Breaking Down the Barriers to Homeownership for First-Time Buyers

Purchasing a home can be a daunting task, especially for first-time buyers in Texas. The Lone Star State is known for its thriving cities, vibrant culture, and strong economy, but it also comes with a high cost of living. For many, the dream of homeownership seems out of reach due to high down payments, closing costs, and strict credit requirements. However, there are options available to help first-time home buyers overcome these barriers and achieve their goal of owning a home.

One of the primary challenges faced by first-time home buyers in Texas is the high down payment required for a mortgage. Typically, lenders require a down payment of 20% of the purchase price, which can be a significant amount for those who are just starting out. Additionally, closing costs, which can range from 2% to 5% of the purchase price, can add up quickly. These costs can be overwhelming for first-time buyers who may not have a lot of savings or equity to draw from.

Another hurdle that first-time home buyers in Texas may face is strict credit requirements. Lenders typically require a minimum credit score of 620 to 650 to qualify for a mortgage, which can be a challenge for those who have limited credit history or have made mistakes in the past. Furthermore, the debt-to-income ratio, which is the percentage of monthly gross income that goes towards paying debts, must be below 36% to qualify for a mortgage.

Fortunately, there are grants and assistance programs available to help first-time home buyers in Texas overcome these challenges. The Texas Department of Housing and Community Affairs (TDHCA) and the Texas State Affordable Housing Corporation (TSAHC) offer a range of programs that provide financial assistance, such as down payment assistance, closing cost assistance, and tax credits. These programs can help first-time home buyers reduce their down payment, lower their interest rate, and decrease their monthly mortgage payment.

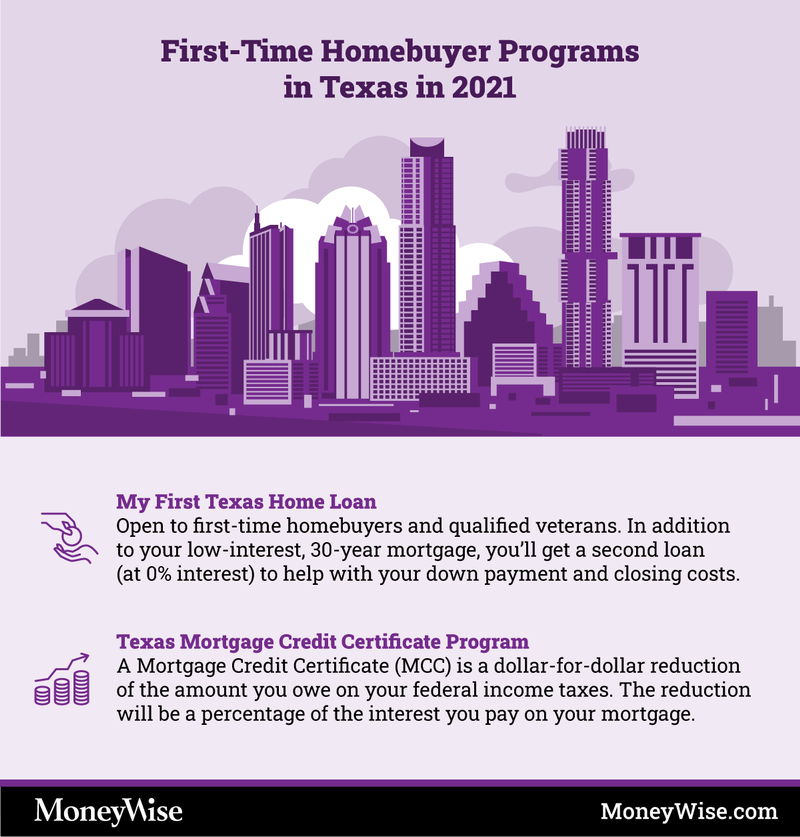

For example, the TDHCA’s My First Texas Home (MFTH) Program provides up to 5% of the home’s purchase price in down payment assistance, which can be used towards the down payment and closing costs. The TSAHC’s Homes for Texas Heroes Program offers a 3% to 5% down payment assistance grant, which can be used towards the down payment and closing costs. These programs can be a game-changer for first-time home buyers who are struggling to come up with the funds needed to purchase a home.

In addition to these programs, there are also tax credits available to first-time home buyers in Texas. The Mortgage Credit Certificate (MCC) Program, which is offered by the TDHCA, allows first-time home buyers to claim a federal tax credit of up to $2,000 per year for the life of the loan. This can help first-time home buyers reduce their federal income tax liability and increase their disposable income.

Overall, while the challenges faced by first-time home buyers in Texas can seem insurmountable, there are options available to help them overcome these barriers and achieve their dream of homeownership. By taking advantage of grants and assistance programs, such as those offered by the TDHCA and TSAHC, first-time home buyers can reduce their down payment, lower their interest rate, and decrease their monthly mortgage payment. With the right resources and support, first-time home buyers in Texas can overcome the challenges of homeownership and start building a brighter financial future.

How to Get Started with First-Time Home Buyer Grants in Texas

For first-time home buyers in Texas, navigating the process of obtaining grants and assistance programs can be overwhelming. However, with the right guidance, it can be a straightforward and rewarding experience. In this section, we will provide an overview of the different types of grants and assistance programs available to first-time home buyers in Texas, including the Texas Department of Housing and Community Affairs (TDHCA) and the Texas State Affordable Housing Corporation (TSAHC).

The TDHCA offers a range of programs designed to help first-time home buyers achieve their dream of homeownership. The My First Texas Home (MFTH) Program, for example, provides up to 5% of the home’s purchase price in down payment assistance. This program is available to first-time home buyers who meet certain income and credit requirements. The TDHCA also offers the Homes for Texas Heroes Program, which provides up to 5% of the home’s purchase price in down payment assistance to eligible home buyers who are also Texas heroes, such as teachers, police officers, and firefighters.

The TSAHC also offers a range of programs designed to help first-time home buyers achieve their dream of homeownership. The Homeownership Across Texas (HAT) Program, for example, provides up to 4% of the home’s purchase price in down payment assistance. This program is available to first-time home buyers who meet certain income and credit requirements. The TSAHC also offers the Texas Mortgage Credit Certificate (MCC) Program, which allows first-time home buyers to claim a federal tax credit of up to $2,000 per year for the life of the loan.

To be eligible for these programs, first-time home buyers must meet certain income and credit requirements. For example, the TDHCA’s MFTH Program requires that borrowers have a minimum credit score of 620 and a maximum debt-to-income ratio of 45%. The TSAHC’s HAT Program requires that borrowers have a minimum credit score of 640 and a maximum debt-to-income ratio of 45%.

The application process for these programs typically involves submitting an application to the TDHCA or TSAHC, along with required documentation such as proof of income, credit reports, and identification. Borrowers may also need to complete a homebuyer education course to be eligible for these programs.

It’s worth noting that these programs are subject to change, and availability may be limited. First-time home buyers should check with the TDHCA and TSAHC for the most up-to-date information on these programs and to determine their eligibility.

By taking advantage of these grants and assistance programs, first-time home buyers in Texas can overcome the challenges of homeownership and achieve their dream of owning a home. Whether you’re a teacher, police officer, or simply a first-time home buyer, there are programs available to help you get started on the path to homeownership.

Understanding the Benefits of Texas First-Time Home Buyer Grants

For first-time home buyers in Texas, grants and assistance programs can be a game-changer. These programs offer a range of benefits, including reduced down payments, lower interest rates, and tax credits. In this section, we will explore the benefits of using grants and assistance programs to purchase a home in Texas, and provide real-life examples of how these programs have helped first-time home buyers achieve their dream of homeownership.

One of the primary benefits of using grants and assistance programs is the reduced down payment requirement. For example, the Texas Department of Housing and Community Affairs (TDHCA) offers a program that provides up to 5% of the home’s purchase price in down payment assistance. This means that first-time home buyers can purchase a home with a lower down payment, making it more affordable and accessible.

Another benefit of using grants and assistance programs is the lower interest rate. For example, the Texas State Affordable Housing Corporation (TSAHC) offers a program that provides a lower interest rate on mortgages for first-time home buyers. This can result in lower monthly mortgage payments, making it easier for first-time home buyers to afford their home.

In addition to reduced down payments and lower interest rates, grants and assistance programs can also provide tax credits. For example, the TDHCA’s Mortgage Credit Certificate (MCC) Program allows first-time home buyers to claim a federal tax credit of up to $2,000 per year for the life of the loan. This can result in significant savings for first-time home buyers, making it easier for them to afford their home.

But don’t just take our word for it. Here are some real-life examples of how grants and assistance programs have helped first-time home buyers in Texas achieve their dream of homeownership:

For example, Sarah, a first-time home buyer in Austin, used the TDHCA’s MFTH Program to purchase her home. With the program’s down payment assistance, Sarah was able to purchase her home with a lower down payment, making it more affordable and accessible. “I was able to purchase my home with a lower down payment, which made it easier for me to afford my monthly mortgage payments,” Sarah said.

Another example is John, a first-time home buyer in Dallas, who used the TSAHC’s HAT Program to purchase his home. With the program’s lower interest rate, John was able to save money on his monthly mortgage payments. “I was able to save money on my monthly mortgage payments, which made it easier for me to afford my home,” John said.

These are just a few examples of how grants and assistance programs can help first-time home buyers in Texas achieve their dream of homeownership. By providing reduced down payments, lower interest rates, and tax credits, these programs can make homeownership more affordable and accessible for first-time home buyers.

Exploring the Different Types of Grants Available in Texas

For first-time home buyers in Texas, there are several types of grants available to help with the home buying process. In this section, we will delve deeper into the different types of grants available, including the Homes for Texas Heroes Program, the Homeownership Across Texas (HAT) Program, and the My First Texas Home (MFTH) Program.

The Homes for Texas Heroes Program is a grant program that provides financial assistance to first-time home buyers who are also Texas heroes, such as teachers, police officers, and firefighters. This program provides up to 5% of the home’s purchase price in down payment assistance, and also offers a lower interest rate on mortgages. To be eligible for this program, applicants must meet certain income and credit requirements, and must also be a first-time home buyer.

The Homeownership Across Texas (HAT) Program is another grant program available to first-time home buyers in Texas. This program provides up to 4% of the home’s purchase price in down payment assistance, and also offers a lower interest rate on mortgages. To be eligible for this program, applicants must meet certain income and credit requirements, and must also be a first-time home buyer.

The My First Texas Home (MFTH) Program is a grant program that provides financial assistance to first-time home buyers in Texas. This program provides up to 5% of the home’s purchase price in down payment assistance, and also offers a lower interest rate on mortgages. To be eligible for this program, applicants must meet certain income and credit requirements, and must also be a first-time home buyer.

Each of these grant programs has its own unique features and benefits, and can be used in conjunction with other forms of assistance, such as FHA loans or VA loans. By understanding the different types of grants available, first-time home buyers in Texas can make informed decisions about which program is best for their needs.

For example, the Homes for Texas Heroes Program may be a good option for first-time home buyers who are also Texas heroes, as it provides a higher amount of down payment assistance and a lower interest rate on mortgages. On the other hand, the HAT Program may be a good option for first-time home buyers who are looking for a lower interest rate on their mortgage, but may not need as much down payment assistance.

By exploring the different types of grants available in Texas, first-time home buyers can find the program that best fits their needs and helps them achieve their dream of homeownership.

How to Combine Grants with Other Forms of Assistance

For first-time home buyers in Texas, combining grants with other forms of assistance can be a great way to maximize the benefits of homeownership. In this section, we will discuss the possibility of combining grants with other forms of assistance, such as FHA loans or VA loans, and provide examples of how this can be done.

One way to combine grants with other forms of assistance is to use a grant program in conjunction with an FHA loan. FHA loans are a popular choice for first-time home buyers because they offer more lenient credit score requirements and lower down payment options. By combining an FHA loan with a grant program, first-time home buyers can reduce their down payment even further and lower their monthly mortgage payments.

For example, the Texas Department of Housing and Community Affairs (TDHCA) offers a grant program that provides up to 5% of the home’s purchase price in down payment assistance. This grant can be used in conjunction with an FHA loan to reduce the down payment even further. By combining these two forms of assistance, first-time home buyers can purchase a home with a lower down payment and lower monthly mortgage payments.

Another way to combine grants with other forms of assistance is to use a grant program in conjunction with a VA loan. VA loans are a popular choice for military veterans and active-duty personnel because they offer more lenient credit score requirements and lower interest rates. By combining a VA loan with a grant program, military veterans and active-duty personnel can reduce their down payment even further and lower their monthly mortgage payments.

For example, the Texas State Affordable Housing Corporation (TSAHC) offers a grant program that provides up to 4% of the home’s purchase price in down payment assistance. This grant can be used in conjunction with a VA loan to reduce the down payment even further. By combining these two forms of assistance, military veterans and active-duty personnel can purchase a home with a lower down payment and lower monthly mortgage payments.

By combining grants with other forms of assistance, first-time home buyers in Texas can maximize the benefits of homeownership and achieve their dream of owning a home. Whether you’re a first-time home buyer or a military veteran, there are grant programs available to help you achieve your goal of homeownership.

Common Mistakes to Avoid When Applying for First-Time Home Buyer Grants

When applying for first-time home buyer grants in Texas, there are several common mistakes to avoid. These mistakes can lead to delays or even rejection of the application, which can be frustrating and disappointing for first-time home buyers. In this section, we will discuss some of the most common mistakes to avoid when applying for first-time home buyer grants in Texas.

One of the most common mistakes to avoid is failing to meet the eligibility criteria for the grant program. Each grant program has its own set of eligibility criteria, which may include income limits, credit score requirements, and other factors. First-time home buyers should carefully review the eligibility criteria for each program to ensure they meet the requirements before applying.

Another common mistake to avoid is not providing required documentation. Grant programs typically require a range of documentation, including proof of income, credit reports, and identification. First-time home buyers should ensure they have all the required documentation before applying, and should carefully review the application to ensure all required fields are completed.

Not working with a qualified lender is another common mistake to avoid. Grant programs often require first-time home buyers to work with a qualified lender who is familiar with the program and its requirements. First-time home buyers should research and select a qualified lender who can guide them through the application process and help them avoid common mistakes.

Additionally, first-time home buyers should avoid applying for multiple grant programs at the same time. This can lead to confusion and delays, and may even result in rejection of the application. Instead, first-time home buyers should carefully research and select the grant program that best fits their needs and goals, and should focus on applying for that program only.

Finally, first-time home buyers should avoid waiting until the last minute to apply for a grant program. Grant programs often have limited funding, and may close to new applications when the funding is depleted. First-time home buyers should plan ahead and apply for a grant program as early as possible to ensure they have the best chance of approval.

By avoiding these common mistakes, first-time home buyers in Texas can increase their chances of approval for a grant program and achieve their dream of homeownership. Whether you’re a first-time home buyer or a seasoned homeowner, there are grant programs available to help you achieve your goals.

Success Stories from First-Time Home Buyers in Texas

For many first-time home buyers in Texas, the dream of homeownership seems out of reach. However, with the help of first-time home buyer grants and assistance programs, many individuals and families have been able to achieve their dream of owning a home. In this section, we will share some success stories from first-time home buyers in Texas who have used grants and assistance programs to purchase a home.

One such success story is that of Sarah, a first-time home buyer from Austin. Sarah had been renting for several years and was eager to own her own home. However, she was struggling to come up with the down payment and closing costs. After researching her options, Sarah discovered the Texas Department of Housing and Community Affairs (TDHCA) and its My First Texas Home (MFTH) Program. With the help of the MFTH Program, Sarah was able to receive a grant of up to 5% of the home’s purchase price in down payment assistance. She was also able to take advantage of a lower interest rate on her mortgage, which helped to reduce her monthly payments.

Another success story is that of John, a first-time home buyer from Dallas. John had been serving in the military for several years and was looking to purchase a home in Texas. However, he was struggling to come up with the down payment and closing costs. After researching his options, John discovered the Texas State Affordable Housing Corporation (TSAHC) and its Homes for Texas Heroes Program. With the help of the Homes for Texas Heroes Program, John was able to receive a grant of up to 5% of the home’s purchase price in down payment assistance. He was also able to take advantage of a lower interest rate on his mortgage, which helped to reduce his monthly payments.

These success stories illustrate the impact that first-time home buyer grants and assistance programs can have on individuals and families in Texas. By providing financial assistance and other forms of support, these programs can help to make the dream of homeownership a reality for many people.

In addition to these success stories, there are many other examples of first-time home buyers in Texas who have used grants and assistance programs to purchase a home. These programs have helped to make homeownership more accessible and affordable for many individuals and families, and have provided a sense of stability and security that comes with owning a home.

By sharing these success stories, we hope to inspire and motivate other first-time home buyers in Texas to pursue their dream of homeownership. With the help of first-time home buyer grants and assistance programs, many individuals and families can achieve their goal of owning a home and starting a new chapter in their lives.

Next Steps for First-Time Home Buyers in Texas

Now that you’ve learned about the different types of first-time home buyer grants available in Texas, it’s time to take the next step towards achieving your dream of homeownership. Here are some steps you can take to get started:

First, research and review the different grant programs available in Texas. Look into the eligibility criteria, application process, and benefits of each program to determine which one is best for you. You can visit the websites of the Texas Department of Housing and Community Affairs (TDHCA) and the Texas State Affordable Housing Corporation (TSAHC) to learn more about their grant programs.

Next, contact a qualified lender who is familiar with the grant programs available in Texas. A qualified lender can help you navigate the application process and ensure that you meet the eligibility criteria for the grant program you’re interested in. You can also ask your lender about other forms of assistance, such as FHA loans or VA loans, that you may be eligible for.

Once you’ve selected a grant program and a lender, it’s time to start the application process. Be sure to gather all the required documentation, including proof of income, credit reports, and identification. Your lender can help you with the application process and ensure that you have everything you need to submit a successful application.

Finally, don’t be afraid to seek the advice of a housing counselor if you need help navigating the home buying process. A housing counselor can provide you with valuable guidance and advice on how to achieve your dream of homeownership.

By following these steps, you can take the next step towards achieving your dream of homeownership in Texas. Remember to stay focused, persistent, and patient, and don’t be afraid to ask for help along the way. Good luck!