What is a Home Equity Line of Credit and How Does it Work?

A home equity line of credit (HELOC) is a type of loan that allows homeowners to borrow money using the equity in their home as collateral. It is a revolving line of credit, meaning that homeowners can draw on the funds as needed, and repay them as they go. This type of loan is often used to finance home renovations, consolidate debt, or cover unexpected expenses.

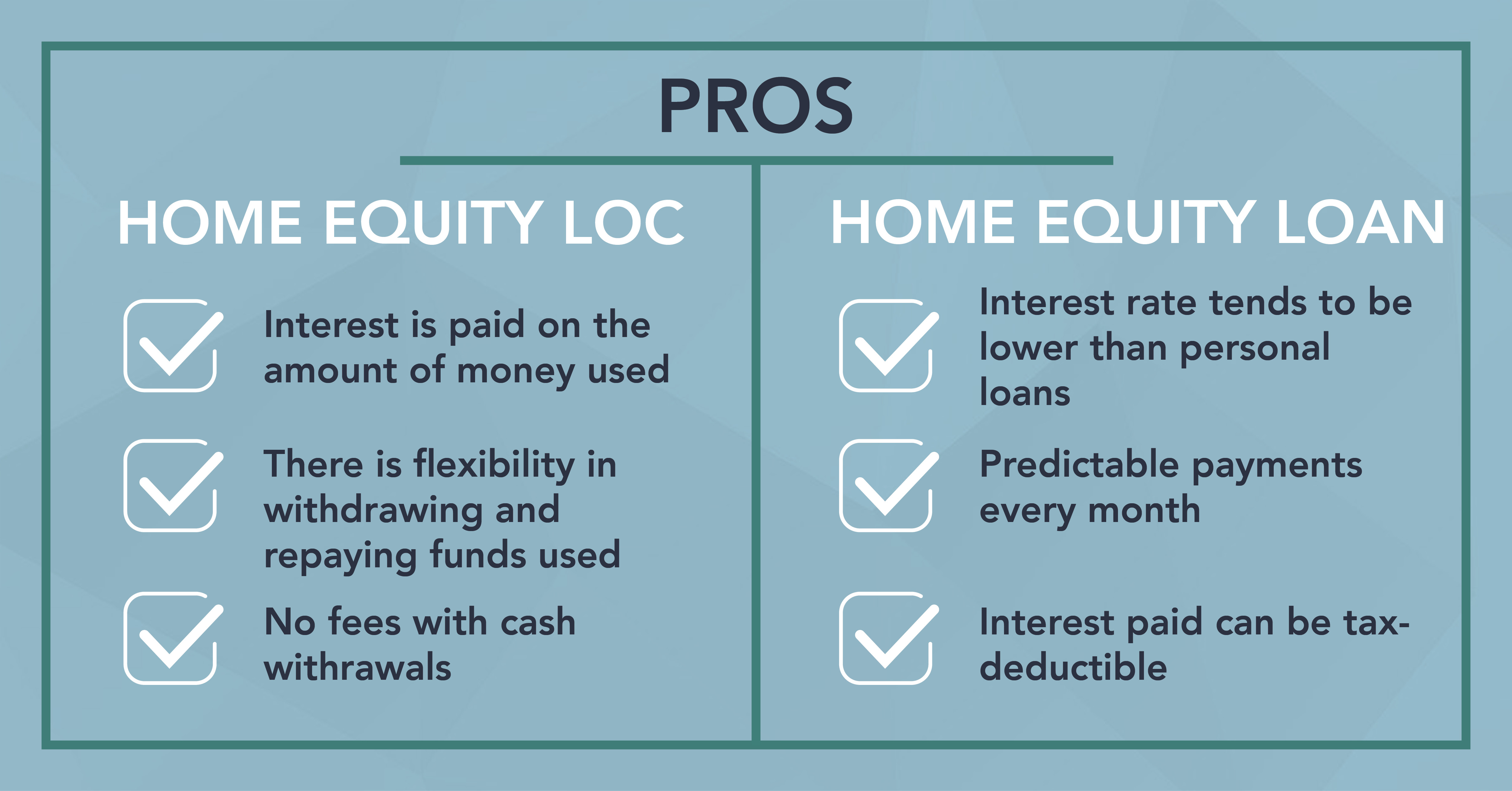

One of the key benefits of a HELOC is its flexibility. Homeowners can use the funds for a variety of purposes, and can choose to repay the loan over a period of time that works for them. Additionally, the interest rates on HELOCs are often lower than those on other types of loans, making them a more affordable option for many homeowners.

HELOCs differ from traditional home equity loans in that they are revolving lines of credit, rather than lump-sum loans. This means that homeowners can draw on the funds as needed, rather than receiving a single payment upfront. This can be beneficial for homeowners who need to finance ongoing projects, or who want to have access to funds in case of an emergency.

For example, a homeowner might use a HELOC to finance a home renovation project. They could draw on the funds as needed to pay for materials and labor, and then repay the loan over time. Alternatively, a homeowner might use a HELOC to consolidate debt, such as credit card balances or personal loans. By consolidating their debt into a single loan with a lower interest rate, homeowners can save money on interest and simplify their finances.

Overall, a HELOC can be a valuable tool for homeowners who need to access funds for a variety of purposes. By understanding how a HELOC works, and how it can be used, homeowners can make informed decisions about their financial options.

When considering a HELOC, it’s essential to understand the home equity line of credit requirements. Lenders typically require homeowners to have a certain amount of equity in their home, as well as a good credit score and a stable income. Homeowners should also be aware of the fees and interest rates associated with a HELOC, and should carefully review the terms and conditions of the loan before signing.

By doing their research and understanding the home equity line of credit requirements, homeowners can make informed decisions about their financial options and choose the best loan for their needs.

How to Qualify for a Home Equity Line of Credit: Meeting the Requirements

To qualify for a home equity line of credit (HELOC), homeowners must meet certain requirements. These requirements typically include a good credit score, a stable income, and a sufficient amount of equity in their home. In this section, we will discuss the typical requirements for qualifying for a HELOC and provide tips on how to improve your chances of approval.

One of the most important factors in qualifying for a HELOC is credit score. Lenders typically require a minimum credit score of 620-650, although some may have stricter requirements. Homeowners with higher credit scores are more likely to be approved for a HELOC and may qualify for better interest rates. To improve your credit score, make sure to pay your bills on time, keep credit card balances low, and monitor your credit report for errors.

In addition to credit score, lenders also consider income and debt-to-income ratio when evaluating HELOC applications. Homeowners must have a stable income and a debt-to-income ratio of 36% or less. This means that your monthly debt payments, including the proposed HELOC payment, cannot exceed 36% of your gross income. To improve your chances of approval, consider reducing your debt or increasing your income.

Another important factor in qualifying for a HELOC is loan-to-value (LTV) ratio. LTV ratio is the percentage of your home’s value that you are borrowing against. For example, if your home is worth $200,000 and you want to borrow $100,000, your LTV ratio would be 50%. Lenders typically require an LTV ratio of 80% or less, although some may have stricter requirements. To improve your LTV ratio, consider making a larger down payment or reducing the amount you are borrowing.

Finally, lenders may also consider other factors, such as employment history and credit history, when evaluating HELOC applications. To improve your chances of approval, make sure to provide complete and accurate documentation, including pay stubs, tax returns, and credit reports.

By understanding the home equity line of credit requirements and taking steps to improve your credit score, income, and LTV ratio, you can increase your chances of approval and secure a HELOC that meets your needs. Remember to carefully review the terms and conditions of the loan and compare rates and terms from different lenders before making a decision.

Meeting the home equity line of credit requirements is crucial to securing a HELOC. By following these tips and guidelines, homeowners can improve their chances of approval and access the funds they need to achieve their financial goals.

Understanding the Importance of Credit Score in HELOC Approval

Credit score plays a crucial role in the approval process for a home equity line of credit (HELOC). Lenders use credit scores to evaluate the creditworthiness of borrowers and determine the level of risk involved in lending. A good credit score can help borrowers qualify for a HELOC with a lower interest rate and more favorable terms.

The minimum credit score required for a HELOC varies from lender to lender, but most lenders require a credit score of at least 620-650. However, some lenders may have stricter requirements, and borrowers with credit scores below 700 may face higher interest rates or less favorable terms.

To improve your credit score and increase your chances of approval for a HELOC, it’s essential to understand the factors that affect your credit score. These factors include payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. By focusing on these areas, you can improve your credit score over time and qualify for better loan terms.

Payment history is the most significant factor in determining your credit score, accounting for 35% of the total score. Late payments, collections, and bankruptcies can all negatively impact your credit score. To improve your payment history, make sure to pay all bills on time, every time.

Credit utilization is another critical factor, accounting for 30% of the total score. This refers to the amount of credit used compared to the amount of credit available. To improve your credit utilization, keep credit card balances low and avoid applying for too many credit cards.

Length of credit history accounts for 15% of the total score. A longer credit history can help improve your credit score, as it demonstrates a track record of responsible credit behavior. To improve your credit history, consider keeping old accounts open and avoiding frequent credit inquiries.

Credit mix accounts for 10% of the total score. A diverse mix of credit types, such as credit cards, loans, and mortgages, can help improve your credit score. To improve your credit mix, consider applying for a personal loan or becoming an authorized user on someone else’s credit account.

New credit inquiries account for 10% of the total score. Avoid applying for too many credit cards or loans in a short period, as this can negatively impact your credit score. To improve your credit score, space out credit inquiries and avoid applying for credit unnecessarily.

By understanding the factors that affect your credit score and taking steps to improve your creditworthiness, you can increase your chances of approval for a HELOC and qualify for better loan terms. Remember to always check your credit report and dispute any errors to ensure that your credit score accurately reflects your credit history.

Meeting the home equity line of credit requirements, including a good credit score, is essential to securing a HELOC. By following these tips and guidelines, borrowers can improve their credit score and increase their chances of approval.

Assessing Your Home’s Value: How to Determine Your Loan-to-Value Ratio

When applying for a home equity line of credit (HELOC), one of the key factors lenders consider is the loan-to-value (LTV) ratio. The LTV ratio is the percentage of your home’s value that you are borrowing against. To determine your LTV ratio, you need to know the value of your home and the amount you want to borrow.

There are several ways to determine the value of your home, including:

1. Hire an appraiser: An appraiser can provide an independent assessment of your home’s value. This can be a costly option, but it provides a professional opinion of your home’s value.

2. Use online valuation tools: There are several online tools available that can provide an estimate of your home’s value. These tools use data from recent sales of similar homes in your area to estimate your home’s value.

3. Check with your local government: Your local government may have records of recent sales of homes in your area, which can give you an idea of your home’s value.

Once you have determined the value of your home, you can calculate your LTV ratio by dividing the amount you want to borrow by the value of your home. For example, if your home is worth $200,000 and you want to borrow $100,000, your LTV ratio would be 50%.

Lenders typically require an LTV ratio of 80% or less, although some may have stricter requirements. This means that if your home is worth $200,000, you can borrow up to $160,000. However, if your LTV ratio is higher than 80%, you may be required to pay private mortgage insurance (PMI), which can increase your monthly payments.

It’s essential to note that the LTV ratio is just one factor lenders consider when evaluating a HELOC application. Other factors, such as credit score, income, and debt-to-income ratio, also play a crucial role in determining whether you qualify for a HELOC and what interest rate you will be offered.

By understanding how to determine your LTV ratio and what it means for your HELOC application, you can make informed decisions about your financial options and increase your chances of approval. Remember to always review the terms and conditions of the loan carefully and compare rates and terms from different lenders before making a decision.

Meeting the home equity line of credit requirements, including a suitable LTV ratio, is crucial to securing a HELOC. By following these tips and guidelines, homeowners can improve their chances of approval and access the funds they need to achieve their financial goals.

Income and Debt Requirements: What You Need to Know

When applying for a home equity line of credit (HELOC), lenders consider several factors to determine your creditworthiness. In addition to your credit score and loan-to-value (LTV) ratio, your income and debt obligations play a crucial role in the approval process. Understanding the income and debt requirements for a HELOC can help you prepare and improve your chances of approval.

Lenders typically evaluate your debt-to-income (DTI) ratio to assess your ability to manage monthly payments. Your DTI ratio is calculated by dividing your total monthly debt payments by your gross income. A lower DTI ratio indicates a more manageable debt burden and increases your chances of approval. Typically, lenders prefer a DTI ratio of 36% or less, although some may consider higher ratios in certain circumstances.

To calculate your DTI ratio, add up your monthly debt payments, including:

- Mortgage payments

- Minimum credit card payments

- Car loan payments

- Student loan payments

- Alimony or child support payments

- Other debt obligations

Next, divide the total by your gross income. For example, if your monthly debt payments total $2,500 and your gross income is $6,000, your DTI ratio would be approximately 42% ($2,500 ÷ $6,000).

In addition to your DTI ratio, lenders may consider other income and debt factors, such as:

- Stable income: A steady income from a reliable source can improve your chances of approval.

- Debt history: A history of timely payments and low debt balances can positively impact your application.

- Credit utilization: Keeping credit card balances low and avoiding new credit inquiries can demonstrate responsible credit behavior.

To improve your chances of approval, consider the following strategies:

- Reduce debt: Paying off high-interest debt or consolidating debt into a lower-interest loan can lower your DTI ratio.

- Increase income: Taking on a side job or pursuing additional income sources can improve your debt-to-income ratio.

- Improve credit habits: Making timely payments and keeping credit utilization low can demonstrate responsible credit behavior.

By understanding the income and debt requirements for a HELOC and taking steps to improve your financial situation, you can increase your chances of approval and unlock the power of your home equity.

How to Apply for a Home Equity Line of Credit: A Step-by-Step Guide

Applying for a home equity line of credit (HELOC) can seem daunting, but breaking down the process into manageable steps can make it more accessible. By following this step-by-step guide, you can navigate the application process with confidence and increase your chances of approval.

Step 1: Gather Required Documents

To apply for a HELOC, you’ll need to provide various documents to support your application. These may include:

- Identification: Driver’s license, passport, or state ID

- Income verification: Pay stubs, W-2 forms, or tax returns

- Employment verification: Letter from employer or business tax returns

- Property documents: Deed, title report, or appraisal report

- Credit reports: Recent credit reports from the three major credit bureaus

Step 2: Choose a Lender

With numerous lenders offering HELOCs, it’s essential to research and compare rates, terms, and fees. Consider the following factors when selecting a lender:

- Interest rates: Look for competitive rates and consider the potential for rate changes

- Fees: Understand the origination fees, annual fees, and potential penalties

- Repayment terms: Consider the repayment period, minimum payment requirements, and potential for prepayment penalties

- Customer service: Evaluate the lender’s reputation, customer support, and online platform

Step 3: Submit Your Application

Once you’ve chosen a lender, submit your application, either online, by phone, or in-person. Be prepared to provide the required documents and answer questions about your income, employment, and property.

Step 4: Review and Sign the Loan Agreement

After submitting your application, the lender will review your creditworthiness and property value. If approved, you’ll receive a loan agreement outlining the terms and conditions of your HELOC. Carefully review the agreement, ensuring you understand the interest rate, fees, and repayment terms.

Step 5: Close the Loan and Access Your Funds

Once you’ve signed the loan agreement, the lender will disburse the funds, and you can access your HELOC. Use the funds wisely, making timely payments to avoid fees and penalties.

Additional Tips:

- Compare rates and terms from multiple lenders to ensure you’re getting the best deal

- Consider working with a mortgage broker to streamline the application process

- Don’t hesitate to ask questions or seek clarification on any aspect of the application process

By following these steps and being prepared, you can navigate the HELOC application process with confidence and unlock the power of your home equity.

Common Mistakes to Avoid When Applying for a HELOC

Applying for a home equity line of credit (HELOC) can be a complex process, and making mistakes can lead to delays, rejections, or unfavorable terms. To ensure a smooth application process, it’s essential to avoid common mistakes that can harm your chances of approval.

Mistake 1: Not Checking Your Credit Report

Before applying for a HELOC, it’s crucial to review your credit report to ensure it’s accurate and up-to-date. Errors or negative marks on your report can significantly impact your credit score and chances of approval. Obtain a copy of your credit report from the three major credit bureaus and dispute any errors or inaccuracies.

Mistake 2: Not Providing Complete Documentation

Failing to provide required documents or submitting incomplete applications can lead to delays or rejections. Ensure you have all necessary documents, including identification, income verification, employment verification, and property documents. Double-check your application to ensure it’s complete and accurate.

Mistake 3: Not Comparing Rates and Terms

Not comparing rates and terms from different lenders can result in unfavorable terms or higher interest rates. Research and compare offers from multiple lenders to ensure you’re getting the best deal. Consider factors such as interest rates, fees, repayment terms, and customer service.

Mistake 4: Not Understanding the Fine Print

Failing to understand the terms and conditions of your HELOC can lead to unexpected fees, penalties, or repayment terms. Carefully review the loan agreement and ask questions if you’re unsure about any aspect of the loan.

Mistake 5: Not Considering Alternative Options

Not exploring alternative options can lead to choosing a HELOC that’s not suitable for your needs. Consider other financing options, such as personal loans or credit cards, and weigh the pros and cons of each.

Mistake 6: Not Managing Your Debt

Failing to manage your debt can lead to overspending and accumulating more debt. Create a budget and prioritize your debt payments to ensure you’re using your HELOC responsibly.

Additional Tips:

- Work with a reputable lender to ensure a smooth application process

- Don’t apply for multiple credit products simultaneously, as this can negatively impact your credit score

- Keep records of your application and communication with the lender

By avoiding these common mistakes, you can ensure a successful HELOC application and unlock the power of your home equity.

Maximizing Your Home Equity: Tips for Using Your Line of Credit Wisely

Once you’ve secured a home equity line of credit (HELOC), it’s essential to use it wisely to maximize your home equity and avoid potential pitfalls. By following these tips, you can make the most of your HELOC and achieve your financial goals.

Tip 1: Manage Your Debt

A HELOC can be a powerful tool for consolidating debt, but it’s crucial to manage your debt responsibly. Create a budget and prioritize your debt payments to ensure you’re using your HELOC to reduce your debt burden, not increase it.

Tip 2: Avoid Overspending

A HELOC can provide a sense of financial freedom, but it’s essential to avoid overspending. Set a budget and stick to it, and avoid using your HELOC for non-essential purchases. Remember, your HELOC is a loan, and you’ll need to repay it with interest.

Tip 3: Make Timely Payments

Making timely payments is crucial to avoiding fees and penalties associated with your HELOC. Set up automatic payments to ensure you never miss a payment, and consider making extra payments to pay off your principal balance faster.

Tip 4: Monitor Your Credit Report

Regularly monitoring your credit report can help you detect any errors or negative marks that could impact your credit score. Check your report regularly and dispute any errors or inaccuracies to ensure your credit score remains healthy.

Tip 5: Consider a Budgeting App

Using a budgeting app can help you track your expenses and stay on top of your finances. Consider using an app like Mint or Personal Capital to help you manage your debt and stay on track with your financial goals.

Additional Tips:

- Keep records of your HELOC payments and correspondence with your lender

- Consider working with a financial advisor to create a personalized budget and financial plan

- Don’t use your HELOC as an emergency fund – consider building a separate emergency fund to cover unexpected expenses

By following these tips, you can maximize your home equity and use your HELOC wisely to achieve your financial goals. Remember to always prioritize responsible borrowing and debt management to ensure a healthy financial future.