Understanding the Taxation of Mutual Funds: A Comprehensive Guide

When it comes to investing in mutual funds, understanding the tax implications is crucial to maximizing returns and minimizing tax liabilities. The taxation of mutual funds can be complex, and failing to comprehend the rules can result in unexpected tax bills or missed opportunities for tax savings. In this article, we will delve into the world of mutual fund taxation, exploring how mutual funds are taxed, the tax implications of buying and selling, and strategies for minimizing taxes on mutual fund investments.

For investors seeking to grow their wealth over time, mutual funds offer a popular and convenient way to diversify a portfolio. However, the tax implications of mutual fund investments can significantly impact returns, making it essential to understand how mutual funds are taxed. The question of how are mutual funds taxed is a common one, and the answer lies in the complex interplay of tax laws and regulations governing mutual fund investments.

At its core, mutual fund taxation is based on the principle of pass-through taxation, where the mutual fund company passes through the tax liabilities of the underlying investments to the shareholders. This means that mutual fund investors are responsible for reporting and paying taxes on their share of the fund’s income, capital gains, and dividends. Understanding these tax implications is critical to making informed investment decisions and minimizing tax liabilities.

By grasping the fundamentals of mutual fund taxation, investors can better navigate the complex tax landscape and make more informed decisions about their investments. Whether you’re a seasoned investor or just starting to build your portfolio, understanding how mutual funds are taxed is essential to achieving your long-term financial goals.

How Mutual Fund Earnings Are Taxed: A Step-by-Step Explanation

Mutual fund earnings are taxed in a unique way, and understanding the process is essential to navigating the tax implications of these investments. When a mutual fund generates income, it is required to distribute this income to its shareholders in the form of dividends, capital gains, and interest income. These distributions are then taxed at the individual level, and the tax implications can vary depending on the type of income and the investor’s tax situation.

The first step in understanding how mutual fund earnings are taxed is to recognize the different types of income that mutual funds can generate. These include ordinary income, such as interest and dividends, and capital gains, which are generated when the mutual fund sells securities at a profit. The mutual fund company is required to report these income types to the IRS and to provide shareholders with a Form 1099-DIV, which shows the amount of income distributed to each shareholder.

When it comes to calculating capital gains, mutual funds use a complex formula that takes into account the fund’s net asset value, the number of shares outstanding, and the amount of gains generated by the sale of securities. This calculation is used to determine the amount of capital gains that are distributed to shareholders, and these gains are then taxed at the individual level. Understanding how capital gains are calculated and taxed is essential to answering the question of how are mutual funds taxed.

In addition to capital gains, mutual funds also generate ordinary income in the form of interest and dividends. This income is taxed at the individual level, and the tax rate depends on the investor’s tax situation. For example, qualified dividends are taxed at a lower rate than ordinary income, while interest income is taxed as ordinary income.

Overall, the taxation of mutual fund earnings is a complex process that requires a thorough understanding of the different types of income and the tax implications of each. By grasping these concepts, investors can better navigate the tax landscape and make more informed decisions about their mutual fund investments.

The Tax Implications of Buying and Selling Mutual Funds

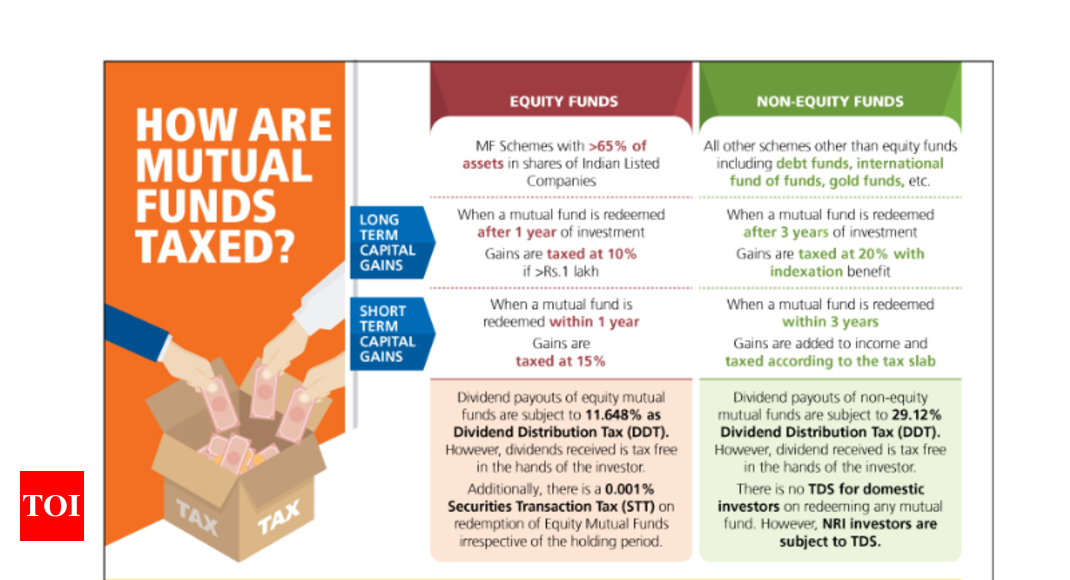

When it comes to buying and selling mutual funds, the tax implications can be significant. Understanding these implications is crucial to making informed investment decisions and minimizing tax liabilities. One of the key considerations is the distinction between short-term and long-term capital gains. Short-term capital gains, which occur when a mutual fund is sold within one year of purchase, are taxed as ordinary income. In contrast, long-term capital gains, which occur when a mutual fund is sold after one year of purchase, are taxed at a lower rate.

Another important consideration is the concept of wash sales. A wash sale occurs when a mutual fund is sold at a loss, and a substantially identical security is purchased within 30 days. In this scenario, the loss is disallowed for tax purposes, and the investor is not able to claim the loss as a deduction. Understanding the rules surrounding wash sales is essential to avoiding unintended tax consequences.

Tax-loss harvesting is another strategy that can be used to minimize taxes on mutual fund investments. This involves selling a mutual fund at a loss to offset gains from other investments. By doing so, investors can reduce their tax liability and maximize their after-tax returns. However, it’s essential to understand the rules surrounding tax-loss harvesting, including the wash sale rule, to avoid unintended consequences.

When buying and selling mutual funds, it’s also essential to consider the impact of taxes on investment returns. Taxes can significantly erode investment returns, especially for investors in higher tax brackets. By understanding the tax implications of buying and selling mutual funds, investors can make more informed decisions and minimize their tax liability.

Ultimately, the tax implications of buying and selling mutual funds are complex and multifaceted. By understanding the rules surrounding short-term and long-term capital gains, wash sales, and tax-loss harvesting, investors can make more informed decisions and maximize their after-tax returns. By considering the tax implications of mutual fund investments, investors can better navigate the tax landscape and achieve their long-term financial goals.

How to Minimize Taxes on Mutual Fund Investments

Minimizing taxes on mutual fund investments is crucial to maximizing after-tax returns. One effective strategy is to utilize tax-deferred accounts, such as 401(k) or IRA accounts, to hold mutual fund investments. These accounts allow investors to delay paying taxes on investment gains until withdrawal, potentially reducing tax liabilities.

Another strategy is to engage in tax-loss swapping, which involves selling a mutual fund at a loss to offset gains from other investments. This can help reduce tax liabilities and maximize after-tax returns. However, it’s essential to understand the wash sale rule, which disallows losses if a substantially identical security is purchased within 30 days.

Investing in index funds or tax-efficient investment products is also an effective way to minimize taxes on mutual fund investments. These funds typically have lower turnover rates, resulting in fewer capital gains distributions and reduced tax liabilities. Additionally, index funds often have lower fees, which can further enhance after-tax returns.

Other strategies for minimizing taxes on mutual fund investments include harvesting tax losses, deferring capital gains, and utilizing tax-efficient withdrawal strategies. By incorporating these strategies into an investment plan, investors can potentially reduce their tax liabilities and maximize their after-tax returns.

It’s also essential to consider the tax implications of mutual fund investments when selecting a fund. Some mutual funds are more tax-efficient than others, and selecting a fund with a low turnover rate and minimal capital gains distributions can help minimize tax liabilities. By understanding how mutual funds are taxed and incorporating tax-efficient strategies into an investment plan, investors can potentially maximize their after-tax returns and achieve their long-term financial goals.

Taxation of Mutual Fund Distributions: What You Need to Know

Mutual fund distributions are taxed in various ways, depending on the type of income generated. Ordinary income, such as dividends and interest, is taxed as ordinary income and reported on the investor’s tax return. Capital gains, on the other hand, are taxed at a lower rate and reported on Schedule D of the tax return.

Return of capital, which occurs when a mutual fund distributes more than its earnings and profits, is not taxed as income. Instead, it is treated as a return of the investor’s original investment and reduces the investor’s tax basis in the mutual fund. This can have significant tax implications, as it can reduce the investor’s capital gains tax liability when the mutual fund is eventually sold.

Understanding how mutual fund distributions are taxed is essential to answering the question of how are mutual funds taxed. By grasping the tax implications of ordinary income, capital gains, and return of capital, investors can make more informed decisions about their mutual fund investments and minimize their tax liabilities.

When reporting mutual fund distributions on tax returns, investors must use Form 1099-DIV, which shows the amount of dividends, capital gains, and return of capital distributed by the mutual fund. This information is then reported on Schedule D of the tax return, where capital gains and losses are calculated and reported.

It’s also important to note that mutual fund distributions can have different tax implications depending on the investor’s tax situation. For example, investors in higher tax brackets may be subject to a higher tax rate on ordinary income, while investors in lower tax brackets may be subject to a lower tax rate on capital gains.

By understanding the taxation of mutual fund distributions, investors can better navigate the complex tax landscape and make more informed decisions about their investments.

How to Report Mutual Fund Taxes on Your Tax Return

Reporting mutual fund taxes on your tax return can be a complex process, but it’s essential to get it right to avoid any potential penalties or fines. The first step is to gather all the necessary documents, including Form 1099-DIV, which shows the amount of dividends, capital gains, and return of capital distributed by the mutual fund.

Next, you’ll need to report the ordinary income from the mutual fund on your tax return. This includes dividends and interest income, which are reported on Line 9 of Form 1040. You’ll also need to report capital gains from the mutual fund on Schedule D of your tax return. This includes both short-term and long-term capital gains, which are calculated separately.

Form 8949 is used to report the sale of mutual fund shares, and it’s essential to complete this form accurately to avoid any errors. You’ll need to report the date of sale, the number of shares sold, and the proceeds from the sale. You’ll also need to report any wash sales, which occur when you sell a mutual fund at a loss and buy a substantially identical security within 30 days.

It’s also important to note that mutual fund taxes can be reported on different tax forms, depending on the type of income generated. For example, qualified dividends are reported on Form 1099-DIV and are eligible for a lower tax rate. On the other hand, ordinary income from mutual funds is reported on Form 1099-DIV and is taxed at the investor’s ordinary income tax rate.

By following these steps and using the correct tax forms, you can ensure that you’re reporting your mutual fund taxes accurately and avoiding any potential penalties or fines. Remember to always consult with a tax professional or financial advisor if you’re unsure about any aspect of reporting mutual fund taxes on your tax return.

Common Tax Mistakes to Avoid with Mutual Fund Investments

When it comes to mutual fund investments, there are several common tax mistakes that can be avoided with proper planning and understanding of the tax implications. One of the most common mistakes is failing to report income from mutual fund investments. This can include dividends, interest, and capital gains, which must be reported on the investor’s tax return.

Another common mistake is incorrectly calculating capital gains. This can occur when an investor sells a mutual fund and fails to account for the correct cost basis, resulting in an incorrect calculation of capital gains. This can lead to an incorrect tax liability and potentially result in penalties and fines.

Neglecting to take advantage of tax-loss harvesting is another common mistake. Tax-loss harvesting involves selling a mutual fund at a loss to offset gains from other investments. This can help reduce an investor’s tax liability and maximize after-tax returns.

Additionally, investors should be aware of the wash sale rule, which disallows losses if a substantially identical security is purchased within 30 days. This can result in an incorrect calculation of capital gains and potentially lead to penalties and fines.

It’s also important to note that mutual fund taxes can be complex and nuanced, and investors should seek the advice of a tax professional or financial advisor to ensure they are in compliance with all tax laws and regulations.

By avoiding these common tax mistakes, investors can ensure they are maximizing their after-tax returns and minimizing their tax liability. It’s essential to have a thorough understanding of how mutual funds are taxed and to seek professional advice when needed.

Maximizing After-Tax Returns: A Mutual Fund Tax Optimization Strategy

To maximize after-tax returns on mutual fund investments, it’s essential to have a comprehensive tax optimization strategy in place. This involves incorporating tax-efficient investment selection, portfolio rebalancing, and tax-loss harvesting into your investment approach.

One key aspect of tax-efficient investment selection is to focus on mutual funds with low turnover rates. These funds tend to generate fewer capital gains distributions, which can help reduce tax liabilities. Additionally, consider investing in index funds or tax-efficient investment products, which are designed to minimize tax liabilities.

Portfolio rebalancing is another critical component of a tax optimization strategy. This involves regularly reviewing your portfolio to ensure that it remains aligned with your investment objectives and risk tolerance. By rebalancing your portfolio, you can help minimize tax liabilities and maximize after-tax returns.

Tax-loss harvesting is also an essential tool for maximizing after-tax returns. This involves selling mutual funds at a loss to offset gains from other investments. By doing so, you can help reduce your tax liability and maximize your after-tax returns.

It’s also important to consider the tax implications of mutual fund distributions. By understanding how mutual fund distributions are taxed, you can make more informed investment decisions and minimize your tax liability.

By incorporating these strategies into your investment approach, you can help maximize your after-tax returns and achieve your long-term financial goals. Remember to always consult with a tax professional or financial advisor to ensure that your investment strategy is aligned with your individual circumstances and goals.