Understanding the Home Buying Process

Purchasing a home is a significant milestone in one’s life, and it’s essential to approach it with a clear understanding of the process. The journey to homeownership can be complex, but with the right guidance, it can be a smooth and rewarding experience. The first steps to buying a home involve more than just finding the perfect property; it requires a thorough understanding of the entire process, from preparation to closing. By grasping the intricacies of the home buying process, individuals can make informed decisions, avoid costly mistakes, and ultimately achieve their goal of becoming a homeowner.

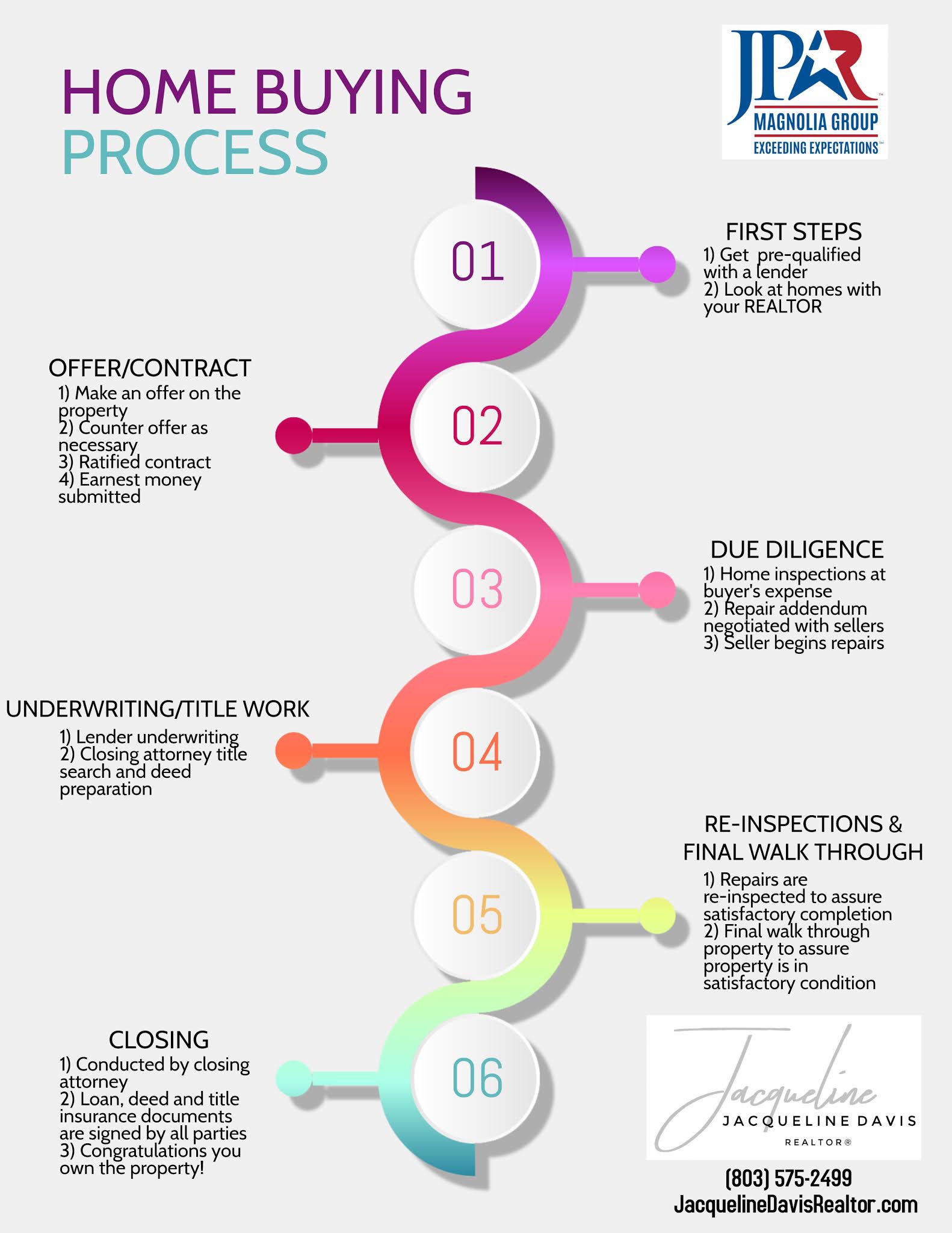

The home buying process typically begins with preparation, which includes evaluating one’s financial situation, getting pre-approved for a mortgage, and identifying one’s needs and wants in a home. This initial stage is crucial, as it sets the foundation for the rest of the process. By understanding the home buying process, individuals can better navigate the subsequent stages, including researching neighborhoods and communities, working with a real estate agent, and navigating the home inspection and due diligence process.

Embarking on the journey to homeownership requires patience, persistence, and a willingness to learn. By taking the time to understand the home buying process, individuals can ensure a successful and stress-free experience. Whether you’re a first-time homebuyer or a seasoned pro, it’s essential to stay informed and adapt to the ever-changing real estate market. In the following sections, we’ll delve deeper into the first steps to buying a home, providing valuable insights and practical advice to help you achieve your goal of becoming a homeowner.

Assessing Your Financial Readiness

Before embarking on the journey to homeownership, it’s essential to assess your financial readiness. This involves evaluating your financial situation, including your income, expenses, debts, and credit score. By understanding your financial health, you can determine how much home you can afford and make informed decisions throughout the home buying process.

One of the first steps in assessing your financial readiness is to check your credit score. Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a mortgage. You can request a free credit report from the three major credit reporting agencies (Experian, TransUnion, and Equifax) and review it for any errors or inaccuracies.

In addition to checking your credit score, it’s essential to gather all necessary financial documents, including pay stubs, bank statements, and tax returns. These documents will be required when applying for a mortgage, and having them organized and readily available will make the process smoother.

Determining your budget is also a critical step in assessing your financial readiness. Consider all your income and expenses, including your debt payments, and calculate how much you can afford to spend on a home. A general rule of thumb is to spend no more than 30% of your gross income on housing costs.

By taking the time to assess your financial readiness, you’ll be better equipped to navigate the home buying process and make informed decisions that will help you achieve your goal of becoming a homeowner. In the next section, we’ll discuss the importance of getting pre-approved for a mortgage and how it can give you an edge in the home buying process.

Getting Pre-Approved for a Mortgage

Getting pre-approved for a mortgage is a crucial step in the home buying process. It not only gives you an idea of how much you can afford to spend on a home, but it also provides you with a competitive edge when making an offer on a property. In today’s competitive real estate market, many sellers require a pre-approval letter from potential buyers before considering their offer.

To get pre-approved for a mortgage, you’ll need to contact a lender and provide them with financial information, such as your income, credit score, and debt obligations. The lender will then review this information and provide you with a pre-approval letter stating the amount they are willing to lend you.

The pre-approval process typically involves the following steps:

1. Contact a lender: Reach out to a lender and ask about their pre-approval process. They will guide you through the necessary steps and provide you with a list of required documents.

2. Gather financial documents: You’ll need to provide the lender with financial documents, such as pay stubs, bank statements, and tax returns.

3. Review and verify information: The lender will review and verify the information you provided to determine how much they are willing to lend you.

4. Receive pre-approval letter: Once the lender has reviewed and verified your information, they will provide you with a pre-approval letter stating the amount they are willing to lend you.

Having a pre-approval letter in hand can give you a competitive edge when making an offer on a property. It shows the seller that you are serious about purchasing the property and that you have already taken the necessary steps to secure financing.

In the next section, we’ll discuss the importance of identifying your home needs and wants and how it can help you focus your search and find the right home for you.

Identifying Your Home Needs and Wants

When it comes to buying a home, it’s essential to identify your needs and wants to ensure you find the right property for you. Your needs are the essential features that a home must have, while your wants are the desirable features that would be nice to have. By making a list of your needs and wants, you can focus your search and avoid wasting time looking at properties that don’t meet your requirements.

To start, make a list of your needs, including the number of bedrooms and bathrooms, square footage, and location. Consider factors such as proximity to work, schools, and public transportation. You should also think about the type of property you’re looking for, such as a single-family home, condo, or townhouse.

Next, make a list of your wants, including features such as a backyard, pool, or specific architectural style. Consider the type of community you want to live in, such as a quiet neighborhood or a bustling city center. You should also think about the amenities you want, such as a gym, park, or shopping center.

Once you have your lists, prioritize your needs and wants. This will help you focus your search and make decisions when looking at properties. Remember, it’s unlikely you’ll find a property that meets all of your needs and wants, so be prepared to make compromises.

By identifying your home needs and wants, you can ensure you find a property that meets your requirements and provides you with a comfortable and enjoyable living space. In the next section, we’ll discuss the importance of researching neighborhoods and communities before buying a home.

Researching Neighborhoods and Communities

When buying a home, it’s essential to research the neighborhood and community to ensure it’s a good fit for you and your family. The neighborhood and community can have a significant impact on the quality of life, safety, and property value. By researching the area, you can make an informed decision and avoid potential pitfalls.

One of the first steps in researching a neighborhood is to evaluate the local schools. Even if you don’t have children, the quality of the schools can impact the property value and desirability of the area. You can research the schools online, read reviews, and talk to locals to get a sense of the school district.

Another important factor to consider is transportation. Is the area easily accessible by car, public transportation, or on foot? Are there bike lanes and pedestrian-friendly roads? Consider the commute time to work, schools, and other essential services.

Local amenities are also crucial to consider. Are there parks, playgrounds, and recreational facilities nearby? Are there shopping centers, restaurants, and entertainment options within walking distance? Consider the types of amenities that are important to you and your family.

In addition to these factors, you should also research the safety and crime rate of the area. You can check online crime statistics, talk to locals, and drive around the neighborhood to get a sense of the area.

By researching the neighborhood and community, you can make an informed decision and find a home that meets your needs and provides a high quality of life. In the next section, we’ll discuss the benefits of working with a real estate agent and how they can guide you through the home buying process.

Working with a Real Estate Agent

When buying a home, working with a real estate agent can be a valuable asset. A real estate agent can guide you through the home buying process, provide valuable insights and advice, and help you navigate the complex world of real estate. In this section, we’ll discuss the benefits of working with a real estate agent and how to find the right agent for you.

A real estate agent can provide a wealth of knowledge and expertise, including information on the local market, current trends, and the best neighborhoods to consider. They can also help you find homes that meet your needs and budget, and provide guidance on how to negotiate the terms of the sale.

When selecting a real estate agent, it’s essential to find someone who is knowledgeable, experienced, and a good fit for your needs. Here are some tips to consider:

1. Ask for referrals: Ask friends, family, or colleagues who have recently bought or sold a home for recommendations.

2. Check online reviews: Look up real estate agents in your area and read online reviews to get a sense of their reputation and expertise.

3. Interview potential agents: Meet with several agents and ask them questions about their experience, knowledge, and approach to working with clients.

4. Check their credentials: Make sure the agent is licensed and has any necessary certifications or designations.

By working with a real estate agent, you can gain a valuable partner in the home buying process. They can provide guidance, support, and expertise to help you find the right home and navigate the complex world of real estate. In the next section, we’ll discuss the importance of navigating the home inspection and due diligence process.

Navigating the Home Inspection and Due Diligence Process

Once you’ve found a home you’re interested in purchasing, it’s essential to conduct a home inspection and due diligence process. This process can help you identify potential issues with the property and avoid costly surprises down the road.

A home inspection is a thorough examination of the property’s condition, including its major systems and components. A licensed home inspector will evaluate the property’s foundation, roof, plumbing, electrical, and HVAC systems, as well as its overall condition.

The due diligence process involves reviewing the property’s title, survey, and other documents to ensure that the seller has the right to sell the property and that there are no unexpected liens or encumbrances.

During the home inspection and due diligence process, you may discover issues with the property that could impact its value or your decision to purchase. This is an opportunity to negotiate with the seller to address these issues or to walk away from the deal if necessary.

Some common issues that may be discovered during the home inspection and due diligence process include:

1. Structural damage: Cracks in the foundation, walls, or roof can indicate structural damage that could be costly to repair.

2. Environmental hazards: Asbestos, lead paint, and mold can be hazardous to your health and require costly remediation.

3. Electrical and plumbing issues: Outdated or faulty electrical and plumbing systems can be a safety hazard and require costly repairs.

4. Pest and rodent infestations: Termite damage, rodent infestations, and other pest issues can be costly to repair and require ongoing maintenance.

By conducting a thorough home inspection and due diligence process, you can gain a better understanding of the property’s condition and make an informed decision about your purchase. In the next section, we’ll discuss the final stages of the home buying process, including making an offer and closing the deal.

Making an Offer and Closing the Deal

Once you’ve found the perfect home and completed the home inspection and due diligence process, it’s time to make an offer and close the deal. This is the final stage of the home buying process, and it requires careful consideration and negotiation.

When making an offer, you’ll need to consider several factors, including the price of the home, the terms of the sale, and any contingencies or conditions. Your real estate agent can help you navigate this process and ensure that your offer is competitive and reasonable.

Some common contingencies or conditions that may be included in an offer include:

1. Financing contingency: This contingency allows you to back out of the deal if you’re unable to secure financing.

2. Inspection contingency: This contingency allows you to back out of the deal if the home inspection reveals significant issues with the property.

3. Appraisal contingency: This contingency allows you to back out of the deal if the appraised value of the property is lower than the sale price.

Once your offer is accepted, you’ll enter into a contract with the seller, and the closing process will begin. This process typically takes several weeks to complete and involves several steps, including:

1. Title search and insurance: A title search will be conducted to ensure that the seller has clear ownership of the property, and title insurance will be purchased to protect against any potential issues.

2. Loan processing: Your lender will process your loan application and prepare the necessary documents for closing.

3. Closing preparations: Your real estate agent and attorney will prepare the necessary documents for closing, including the deed and title.

4. Closing: The final step in the home buying process is the closing, where you’ll sign the necessary documents and transfer the ownership of the property.

By understanding the final stages of the home buying process, you can ensure a smooth and successful transaction. Remember to stay organized, communicate effectively with your real estate agent and lender, and carefully review all documents before signing.