What is a Whole Life Policy and How Does it Work?

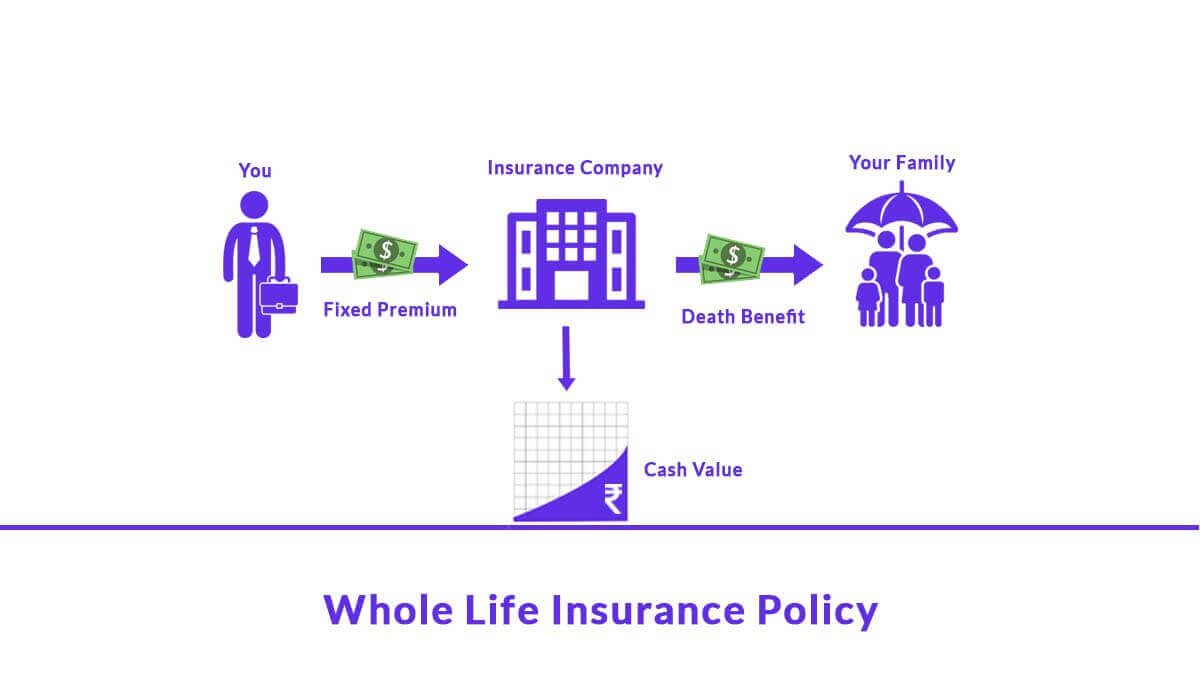

Whole life insurance, also known as traditional life insurance or straight life insurance, is a type of permanent life insurance that provides coverage for the policyholder’s entire lifetime. This means that as long as premiums are paid, the policy will remain in force and pay a death benefit to the beneficiary when the policyholder passes away. But how does a whole life policy work, exactly? In essence, it’s a contract between the policyholder and the insurance company, where the policyholder pays premiums in exchange for a guaranteed death benefit and a cash value component that grows over time.

One of the key benefits of whole life insurance is that it provides a guaranteed death benefit, which can help ensure that loved ones are financially protected in the event of the policyholder’s passing. Additionally, the cash value component of the policy can be used to supplement retirement income, pay for unexpected expenses, or even fund a down payment on a house. But to truly understand how a whole life policy works, it’s essential to grasp the different components that make up the policy and how they interact with one another.

When a policyholder purchases a whole life insurance policy, they typically pay a level premium, which is a fixed amount that’s paid at regular intervals (e.g., monthly or annually). A portion of this premium goes towards paying for the insurance company’s costs, such as administrative expenses and claims payouts, while the remaining amount is invested in a cash value account. Over time, the cash value account grows, earning interest and potentially dividends, which can be used to increase the policy’s death benefit or provide a source of funds for the policyholder.

So, how does a whole life policy work in terms of providing a return on investment? While the primary purpose of whole life insurance is to provide a death benefit, the cash value component can also generate returns through interest and dividends. However, it’s essential to note that the returns on whole life insurance are generally lower than those of other investment vehicles, such as stocks or mutual funds. Nevertheless, the guaranteed death benefit and cash value component make whole life insurance an attractive option for those seeking a stable and predictable source of funds.

Key Components of a Whole Life Policy

A whole life policy is composed of several key components that work together to provide a comprehensive insurance solution. Understanding these components is essential to grasping how a whole life policy works. The four main components of a whole life policy are the death benefit, cash value, premiums, and dividends.

The death benefit is the amount paid to the beneficiary when the policyholder passes away. This benefit is guaranteed, as long as premiums are paid, and is typically tax-free. The death benefit can be used to cover funeral expenses, outstanding debts, and other financial obligations, providing a financial safety net for loved ones.

The cash value component is a savings element that grows over time, based on the premiums paid and the interest rates earned. A portion of each premium payment is allocated to the cash value account, which can be used to supplement retirement income, pay for unexpected expenses, or even fund a down payment on a house. The cash value component can also be borrowed against, providing a source of funds in times of need.

Premiums are the regular payments made by the policyholder to maintain coverage. Whole life insurance premiums are typically level, meaning they remain the same for the life of the policy. However, some policies may offer graded or modified premiums, which can increase or decrease over time. Premiums are used to pay for the insurance company’s costs, such as administrative expenses and claims payouts, as well as to fund the cash value account.

Dividends are payments made by the insurance company to policyholders, based on the company’s financial performance. Dividends can be used to increase the policy’s death benefit, reduce premiums, or even provide a source of additional income. Not all whole life insurance policies pay dividends, so it’s essential to review the policy’s terms and conditions to understand the dividend structure.

By understanding the key components of a whole life policy, policyholders can better appreciate how the policy works and make informed decisions about their coverage. Whether it’s the guaranteed death benefit, cash value component, premiums, or dividends, each element plays a critical role in providing a comprehensive insurance solution.

How Whole Life Insurance Accumulates Cash Value

One of the key benefits of whole life insurance is the accumulation of cash value over time. But how does this process work? To understand how whole life insurance accumulates cash value, it’s essential to examine the role of premiums, interest rates, and dividends.

Premiums play a crucial role in accumulating cash value. A portion of each premium payment is allocated to the cash value account, which earns interest over time. The interest rate earned on the cash value account can vary depending on the insurance company and the policy’s terms. Some policies may offer a guaranteed minimum interest rate, while others may offer a variable rate tied to the performance of the insurance company’s investments.

Dividends also contribute to the growth of the cash value account. Dividends are payments made by the insurance company to policyholders, based on the company’s financial performance. When dividends are paid, they can be added to the cash value account, increasing the policy’s value over time.

The cash value account grows tax-deferred, meaning that policyholders won’t pay taxes on the gains until they withdraw the funds. This can be a significant advantage, as it allows the cash value to grow more quickly over time. Additionally, policyholders can borrow against the cash value account, using the funds to supplement retirement income or cover unexpected expenses.

It’s worth noting that the rate at which cash value accumulates can vary depending on the policy and the insurance company. Some policies may offer more aggressive investment options, which can increase the potential for growth but also increase the risk. Other policies may offer more conservative investment options, which can provide more stable returns but lower growth potential.

Understanding how whole life insurance accumulates cash value is essential to grasping how a whole life policy works. By examining the role of premiums, interest rates, and dividends, policyholders can better appreciate the value of their policy and make informed decisions about their coverage.

Understanding Whole Life Insurance Premiums

Whole life insurance premiums are a crucial aspect of maintaining coverage. But how do they work? To understand whole life insurance premiums, it’s essential to examine the different types of premiums and how they’re calculated.

There are three main types of whole life insurance premiums: level, graded, and modified. Level premiums remain the same for the life of the policy, providing a predictable and stable premium payment. Graded premiums, on the other hand, increase over time, often in conjunction with the policyholder’s age. Modified premiums are a combination of level and graded premiums, offering a lower initial premium that increases over time.

Premiums are calculated based on a variety of factors, including the policyholder’s age, health, and coverage amount. Insurance companies use actuarial tables to determine the likelihood of a claim being made and set premiums accordingly. The premium payment is typically made monthly or annually, and it’s essential to make timely payments to maintain coverage.

It’s worth noting that whole life insurance premiums are generally more expensive than term life insurance premiums. However, whole life insurance provides a guaranteed death benefit and a cash value component, which can grow over time. Additionally, whole life insurance premiums can be tax-deductible, providing a potential tax benefit.

Understanding how whole life insurance premiums work is essential to grasping how a whole life policy works. By examining the different types of premiums and how they’re calculated, policyholders can better appreciate the value of their policy and make informed decisions about their coverage.

In addition to understanding premiums, it’s also essential to consider the importance of premium payments in maintaining coverage. Missing premium payments can result in a lapse in coverage, which can have serious consequences. Policyholders should prioritize making timely premium payments to ensure that their coverage remains in force.

Whole Life Insurance vs. Term Life Insurance: Key Differences

When it comes to life insurance, there are two main types: whole life insurance and term life insurance. While both types of insurance provide a death benefit, they differ significantly in terms of their features, benefits, and costs. Understanding the key differences between whole life insurance and term life insurance can help you make an informed decision about which type of insurance is right for you.

One of the main differences between whole life insurance and term life insurance is the duration of coverage. Whole life insurance provides coverage for the policyholder’s entire lifetime, as long as premiums are paid. Term life insurance, on the other hand, provides coverage for a specified period of time, such as 10, 20, or 30 years.

Another key difference is the cash value component. Whole life insurance policies have a cash value component that grows over time, based on the premiums paid and the interest rates earned. Term life insurance policies do not have a cash value component.

Premiums are also a significant difference between whole life insurance and term life insurance. Whole life insurance premiums are typically more expensive than term life insurance premiums, especially in the early years of the policy. However, whole life insurance premiums are often level, meaning they remain the same for the life of the policy. Term life insurance premiums, on the other hand, can increase over time.

Whole life insurance is often referred to as “permanent” life insurance, because it provides coverage for the policyholder’s entire lifetime. Term life insurance, on the other hand, is often referred to as “temporary” life insurance, because it provides coverage for a specified period of time.

When deciding between whole life insurance and term life insurance, it’s essential to consider your individual circumstances and goals. If you want to provide a guaranteed death benefit for your loved ones, regardless of when you pass away, whole life insurance may be the better choice. If you want to provide coverage for a specific period of time, such as until your children are grown and self-sufficient, term life insurance may be the better choice.

Ultimately, the decision between whole life insurance and term life insurance depends on your individual needs and goals. By understanding the key differences between these two types of insurance, you can make an informed decision about which type of insurance is right for you.

How to Choose the Right Whole Life Insurance Policy

Choosing the right whole life insurance policy can be a daunting task, given the numerous options available in the market. To make an informed decision, it’s essential to consider several factors that align with your financial goals, risk tolerance, and personal circumstances. Here are some key considerations to help you select the right whole life insurance policy.

First and foremost, determine your coverage needs by assessing your financial obligations, such as outstanding debts, funeral expenses, and income replacement. This will help you decide on the appropriate coverage amount. It’s also crucial to evaluate your budget and determine how much you can afford to pay in premiums.

Next, research and compare different insurance companies, their financial strength, and reputation. Look for companies with high ratings from reputable rating agencies, such as A.M. Best or Moody’s. This will ensure that the insurer can pay claims and maintain its financial obligations.

When evaluating whole life insurance policies, consider the premium costs, payment terms, and any potential fees. Some policies may offer flexible premium payments, while others may have level premiums for the life of the policy. Be sure to understand how the premiums are calculated and any potential increases.

Another critical factor to consider is the policy’s cash value component. Look for policies with a guaranteed minimum interest rate and a clear explanation of how the cash value grows over time. Some policies may also offer dividend payments, which can increase the policy’s value.

Riders and add-ons can also enhance the policy’s benefits. Common riders include waiver of premium, long-term care, and accidental death benefit. Carefully evaluate the costs and benefits of each rider to determine if it aligns with your needs.

Finally, review the policy’s terms and conditions, including any exclusions, limitations, or surrender charges. It’s essential to understand how the policy works and any potential implications of canceling or surrendering the policy.

By carefully considering these factors, you can make an informed decision when choosing a whole life insurance policy. Remember to ask questions, seek professional advice if needed, and thoroughly review the policy’s terms and conditions before making a decision. By doing so, you can ensure that your whole life insurance policy provides the necessary protection and benefits for you and your loved ones.

Common Riders and Add-ons for Whole Life Insurance

Whole life insurance policies can be customized to meet individual needs through the addition of riders and add-ons. These supplemental benefits can enhance the policy’s value, provide additional protection, and offer flexibility. Here are some common riders and add-ons available for whole life insurance policies.

Waiver of Premium Rider: This rider waives the premium payments if the policyholder becomes disabled or critically ill. This ensures that the policy remains in force, even if the policyholder is unable to pay premiums.

Long-Term Care Rider: This rider provides a portion of the policy’s death benefit to cover long-term care expenses, such as nursing home care or home health care. This can help policyholders maintain their independence and quality of life.

Accidental Death Benefit Rider: This rider provides an additional death benefit if the policyholder dies as a result of an accident. This can provide extra financial protection for the policyholder’s loved ones.

Term Rider: This rider adds a term life insurance component to the whole life policy, providing additional coverage for a specified period. This can be useful for policyholders who need temporary coverage for a specific need, such as a mortgage or business loan.

Cost of Living Adjustment (COLA) Rider: This rider increases the policy’s death benefit and cash value over time to keep pace with inflation. This can help the policyholder’s benefits maintain their purchasing power.

Other riders and add-ons may include a guaranteed insurability rider, which allows the policyholder to purchase additional coverage without providing evidence of insurability, and a policy loan rider, which allows the policyholder to borrow against the policy’s cash value.

When considering riders and add-ons, it’s essential to evaluate the costs and benefits carefully. Some riders may increase the policy’s premiums, while others may provide valuable benefits that enhance the policy’s overall value. Policyholders should carefully review the policy’s terms and conditions, including any riders and add-ons, to ensure they understand how the policy works and what benefits are available.

By adding riders and add-ons to a whole life insurance policy, policyholders can create a customized insurance solution that meets their unique needs and provides additional protection and benefits. It’s essential to work with a licensed insurance professional to determine the best riders and add-ons for your individual circumstances and goals.

Maximizing the Benefits of a Whole Life Policy

To get the most out of a whole life insurance policy, it’s essential to understand how to optimize its benefits. By following a few strategies, policyholders can maximize their coverage, grow their cash value, and minimize taxes.

Optimizing Cash Value Growth: One way to maximize the benefits of a whole life policy is to optimize cash value growth. This can be achieved by paying premiums consistently, taking advantage of dividend payments, and considering a paid-up additions rider. Paid-up additions allow policyholders to purchase additional coverage using dividends, which can increase the policy’s cash value over time.

Minimizing Taxes: Whole life insurance policies can provide tax benefits, such as tax-deferred growth of the cash value and tax-free withdrawals. To minimize taxes, policyholders should consider the tax implications of their policy and consult with a tax professional. They can also explore tax-efficient strategies, such as using the policy’s cash value to supplement retirement income.

Ensuring Adequate Coverage: It’s essential to ensure that the policy provides adequate coverage for the policyholder’s needs. This can be achieved by regularly reviewing the policy’s coverage amount and adjusting it as needed. Policyholders should also consider adding riders or add-ons to enhance the policy’s benefits.

Strategic Premium Payments: Policyholders can also maximize their benefits by making strategic premium payments. For example, they can consider paying premiums annually or semi-annually to reduce the number of payments and minimize fees. They can also explore flexible premium payment options, such as a flexible premium rider, which allows them to adjust their premium payments over time.

Monitoring Policy Performance: Finally, policyholders should regularly monitor their policy’s performance to ensure it’s meeting their needs. This can be achieved by reviewing the policy’s statements, tracking the cash value growth, and adjusting the policy as needed. By monitoring the policy’s performance, policyholders can make informed decisions and maximize their benefits.

By following these strategies, policyholders can maximize the benefits of their whole life insurance policy and achieve their long-term financial goals. It’s essential to work with a licensed insurance professional to determine the best strategies for your individual circumstances and goals.

Whole life insurance policies can provide a lifetime of protection and benefits, but it’s up to the policyholder to maximize their benefits. By understanding how to optimize cash value growth, minimize taxes, and ensure adequate coverage, policyholders can get the most out of their policy and achieve financial peace of mind.