Turning Passion into Profit: Identifying Business Opportunities with Little to No Initial Investment

Identifying business opportunities that require little to no initial investment is crucial for entrepreneurs who want to start a business without breaking the bank. One way to achieve this is by turning passions into profitable ventures. When individuals turn their passions into businesses, they are more likely to be motivated and dedicated to making the business a success. Moreover, starting a business based on a passion can also help reduce startup costs, as entrepreneurs can leverage their existing skills and expertise.

For instance, a photography enthusiast can start a photography business with minimal initial investment. They can use their existing camera equipment and editing software to offer services to clients. Similarly, a writer can start a content writing business with little to no initial investment, using their writing skills to offer services to clients.

Other successful businesses that started with minimal funding include Airbnb, which was founded by two designers who couldn’t afford to pay their rent, and Uber, which was founded by two entrepreneurs who wanted to provide a ride-sharing service with minimal initial investment. These examples demonstrate that it is possible to start a successful business with little to no initial investment, as long as entrepreneurs are willing to put in the hard work and dedication required to make the business a success.

So, how can you start a business without money? The key is to identify business opportunities that align with your passions and skills, and to be creative in finding ways to reduce startup costs. By doing so, entrepreneurs can turn their passions into profitable ventures and achieve success without breaking the bank.

Some popular business ideas that require little to no initial investment include freelancing, affiliate marketing, and selling products online through e-commerce platforms. These business ideas can be started with minimal initial investment, and can be scaled up as the business grows.

In addition, entrepreneurs can also use online platforms and tools to reduce startup costs. For example, they can use website builders like Wix or Squarespace to create a professional website without needing to hire a web developer. They can also use social media platforms like Facebook and Instagram to market their business and reach their target audience.

Overall, identifying business opportunities that require little to no initial investment is crucial for entrepreneurs who want to start a business without breaking the bank. By turning passions into profitable ventures and using online platforms and tools to reduce startup costs, entrepreneurs can achieve success and build a successful business from scratch.

Validating Your Business Idea: Researching Your Market without Breaking the Bank

Validating a business idea through market research is a crucial step in the startup process. It helps entrepreneurs understand their target audience, identify potential competitors, and determine the viability of their business idea. However, conducting market research can be expensive, especially for startups with limited capital. Fortunately, there are ways to conduct market research on a budget, and even without spending a dime.

One way to conduct market research without breaking the bank is to use online tools. There are many free online tools available that can provide valuable insights into your target market. For example, Google Trends can help you identify popular keywords and topics related to your business idea, while social media listening tools like Hootsuite or Sprout Social can help you monitor conversations about your brand or competitors.

Another way to conduct market research on a budget is to leverage social media. Social media platforms like Facebook, Twitter, and LinkedIn can provide valuable insights into your target audience, including demographics, interests, and behaviors. You can also use social media to conduct surveys or polls to gather feedback from potential customers.

Additionally, you can use online communities and forums related to your business idea to gather feedback and insights from potential customers. For example, if you’re starting a business in the tech industry, you can join online communities like Reddit’s r/tech or Stack Overflow to gather feedback and insights from potential customers.

How can you start a business without money? One way is to validate your business idea through market research without breaking the bank. By using online tools, leveraging social media, and gathering feedback from potential customers, you can gain valuable insights into your target market and determine the viability of your business idea without spending a fortune.

Some popular online tools for market research include SurveyMonkey, which allows you to create and distribute surveys to potential customers, and Google Forms, which allows you to create and distribute forms to gather feedback from potential customers. You can also use online analytics tools like Google Analytics to track website traffic and behavior, and social media analytics tools like Facebook Insights to track social media engagement and behavior.

Overall, validating a business idea through market research is a crucial step in the startup process, and it doesn’t have to break the bank. By using online tools, leveraging social media, and gathering feedback from potential customers, entrepreneurs can gain valuable insights into their target market and determine the viability of their business idea without spending a fortune.

By conducting market research on a budget, entrepreneurs can also reduce the risk of launching a business that may not be viable. This can help them avoid wasting time and resources on a business idea that may not work, and instead focus on developing a business idea that has a higher potential for success.

In conclusion, validating a business idea through market research is a crucial step in the startup process, and it can be done on a budget. By using online tools, leveraging social media, and gathering feedback from potential customers, entrepreneurs can gain valuable insights into their target market and determine the viability of their business idea without breaking the bank.

Building a Business Model: Creating a Lean and Agile Framework for Success

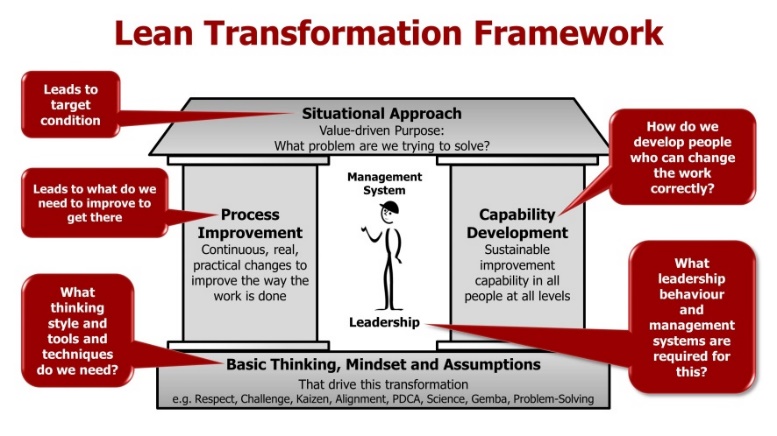

Creating a business model that is lean and agile is crucial for startups with limited capital. A lean business model is one that is designed to be efficient and adaptable, with a focus on delivering value to customers quickly and at a low cost. An agile business model is one that is able to respond quickly to changes in the market and pivot when necessary.

One way to create a lean and agile business model is to use the business model canvas. The business model canvas is a visual tool that helps entrepreneurs design and innovate their business models. It consists of nine building blocks, including customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

By using the business model canvas, entrepreneurs can identify areas of their business model that can be optimized for efficiency and adaptability. For example, they can identify ways to reduce costs, increase revenue, and improve customer relationships. They can also use the canvas to identify potential partnerships and key activities that can help drive growth.

How can you start a business without money? One way is to create a lean and agile business model that is designed to be efficient and adaptable. By using the business model canvas, entrepreneurs can identify areas of their business model that can be optimized for efficiency and adaptability, and make data-driven decisions to drive growth.

Some successful businesses that have used the business model canvas include Airbnb, which used the canvas to identify new revenue streams and optimize its cost structure, and Uber, which used the canvas to identify new customer segments and improve its customer relationships.

In addition to using the business model canvas, entrepreneurs can also use other lean and agile methodologies, such as lean startup and agile development. These methodologies emphasize the importance of rapid experimentation, continuous iteration, and customer feedback in driving business success.

By creating a lean and agile business model, entrepreneurs can reduce the risk of launching a business that may not be viable, and increase their chances of success. They can also use the business model canvas to identify areas of their business model that can be optimized for efficiency and adaptability, and make data-driven decisions to drive growth.

Overall, creating a lean and agile business model is crucial for startups with limited capital. By using the business model canvas and other lean and agile methodologies, entrepreneurs can design and innovate their business models, and drive growth and success.

By focusing on delivering value to customers quickly and at a low cost, entrepreneurs can create a competitive advantage and drive growth. By being adaptable and responsive to changes in the market, entrepreneurs can pivot when necessary and stay ahead of the competition.

In today’s fast-paced and rapidly changing business environment, creating a lean and agile business model is more important than ever. By using the business model canvas and other lean and agile methodologies, entrepreneurs can drive growth and success, and achieve their business goals.

Securing Funding: Exploring Alternative Options for Startups with Limited Capital

Securing funding is a crucial step in starting a business, but it can be a significant challenge for startups with limited capital. Traditional funding options, such as venture capital and bank loans, can be difficult to access for new businesses with limited financial resources. However, there are alternative funding options available that can help startups get off the ground.

Crowdfunding is one alternative funding option that has gained popularity in recent years. Platforms like Kickstarter, Indiegogo, and GoFundMe allow businesses to raise funds from a large number of people, typically in exchange for rewards or equity. Crowdfunding can be a great way for startups to raise funds without giving up control of their business.

Bootstrapping is another alternative funding option that involves using personal savings or revenue from early customers to fund the business. This approach can be challenging, but it allows startups to maintain control and avoid debt. Many successful businesses, including Airbnb and Uber, have bootstrapped their way to success.

Incubators and accelerators are also alternative funding options that provide startups with resources, mentorship, and funding in exchange for equity. These programs can be highly competitive, but they can provide startups with the support and funding they need to grow.

How can you start a business without money? One way is to explore alternative funding options, such as crowdfunding, bootstrapping, and incubators. These options can provide startups with the funding they need to get off the ground, without requiring a large amount of capital.

Some successful businesses that have used alternative funding options include Pebble, which raised over $10 million on Kickstarter, and Warby Parker, which bootstrapped its way to success before raising venture capital. These examples demonstrate that alternative funding options can be a viable way for startups to raise funds and achieve success.

In addition to these alternative funding options, startups can also consider other creative ways to raise funds, such as hosting events or selling products online. By thinking outside the box and exploring alternative funding options, startups can increase their chances of success and achieve their business goals.

Overall, securing funding is a critical step in starting a business, but it doesn’t have to be a barrier to entry. By exploring alternative funding options, startups can raise the funds they need to get off the ground and achieve success.

When considering alternative funding options, startups should carefully evaluate the pros and cons of each option and consider what will work best for their business. By doing their research and exploring different options, startups can make informed decisions and increase their chances of success.

In today’s fast-paced and rapidly changing business environment, alternative funding options can provide startups with the flexibility and creativity they need to succeed. By thinking outside the box and exploring new ways to raise funds, startups can achieve their business goals and make their mark on the world.

Building a Team: Attracting and Retaining Talent without a Big Budget

Building a strong team is crucial for business success, but it can be a challenge for startups with limited capital. Attracting and retaining top talent requires a strategic approach, but it doesn’t have to break the bank. In this article, we’ll explore how to build a team without a big budget.

One way to attract top talent without a big budget is to offer equity. Equity can be a powerful motivator for employees, as it gives them a stake in the company’s success. By offering equity, startups can attract top talent who are willing to take a risk on a new company in exchange for a potential long-term payoff.

Another way to attract and retain talent is to create a positive company culture. A positive company culture can be a major draw for employees, as it provides a supportive and motivating work environment. Startups can create a positive company culture by fostering open communication, recognizing employee achievements, and providing opportunities for growth and development.

How can you start a business without money? One way is to build a team without a big budget. By offering equity and creating a positive company culture, startups can attract and retain top talent without breaking the bank.

Some successful businesses that have built strong teams without a big budget include Airbnb, which offered equity to its early employees, and Warby Parker, which created a positive company culture that emphasizes social responsibility and employee well-being. These examples demonstrate that building a strong team doesn’t have to require a big budget.

In addition to offering equity and creating a positive company culture, startups can also use other creative strategies to attract and retain talent. For example, they can offer flexible work arrangements, provide opportunities for professional development, and recognize employee achievements through awards or bonuses.

When building a team without a big budget, it’s also important to focus on finding the right people for the job. This means looking for employees who are passionate about the company’s mission and values, and who have the skills and experience needed to drive success.

By building a strong team without a big budget, startups can achieve their business goals and drive success. It requires a strategic approach, but the payoff can be significant.

In today’s competitive job market, attracting and retaining top talent is more important than ever. By offering equity, creating a positive company culture, and using other creative strategies, startups can build a strong team without breaking the bank.

Building a team without a big budget requires a long-term perspective and a willingness to think outside the box. By focusing on finding the right people for the job and creating a positive company culture, startups can build a team that will drive success for years to come.

Marketing on a Shoestring: Leveraging Digital Channels to Reach Your Target Audience

Marketing is a crucial aspect of business success, but it can be a challenge for startups with limited capital. However, with the rise of digital channels, it’s now possible to reach your target audience without breaking the bank. In this article, we’ll explore how to market your business on a shoestring budget.

One of the most effective ways to market your business on a shoestring budget is to leverage social media. Social media platforms like Facebook, Twitter, and Instagram offer a range of free and paid marketing options that can help you reach your target audience. By creating engaging content and using relevant hashtags, you can increase your visibility and attract new customers.

Another way to market your business on a shoestring budget is to use content marketing. Content marketing involves creating valuable and relevant content that attracts and retains a clearly defined audience. By creating high-quality content, such as blog posts, videos, and infographics, you can establish your business as a thought leader in your industry and attract new customers.

How can you start a business without money? One way is to market your business on a shoestring budget. By leveraging digital channels like social media and content marketing, you can reach your target audience without breaking the bank.

Some successful businesses that have used digital marketing on a shoestring budget include Dollar Shave Club, which used social media and content marketing to reach a large audience and attract new customers, and Warby Parker, which used social media and influencer marketing to establish its brand and attract new customers. These examples demonstrate that digital marketing can be an effective way to reach your target audience without a big budget.

In addition to social media and content marketing, there are many other digital marketing channels that you can use to reach your target audience. These include email marketing, search engine optimization (SEO), and pay-per-click (PPC) advertising. By using these channels effectively, you can increase your visibility and attract new customers.

When marketing your business on a shoestring budget, it’s also important to focus on measuring and optimizing your results. By using analytics tools to track your website traffic and social media engagement, you can see what’s working and what’s not, and make adjustments to your marketing strategy accordingly.

By leveraging digital channels and focusing on measuring and optimizing your results, you can market your business on a shoestring budget and achieve success. It requires creativity and hard work, but the payoff can be significant.

In today’s digital age, marketing your business on a shoestring budget is more possible than ever. By using digital channels and focusing on measuring and optimizing your results, you can reach your target audience and achieve success without breaking the bank.

Marketing on a shoestring budget requires a strategic approach and a willingness to think outside the box. By leveraging digital channels and focusing on measuring and optimizing your results, you can achieve success and grow your business over time.

Managing Finances: Keeping Track of Expenses and Revenue without Breaking the Bank

Managing finances is a crucial aspect of business success, but it can be a challenge for startups with limited capital. Keeping track of expenses and revenue is essential to making informed decisions and ensuring the financial health of your business. In this article, we’ll explore how to manage finances without breaking the bank.

One of the most effective ways to manage finances is to use online accounting tools. Online accounting tools like QuickBooks, Xero, and Wave provide a range of features that can help you track expenses and revenue, including invoicing, expense tracking, and financial reporting. By using online accounting tools, you can streamline your financial management and reduce the risk of errors.

Another way to manage finances is to create a budget. A budget is a financial plan that outlines projected income and expenses over a specific period of time. By creating a budget, you can identify areas where you can cut costs and allocate resources more effectively. You can also use budgeting software like Mint or Personal Capital to track your expenses and stay on top of your finances.

How can you start a business without money? One way is to manage your finances effectively. By using online accounting tools and creating a budget, you can keep track of expenses and revenue without breaking the bank.

Some successful businesses that have managed their finances effectively include Airbnb, which used online accounting tools to track its expenses and revenue, and Warby Parker, which created a budget to allocate resources effectively. These examples demonstrate that managing finances effectively is crucial for business success.

In addition to using online accounting tools and creating a budget, there are many other ways to manage finances effectively. These include tracking cash flow, managing accounts payable and accounts receivable, and monitoring financial ratios. By using these strategies, you can ensure the financial health of your business and make informed decisions.

When managing finances, it’s also important to focus on cash flow management. Cash flow management involves managing the inflow and outflow of cash to ensure that your business has enough liquidity to meet its financial obligations. By using cash flow management techniques like cash flow forecasting and cash flow optimization, you can ensure that your business has enough cash to meet its financial obligations.

By managing finances effectively, you can ensure the financial health of your business and make informed decisions. It requires discipline and attention to detail, but the payoff can be significant.

In today’s fast-paced business environment, managing finances effectively is more important than ever. By using online accounting tools, creating a budget, and focusing on cash flow management, you can ensure the financial health of your business and achieve success.

Managing finances effectively requires a strategic approach and a willingness to think outside the box. By using innovative financial management techniques and staying on top of your finances, you can achieve success and grow your business over time.

Scaling Your Business: Strategies for Growth without a Big Budget

Scaling a business can be a challenging and costly process, but it doesn’t have to be. With the right strategies, you can grow your business without breaking the bank. In this article, we’ll explore how to scale your business without a big budget.

One of the most effective ways to scale a business without a big budget is to outsource. Outsourcing involves hiring external companies or freelancers to handle specific tasks or projects. By outsourcing, you can free up resources and focus on high-priority tasks. You can also use outsourcing to access specialized skills and expertise that you may not have in-house.

Another way to scale a business without a big budget is to partner with other businesses. Partnering involves collaborating with other companies to achieve a common goal. By partnering, you can access new markets, customers, and technologies without having to invest heavily in new infrastructure or personnel.

How can you start a business without money? One way is to scale your business without a big budget. By outsourcing and partnering with other businesses, you can grow your business without breaking the bank.

Some successful businesses that have scaled without a big budget include Airbnb, which used outsourcing and partnering to expand its operations, and Warby Parker, which used technology to scale its business. These examples demonstrate that scaling a business without a big budget is possible with the right strategies.

In addition to outsourcing and partnering, there are many other ways to scale a business without a big budget. These include using technology to automate processes, leveraging social media to reach new customers, and focusing on customer retention to reduce acquisition costs. By using these strategies, you can scale your business without breaking the bank.

When scaling a business, it’s also important to focus on efficiency and productivity. By streamlining processes and eliminating waste, you can reduce costs and improve profitability. You can also use data analytics to track performance and make data-driven decisions.

By scaling your business without a big budget, you can achieve success and growth without sacrificing profitability. It requires creativity and resourcefulness, but the payoff can be significant.

In today’s fast-paced business environment, scaling a business without a big budget is more possible than ever. By using outsourcing, partnering, and technology, you can grow your business without breaking the bank.

Scaling a business without a big budget requires a strategic approach and a willingness to think outside the box. By using innovative strategies and staying focused on efficiency and productivity, you can achieve success and grow your business over time.