Understanding Your Check Cashing Options

Cashing a check can be a straightforward process, but it’s essential to understand the various options available to ensure a smooth and secure transaction. When wondering how can I cash a check, individuals can explore several alternatives, each with its pros and cons. Banks, credit unions, check cashing stores, and online services are the most common options for cashing a check.

Banks and credit unions are traditional institutions that offer check cashing services. These establishments typically require a valid government-issued ID and may have specific requirements for non-account holders. The benefits of using a bank or credit union include the ability to deposit the check into an existing account, access to customer support, and a secure environment. However, some banks may have restrictive policies or fees for non-account holders.

Check cashing stores, on the other hand, specialize in cashing checks and often have more flexible requirements. These stores may not require an ID, but they typically charge a fee for their services. The advantages of using a check cashing store include convenience, extended hours of operation, and quick access to cash. However, the fees associated with these services can be steep, and the stores may not offer the same level of security as a bank or credit union.

Online services have emerged as a convenient and innovative way to cash checks. These platforms allow individuals to upload a photo of the check and receive the funds electronically. The benefits of online services include convenience, speed, and often lower fees compared to traditional check cashing stores. However, online services may require a smartphone or computer, and the verification process can be more complex.

When deciding how to cash a check, it’s crucial to weigh the pros and cons of each option. By understanding the various alternatives and their associated fees, requirements, and benefits, individuals can make an informed decision that suits their needs. Whether using a bank, credit union, check cashing store, or online service, cashing a check can be a secure and efficient process with the right knowledge and preparation.

What You Need to Cash a Check

To cash a check, individuals typically need to provide certain documents and information to verify their identity and the check’s authenticity. When wondering how can I cash a check, it’s essential to gather the necessary requirements to ensure a smooth transaction. The most common documents required to cash a check include a valid government-issued ID, such as a driver’s license or passport, and the check itself.

The ID should be current and not expired, and it should match the name on the check. Some cashing institutions may also require additional verification, such as a social security number or proof of address. It’s crucial to check with the cashing institution beforehand to confirm their specific requirements.

In addition to the ID and check, individuals may need to provide other information, such as their address, phone number, and date of birth. This information helps the cashing institution to verify the individual’s identity and ensure that the check is legitimate.

Some cashing institutions may also require the check to be endorsed, which involves signing the back of the check to verify its authenticity. This step helps to prevent fraud and ensures that the check is cashed by the rightful owner.

It’s also important to note that some cashing institutions may have specific requirements for certain types of checks, such as payroll checks or government checks. Individuals should check with the cashing institution beforehand to confirm their requirements and ensure that they have the necessary documents and information.

By gathering the necessary documents and information, individuals can ensure a smooth and secure check cashing process. Whether cashing a check at a bank, credit union, or check cashing store, having the right requirements can help to prevent delays and ensure that the transaction is completed efficiently.

How to Cash a Check at a Bank

Cashing a check at a bank can be a straightforward process, but it’s essential to follow the correct steps to ensure a smooth transaction. When wondering how can I cash a check, individuals can follow these step-by-step instructions to cash a check at a bank.

Step 1: Find a Bank that Accepts Check Cashing

Not all banks accept check cashing, so it’s crucial to find a bank that offers this service. Individuals can search online or visit the bank’s website to confirm their check cashing policies.

Step 2: Verify the Check

Before cashing the check, the bank will verify its authenticity. This involves checking the check’s routing number, account number, and signature. The bank may also contact the issuer to confirm the check’s validity.

Step 3: Endorse the Check (If Required)

Some banks may require the check to be endorsed, which involves signing the back of the check to verify its authenticity. This step helps to prevent fraud and ensures that the check is cashed by the rightful owner.

Step 4: Present the Check and ID

Individuals should present the check and a valid government-issued ID to the bank teller. The teller will verify the ID and check to ensure that they match.

Step 5: Receive the Cash

Once the check is verified and the ID is confirmed, the bank teller will provide the cash. Individuals should count the cash to ensure that it’s accurate and sign a receipt to confirm the transaction.

By following these steps, individuals can cash a check at a bank with confidence. It’s essential to note that some banks may have specific requirements or fees associated with check cashing, so it’s crucial to check with the bank beforehand to confirm their policies.

Alternative Check Cashing Methods

While banks are a traditional option for cashing checks, they may not always be the most convenient or cost-effective choice. Fortunately, there are alternative check cashing methods available, including check cashing stores and online services. When wondering how can I cash a check, individuals can consider these alternatives to find a method that suits their needs.

Check Cashing Stores

Check cashing stores specialize in cashing checks and often have more flexible requirements than banks. These stores may not require a bank account or ID, but they typically charge a fee for their services. The fees can vary depending on the store and the type of check being cashed.

Online Check Cashing Services

Online check cashing services have emerged as a convenient and innovative way to cash checks. These services allow individuals to upload a photo of the check and receive the funds electronically. Online services often have lower fees than check cashing stores and can be more convenient than visiting a physical location.

Requirements and Fees

Alternative check cashing methods often have different requirements and fees than banks. Check cashing stores may require a valid ID and proof of address, while online services may require a bank account or debit card. The fees associated with these methods can vary, but they are often lower than bank fees.

Benefits and Drawbacks

Alternative check cashing methods offer several benefits, including convenience, flexibility, and lower fees. However, they also have some drawbacks, such as limited availability and potential security risks. Individuals should carefully consider these factors when choosing an alternative check cashing method.

By considering alternative check cashing methods, individuals can find a convenient and cost-effective way to cash their checks. Whether using a check cashing store or online service, it’s essential to understand the requirements and fees associated with these methods to make an informed decision.

Mobile Check Cashing: A Convenient Option

Mobile check cashing has emerged as a convenient and innovative way to cash checks remotely. With the rise of mobile banking apps, individuals can now deposit checks using their smartphones, eliminating the need to visit a physical bank or check cashing store. When wondering how can I cash a check, mobile check cashing is a viable option to consider.

How Mobile Check Cashing Works

Mobile check cashing involves using a mobile banking app to deposit a check remotely. The process typically involves taking a photo of the check, entering the check details, and confirming the deposit. The funds are then deposited into the individual’s bank account, usually within a few hours.

Benefits of Mobile Check Cashing

Mobile check cashing offers several benefits, including convenience, speed, and flexibility. Individuals can deposit checks from anywhere, at any time, using their smartphones. This eliminates the need to visit a physical bank or check cashing store, saving time and effort.

Security Features

Mobile check cashing apps typically have robust security features to ensure the safety and security of transactions. These features may include encryption, secure login, and verification processes to prevent unauthorized access.

Requirements and Fees

Mobile check cashing apps may have specific requirements and fees associated with their services. Individuals may need to have a bank account, debit card, or credit card to use the app. Fees may vary depending on the app and the type of check being deposited.

Popular Mobile Check Cashing Apps

Several mobile check cashing apps are available, including those offered by banks, credit unions, and specialized check cashing services. Some popular apps include [list popular apps]. These apps are designed to provide a convenient and secure way to cash checks remotely

https://www.youtube.com/watch?v=IQDCcE7WXMQ

Check Cashing Fees: What to Expect

When cashing a check, it’s essential to understand the fees associated with the process. Fees can vary depending on the institution, type of check, and other factors. When wondering how can I cash a check, it’s crucial to consider the fees involved to make an informed decision.

Bank Fees

Banks typically charge a fee for cashing checks, especially for non-account holders. The fee can range from $5 to $20 or more, depending on the bank and the type of check. Some banks may also charge a percentage of the check amount, usually around 1% to 3%.

Check Cashing Store Fees

Check cashing stores often charge higher fees than banks, typically ranging from 2% to 5% of the check amount. These fees can add up quickly, especially for larger checks. Additionally, some check cashing stores may charge extra fees for services like check verification or document preparation.

Online Service Fees

Online check cashing services usually charge lower fees than check cashing stores, typically ranging from 1% to 3% of the check amount. However, some online services may charge extra fees for expedited processing or other services.

Other Fees to Consider

In addition to the fees mentioned above, there may be other fees associated with cashing a check. For example, some institutions may charge a fee for check verification or document preparation. It’s essential to ask about these fees before cashing a check to avoid any surprises.

Minimizing Fees

To minimize fees when cashing a check, it’s essential to shop around and compare fees among different institutions. Consider using a bank or credit union, which often charge lower fees than check cashing stores. Additionally, look for online services that offer competitive fees and convenient processing.

By understanding the fees associated with cashing a check, individuals can make an informed decision and choose the best option for their needs. Remember to always ask about fees before cashing a check to avoid any surprises.

Tips for Cashing a Check Safely

Cashing a check can be a straightforward process, but it’s essential to take certain precautions to ensure a safe and secure transaction. When wondering how can I cash a check, it’s crucial to consider the potential risks involved and take steps to mitigate them. Here are some valuable tips for cashing a check safely:

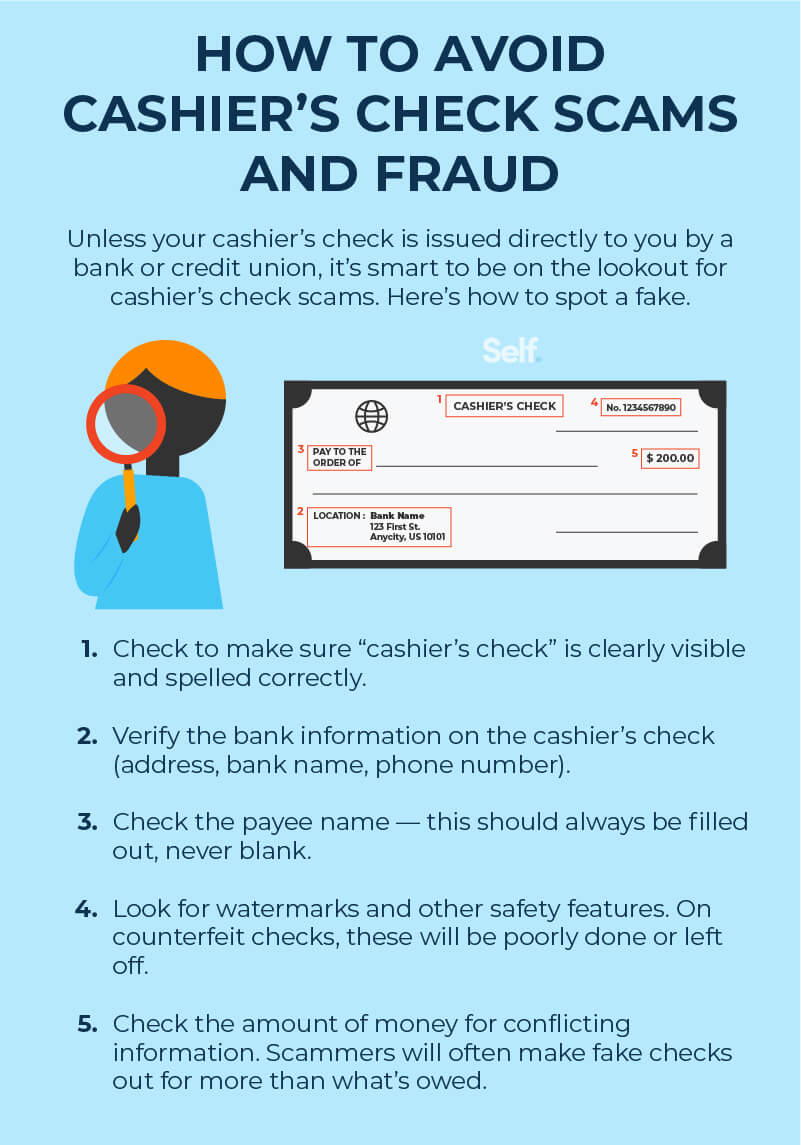

Verify the check’s authenticity: Before attempting to cash a check, make sure it’s legitimate. Check for any signs of tampering, such as altered dates, amounts, or signatures. Be wary of checks with low-quality paper or printing. If you’re unsure, contact the issuer to verify the check’s authenticity.

Be aware of scams: Scammers often use fake checks to trick individuals into revealing personal information or sending money. Be cautious of checks with unusual or suspicious instructions, such as requests to send a portion of the funds to a third party. Never provide personal or financial information to someone you don’t trust.

Keep personal information secure: When cashing a check, only provide the necessary identification and information required by the cashing institution. Avoid sharing personal details, such as your social security number or bank account information, unless absolutely necessary.

Use a secure location: When cashing a check, choose a secure location, such as a bank or credit union, that has a good reputation and robust security measures in place. Avoid using public computers or unsecured Wi-Fi networks to deposit checks online.

Monitor your accounts: After cashing a check, keep a close eye on your bank account to ensure the funds are deposited correctly. Report any discrepancies or suspicious activity to your bank immediately.

Understand the fees: Be aware of the fees associated with cashing a check, including any charges for overdrafts or insufficient funds. Make sure you understand the terms and conditions of the cashing institution before proceeding.

By following these tips, individuals can minimize the risks associated with cashing a check and ensure a safe and secure transaction. Whether you’re wondering how can I cash a check at a bank or exploring alternative check cashing methods, being informed and prepared is key to a successful and stress-free experience.

Conclusion: Cashing a Check with Confidence

Cashing a check can seem like a daunting task, but with the right knowledge and preparation, it can be a straightforward and secure process. By understanding the different check cashing options available, including banks, credit unions, check cashing stores, and online services, individuals can make informed decisions about how to cash their checks. Additionally, being aware of the required documents and information needed to cash a check, as well as the associated fees and requirements, can help to ensure a smooth transaction.

For those wondering how can I cash a check, the answer is simpler than you think. By following the step-by-step instructions outlined in this article, individuals can confidently cash their checks at a bank, use alternative check cashing methods, or even take advantage of mobile check cashing. Moreover, by being mindful of the tips for cashing a check safely, individuals can protect themselves from potential scams and ensure that their personal information remains secure.

In conclusion, cashing a check is a common financial task that can be accomplished with ease and confidence. By understanding the different options available, being prepared with the necessary documents and information, and taking steps to ensure a safe and secure transaction, individuals can successfully cash their checks and access their funds. Whether you’re looking to cash a check at a bank, online, or through a mobile app, the key is to be informed and prepared. With the right knowledge and preparation, cashing a check can be a hassle-free experience.