Why Financial Literacy Matters for Young Minds

Financial literacy is a crucial life skill that can benefit individuals of all ages, but it is especially important for teenagers to learn how to manage their finances effectively. Teaching financial literacy to 13-year-olds can have a significant impact on their future financial stability and independence. By understanding the basics of personal finance, teenagers can develop good habits and make informed decisions about money that will serve them well throughout their lives.

One of the most effective ways to teach financial literacy is through hands-on experience. Having a part-time job or earning money through other means can help 13-year-olds develop essential life skills such as budgeting, saving, and investing. By earning their own money, teenagers can learn the value of hard work and the importance of making smart financial decisions. This, in turn, can help them develop a sense of financial responsibility and independence.

Moreover, financial literacy can also help teenagers avoid common financial pitfalls such as debt and overspending. By understanding how to create a budget and prioritize expenses, teenagers can make informed decisions about how to allocate their money. This can help them avoid financial stress and anxiety, and instead, focus on achieving their long-term financial goals.

In addition to teaching financial literacy, it is also essential to provide teenagers with opportunities to practice what they have learned. This can include opening a savings account, investing in a retirement fund, or even starting a small business. By providing teenagers with hands-on experience, parents and educators can help them develop the skills and confidence they need to succeed financially.

Overall, teaching financial literacy to 13-year-olds is an essential step in helping them develop the skills and knowledge they need to succeed financially. By providing them with hands-on experience and opportunities to practice what they have learned, parents and educators can help teenagers develop good financial habits and make informed decisions about money. This, in turn, can help them achieve financial independence and stability, and set them up for long-term success.

Exploring Online Opportunities for Teenage Entrepreneurs

The internet has opened up a world of opportunities for teenagers to earn money, and one of the most popular ways is through online platforms and websites. These platforms provide a range of ways for 13-year-olds to make money, from taking surveys and completing gig economy jobs to offering freelance services and selling products.

One of the most well-known online platforms for teenagers is Swagbucks, which allows users to earn money by taking surveys, watching videos, and shopping online. Another popular platform is Survey Junkie, which rewards users for completing surveys and providing feedback to businesses. Fiverr is another platform that allows teenagers to offer their skills and services, such as graphic design, writing, and social media management, starting at just $5 per gig.

In addition to these platforms, there are many other websites and apps that allow teenagers to earn money online. For example, UserTesting pays users for testing and providing feedback on websites and apps, while InboxDollars rewards users for taking surveys, playing games, and watching videos. Teenagers can also use platforms like Upwork and Freelancer to offer their services and compete for freelance projects.

When using online platforms to earn money, it’s essential for teenagers to be aware of the potential risks and take steps to protect themselves. This includes being cautious when sharing personal data, avoiding scams and phishing attempts, and using strong passwords and two-factor authentication to secure their accounts.

Overall, online platforms and websites provide a range of opportunities for 13-year-olds to earn money and develop their entrepreneurial skills. By exploring these opportunities and taking the necessary precautions, teenagers can start building their financial futures and achieving their goals.

For teenagers who are interested in learning more about how to make money online, there are many resources available. This includes online tutorials, blogs, and forums, as well as books and courses on entrepreneurship and online marketing. By taking the time to learn and understand the opportunities and risks of online earning, teenagers can set themselves up for success and start building their financial futures.

Monetizing Hobbies and Interests: Turning Passions into Profits

Many 13-year-olds have hobbies and interests that they are passionate about, and with a little creativity, these can be turned into money-making opportunities. One way to monetize a hobby is to sell handmade products. For example, if a teenager enjoys crafting or making jewelry, they can sell their creations online or at local markets.

Another way to turn a hobby into a money-making opportunity is to offer services related to that hobby. For example, if a teenager loves animals, they can offer pet-sitting or dog-walking services to neighbors and family friends. Similarly, if a teenager enjoys gardening, they can offer lawn-care services to homeowners in their area.

Creating and selling digital content is another way for 13-year-olds to monetize their hobbies and interests. For example, if a teenager enjoys writing, they can create and sell ebooks or articles on topics they are knowledgeable about. Similarly, if a teenager enjoys making videos, they can create and sell video content on platforms like YouTube or Vimeo.

Turning a hobby into a money-making opportunity requires some creativity and hard work, but it can be a rewarding way for 13-year-olds to earn money and develop their entrepreneurial skills. By identifying their passions and interests, and finding ways to monetize them, teenagers can start building their financial futures and achieving their goals.

Some popular platforms for selling handmade products include Etsy and Redbubble, while platforms like Upwork and Freelancer can be used to offer services related to a hobby. For creating and selling digital content, platforms like Gumroad and Sellfy can be used.

When monetizing a hobby, it’s essential to consider the costs involved and to price products or services accordingly. It’s also important to be aware of any laws or regulations that may apply, such as those related to taxes or intellectual property.

Overall, turning a hobby into a money-making opportunity is a great way for 13-year-olds to earn money and develop their entrepreneurial skills. By being creative and hardworking, teenagers can turn their passions into profits and start building their financial futures.

Part-Time Jobs for Teenagers: Exploring Local Opportunities

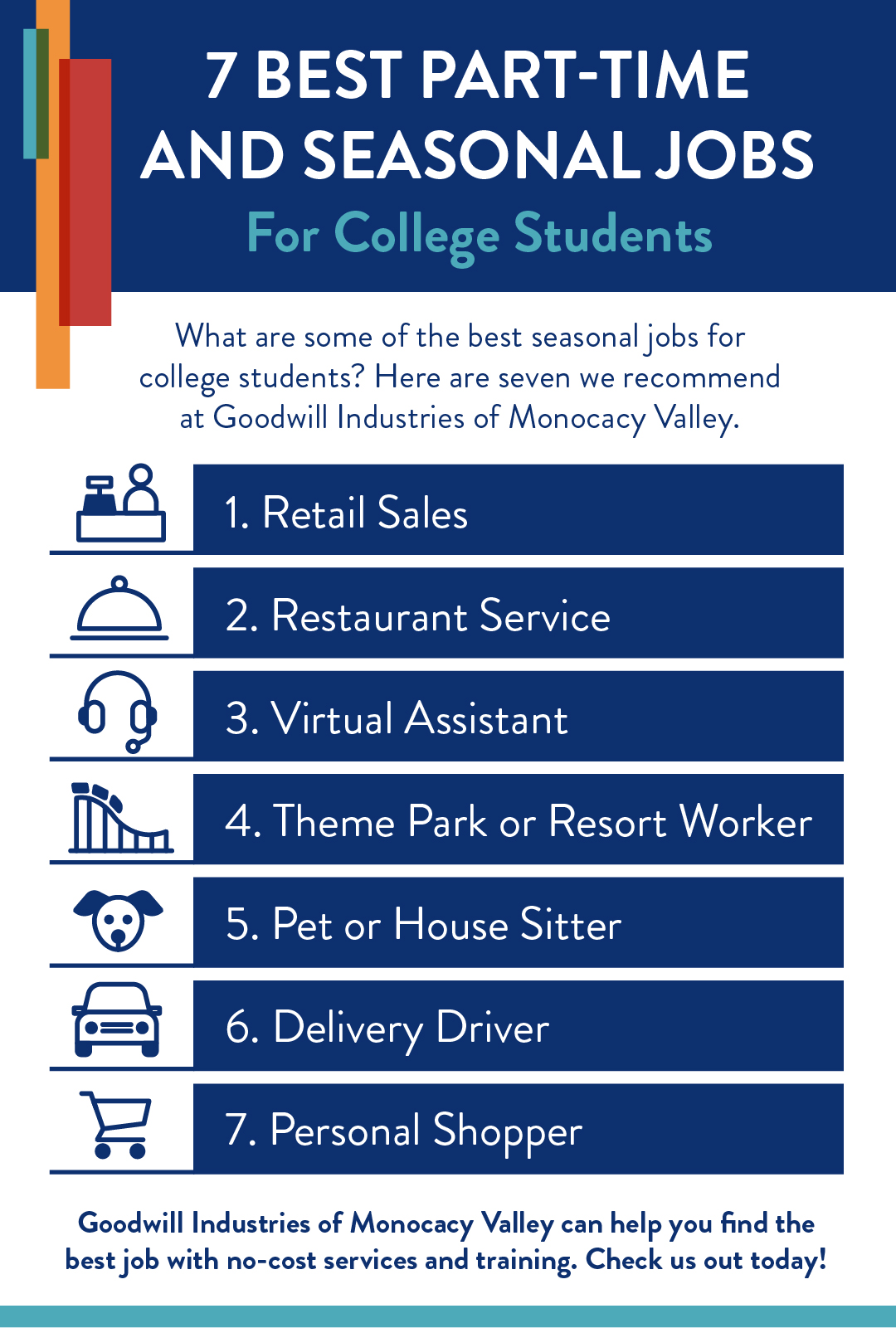

For many 13-year-olds, finding a part-time job is a great way to earn money and gain valuable work experience. Local part-time jobs can be found in a variety of industries, including retail, food service, and babysitting. In this section, we will explore some of the most common part-time jobs for teenagers and provide tips on how to find and apply for these jobs.

Retail jobs are a popular option for teenagers, as they often involve working in a store or shopping center. Some examples of retail jobs include working as a sales associate, cashier, or stockroom assistant. Food service jobs are another option, and can include working as a server, host/hostess, or kitchen staff member. Babysitting is also a popular option for teenagers, as it allows them to work with children and gain experience in childcare.

To find part-time jobs in the local community, teenagers can start by searching online job boards or visiting local businesses in person. Many businesses also post job openings on their social media pages or websites, so it’s a good idea to check these regularly. Additionally, teenagers can ask friends, family members, or teachers for job leads or recommendations.

When applying for part-time jobs, it’s essential to have a well-written resume and cover letter. A resume should include relevant work experience, skills, and education, while a cover letter should introduce the applicant and explain why they are a good fit for the job. Teenagers can also prepare for interviews by researching the company and practicing common interview questions.

Negotiating pay is also an important part of finding a part-time job. Teenagers should research the average pay rate for their job and location, and be prepared to negotiate their salary based on their skills and experience. It’s also essential to understand the terms of the job, including the number of hours worked per week and any benefits or perks.

Some popular websites for finding part-time jobs include Indeed, LinkedIn, and Glassdoor. Teenagers can also search for job openings on company websites or social media pages. By following these tips and being proactive in their job search, teenagers can find a part-time job that fits their skills and interests.

Remember, finding a part-time job is just the first step. Teenagers should also be prepared to work hard, learn new skills, and take on new challenges. By doing so, they can gain valuable work experience and set themselves up for long-term success.

Selling Products Online: A Guide to E-commerce for Teenagers

Selling products online is a great way for 13-year-olds to earn money and develop their entrepreneurial skills. With the rise of e-commerce, it’s easier than ever to start an online business and reach a global audience. In this section, we’ll provide a step-by-step guide on how to sell products online, including setting up an online store, marketing products, and managing finances.

The first step in selling products online is to choose a platform or website to sell on. Popular options include Amazon, eBay, and Etsy, as well as e-commerce websites like Shopify and WooCommerce. Each platform has its own fees and requirements, so it’s essential to research and compare options before making a decision.

Once you’ve chosen a platform, you’ll need to set up an online store. This includes creating a professional-looking website, adding products, and setting up payment and shipping options. Many platforms offer templates and tools to help you get started, but you may also want to consider hiring a web designer or developer to help you create a custom website.

Marketing your products is also crucial to success in e-commerce. This includes creating a social media presence, running ads, and optimizing your website for search engines. You can also use email marketing and influencer marketing to reach new customers and promote your products.

Managing finances is also an essential part of selling products online. This includes tracking sales, managing inventory, and handling customer service. You’ll also need to consider taxes and accounting, as well as any other financial regulations that apply to your business.

Some popular tools for managing e-commerce finances include QuickBooks and Xero, as well as payment processors like PayPal and Stripe. You can also use inventory management software like TradeGecko and Zoho Inventory to help you keep track of your products and orders.

Overall, selling products online is a great way for 13-year-olds to earn money and develop their entrepreneurial skills. By following these steps and using the right tools and platforms, you can create a successful online business and start building your financial future.

Remember, starting an online business takes time and effort, but it can be a rewarding and lucrative venture. By staying focused, working hard, and continuously learning and improving, you can achieve success in e-commerce and start building your financial independence.

Creating and Selling Digital Products: A Lucrative Opportunity

Creating and selling digital products is a lucrative opportunity for 13-year-olds to earn money and develop their entrepreneurial skills. Digital products can include ebooks, printables, courses, and software, and can be sold through various online platforms. In this section, we’ll discuss the potential of creating and selling digital products, and provide tips on how to get started.

One of the benefits of creating and selling digital products is that it allows 13-year-olds to monetize their skills and expertise. For example, if a teenager is skilled in graphic design, they can create and sell digital products such as printables, templates, and courses. Similarly, if a teenager is knowledgeable in a particular subject, they can create and sell ebooks, courses, and software.

Another benefit of creating and selling digital products is that it allows 13-year-olds to reach a global audience. With the rise of e-commerce and online marketplaces, it’s easier than ever to sell digital products to customers all over the world. This can be a great way for teenagers to earn money and develop their entrepreneurial skills, while also learning about marketing, sales, and customer service.

To get started with creating and selling digital products, 13-year-olds will need to identify their skills and expertise, and determine what type of digital product they want to create. They’ll also need to research their target market and competition, and develop a marketing and sales strategy. Additionally, they’ll need to consider the technical aspects of creating and selling digital products, such as website design, payment processing, and customer support.

Some popular platforms for creating and selling digital products include Gumroad, Sellfy, and Etsy. These platforms allow 13-year-olds to create and sell digital products, and provide tools and resources to help them get started. Additionally, there are many online resources and tutorials available that can help 13-year-olds learn about creating and selling digital products.

Overall, creating and selling digital products is a great way for 13-year-olds to earn money and develop their entrepreneurial skills. By identifying their skills and expertise, researching their target market and competition, and developing a marketing and sales strategy, 13-year-olds can create and sell digital products that meet the needs of their customers and help them achieve their financial goals.

Remember, creating and selling digital products requires hard work, dedication, and a willingness to learn and adapt. However, with the right mindset and resources, 13-year-olds can succeed in this lucrative opportunity and achieve their financial goals.

Staying Safe While Earning Money Online: Essential Tips

Earning money online can be a great way for 13-year-olds to gain financial independence, but it’s essential to stay safe while doing so. With the rise of online scams and cyber threats, it’s crucial to take steps to protect personal data, avoid scams, and maintain online security. In this section, we’ll provide essential tips and advice on how to stay safe while earning money online.

One of the most important things to do when earning money online is to protect personal data. This includes using strong passwords, keeping software up to date, and being cautious when sharing personal information. It’s also essential to use reputable websites and platforms, and to avoid clicking on suspicious links or downloading attachments from unknown sources.

Avoiding scams is also crucial when earning money online. This includes being wary of opportunities that seem too good to be true, and doing research on companies and websites before signing up. It’s also essential to read reviews and check ratings from other users to ensure that a website or platform is legitimate.

Maintaining online security is also essential when earning money online. This includes using antivirus software, keeping software up to date, and being cautious when using public Wi-Fi. It’s also essential to use a VPN (Virtual Private Network) when accessing public Wi-Fi to protect personal data.

Some popular tools for staying safe online include password managers like LastPass and 1Password, antivirus software like Norton and McAfee, and VPNs like ExpressVPN and NordVPN. These tools can help protect personal data, avoid scams, and maintain online security.

Additionally, it’s essential to be aware of online safety best practices, such as using strong passwords, keeping software up to date, and being cautious when sharing personal information. By following these tips and using the right tools, 13-year-olds can stay safe while earning money online and achieve their financial goals.

Remember, staying safe online is an ongoing process that requires constant vigilance and attention. By being aware of online safety best practices and using the right tools, 13-year-olds can protect themselves from online threats and achieve their financial goals.

Managing Earnings: Saving, Budgeting, and Investing for the Future

Once 13-year-olds start earning money, it’s essential to manage their earnings effectively to achieve their financial goals. This includes saving, budgeting, and investing for the future. In this section, we’ll provide guidance on how to manage earnings and discuss the importance of setting financial goals and creating a long-term financial plan.

Saving is an essential part of managing earnings. It’s crucial to set aside a portion of earnings each month in a savings account or emergency fund. This will help 13-year-olds build a safety net and achieve their short-term financial goals. Some popular savings options for teenagers include high-yield savings accounts, certificates of deposit (CDs), and savings apps like Qapital and Digit.

Budgeting is also essential for managing earnings. It’s crucial to track income and expenses to understand where money is going and make informed financial decisions. 13-year-olds can use budgeting apps like Mint and Personal Capital to track their spending and create a budget. They can also use the 50/30/20 rule to allocate their earnings towards necessities, discretionary spending, and saving.

Investing is another important aspect of managing earnings. It’s crucial to start investing early to take advantage of compound interest and achieve long-term financial goals. 13-year-olds can consider investing in a Roth IRA or a custodial account, such as a UGMA or UTMA account. They can also consider investing in a brokerage account or a robo-advisor like Acorns or Stash.

Setting financial goals is also essential for managing earnings. 13-year-olds should set specific, measurable, achievable, relevant, and time-bound (SMART) goals for their financial future. This could include saving for a car, college, or a down payment on a house. They should also create a long-term financial plan to achieve their goals and make informed financial decisions.

Some popular tools for managing earnings include budgeting apps like Mint and Personal Capital, savings apps like Qapital and Digit, and investment apps like Acorns and Stash. These tools can help 13-year-olds track their spending, save money, and invest for the future.

Overall, managing earnings is an essential part of achieving financial independence. By saving, budgeting, and investing for the future, 13-year-olds can set themselves up for long-term financial success and achieve their financial goals.

Remember, managing earnings is an ongoing process that requires constant attention and effort. By following these tips and using the right tools, 13-year-olds can take control of their finances and achieve their financial goals.