What are Instant Sign-Up Bonuses and How Do They Work?

Instant sign-up bonuses are a type of incentive offered by financial institutions to attract new customers to their debit card programs. Unlike traditional rewards programs, which may require customers to accumulate points or miles over time, instant sign-up bonuses provide a one-time reward immediately after signing up for a debit card. This can be a lucrative offer, especially for those who are looking for a new debit card with a free sign-up bonus.

Instant sign-up bonuses can take many forms, including cashback rewards, points, or other perks. For example, a debit card may offer a $100 cashback reward for new customers who sign up and make a certain number of purchases within a specified timeframe. These bonuses are designed to incentivize customers to choose a particular debit card over others in the market.

The benefits of receiving an instant sign-up bonus are numerous. For one, it provides an immediate reward for signing up for a new debit card, which can be a great motivator for those who are looking for a new financial product. Additionally, instant sign-up bonuses can help customers offset the costs associated with switching to a new debit card, such as any potential fees or charges.

However, it’s essential to note that not all instant sign-up bonuses are created equal. Some may come with strict eligibility requirements or hidden fees, so it’s crucial to carefully review the terms and conditions before signing up. By doing so, customers can ensure that they are getting the best possible deal on their new debit card.

Free debit cards with instant sign-up bonuses are becoming increasingly popular, and it’s easy to see why. With the rise of digital banking and online financial products, customers are looking for ways to get rewarded for their loyalty and business. Instant sign-up bonuses offer a unique opportunity for customers to get a head start on their financial goals, and they can be a valuable incentive for those who are looking for a new debit card.

How to Choose the Best Debit Card for Your Financial Needs

With so many debit cards on the market, choosing the right one can be overwhelming. However, by considering a few key factors, you can find a debit card that aligns with your financial goals and spending habits. When selecting a debit card, it’s essential to think about your lifestyle and how you plan to use the card.

One of the most critical factors to consider is fees. Look for a debit card with low or no fees, including monthly maintenance fees, ATM fees, and foreign transaction fees. Some debit cards may also offer fee-free overdraft protection or other perks that can save you money in the long run.

Interest rates are another crucial factor to consider. If you plan to carry a balance on your debit card, look for a card with a low interest rate. However, if you pay your balance in full each month, you may not need to worry about interest rates.

Rewards structures are also an essential consideration. If you want to earn cashback or rewards points, look for a debit card with a rewards program that aligns with your spending habits. For example, if you frequently dine out, look for a card that offers cashback on restaurant purchases.

When searching for a debit card with an instant sign-up bonus, consider the requirements for receiving the bonus. Some cards may require you to make a certain number of purchases or deposit a specific amount of money to qualify for the bonus.

Free debit cards with instant sign-up bonuses can be an excellent option for those who want to earn rewards without paying annual fees. By considering your financial needs and goals, you can find a debit card that offers the perfect combination of rewards, low fees, and convenient features.

Ultimately, the best debit card for you will depend on your individual financial situation and spending habits. By doing your research and comparing different cards, you can find a debit card that meets your needs and helps you achieve your financial goals.

Discover the Top Debit Cards with Instant Sign-Up Bonuses

Several debit cards on the market offer instant sign-up bonuses, providing an excellent opportunity for consumers to earn rewards and benefits. Here are some top debit cards with instant sign-up bonuses:

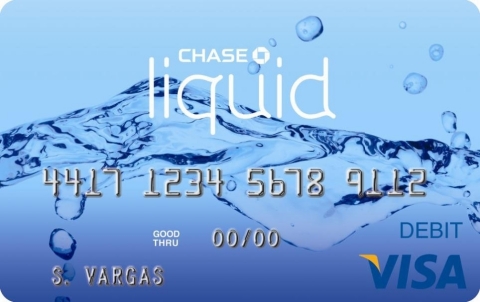

Chase Bank’s Liquid Card is a popular option that offers a $200 instant sign-up bonus for new customers who open a Chase Liquid account and complete a series of qualifying activities. This card also offers a rewards program that provides 1% cashback on all purchases, with no rotating categories or spending limits.

PNC Bank’s Virtual Wallet is another top debit card that offers an instant sign-up bonus of $200 for new customers who open a Virtual Wallet account and complete a series of qualifying activities. This card also offers a rewards program that provides 1% cashback on all purchases, with no rotating categories or spending limits.

Discover’s Cashback Debit Card is a great option for those who want to earn cashback rewards on their debit card purchases. This card offers 1% cashback on up to $3,000 in debit card purchases each month, with no rotating categories or spending limits. New customers can also earn a $100 instant sign-up bonus for opening a Discover Cashback Debit account and completing a series of qualifying activities.

These debit cards offer a range of benefits and rewards, including instant sign-up bonuses, cashback rewards, and low fees. By considering these options, consumers can find a debit card that meets their financial needs and provides a valuable rewards program.

Free debit cards with instant sign-up bonuses can be an excellent option for those who want to earn rewards without paying annual fees. By doing your research and comparing different cards, you can find a debit card that offers the perfect combination of rewards, low fees, and convenient features.

When selecting a debit card with an instant sign-up bonus, be sure to read the terms and conditions carefully to understand the requirements for receiving the bonus and any potential fees or restrictions.

Chase Bank’s Liquid Card: A Closer Look at its Instant Sign-Up Bonus

Chase Bank’s Liquid Card is a popular debit card that offers a $200 instant sign-up bonus for new customers who open a Chase Liquid account and complete a series of qualifying activities. This card is designed for individuals who want to manage their finances effectively and earn rewards on their debit card purchases.

To qualify for the instant sign-up bonus, new customers must open a Chase Liquid account and complete the following activities within 60 days of account opening: make a direct deposit of at least $500, make 10 debit card purchases, and set up online banking. Once these activities are completed, the $200 bonus will be deposited into the customer’s account within 10 business days.

In addition to the instant sign-up bonus, the Chase Liquid Card offers a range of benefits and features, including a rewards program that provides 1% cashback on all purchases, with no rotating categories or spending limits. This card also offers a mobile banking app that allows customers to manage their accounts, pay bills, and transfer funds on the go.

The Chase Liquid Card has a monthly maintenance fee of $4.95, but this fee can be waived if the customer has a direct deposit of at least $500 or maintains a minimum balance of $300. This card also has a foreign transaction fee of 3%, but this fee can be waived if the customer has a Chase Sapphire Preferred or Chase Sapphire Reserve credit card.

Overall, the Chase Liquid Card is a great option for individuals who want to earn rewards on their debit card purchases and manage their finances effectively. The instant sign-up bonus of $200 is a valuable incentive for new customers, and the card’s rewards program and mobile banking app make it a convenient and user-friendly option.

Free debit cards with instant sign-up bonuses like the Chase Liquid Card can be an excellent option for those who want to earn rewards without paying annual fees. By considering the features and benefits of this card, individuals can make an informed decision about whether it is the right choice for their financial needs.

Maximizing Your Rewards: Tips for Using Your Debit Card Effectively

To get the most out of your debit card’s rewards program, it’s essential to understand how to earn and redeem points or cashback effectively. Here are some tips to help you maximize your rewards:

First, make sure you understand the rewards structure of your debit card. Check the terms and conditions to see how points or cashback are earned and redeemed. Some debit cards may offer rewards on specific categories, such as groceries or gas, while others may offer flat-rate rewards on all purchases.

Next, use your debit card for all your daily purchases, including small transactions like coffee or snacks. This will help you earn points or cashback on a consistent basis, which can add up over time.

Another tip is to take advantage of bonus rewards categories. Some debit cards may offer bonus rewards on specific categories, such as 5% cashback on groceries or 3% cashback on gas. Make sure you understand which categories offer bonus rewards and use your debit card accordingly.

Additionally, consider using your debit card for online purchases. Many debit cards offer rewards on online purchases, and some may even offer bonus rewards on specific online retailers.

Finally, make sure you redeem your rewards regularly. Some debit cards may have expiration dates on rewards, so it’s essential to redeem them before they expire. You can usually redeem rewards through the debit card issuer’s website or mobile app.

By following these tips, you can maximize your rewards and get the most out of your debit card’s rewards program. Free debit cards with instant sign-up bonuses can be an excellent option for those who want to earn rewards without paying annual fees. By understanding how to earn and redeem rewards effectively, you can make the most of your debit card and achieve your financial goals.

Remember, the key to maximizing your rewards is to understand the rewards structure of your debit card and use it consistently. By doing so, you can earn points or cashback on a regular basis and redeem them for rewards that matter to you.

Common Mistakes to Avoid When Applying for a Debit Card with a Sign-Up Bonus

When applying for a debit card with a sign-up bonus, it’s essential to be aware of potential pitfalls that can cost you money or affect your credit score. Here are some common mistakes to avoid:

One of the most significant mistakes is not reading the terms and conditions carefully. Many debit cards with sign-up bonuses come with hidden fees, such as monthly maintenance fees, ATM fees, or foreign transaction fees. Make sure you understand all the fees associated with the card before applying.

Another mistake is not meeting the eligibility requirements for the sign-up bonus. Some debit cards may require you to make a certain number of purchases or deposit a specific amount of money to qualify for the bonus. Make sure you understand the requirements and can meet them before applying.

Additionally, be aware of the credit score requirements for the debit card. Some debit cards may require a good credit score to qualify for the sign-up bonus or to avoid high fees. Make sure you understand the credit score requirements and can meet them before applying.

It’s also essential to avoid applying for multiple debit cards with sign-up bonuses in a short period. This can negatively affect your credit score and may lead to rejection. Instead, apply for one debit card at a time and wait for the approval before applying for another.

Finally, be cautious of debit cards with sign-up bonuses that seem too good to be true. Some debit cards may offer extremely high sign-up bonuses or rewards rates, but these may come with hidden fees or strict eligibility requirements. Always read the terms and conditions carefully and do your research before applying.

By avoiding these common mistakes, you can ensure that you get the most out of your debit card with a sign-up bonus and avoid any potential pitfalls. Free debit cards with instant sign-up bonuses can be an excellent option for those who want to earn rewards without paying annual fees. By being aware of the potential mistakes and taking the necessary precautions, you can make the most of your debit card and achieve your financial goals.

Instant Sign-Up Bonuses: Are They Worth the Hype?

Instant sign-up bonuses have become a popular incentive for debit card issuers to attract new customers. But are they worth the hype? In this section, we’ll discuss the pros and cons of instant sign-up bonuses and whether they are a worthwhile incentive for choosing a debit card.

One of the main advantages of instant sign-up bonuses is that they provide an immediate reward for signing up for a debit card. This can be a great motivator for individuals who want to earn rewards quickly. Additionally, instant sign-up bonuses can be a good way to offset the costs associated with switching to a new debit card, such as any potential fees or charges.

However, there are also some potential drawbacks to consider. For example, some debit cards with instant sign-up bonuses may come with strict eligibility requirements or hidden fees. Additionally, the rewards structure of the debit card may not be as generous as other cards on the market.

Another consideration is that instant sign-up bonuses may not be as valuable as they seem. For example, a debit card may offer a $200 instant sign-up bonus, but the rewards structure of the card may only provide 1% cashback on purchases. In this case, the instant sign-up bonus may not be as valuable as a debit card with a more generous rewards structure.

Ultimately, whether or not an instant sign-up bonus is worth the hype depends on the individual’s financial goals and needs. If you’re looking for a debit card with a generous rewards structure and low fees, an instant sign-up bonus may be a good incentive to consider. However, if you’re looking for a debit card with a specific feature or benefit, an instant sign-up bonus may not be as important.

Free debit cards with instant sign-up bonuses can be a great option for individuals who want to earn rewards quickly and easily. By considering the pros and cons of instant sign-up bonuses and doing your research, you can find a debit card that meets your financial needs and provides a valuable rewards program.

https://www.youtube.com/watch?v=M-s-4DOFGU8

Conclusion: Finding the Best Debit Card for Your Financial Future

In conclusion, instant sign-up bonuses can be a valuable incentive for choosing a debit card. By considering the pros and cons of instant sign-up bonuses and doing your research, you can find a debit card that meets your financial needs and provides a generous rewards program.

When selecting a debit card with an instant sign-up bonus, it’s essential to consider your financial goals and spending habits. Look for a debit card that aligns with your needs and provides a rewards structure that is generous and easy to understand.

Additionally, be aware of potential pitfalls to avoid when applying for a debit card with a sign-up bonus, such as hidden fees or strict eligibility requirements. By doing your research and carefully reviewing the terms and conditions, you can avoid these pitfalls and find a debit card that meets your needs.

Free debit cards with instant sign-up bonuses can be a great option for individuals who want to earn rewards quickly and easily. By considering the key takeaways from this article and doing your research, you can find a debit card that provides a valuable rewards program and meets your financial needs.

Remember, the key to finding the best debit card for your financial future is to do your research and carefully consider your options. By taking the time to review the terms and conditions and understand the rewards structure, you can find a debit card that meets your needs and provides a generous rewards program.