Overcoming the Financial Barrier: Is It Possible to Start a Business with Little to No Capital?

Starting a business is often perceived as a costly endeavor, requiring significant investment to get off the ground. However, this common misconception can be a major obstacle for aspiring entrepreneurs who lack the necessary funds. The good news is that it is possible to start a business without breaking the bank. In fact, many successful entrepreneurs have bootstrapped their way to success, using creative strategies to overcome the financial barrier.

Bootstrapping involves using personal savings, revenue from early customers, or other forms of creative financing to fund a business. This approach requires careful planning, resourcefulness, and a willingness to take calculated risks. By adopting a lean and agile mindset, entrepreneurs can minimize startup costs and maximize their chances of success.

So, how can you start a business without money? The first step is to challenge your assumptions about what it takes to launch a business. Instead of focusing on the costs, think about the value you can create for your customers. Identify your unique strengths and skills, and consider how you can monetize them. With a little creativity and perseverance, you can turn your business idea into a reality, even with limited financial resources.

Take, for example, the story of Sara Blakely, founder of Spanx. With just $5,000 in savings, Blakely launched her revolutionary shapewear company from her apartment. Through hard work, determination, and a willingness to take risks, she was able to turn her idea into a global brand. Today, Spanx is a household name, and Blakely’s success is an inspiration to entrepreneurs everywhere.

While Blakely’s story is certainly impressive, it’s not unique. Many entrepreneurs have achieved success through bootstrapping, and their stories offer valuable lessons for those who are just starting out. By studying their strategies and adapting them to your own business, you can overcome the financial barrier and achieve your goals.

In the next section, we’ll explore the importance of identifying a business idea with low startup costs. By choosing the right idea, you can minimize your financial risks and maximize your chances of success.

Identifying Your Business Idea: Finding Opportunities with Low Startup Costs

When it comes to starting a business with little to no money, choosing the right business idea is crucial. Many entrepreneurs make the mistake of pursuing ideas that require significant upfront investments, only to find themselves struggling to stay afloat. However, by identifying business ideas with low startup costs, you can minimize your financial risks and maximize your chances of success.

So, how can you start a business without money? One approach is to focus on service-based businesses, which often require little to no initial investment. For example, if you have expertise in a particular area, you can offer consulting or coaching services to clients. This can be done remotely, eliminating the need for office space or equipment.

Another option is to explore online business ideas, such as affiliate marketing or selling digital products. These types of businesses can be started with little to no upfront costs and can be run from anywhere with an internet connection. Additionally, they can be scaled up quickly, allowing you to reach a large audience and generate significant revenue.

Other low-cost business ideas include freelancing, tutoring, or selling handmade products. These types of businesses can be started with minimal investment and can be run on a part-time basis, allowing you to test the waters and see if the business is viable before committing to it full-time.

When evaluating business ideas, it’s essential to consider the startup costs and potential revenue streams. Ask yourself, “How can I start this business with little to no money?” and “What are the potential revenue streams for this business?” By answering these questions, you can identify business ideas that are well-suited to your financial situation and increase your chances of success.

In the next section, we’ll explore the principles of lean business modeling and how to apply them to minimize startup costs. By adopting a lean and agile mindset, you can reduce your financial risks and increase your chances of success, even with limited financial resources.

Developing a Lean Business Model: Minimizing Expenses and Maximizing Efficiency

When starting a business with little to no money, it’s essential to adopt a lean business model that minimizes expenses and maximizes efficiency. This approach allows entrepreneurs to test and validate their business ideas with minimal investment, reducing the risk of financial loss.

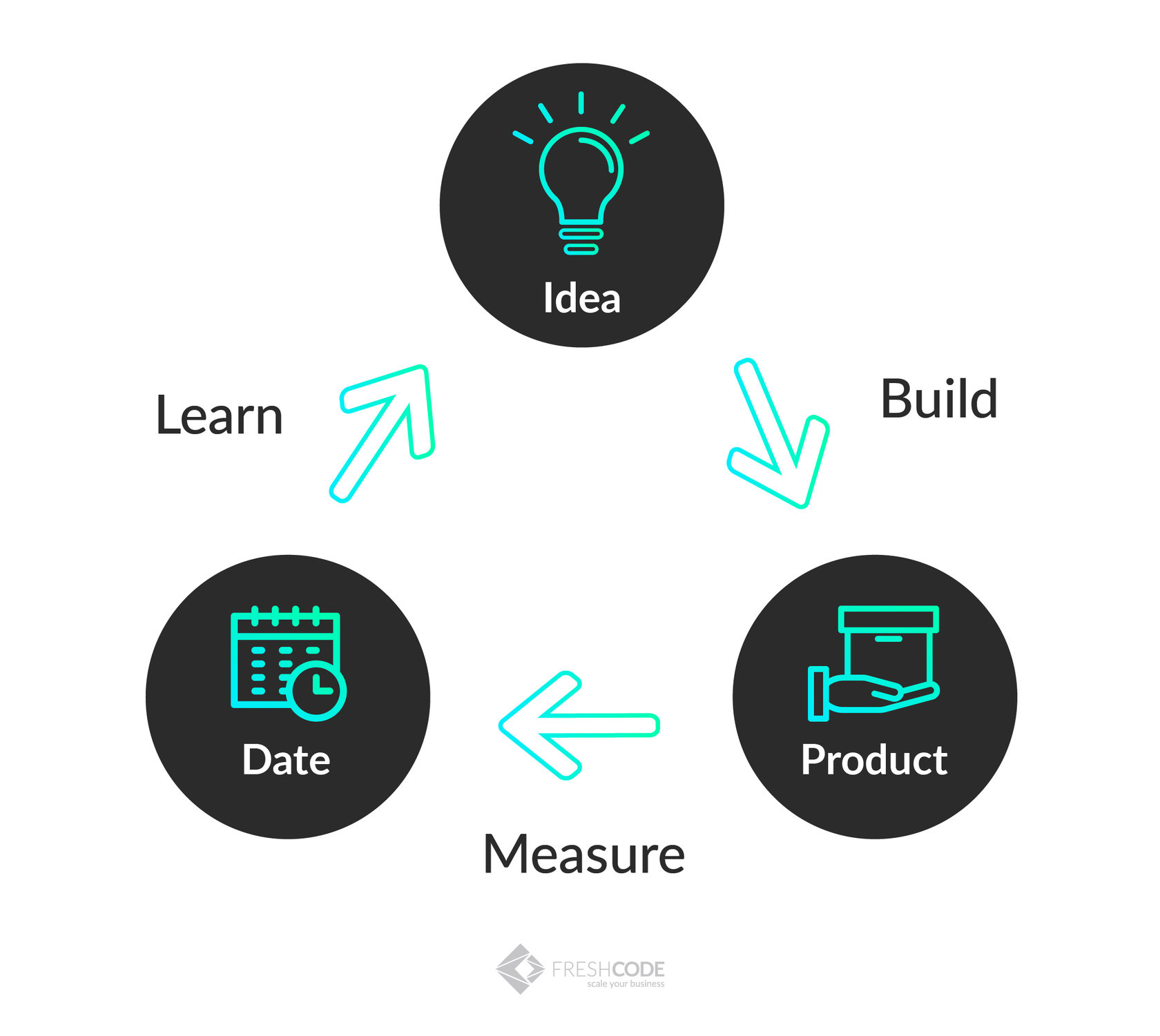

One of the key principles of lean business modeling is the concept of the “minimum viable product” (MVP). An MVP is a product or service that has just enough features to satisfy early customers and provide feedback for future development. By launching an MVP, entrepreneurs can test their business idea with minimal investment and gather valuable feedback from customers.

Another important aspect of lean business modeling is the use of agile methodologies. Agile methodologies involve breaking down work into small, manageable chunks, and prioritizing tasks based on their importance and urgency. This approach allows entrepreneurs to respond quickly to changes in the market and make adjustments to their business model as needed.

To apply lean business modeling to your startup, start by identifying the essential features and functions of your product or service. Ask yourself, “What is the minimum amount of work required to launch a viable product?” and “What are the most important features and functions that will provide value to my customers?”

Next, prioritize your tasks based on their importance and urgency. Focus on the most critical tasks first, and delegate or defer less important tasks as needed. Use free and low-cost tools, such as project management software and collaboration platforms, to streamline your workflow and reduce expenses.

Finally, be prepared to pivot your business model as needed. Lean business modeling is all about experimentation and iteration. Don’t be afraid to try new approaches and adjust your business model based on customer feedback and market conditions.

By adopting a lean business model, entrepreneurs can minimize expenses, maximize efficiency, and increase their chances of success, even with limited financial resources. In the next section, we’ll explore alternative funding options for startups, including crowdfunding platforms, incubators, and accelerators.

Securing Funding Alternatives: Crowdfunding, Incubators, and Accelerators

When starting a business with little to no money, securing funding can be a significant challenge. However, there are alternative funding options available that can help entrepreneurs overcome this hurdle. In this section, we’ll explore crowdfunding, incubators, and accelerators as potential funding alternatives.

Crowdfunding platforms, such as Kickstarter and Indiegogo, allow entrepreneurs to raise funds from a large number of people, typically in exchange for rewards or equity. This approach can be an effective way to validate a business idea and raise funds without giving up control of the company.

Incubators and accelerators, on the other hand, provide entrepreneurs with access to resources, mentorship, and funding in exchange for equity. These programs can be highly competitive, but they offer a unique opportunity for entrepreneurs to accelerate their business growth and secure funding.

To increase your chances of securing funding through these channels, it’s essential to have a solid business plan, a clear pitch, and a strong online presence. You should also be prepared to demonstrate your business’s potential for growth and scalability.

For example, the crowdfunding platform Kickstarter has helped numerous entrepreneurs raise funds for their businesses. One notable example is the Pebble Watch, which raised over $10 million in funding through Kickstarter. Similarly, incubators and accelerators like Y Combinator and 500 Startups have helped many successful startups secure funding and grow their businesses.

When considering alternative funding options, it’s crucial to weigh the pros and cons of each approach. Crowdfunding, for instance, can be a time-consuming process, and there’s no guarantee of success. Incubators and accelerators, on the other hand, can provide valuable resources and mentorship, but they often require equity in exchange for funding.

By understanding the different funding alternatives available, entrepreneurs can make informed decisions about how to secure funding for their businesses. In the next section, we’ll explore the importance of building a strong online presence and leveraging free and low-cost marketing tools to grow your business.

Building a Strong Online Presence: Leveraging Free and Low-Cost Marketing Tools

In today’s digital age, having a strong online presence is crucial for businesses to succeed. However, building a professional website and marketing campaign can be expensive. Fortunately, there are many free and low-cost marketing tools available that can help entrepreneurs build a strong online presence without breaking the bank.

One of the most effective ways to build a strong online presence is through social media marketing. Platforms like Facebook, Twitter, and Instagram offer free accounts and a range of tools to help businesses reach their target audience. By creating engaging content and using relevant hashtags, businesses can increase their visibility and attract new customers.

Content marketing is another effective way to build a strong online presence. By creating high-quality, informative content, businesses can attract and engage with their target audience. This can be done through blog posts, videos, podcasts, and other forms of content. There are many free and low-cost content creation tools available, such as WordPress, Medium, and Canva.

Email marketing is also a powerful tool for building a strong online presence. By creating a mailing list and sending regular newsletters, businesses can stay in touch with their customers and promote their products or services. There are many free and low-cost email marketing tools available, such as Mailchimp and Constant Contact.

Search engine optimization (SEO) is also important for building a strong online presence. By optimizing their website and content for search engines, businesses can increase their visibility and attract more traffic. There are many free and low-cost SEO tools available, such as Google Analytics and SEMrush.

By leveraging these free and low-cost marketing tools, entrepreneurs can build a strong online presence and reach their target audience without spending a fortune. In the next section, we’ll discuss the importance of networking and partnerships in starting a business with little to no money.

Networking and Partnerships: Collaborating with Others to Achieve Success

When starting a business with little to no money, networking and partnerships can be a powerful way to achieve success. By collaborating with others, entrepreneurs can gain access to new skills, resources, and markets, all while minimizing costs.

One of the most effective ways to network is through attending industry events and conferences. These events provide a platform for entrepreneurs to meet potential partners, investors, and customers, all while learning about the latest trends and developments in their industry.

Another way to network is through online communities and forums. These platforms provide a space for entrepreneurs to connect with others who share similar interests and goals, all while gaining valuable insights and advice.

Partnerships can also be a powerful way to achieve success when starting a business with little to no money. By partnering with other businesses or organizations, entrepreneurs can gain access to new resources, expertise, and markets, all while minimizing costs.

For example, a business can partner with a supplier to gain access to new products or services, all while minimizing costs. Alternatively, a business can partner with a marketing agency to gain access to new marketing channels and expertise, all while minimizing costs.

When forming partnerships, it’s essential to identify potential partners who share similar goals and values. This can be done by researching potential partners, attending industry events, and networking with others in the industry.

Once potential partners have been identified, it’s essential to build relationships and collaborate to achieve common goals. This can be done by communicating effectively, setting clear goals and expectations, and working together to achieve success.

By networking and forming partnerships, entrepreneurs can gain access to new skills, resources, and markets, all while minimizing costs. In the next section, we’ll discuss the importance of managing finances effectively, including budgeting, cash flow management, and accounting.

Managing Finances Effectively: Budgeting and Cash Flow Management

When starting a business with little to no money, managing finances effectively is crucial to success. This includes creating a budget, managing cash flow, and using accounting tools to track expenses and income.

Creating a budget is the first step in managing finances effectively. This involves identifying all sources of income and expenses, and allocating funds accordingly. A budget should be realistic and take into account all financial obligations, including rent, utilities, and employee salaries.

Managing cash flow is also critical to success. This involves ensuring that there is enough cash on hand to meet financial obligations, such as paying bills and employees. Cash flow management can be achieved by creating a cash flow forecast, which predicts income and expenses over a certain period of time.

Accounting tools are also essential for managing finances effectively. These tools can help track expenses and income, and provide valuable insights into financial performance. Some popular accounting tools include QuickBooks, Xero, and Wave.

In addition to these tools, there are also many free and low-cost financial management resources available. For example, the Small Business Administration (SBA) offers a range of financial management resources, including budgeting and cash flow management templates.

By managing finances effectively, entrepreneurs can ensure that their business is financially stable and able to grow. This includes creating a budget, managing cash flow, and using accounting tools to track expenses and income.

Some popular free and low-cost financial management tools include:

- Wave: A cloud-based accounting and invoicing tool that offers a range of features, including budgeting and cash flow management.

- Zoho Books: A cloud-based accounting tool that offers a range of features, including budgeting and cash flow management.

- Mint: A personal finance tool that offers a range of features, including budgeting and cash flow management.

By using these tools and resources, entrepreneurs can manage their finances effectively and ensure that their business is financially stable and able to grow.

Staying Motivated and Focused: Overcoming the Challenges of Bootstrapping

Starting a business with little to no money can be a challenging and demotivating experience. However, with the right mindset and strategies, entrepreneurs can overcome these challenges and achieve success.

One of the most significant challenges of bootstrapping is the lack of financial resources. This can lead to feelings of frustration, anxiety, and uncertainty. However, by focusing on the benefits of bootstrapping, such as increased innovation and resilience, entrepreneurs can stay motivated and focused.

Another challenge of bootstrapping is the need to wear multiple hats. Entrepreneurs must handle all aspects of the business, from marketing and sales to accounting and customer service. This can be overwhelming and lead to burnout. However, by prioritizing tasks, delegating responsibilities, and seeking support from others, entrepreneurs can manage their workload and maintain their motivation.

Additionally, bootstrapping requires a high degree of adaptability and flexibility. Entrepreneurs must be able to pivot their business model, adjust to changes in the market, and respond to unexpected challenges. By staying agile and open to new opportunities, entrepreneurs can overcome the challenges of bootstrapping and achieve success.

Finally, bootstrapping requires a strong support network. Entrepreneurs must surround themselves with people who believe in their vision and are willing to offer guidance, advice, and encouragement. By building a strong support network, entrepreneurs can stay motivated and focused, even in the face of challenges and setbacks.

Some strategies for staying motivated and focused while bootstrapping include:

- Setting clear goals and priorities

- Breaking tasks into smaller, manageable chunks

- Seeking support from others, such as mentors, advisors, or peers

- Staying flexible and adaptable in the face of challenges and setbacks

- Celebrating small wins and accomplishments along the way

By employing these strategies, entrepreneurs can overcome the challenges of bootstrapping and achieve success, even with little to no money.