCBs have developed APIs that allow third-party providers to access bank data and create new services. Others have partnered with fintech providers to leverage their expertise and technology and develop new services.

One of the key benefits of open banking and APIs is the ability to create new services and products that can improve customer experience. For example, a PCB company can use APIs to integrate its services with other financial services, such as account management and bill payment. This can provide customers with a more seamless and convenient experience.

Another benefit of open banking and APIs is the ability to reduce costs and improve efficiency. By enabling the integration of different systems and services, APIs can reduce the complexity and cost of developing new services. This can also improve the speed and efficiency of transaction processing.

Overall, open banking and APIs are key to fintech innovation in PCB. By enabling innovation and improving customer experience, open banking and APIs can help PCB companies stay competitive in the market. Fintech innovation strategies for PCB companies must include the use of open banking and APIs to unlock new opportunities for innovation and growth.

Collaboration and Partnerships: Key to Fintech Innovation in PCB

Collaboration and partnerships are essential for driving fintech innovation in the payment card banking (PCB) industry. By working together, PCB companies, fintech providers, and other stakeholders can leverage each other’s expertise and resources to develop innovative solutions that improve customer experience and drive business growth.

One of the key benefits of collaboration and partnerships in fintech innovation is the ability to access new technologies and expertise. Fintech providers can offer PCB companies access to cutting-edge technologies and innovative solutions that can help them stay ahead of the competition. Similarly, PCB companies can provide fintech providers with valuable insights into the needs and preferences of their customers.

Several successful partnerships have been formed in the PCB industry to drive fintech innovation. For example, some PCB companies have partnered with fintech providers to develop mobile payment apps and other digital payment solutions. Others have partnered with technology companies to develop blockchain-based solutions for secure and efficient transaction processing.

Collaboration and partnerships can also help PCB companies overcome regulatory hurdles and ensure compliance with relevant regulations and industry standards. By working together, PCB companies and fintech providers can share knowledge and expertise to develop solutions that meet regulatory requirements and industry standards.

In addition, collaboration and partnerships can help PCB companies measure the success of their fintech innovation initiatives. By working together, PCB companies and fintech providers can develop key performance indicators (KPIs) that can be used to evaluate the effectiveness of their initiatives and make data-driven decisions.

Overall, collaboration and partnerships are key to fintech innovation in the PCB industry. By working together, PCB companies, fintech providers, and other stakeholders can develop innovative solutions that improve customer experience and drive business growth. Fintech innovation strategies for PCB companies must include collaboration and partnerships to stay ahead of the competition.

Overcoming Regulatory Hurdles: Strategies for PCB Companies to Ensure Compliance

Payment Card Banks (PCBs) face numerous regulatory challenges when implementing fintech solutions. Ensuring compliance with relevant regulations and industry standards is crucial to avoid penalties, reputational damage, and loss of customer trust. Fintech innovation strategies for PCB companies must include strategies for overcoming regulatory hurdles and ensuring compliance.

One of the key regulatory challenges faced by PCBs is the need to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Fintech solutions can help PCBs streamline their AML and KYC processes, reducing the risk of non-compliance and improving customer experience.

Another regulatory challenge faced by PCBs is the need to comply with data protection regulations, such as the General Data Protection Regulation (GDPR). Fintech solutions can help PCBs ensure the secure storage and processing of customer data, reducing the risk of data breaches and non-compliance.

PCBs can also leverage fintech solutions to ensure compliance with payment card industry (PCI) standards. Fintech solutions can help PCBs implement robust security measures, such as encryption and tokenization, to protect customer data and prevent data breaches.

In addition, PCBs can partner with fintech providers to ensure compliance with relevant regulations and industry standards. Fintech providers can offer PCBs expertise and resources to help them navigate complex regulatory requirements and ensure compliance.

Overall, overcoming regulatory hurdles is crucial for PCBs to ensure compliance and avoid reputational damage. Fintech innovation strategies for PCB companies must include strategies for overcoming regulatory hurdles and ensuring compliance. By leveraging fintech solutions and partnering with fintech providers, PCBs can ensure compliance and improve customer experience.

Measuring Success: Key Performance Indicators for Fintech Innovation in PCB

Measuring the success of fintech innovation initiatives in Payment Card Banking (PCB) is crucial to evaluate their effectiveness and identify areas for improvement. Fintech innovation strategies for PCB companies must include key performance indicators (KPIs) that can be used to measure the success of these initiatives.

One of the key KPIs for measuring the success of fintech innovation initiatives in PCB is the adoption rate of new technologies and services. This can include metrics such as the number of customers using mobile payment apps, the volume of transactions processed through real-time payment systems, and the number of customers using open banking services.

Another important KPI is customer satisfaction. This can be measured through surveys, feedback forms, and other tools that gather customer feedback and opinions. By measuring customer satisfaction, PCB companies can identify areas for improvement and make data-driven decisions to enhance customer experience.

Return on investment (ROI) is also a critical KPI for measuring the success of fintech innovation initiatives in PCB. This can include metrics such as the cost savings achieved through the implementation of new technologies, the revenue generated through new services, and the increase in customer loyalty and retention.

In addition, PCB companies can use KPIs such as net promoter score (NPS), customer retention rate, and customer acquisition cost to measure the success of their fintech innovation initiatives. By tracking these KPIs, PCB companies can evaluate the effectiveness of their fintech innovation strategies and make data-driven decisions to drive business growth.

Overall, measuring the success of fintech innovation initiatives in PCB is crucial to evaluate their effectiveness and identify areas for improvement. By using KPIs such as adoption rate, customer satisfaction, ROI, NPS, customer retention rate, and customer acquisition cost, PCB companies can make data-driven decisions to drive business growth and stay ahead of the competition.