What is a Wholesale License and Why Do You Need One

A wholesale license is a permit that allows businesses to purchase products at discounted rates, typically for resale purposes. Obtaining a wholesale license is essential for businesses that want to increase their profit margins and stay competitive in the market. With a wholesale license, businesses can buy products at lower prices, which enables them to sell them at a higher markup, resulting in increased revenue.

In today’s fast-paced business environment, having a wholesale license can be a game-changer for companies looking to expand their product offerings and reach new customers. By obtaining a wholesale license, businesses can tap into a vast network of suppliers and manufacturers, gaining access to a wide range of products at discounted prices. This, in turn, enables them to offer their customers a broader selection of products, which can lead to increased customer satisfaction and loyalty.

Furthermore, a wholesale license can also help businesses to streamline their operations and reduce costs. By purchasing products in bulk, businesses can take advantage of economies of scale, which can lead to significant cost savings. Additionally, a wholesale license can also provide businesses with greater flexibility and control over their inventory management, enabling them to respond quickly to changes in demand and stay ahead of the competition.

So, how do you get a wholesale license? The process typically involves registering your business and obtaining the necessary permits and licenses. This may include obtaining a sales tax permit, resale certificate, or federal tax ID number, depending on the state and type of business. By understanding the requirements and benefits of a wholesale license, businesses can take the first step towards unlocking the secrets of wholesale purchasing and increasing their profitability.

In the next section, we will delve into the requirements for obtaining a wholesale license, including the necessary documentation and application process. By understanding these requirements, businesses can ensure a smooth and successful application process, and start enjoying the benefits of wholesale purchasing.

Understanding the Requirements for a Wholesale License

To obtain a wholesale license, businesses must meet certain requirements, which vary depending on the state and type of business. Typically, businesses must register with the state and obtain necessary permits and licenses. This may include obtaining a sales tax permit, resale certificate, or federal tax ID number.

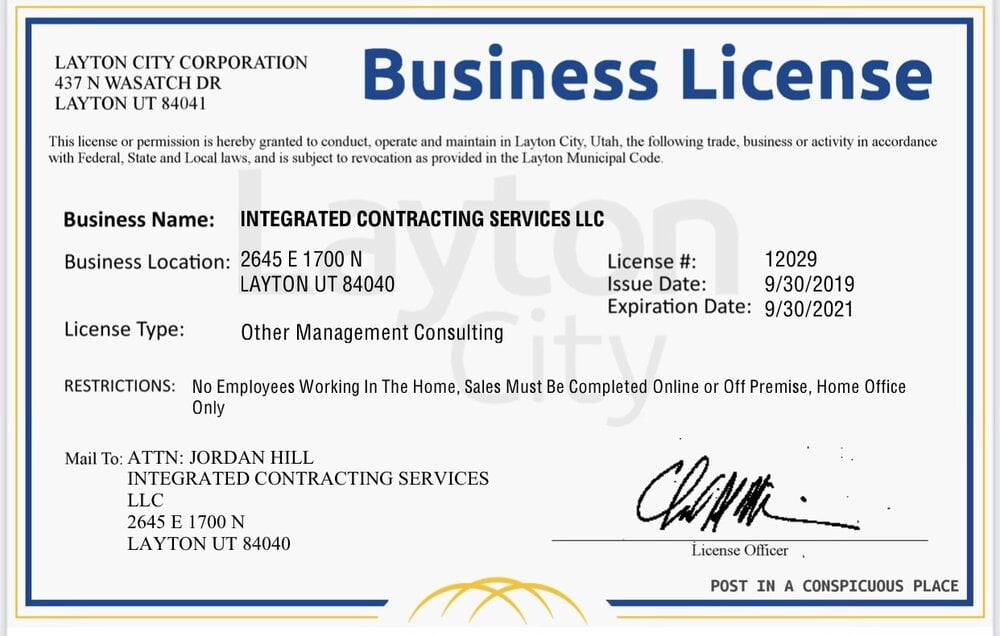

Business registration is a critical step in obtaining a wholesale license. This involves registering the business with the state and obtaining any necessary licenses and permits. The specific requirements for business registration vary depending on the state and type of business. For example, some states require businesses to register with the Secretary of State, while others require registration with the Department of Revenue.

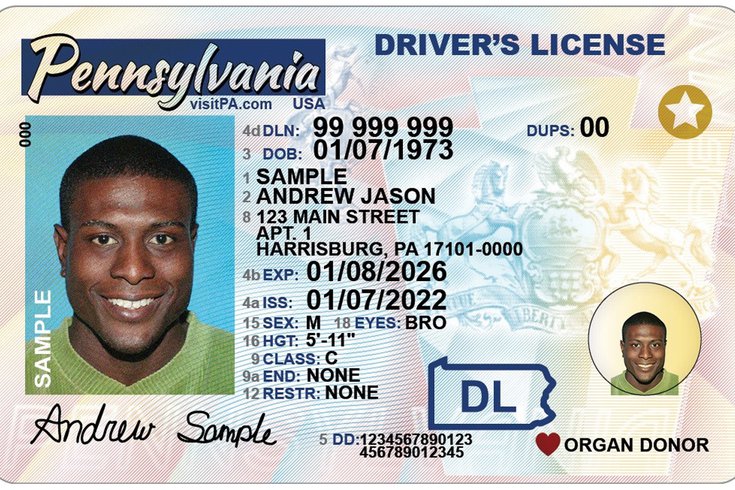

In addition to business registration, businesses must also obtain a tax ID number, also known as an Employer Identification Number (EIN). This is a unique number assigned to the business by the Internal Revenue Service (IRS) and is used to identify the business for tax purposes. To obtain an EIN, businesses must submit an application to the IRS and provide required documentation, such as a copy of the business registration and a valid government-issued ID.

Sales tax permits and resale certificates are also required for businesses that plan to purchase products at wholesale prices. A sales tax permit allows businesses to collect sales tax on products sold to customers, while a resale certificate allows businesses to purchase products at wholesale prices without paying sales tax. To obtain these permits and certificates, businesses must submit an application to the state and provide required documentation, such as a copy of the business registration and a valid government-issued ID.

Meeting these requirements is essential to ensure a smooth application process for a wholesale license. By understanding the requirements and taking the necessary steps to register the business and obtain necessary permits and licenses, businesses can avoid delays and ensure that they are eligible to purchase products at wholesale prices.

In the next section, we will provide a step-by-step guide on how to apply for a wholesale license, including filling out the application form, submitting required documents, and paying the necessary fees.

How to Apply for a Wholesale License: A Step-by-Step Guide

Applying for a wholesale license can seem like a daunting task, but by following these steps, businesses can ensure a smooth and successful application process. To get started, businesses will need to gather the required documents and information, including their business registration, tax ID number, and sales tax permit.

Step 1: Fill out the Application Form

The first step in applying for a wholesale license is to fill out the application form. This form can usually be found on the state’s website or by contacting the licensing authority. Businesses will need to provide their business name, address, and contact information, as well as their tax ID number and sales tax permit number.

Step 2: Submit Required Documents

Once the application form is complete, businesses will need to submit the required documents, including their business registration, tax ID number, and sales tax permit. These documents can usually be uploaded to the state’s website or mailed to the licensing authority.

Step 3: Pay the Necessary Fees

After submitting the required documents, businesses will need to pay the necessary fees. These fees can vary depending on the state and type of business, but they are usually a one-time payment.

Step 4: Wait for Approval

Once the application is submitted and the fees are paid, businesses will need to wait for approval. This can take several weeks or even months, depending on the state and the complexity of the application.

Step 5: Receive Your Wholesale License

Once the application is approved, businesses will receive their wholesale license. This license will allow them to purchase products at wholesale prices and sell them to customers.

By following these steps, businesses can ensure a smooth and successful application process for a wholesale license. Remember to carefully review the application form and required documents to ensure that everything is accurate and complete. This will help to avoid delays and ensure that the application is approved quickly.

In the next section, we will discuss the different types of wholesale licenses available and help businesses determine which one is right for their needs.

Types of Wholesale Licenses: Which One is Right for Your Business

There are several types of wholesale licenses available, each with its own unique requirements and benefits. Understanding the differences between each type of license is essential to ensure that businesses obtain the right license for their needs.

Sales Tax Permit

A sales tax permit is a type of wholesale license that allows businesses to collect sales tax on products sold to customers. This license is typically required for businesses that sell products to customers in a state that has a sales tax. To obtain a sales tax permit, businesses must register with the state and provide documentation, such as a business registration and tax ID number.

Resale Certificate

A resale certificate is a type of wholesale license that allows businesses to purchase products at wholesale prices without paying sales tax. This license is typically required for businesses that resell products to customers. To obtain a resale certificate, businesses must register with the state and provide documentation, such as a business registration and tax ID number.

Federal Tax ID Number

A federal tax ID number is a type of wholesale license that is required for businesses that operate across state lines. This license is typically required for businesses that sell products to customers in multiple states. To obtain a federal tax ID number, businesses must register with the IRS and provide documentation, such as a business registration and tax ID number.

Other Types of Wholesale Licenses

There are other types of wholesale licenses available, including a wholesale license, a distributor’s license, and a manufacturer’s license. Each of these licenses has its own unique requirements and benefits, and businesses should carefully review the requirements to ensure that they obtain the right license for their needs.

Choosing the Right Wholesale License

Choosing the right wholesale license can be a complex process, and businesses should carefully review the requirements and benefits of each type of license. By understanding the differences between each type of license, businesses can ensure that they obtain the right license for their needs and avoid any potential penalties or fines.

In the next section, we will discuss common mistakes to avoid when applying for a wholesale license, including incomplete applications, incorrect documentation, and failure to meet requirements.

Common Mistakes to Avoid When Applying for a Wholesale License

When applying for a wholesale license, businesses must be careful to avoid common mistakes that can delay or even prevent the approval of their application. In this section, we will highlight some of the most common mistakes businesses make when applying for a wholesale license and provide tips on how to avoid them.

Incomplete Applications

One of the most common mistakes businesses make when applying for a wholesale license is submitting an incomplete application. This can include failing to provide required documentation, such as a business registration or tax ID number, or failing to complete all sections of the application form.

Incorrect Documentation

Another common mistake businesses make when applying for a wholesale license is submitting incorrect documentation. This can include providing a business registration that is not up-to-date or providing a tax ID number that is not valid.

Failure to Meet Requirements

Businesses must also be careful to meet all the requirements for a wholesale license. This can include registering with the state, obtaining a tax ID number, and meeting any other requirements specified by the state or licensing authority.

Tips for Avoiding Common Mistakes

To avoid common mistakes when applying for a wholesale license, businesses should carefully review the application form and requirements before submitting their application. They should also ensure that they have all the required documentation and that it is accurate and up-to-date.

Additionally, businesses should consider seeking the advice of a professional, such as an attorney or accountant, to ensure that they are meeting all the requirements and avoiding common mistakes.

By avoiding common mistakes and ensuring that they meet all the requirements, businesses can increase their chances of a successful application and obtain a wholesale license that will help them to purchase products at discounted rates and increase their profit margins.

In the next section, we will discuss how to verify a wholesale license to ensure authenticity and legitimacy.

How to Verify a Wholesale License: Ensuring Authenticity and Legitimacy

Verifying a wholesale license is an essential step in ensuring that a business is legitimate and compliant with state regulations. In this section, we will discuss the importance of verifying a wholesale license and provide tips on how to do so.

Why Verify a Wholesale License?

Verifying a wholesale license is crucial to ensure that a business is legitimate and compliant with state regulations. A wholesale license is a permit that allows a business to purchase products at wholesale prices and resell them to customers. However, not all businesses that claim to have a wholesale license are legitimate. Some businesses may use fake or expired licenses to deceive customers and suppliers.

How to Verify a Wholesale License

There are several ways to verify a wholesale license, including:

Checking with the State Government

One way to verify a wholesale license is to check with the state government. Each state has a database of licensed businesses, and you can search for a business by name or license number. If the business is licensed, you will be able to view their license information, including the license number, expiration date, and business name.

Contacting the Licensing Authority

Another way to verify a wholesale license is to contact the licensing authority directly. The licensing authority is responsible for issuing and regulating wholesale licenses, and they can provide you with information about a business’s license status. You can contact the licensing authority by phone or email and provide them with the business’s name and license number.

Checking Online Directories

There are also online directories that list licensed businesses. These directories are usually maintained by the state government or a third-party provider, and they can provide you with information about a business’s license status. Some popular online directories include the Better Business Bureau and the Federal Trade Commission.

Conclusion

Verifying a wholesale license is an essential step in ensuring that a business is legitimate and compliant with state regulations. By checking with the state government, contacting the licensing authority, or checking online directories, you can verify a wholesale license and ensure that you are doing business with a legitimate and compliant business.

In the next section, we will discuss the importance of maintaining a wholesale license, including renewal procedures, compliance requirements, and any necessary documentation.

Maintaining Your Wholesale License: Renewal and Compliance Requirements

Maintaining a wholesale license requires ongoing compliance with state regulations and renewal procedures. In this section, we will outline the requirements for maintaining a wholesale license and emphasize the importance of staying up-to-date to avoid penalties or license revocation.

Renewal Procedures

Wholesale licenses typically need to be renewed annually or bi-annually, depending on the state and type of license. Businesses must submit a renewal application and pay the required fees to maintain their license. Failure to renew a license can result in penalties, fines, or even license revocation.

Compliance Requirements

Businesses must also comply with ongoing requirements, such as filing tax returns, maintaining accurate records, and reporting any changes to their business. Failure to comply with these requirements can result in penalties, fines, or even license revocation.

Necessary Documentation

Businesses must maintain accurate and up-to-date documentation, including their license, tax returns, and business records. This documentation may be required during audits or inspections, and failure to produce it can result in penalties or fines.

Importance of Staying Up-to-Date

Staying up-to-date with renewal procedures, compliance requirements, and necessary documentation is crucial to maintaining a wholesale license. Failure to do so can result in penalties, fines, or even license revocation, which can have serious consequences for a business.

Tips for Maintaining a Wholesale License

To maintain a wholesale license, businesses should:

Keep accurate and up-to-date records

File tax returns on time

Report any changes to their business

Renew their license on time

By following these tips, businesses can ensure that they maintain their wholesale license and avoid any penalties or fines.

In the next section, we will summarize the benefits of obtaining a wholesale license and encourage businesses to take the necessary steps to apply.

Conclusion: Unlocking the Benefits of a Wholesale License

Obtaining a wholesale license can be a game-changer for businesses looking to increase their profit margins and stay competitive in the market. By understanding the requirements, avoiding common mistakes, and maintaining compliance, businesses can unlock the benefits of a wholesale license and take their business to the next level.

In this article, we have discussed the concept of a wholesale license, its benefits, and the requirements for obtaining one. We have also provided a step-by-step guide on how to apply for a wholesale license, discussed the different types of wholesale licenses available, and highlighted common mistakes to avoid when applying for a wholesale license.

Additionally, we have emphasized the importance of verifying a wholesale license to ensure authenticity and legitimacy, and outlined the requirements for maintaining a wholesale license, including renewal procedures, compliance requirements, and any necessary documentation.

By following the tips and guidelines outlined in this article, businesses can ensure a successful and profitable wholesale licensing experience. Remember, obtaining a wholesale license is just the first step – maintaining compliance and staying up-to-date with requirements is crucial to avoiding penalties or license revocation.

Don’t let the complexities of wholesale licensing hold you back from achieving your business goals. Take the necessary steps to apply for a wholesale license today and start enjoying the benefits of increased profit margins and competitiveness in the market.