Unlocking the Power of High Yield Savings Accounts

High yield savings accounts have become an increasingly popular option for individuals seeking to maximize their savings while minimizing risk. These accounts offer a higher interest rate compared to traditional savings accounts, allowing individuals to earn a higher return on their deposits. With the rise of online banking, high yield savings accounts have become more accessible, making it easier for individuals to take advantage of their benefits.

One of the primary advantages of high yield savings accounts is their low risk. Unlike investments in the stock market or other securities, high yield savings accounts are typically insured by the FDIC or NCUA, protecting deposits up to $250,000. This makes them an attractive option for individuals seeking to preserve their capital while earning a higher interest rate.

High yield savings accounts can be an effective tool for achieving savings goals, such as building an emergency fund, saving for a down payment on a house, or funding a big purchase. By earning a higher interest rate, individuals can accelerate their savings and reach their goals faster. Additionally, high yield savings accounts can provide a sense of security and peace of mind, knowing that deposits are safe and earning a competitive interest rate.

When considering a high yield savings account, it’s essential to evaluate the account’s features and benefits. This includes the interest rate, fees, minimum balance requirements, and mobile banking capabilities. By carefully evaluating these factors, individuals can choose a high yield savings account that aligns with their financial goals and needs.

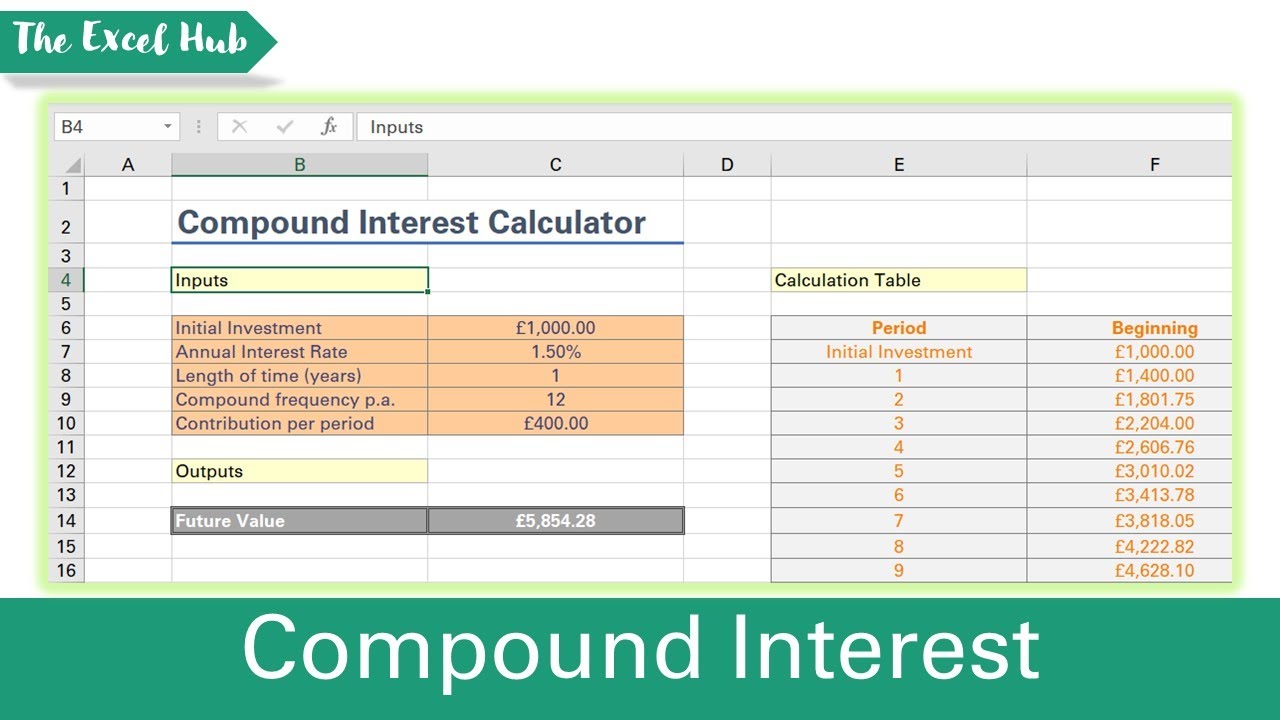

Furthermore, utilizing a high yield savings account calculator can help individuals determine the potential earnings of a high yield savings account. These calculators take into account the interest rate, principal amount, and time period to provide an estimate of the total interest earned. By using a high yield savings account calculator, individuals can make informed decisions about their savings and optimize their earnings.

How to Choose the Best High Yield Savings Account for Your Needs

When selecting a high yield savings account, there are several key factors to consider. One of the most important is the interest rate, as it can significantly impact the growth of your savings over time. Look for accounts that offer competitive interest rates, and be sure to check the APY (Annual Percentage Yield) to ensure you’re getting the best rate available.

Another crucial factor to consider is fees. Some high yield savings accounts may come with fees for services such as overdrafts, ATM withdrawals, or maintenance. Be sure to review the fee schedule carefully to avoid any unexpected charges. Additionally, consider the minimum balance requirements for the account, as some may require a higher balance to avoid fees or earn interest.

Mobile banking capabilities are also an essential consideration. Look for accounts that offer user-friendly mobile apps, allowing you to easily manage your account, transfer funds, and monitor your balance on the go. This can be especially useful for individuals who need to access their account frequently or want to stay on top of their finances.

Furthermore, consider the reputation and stability of the financial institution offering the high yield savings account. Look for institutions that are FDIC-insured or NCUA-insured, as this provides an added layer of protection for your deposits. Additionally, research the institution’s customer service and support, as this can be an important factor in your overall satisfaction with the account.

By carefully evaluating these factors, you can choose a high yield savings account that meets your needs and helps you achieve your savings goals. Remember to also consider using a high yield savings account calculator to determine the potential earnings of your account and make informed decisions about your savings.

Top High Yield Savings Accounts to Consider

When it comes to high yield savings accounts, there are several top options to consider. Ally, Marcus, and Discover are three of the most popular and highly-regarded institutions offering high yield savings accounts. Here’s a brief overview of each:

Ally’s High Yield Savings Account offers a competitive interest rate and no minimum balance requirement. Ally is also known for its user-friendly mobile app and 24/7 customer support. Additionally, Ally’s account is FDIC-insured, providing an added layer of protection for deposits.

Marcus by Goldman Sachs offers a High Yield Savings Account with a competitive interest rate and no fees. Marcus is also known for its low minimum balance requirement and mobile banking capabilities. Additionally, Marcus’ account is FDIC-insured, providing an added layer of protection for deposits.

Discover’s High Yield Savings Account offers a competitive interest rate and no fees. Discover is also known for its mobile banking capabilities and 24/7 customer support. Additionally, Discover’s account is FDIC-insured, providing an added layer of protection for deposits.

When comparing these high yield savings accounts, consider the interest rates, fees, and minimum balance requirements. It’s also essential to evaluate the mobile banking capabilities and customer support offered by each institution. By doing so, you can choose the best high yield savings account for your needs and maximize your savings.

Using a high yield savings account calculator can also help you determine the potential earnings of each account and make informed decisions about your savings. By considering these top high yield savings accounts and using a calculator to optimize your savings, you can achieve your savings goals and maximize your earnings.

Using a High Yield Savings Account Calculator to Optimize Your Savings

A high yield savings account calculator is a valuable tool that can help individuals make informed decisions about their savings strategy. By using a calculator, savers can determine the potential earnings of a high yield savings account and compare different options to find the best fit for their needs.

One of the primary benefits of using a high yield savings account calculator is that it allows individuals to see the impact of different interest rates and compounding frequencies on their savings. By inputting the principal amount, interest rate, and compounding frequency, the calculator can provide a clear picture of how much interest will be earned over a specific period.

For example, let’s say an individual wants to save $10,000 in a high yield savings account with a 2.0% APY, compounded daily. Using a high yield savings account calculator, they can see that after one year, their savings will have earned approximately $200 in interest, bringing their total balance to $10,200. This can help them understand the potential earnings of their savings and make informed decisions about their financial goals.

High yield savings account calculators can also help individuals compare different accounts and find the best option for their needs. By inputting the details of different accounts, such as the interest rate, fees, and minimum balance requirements, the calculator can provide a side-by-side comparison of the different options. This can help individuals make an informed decision about which account is best for them.

In addition to helping individuals make informed decisions, high yield savings account calculators can also help them optimize their savings strategy. By using a calculator, individuals can see the impact of different savings strategies, such as making regular deposits or increasing the principal amount, on their earnings. This can help them develop a savings plan that is tailored to their financial goals and maximizes their earnings.

When using a high yield savings account calculator, it’s essential to consider the following factors:

- Interest rate: Look for a calculator that allows you to input the interest rate of the account you’re considering.

- Compounding frequency: Make sure the calculator takes into account the compounding frequency of the account, whether it’s daily, monthly, or annually.

- Principal amount: Input the amount you plan to save to see the potential earnings.

- Timeframe: Consider the timeframe you plan to save for, whether it’s a few months or several years.

By using a high yield savings account calculator and considering these factors, individuals can make informed decisions about their savings strategy and optimize their earnings. Whether you’re saving for a short-term goal or a long-term objective, a high yield savings account calculator can help you achieve your financial goals.

https://www.youtube.com/watch?v=Zh0OOlt12Og

Understanding the Impact of Compound Interest on Your Savings

Compound interest is a powerful force that can significantly impact the growth of savings over time. When it comes to high yield savings accounts, understanding how compound interest works can help individuals maximize their earnings and achieve their savings goals.

Compound interest is the process of earning interest on both the principal amount and any accrued interest over time. This means that as interest is earned, it is added to the principal amount, and then the interest rate is applied to the new total. This creates a snowball effect, where the interest earned in previous periods becomes the base for the interest earned in subsequent periods.

High yield savings accounts can take advantage of compound interest to maximize earnings. By offering higher interest rates than traditional savings accounts, high yield savings accounts can help individuals earn more interest over time. Additionally, many high yield savings accounts compound interest daily, which means that interest is earned and added to the principal amount every day.

To illustrate the impact of compound interest on high yield savings accounts, consider the following example:

Suppose an individual deposits $10,000 into a high yield savings account with a 2.0% APY, compounded daily. After one year, the account would have earned approximately $200 in interest, bringing the total balance to $10,200. In the second year, the interest rate would be applied to the new total of $10,200, earning approximately $204 in interest. This process continues, with the interest earned in each period becoming the base for the interest earned in the next period.

As this example demonstrates, compound interest can have a significant impact on the growth of savings over time. By earning interest on both the principal amount and any accrued interest, high yield savings accounts can help individuals maximize their earnings and achieve their savings goals.

It’s essential to note that compound interest can be affected by various factors, including the interest rate, compounding frequency, and principal amount. By understanding how these factors interact, individuals can make informed decisions about their savings strategy and optimize their earnings.

Some key factors to consider when it comes to compound interest and high yield savings accounts include:

- Interest rate: Look for high yield savings accounts with competitive interest rates to maximize earnings.

- Compounding frequency: Daily compounding can result in higher earnings over time compared to monthly or annual compounding.

- Principal amount: The more you save, the more interest you can earn, and the greater the impact of compound interest.

By understanding the impact of compound interest on high yield savings accounts, individuals can make informed decisions about their savings strategy and maximize their earnings. Whether you’re saving for a short-term goal or a long-term objective, high yield savings accounts can help you achieve your financial goals.

Tips for Getting the Most Out of Your High Yield Savings Account

To maximize the benefits of a high yield savings account, it’s essential to use it effectively. Here are some practical tips to help you get the most out of your high yield savings account:

1. Monitor interest rates: Keep an eye on interest rates and adjust your savings strategy accordingly. When interest rates rise, consider transferring your funds to a high yield savings account with a higher interest rate.

2. Make regular deposits: Set up a regular deposit schedule to take advantage of compound interest. This can help you earn more interest over time and reach your savings goals faster.

3. Minimize fees: Be aware of any fees associated with your high yield savings account, such as maintenance fees or overdraft fees. Look for accounts with low or no fees to maximize your earnings.

4. Take advantage of mobile banking: Many high yield savings accounts offer mobile banking apps that allow you to manage your account on the go. Take advantage of these features to monitor your account, transfer funds, and make deposits.

5. Consider a savings challenge: Consider implementing a savings challenge, such as the “52-week savings challenge,” where you save an amount equal to the number of the week. This can help you stay motivated and reach your savings goals.

6. Use a high yield savings account calculator: A high yield savings account calculator can help you determine the potential earnings of your account and make informed decisions about your savings strategy.

7. Avoid unnecessary withdrawals: Try to avoid making unnecessary withdrawals from your high yield savings account, as this can reduce your earnings and slow down your progress towards your savings goals.

8. Consider a savings account with a high-yield savings tier: Some high yield savings accounts offer higher interest rates for larger balances. Consider opening a savings account with a high-yield savings tier to maximize your earnings.

9. Read the fine print: Before opening a high yield savings account, read the fine print and understand the terms and conditions. Look for accounts with flexible terms and minimal restrictions.

10. Review and adjust: Regularly review your high yield savings account and adjust your strategy as needed. This can help you stay on track and reach your savings goals.

By following these tips, you can get the most out of your high yield savings account and achieve your savings goals. Remember to always monitor interest rates, minimize fees, and take advantage of mobile banking features to maximize your earnings.

Common Mistakes to Avoid When Using a High Yield Savings Account

While high yield savings accounts can be a great way to earn interest on your savings, there are some common mistakes to avoid in order to maximize your earnings. Here are some of the most common mistakes individuals make when using high yield savings accounts:

1. Neglecting to monitor interest rates: Interest rates can change over time, and failing to monitor them can result in missed opportunities to earn higher interest. Make sure to regularly check the interest rates offered by your high yield savings account and consider switching to a higher-yielding account if necessary.

2. Failing to take advantage of mobile banking features: Many high yield savings accounts offer mobile banking apps that allow you to manage your account on the go. Failing to take advantage of these features can result in missed opportunities to earn interest and manage your account effectively.

3. Not meeting minimum balance requirements: Some high yield savings accounts require a minimum balance to avoid fees or earn interest. Failing to meet these requirements can result in fees or reduced interest earnings.

4. Making unnecessary withdrawals: High yield savings accounts are designed to help you save money, not to provide easy access to cash. Making unnecessary withdrawals can result in reduced interest earnings and may even trigger fees.

5. Not considering fees: While high yield savings accounts often have low fees, some accounts may charge fees for certain services, such as overdrafts or ATM withdrawals. Failing to consider these fees can result in unexpected charges and reduced interest earnings.

6. Not taking advantage of compound interest: Compound interest can significantly impact the growth of your savings over time. Failing to take advantage of compound interest can result in reduced interest earnings and slower progress towards your savings goals.

7. Not regularly reviewing your account: Regularly reviewing your high yield savings account can help you identify areas for improvement and ensure that you’re earning the highest interest rate possible. Failing to regularly review your account can result in missed opportunities to optimize your savings strategy.

8. Not considering alternative accounts: There may be alternative high yield savings accounts that offer better interest rates or terms. Failing to consider these alternatives can result in reduced interest earnings and slower progress towards your savings goals.

By avoiding these common mistakes, individuals can maximize their earnings and achieve their savings goals with a high yield savings account. Remember to regularly monitor interest rates, take advantage of mobile banking features, and consider alternative accounts to optimize your savings strategy.

Conclusion: Maximizing Your Savings with High Yield Savings Accounts

In conclusion, high yield savings accounts offer a powerful tool for individuals looking to maximize their savings and achieve their financial goals. By understanding the benefits and features of high yield savings accounts, individuals can make informed decisions about their savings strategy and optimize their earnings.

Throughout this article, we’ve discussed the importance of using a high yield savings account calculator to determine the potential earnings of a high yield savings account. We’ve also explored the key factors to consider when selecting a high yield savings account, including interest rates, fees, minimum balance requirements, and mobile banking capabilities.

In addition, we’ve reviewed and compared popular high yield savings accounts, including those offered by Ally, Marcus, and Discover. We’ve also discussed the concept of compound interest and how it can significantly impact the growth of savings over time.

By following the tips and strategies outlined in this article, individuals can maximize their earnings and achieve their savings goals with a high yield savings account. Remember to regularly monitor interest rates, take advantage of mobile banking features, and consider alternative accounts to optimize your savings strategy.

High yield savings accounts offer a low-risk and flexible way to save money and earn interest. By understanding the benefits and features of these accounts, individuals can make informed decisions about their savings strategy and achieve their financial goals.

Start exploring your options today and optimize your savings strategy with a high yield savings account. With the right account and strategy, you can maximize your earnings and achieve your savings goals.

By using a high yield savings account calculator and following the tips and strategies outlined in this article, individuals can make the most of their savings and achieve their financial goals. Don’t miss out on the opportunity to maximize your earnings and achieve your savings goals with a high yield savings account.