Identifying Your Business Idea: Turning Passion into Profit

Generating business ideas can be a challenging but exciting part of the entrepreneurial journey. To increase the chances of success, it’s essential to identify areas of interest and passion. Ask yourself, what problems do you want to solve? What industries or markets are you familiar with? What skills and expertise do you possess? By answering these questions, you can start to generate business ideas that align with your strengths and interests.

Once you have a list of potential business ideas, it’s crucial to research market demand. This involves analyzing your target audience, assessing the competition, and evaluating the potential for growth. You can use online tools, such as Google Trends and Keyword Planner, to gauge interest in your business idea and identify gaps in the market.

Validating your business idea is also critical to success. This involves testing your concept with potential customers, gathering feedback, and refining your idea. You can use techniques like surveys, focus groups, and landing pages to validate your business idea and ensure that it meets the needs of your target audience.

Choosing a business idea that aligns with your skills, expertise, and resources is vital to success. By doing so, you can reduce the risk of failure and increase the chances of launching a successful business. Remember, starting a business with no money requires creativity, resourcefulness, and a willingness to take calculated risks. By identifying a business idea that you’re passionate about and has potential for growth, you can take the first step towards turning your passion into profit.

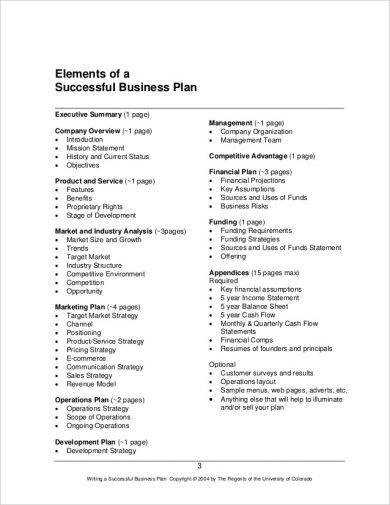

Creating a Business Plan on a Budget: Essential Elements to Include

A business plan is a crucial document that outlines a company’s goals, strategies, and financial projections. However, creating a comprehensive business plan can be a daunting task, especially for entrepreneurs with limited financial resources. The good news is that it’s possible to create a business plan on a budget, without breaking the bank.

The key components of a business plan include market analysis, competitive research, marketing and sales strategies, financial projections, and operational planning. To create a comprehensive plan without spending a fortune, consider the following tips:

Start by conducting market research using free online tools, such as Google Trends and Keyword Planner. This will help you understand your target audience, identify gaps in the market, and develop a unique value proposition.

Next, conduct competitive research by analyzing your competitors’ strengths, weaknesses, and marketing strategies. This will help you differentiate your business and develop a competitive edge.

When it comes to financial projections, use free online templates or accounting software to create a comprehensive financial plan. This should include projected income statements, balance sheets, and cash flow statements.

Finally, outline your operational plan, including your business structure, management team, and operational processes. This will help you develop a clear roadmap for your business and ensure that you’re well-prepared for launch.

By following these tips, entrepreneurs can create a comprehensive business plan on a budget, without sacrificing quality or accuracy. Remember, a business plan is a living document that should be regularly reviewed and updated to ensure that your business stays on track.

Securing Funding: Exploring Alternative Options for Cash-Strapped Entrepreneurs

Securing funding is a crucial step in launching a successful business, but it can be a significant challenge for entrepreneurs with limited financial resources. However, there are alternative funding options available that can help cash-strapped entrepreneurs get their business off the ground.

Crowdfunding is one popular option for entrepreneurs who want to raise funds from a large number of people. Platforms like Kickstarter and Indiegogo allow entrepreneurs to create a campaign and raise funds from backers in exchange for rewards or equity.

Incubators and accelerators are another option for entrepreneurs who want to access funding, mentorship, and resources. These programs provide a supportive environment for startups to grow and develop, and often offer funding in exchange for equity.

Small business loans are also available for entrepreneurs who want to access funding to launch or grow their business. These loans can be obtained from banks, credit unions, or online lenders, and often require a solid business plan and credit history.

Bootstrapping is another option for entrepreneurs who want to launch a business with no money. This involves using personal savings, revenue from early customers, and cost-cutting measures to fund a business. While it can be challenging, bootstrapping allows entrepreneurs to maintain control and equity in their business.

When exploring alternative funding options, it’s essential to consider the pros and cons of each option. For example, crowdfunding can be a great way to raise funds and build a community around your business, but it can also be time-consuming and require a significant amount of effort. Incubators and accelerators can provide valuable resources and mentorship, but they often require equity and can be competitive to get into.

Ultimately, the key to securing funding is to have a solid business plan, a clear understanding of your financials, and a compelling pitch. By exploring alternative funding options and being prepared, entrepreneurs can increase their chances of securing the funding they need to launch and grow a successful business.

Building a Team: Leveraging Free or Low-Cost Resources to Get Started

Building a team is a crucial step in launching a successful business, but it can be a significant challenge for entrepreneurs with limited financial resources. However, there are ways to build a team without breaking the bank. One option is to hire freelancers or part-time employees who can provide specialized skills and expertise without the need for a full-time salary.

Online communities and social media can also be a great resource for finding talent. Platforms like LinkedIn, Twitter, and Facebook can be used to connect with potential team members and promote job openings. Additionally, online communities like Reddit’s r/entrepreneur and r/smallbusiness can provide valuable advice and resources for building a team on a budget.

Coworking spaces are another option for entrepreneurs who want to build a team without committing to a long-term lease. These shared workspaces provide a collaborative environment for entrepreneurs and small businesses to work and connect with others. Many coworking spaces also offer resources and amenities like high-speed internet, meeting rooms, and networking events.

Interns can also be a great way to build a team on a budget. Many colleges and universities offer internship programs that can provide valuable skills and expertise to entrepreneurs. Additionally, interns can be a great way to test out potential team members and see if they are a good fit for the company.

When building a team on a budget, it’s essential to be creative and flexible. Consider hiring team members who can provide multiple skills and expertise, and be open to non-traditional work arrangements like remote work or flexible hours. By leveraging free or low-cost resources, entrepreneurs can build a team that can help them launch and grow a successful business.

For entrepreneurs who want to start their own business with no money, building a team can seem like a daunting task. However, by being creative and resourceful, it’s possible to build a team that can help launch and grow a successful business. By leveraging free or low-cost resources, entrepreneurs can build a team that can help them achieve their goals and succeed in the long term.

Marketing on a Shoestring: Effective Strategies for Reaching Your Target Audience

Marketing is a crucial aspect of any business, but it can be a significant challenge for entrepreneurs with limited financial resources. However, there are effective strategies for marketing a business on a limited budget. One of the most effective ways to market a business on a shoestring budget is to use social media.

Social media platforms like Facebook, Twitter, and Instagram offer a range of free and low-cost marketing tools that can help entrepreneurs reach their target audience. By creating a business page and posting regular updates, entrepreneurs can build a community of followers and drive traffic to their website.

Content marketing is another effective strategy for marketing a business on a limited budget. By creating high-quality, informative content that addresses the needs and interests of their target audience, entrepreneurs can attract and engage with potential customers. This can include blog posts, videos, podcasts, and other types of content.

Email marketing is also a powerful tool for marketing a business on a limited budget. By building an email list and sending regular newsletters, entrepreneurs can stay in touch with their customers and promote their products or services.

Partnerships are another effective way to market a business on a limited budget. By partnering with other businesses or organizations, entrepreneurs can reach new audiences and build their brand. This can include collaborations, joint ventures, and other types of partnerships.

When marketing a business on a limited budget, it’s essential to measure and optimize marketing efforts to maximize ROI. This can include tracking website analytics, monitoring social media engagement, and using other metrics to evaluate the effectiveness of marketing campaigns.

For entrepreneurs who want to start their own business with no money, marketing can seem like a daunting task. However, by using effective strategies like social media marketing, content marketing, email marketing, and partnerships, entrepreneurs can reach their target audience and build their brand without breaking the bank.

Overcoming Common Challenges: Staying Motivated and Focused as a Bootstrapped Entrepreneur

Bootstrapped entrepreneurs often face a range of challenges, from self-doubt and burnout to cash flow management and scaling their business. However, with the right mindset and strategies, it’s possible to overcome these challenges and achieve success.

One of the most common challenges faced by bootstrapped entrepreneurs is self-doubt. This can manifest in a range of ways, from questioning the viability of their business idea to feeling uncertain about their ability to execute. To overcome self-doubt, it’s essential to focus on the reasons why you started your business in the first place, and to remind yourself of your strengths and accomplishments.

Burnout is another common challenge faced by bootstrapped entrepreneurs. This can be caused by a range of factors, from working long hours to taking on too much responsibility. To avoid burnout, it’s essential to prioritize self-care and to take regular breaks. This can include activities like exercise, meditation, and spending time with loved ones.

Cash flow management is also a critical challenge for bootstrapped entrepreneurs. This can involve managing finances, creating a budget, and making smart financial decisions. To overcome cash flow management challenges, it’s essential to create a comprehensive financial plan and to regularly review and adjust your budget.

Finally, scaling a business can be a significant challenge for bootstrapped entrepreneurs. This can involve expanding marketing efforts, hiring new employees, and managing growth. To overcome scaling challenges, it’s essential to create a comprehensive growth plan and to prioritize lean and agile business practices.

For entrepreneurs who want to start their own business with no money, overcoming common challenges requires a combination of hard work, determination, and creativity. By focusing on the reasons why you started your business, prioritizing self-care, managing finances effectively, and creating a comprehensive growth plan, you can overcome the challenges of bootstrapping and achieve success.

Overcoming Common Challenges: Staying Motivated and Focused as a Bootstrapped Entrepreneur

Bootstrapping a business can be a thrilling yet daunting experience, especially when faced with limited financial resources. As an entrepreneur with no initial investment, it’s essential to develop strategies for overcoming common challenges that can hinder progress and success. One of the most significant obstacles is staying motivated and focused in the face of adversity.

Self-doubt and fear of failure can be overwhelming, especially when the stakes are high. However, it’s crucial to recognize that these emotions are normal and can be managed. One effective way to stay motivated is to break down large goals into smaller, achievable milestones. Celebrating these small wins can help build momentum and reinforce a sense of accomplishment.

Another common challenge faced by bootstrapped entrepreneurs is burnout. With limited resources, it’s easy to take on too much and work excessively long hours. However, this can lead to physical and mental exhaustion, ultimately hindering productivity and progress. To avoid burnout, it’s essential to prioritize self-care and establish a healthy work-life balance. This can include delegating tasks, outsourcing when possible, and scheduling regular breaks and time off.

Cash flow management is another critical aspect of bootstrapping a business. With limited financial resources, it’s essential to manage cash flow effectively to ensure the business remains solvent. This can include negotiating payment terms with suppliers, managing accounts receivable and payable, and maintaining a cash reserve for emergencies.

So, how do I start my own business with no money and overcome these common challenges? The key is to stay focused, motivated, and adaptable. By breaking down large goals into smaller milestones, prioritizing self-care, and managing cash flow effectively, entrepreneurs can navigate the challenges of bootstrapping and achieve long-term success.

Additionally, it’s essential to maintain a growth mindset and be open to learning and improvement. This can include seeking mentorship, attending workshops and conferences, and staying up-to-date with industry trends and best practices. By embracing a culture of continuous learning and improvement, entrepreneurs can stay ahead of the curve and overcome the challenges of bootstrapping.

Ultimately, bootstrapping a business requires resilience, determination, and creativity. By developing strategies for overcoming common challenges and staying motivated and focused, entrepreneurs can turn their passion into a successful business, even with limited financial resources.

Scaling Your Business: Strategies for Sustainable Growth

As a bootstrapped entrepreneur, scaling a business on a budget requires careful planning and strategic decision-making. With limited financial resources, it’s essential to prioritize cost-effective strategies that drive sustainable growth. One effective approach is to outsource non-core functions, such as accounting, human resources, or IT, to free up resources and focus on high-leverage activities.

Automating processes is another key strategy for scaling a business on a budget. By leveraging technology, entrepreneurs can streamline operations, reduce manual labor, and increase efficiency. This can include implementing project management tools, marketing automation software, or customer relationship management (CRM) systems.

Expanding marketing efforts is also crucial for scaling a business. However, this doesn’t necessarily require a large budget. By leveraging social media, content marketing, and email marketing, entrepreneurs can reach a wider audience and drive traffic to their website. Additionally, partnerships and collaborations can be an effective way to expand marketing efforts without breaking the bank.

So, how do I start my own business with no money and scale it for sustainable growth? The key is to maintain a lean and agile business model. This means being adaptable, responsive to change, and willing to pivot when necessary. By staying focused on high-leverage activities, outsourcing non-core functions, automating processes, and expanding marketing efforts, entrepreneurs can drive sustainable growth and achieve long-term success.

Another important aspect of scaling a business is measuring and optimizing performance. This includes tracking key performance indicators (KPIs), such as website traffic, conversion rates, and customer acquisition costs. By analyzing these metrics, entrepreneurs can identify areas for improvement and make data-driven decisions to drive growth.

Finally, scaling a business on a budget requires a willingness to take calculated risks. This means being open to new opportunities, experimenting with new strategies, and learning from failures. By embracing a culture of experimentation and innovation, entrepreneurs can stay ahead of the curve and achieve sustainable growth.

In conclusion, scaling a business on a budget requires careful planning, strategic decision-making, and a willingness to take calculated risks. By outsourcing non-core functions, automating processes, expanding marketing efforts, and maintaining a lean and agile business model, entrepreneurs can drive sustainable growth and achieve long-term success. Whether you’re just starting out or looking to scale an existing business, these strategies can help you achieve your goals and build a successful business with limited financial resources.

By following these strategies and staying focused on high-leverage activities, entrepreneurs can overcome the challenges of bootstrapping and achieve sustainable growth. Remember, starting a business with no money requires creativity, resilience, and determination. With the right mindset and strategies, anyone can turn their passion into a successful business and achieve their goals.