Taking the Leap: Why Moving Out at 18 Can Be a Life-Changing Decision

Moving out at 18 can be a daunting experience, but for many, it’s a crucial step towards independence and self-discovery. The decision to leave the family nest and start a new life can be motivated by various factors, including the desire for autonomy, the need for personal growth, and the pursuit of new opportunities. For those who have taken the leap, the experience can be transformative, teaching valuable lessons about responsibility, resilience, and self-reliance.

One of the primary reasons individuals choose to move out at 18 is to gain independence and freedom. Living with family members can be restrictive, and the desire for autonomy can be overwhelming. By moving out, young adults can take control of their lives, make their own decisions, and learn to navigate the world on their own terms. This newfound independence can be incredibly empowering, allowing individuals to develop a sense of self and identity.

Another significant factor driving the decision to move out at 18 is the pursuit of personal growth and development. Living away from family can provide opportunities for self-discovery, allowing individuals to explore their interests, values, and passions. This period of exploration can be instrumental in shaping one’s future, helping young adults to identify their strengths, weaknesses, and goals.

For many, moving out at 18 is also a necessary step towards pursuing new opportunities. Whether it’s attending college, starting a career, or pursuing a passion, living away from family can provide the freedom and flexibility to chase one’s dreams. This can be particularly important for those who feel stifled by their current environment or lack access to resources and opportunities.

While moving out at 18 can be a life-changing decision, it’s essential to acknowledge the challenges that come with it. Young adults may face financial struggles, loneliness, and uncertainty, which can be overwhelming. However, with the right mindset and support, these challenges can be overcome, and the experience can be incredibly rewarding.

For those considering moving out at 18, it’s crucial to weigh the pros and cons carefully. It’s essential to consider factors such as financial stability, emotional readiness, and support systems. However, for those who are willing to take the leap, the experience can be transformative, teaching valuable lessons about independence, self-reliance, and personal growth.

In conclusion, moving out at 18 can be a life-changing decision that offers numerous benefits, including independence, personal growth, and new opportunities. While challenges will arise, the experience can be incredibly rewarding for those who are willing to take the leap. By understanding the motivations and emotions behind this decision, young adults can make informed choices about their future and set themselves up for success.

Preparing for the Big Move: Essential Steps to Take

When considering moving out at 18, it’s essential to prepare thoroughly to ensure a smooth transition. This involves several key steps, including finding a place to live, budgeting, and planning for independence. By taking the time to prepare, young adults can set themselves up for success and avoid common pitfalls.

First and foremost, finding a place to live is a critical step in the moving-out process. This involves researching different neighborhoods, considering factors such as safety, affordability, and proximity to work or school. It’s also essential to think about the type of accommodation that best suits your needs, whether it’s a shared apartment, a studio, or a house.

Once you’ve found a place to live, it’s time to start thinking about budgeting. This involves creating a comprehensive budget that takes into account all of your expenses, including rent, utilities, food, and transportation. It’s also essential to consider ways to reduce costs, such as finding a roommate or cooking at home instead of eating out.

Another critical step in preparing for independence is planning for financial stability. This involves opening a bank account, applying for a credit card, and considering ways to build credit. It’s also essential to think about long-term financial goals, such as saving for college or a down payment on a house.

In addition to financial planning, it’s also essential to think about practical aspects of independence, such as cooking, cleaning, and time management. This involves developing essential life skills, such as meal planning, grocery shopping, and laundry. It’s also essential to consider ways to stay organized, such as using a planner or app to keep track of appointments and deadlines.

Finally, it’s essential to think about the emotional and psychological aspects of moving out. This involves developing a support network, including friends, family, and a therapist if needed. It’s also essential to consider ways to manage stress and anxiety, such as exercise, meditation, or hobbies.

By taking the time to prepare for independence, young adults can set themselves up for success and avoid common pitfalls. Whether you’re moving out at 18 or later in life, the key is to be prepared and to have a plan in place. With the right mindset and support, anyone can thrive in their new life and achieve their goals.

For those who are considering moving out at 18, it’s essential to remember that it’s okay to ask for help. Whether it’s a parent, a friend, or a professional, having a support network can make all the difference. By being prepared and having a plan in place, young adults can take the first step towards independence and start building the life they want.

Overcoming Fears and Doubts: Building Confidence for Independence

When considering moving out at 18, it’s common to experience fears and doubts about the decision. Financial insecurity, loneliness, and uncertainty are just a few of the concerns that may arise. However, with the right mindset and strategies, it’s possible to overcome these fears and build confidence for independence.

One of the most significant fears associated with moving out at 18 is financial insecurity. The thought of managing one’s own finances, paying bills, and budgeting can be daunting. However, by creating a comprehensive budget and prioritizing needs over wants, it’s possible to take control of one’s financial situation. Additionally, seeking advice from a financial advisor or using online resources can provide valuable guidance and support.

Another common fear is loneliness. Leaving the comfort and security of family and friends can be a significant adjustment. However, by building a support network of friends, family, and community, it’s possible to stay connected and build new relationships. Joining clubs, organizations, or volunteering can also provide opportunities to meet new people and build a sense of belonging.

Uncertainty is another fear that may arise when considering moving out at 18. The unknown can be intimidating, and it’s natural to wonder what the future holds. However, by setting clear goals and priorities, it’s possible to create a sense of direction and purpose. Breaking down larger goals into smaller, manageable steps can also help to build confidence and momentum.

To overcome these fears and doubts, it’s essential to focus on building confidence and self-reliance. This can be achieved by taking small steps towards independence, such as managing one’s own schedule, cooking meals, and taking care of personal responsibilities. Celebrating small victories and accomplishments can also help to build confidence and reinforce a sense of capability.

Additionally, seeking support from others can be incredibly valuable. Talking to friends, family, or a therapist can provide a safe and supportive space to discuss fears and doubts. Sharing experiences and advice with others who have gone through similar situations can also provide valuable insights and guidance.

Ultimately, building confidence for independence requires patience, persistence, and self-compassion. It’s essential to acknowledge and accept fears and doubts, rather than trying to suppress or deny them. By doing so, it’s possible to create a sense of safety and security, and to build the confidence and resilience needed to thrive in a new and independent life.

For those who are considering moving out at 18, it’s essential to remember that it’s okay to feel scared and uncertain. However, by focusing on building confidence and self-reliance, it’s possible to overcome these fears and create a bright and successful future.

Creating a Budget and Managing Finances as a Young Adult

As a young adult, managing finances effectively is crucial for achieving independence and securing a bright financial future. Creating a budget is an essential step in taking control of one’s finances, and it’s especially important for those who are moving out at 18. In this article, we’ll provide a detailed guide on how to create a budget and manage finances as a young adult.

The first step in creating a budget is to track one’s income and expenses. This involves keeping a record of all income, including part-time jobs, scholarships, and any other sources of income. It’s also essential to track all expenses, including rent, utilities, food, transportation, and entertainment.

Once income and expenses are tracked, the next step is to categorize expenses into needs and wants. Needs include essential expenses such as rent, utilities, and food, while wants include discretionary expenses such as entertainment and hobbies. By prioritizing needs over wants, young adults can ensure that they’re allocating their resources effectively.

Another crucial aspect of budgeting is saving and investing. Saving involves setting aside a portion of one’s income for short-term goals, such as building an emergency fund or saving for a car. Investing involves allocating a portion of one’s income towards long-term goals, such as retirement or a down payment on a house.

Young adults can also avoid debt by being mindful of their spending habits and avoiding high-interest loans and credit cards. By paying off high-interest debt quickly and avoiding new debt, young adults can save money on interest payments and achieve financial freedom.

In addition to creating a budget and managing finances, young adults can also benefit from learning about financial literacy and responsibility. This involves understanding basic financial concepts, such as compound interest and credit scores, and making informed decisions about financial products and services.

By following these tips and creating a budget, young adults can take control of their finances and achieve independence. Remember, managing finances effectively is a skill that takes time and practice to develop, but with patience and persistence, anyone can achieve financial freedom.

For those who are considering moving out at 18, creating a budget and managing finances is an essential step in achieving independence. By prioritizing needs over wants, saving and investing, and avoiding debt, young adults can set themselves up for financial success and achieve their long-term goals.

Finding a

Finding a Place to Call Home: Tips for First-Time Renters

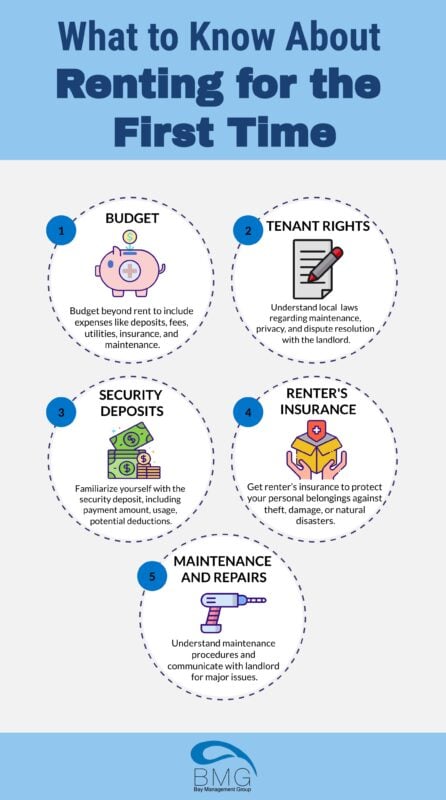

When moving out at 18, finding a place to live can be a daunting task, especially for first-time renters. With so many options available, it’s essential to know what to look for in a rental property and how to navigate the rental application process. In this article, we’ll provide valuable tips and advice for first-time renters to help them find a place to call home.

Before starting the search for a rental property, it’s crucial to define your priorities. What are your non-negotiables? Do you need a place with a yard, or are you looking for a location close to public transportation? Make a list of your priorities to help guide your search.

Next, research different neighborhoods and areas to determine which one is the best fit for you. Consider factors such as safety, proximity to work or school, and access to amenities like grocery stores and restaurants.

When searching for a rental property, it’s essential to

Finding a Place to Call Home: Tips for First-Time Renters

When moving out at 18, finding a place to live can be a daunting task, especially for first-time renters. With so many options available, it’s essential to know what to look for in a rental property and how to navigate the rental application process. In this article, we’ll provide valuable tips and advice for first-time renters to help them find a place to call home.

Before starting the search for a rental property, it’s crucial to define your priorities. What are your non-negotiables? Do you need a place with a yard, or are you looking for a location close to public transportation? Make a list of your priorities to help guide your search.

Next, research different neighborhoods and areas to determine which one is the best fit for you. Consider factors such as safety, proximity to work or school, and access to amenities like grocery stores and restaurants.

When searching for a rental property, it’s essential to

Finding a Place to Call Home: Tips for First-Time Renters

When moving out at 18, finding a place to live can be a daunting task, especially for first-time renters. With so many options available, it’s essential to know what to look for in a rental property and how to navigate the rental application process. In this article, we’ll provide valuable tips and advice for first-time renters to help them find a place to call home.

Before starting the search for a rental property, it’s crucial to define your priorities. What are your non-negotiables? Do you need a place with a yard, or are you looking for a location close to public transportation? Make a list of your priorities to help guide your search.

Next, research different neighborhoods and areas to determine which one is the best fit for you. Consider factors such as safety, proximity to work or school, and access to amenities like grocery stores and restaurants.

When searching for a rental property, it’s essential to