Converting Hourly to Annual Salary: What You Need to Know

Understanding the annual equivalent of an hourly wage is crucial for effective financial planning, budgeting, and tax preparation. Knowing your total yearly income can help you make informed decisions about your career, investments, and lifestyle. In today’s competitive job market, it’s essential to have a clear understanding of your salary structure to negotiate fair compensation and benefits. For instance, if you’re earning $50 an hour, you may wonder how much a year is $50 an hour. This calculation can significantly impact your financial situation, and it’s vital to get it right.

Converting hourly to annual salary involves considering various factors, including the number of hours worked per week, the number of weeks worked per year, and any overtime or bonuses. A clear understanding of these factors can help you accurately calculate your annual salary and make informed decisions about your financial future. By knowing your annual salary, you can better plan for taxes, benefits, and other expenses, ensuring you’re making the most of your hard-earned money.

In addition to financial planning, understanding your annual salary can also help you evaluate job offers and negotiate fair compensation. By knowing the annual equivalent of an hourly wage, you can compare job offers and make informed decisions about your career. For example, if you’re considering a job offer with an hourly wage of $50, you’ll want to know how much a year is $50 an hour to determine if the offer is competitive and fair.

Furthermore, understanding your annual salary can also help you identify areas for improvement in your financial situation. By knowing your total yearly income, you can identify areas where you can cut back on expenses, increase your income, or optimize your benefits. This knowledge can help you make informed decisions about your financial future and achieve your long-term goals.

In conclusion, understanding the annual equivalent of an hourly wage is essential for effective financial planning, budgeting, and tax preparation. By knowing your total yearly income, you can make informed decisions about your career, investments, and lifestyle. Whether you’re earning $50 an hour or any other hourly wage, it’s crucial to understand how much a year is $50 an hour to unlock the full potential of your salary.

How to Calculate Your Annual Salary from Hourly Wage

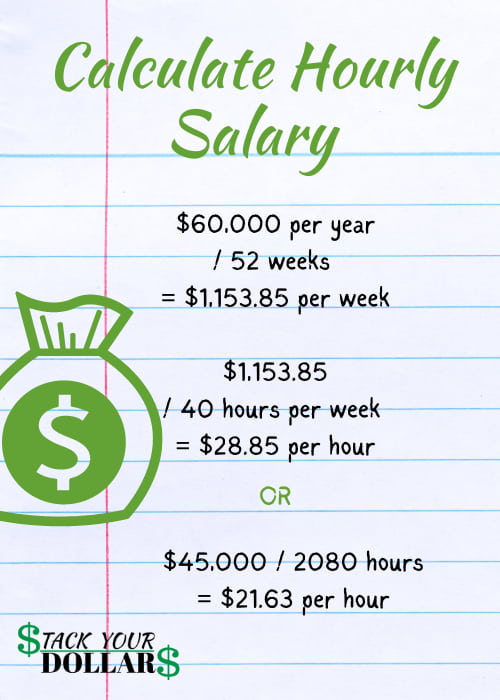

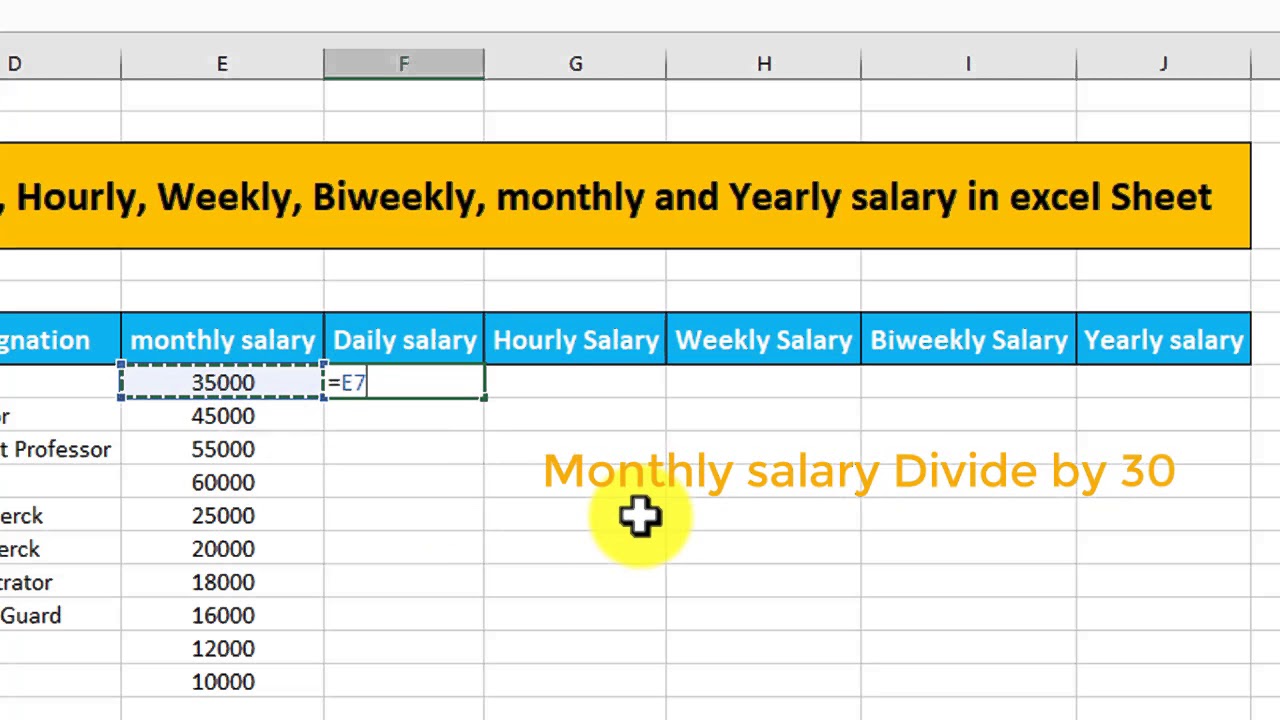

Calculating your annual salary from an hourly wage can be a straightforward process if you know the right formula. To determine how much a year is $50 an hour, you’ll need to consider the number of hours you work per week and the number of weeks you work per year. Here’s a step-by-step guide to help you calculate your annual salary:

Step 1: Determine the number of hours you work per week. This can vary depending on your job, industry, and employer. For example, if you work a standard 40-hour workweek, you’ll need to multiply your hourly wage by 40 to get your weekly salary.

Step 2: Calculate your weekly salary by multiplying your hourly wage by the number of hours you work per week. For instance, if you earn $50 an hour and work 40 hours a week, your weekly salary would be $2,000 (40 hours x $50 per hour).

Step 3: Determine the number of weeks you work per year. This can also vary depending on your job, industry, and employer. For example, if you work a standard 52-week year, you’ll need to multiply your weekly salary by 52 to get your annual salary.

Step 4: Calculate your annual salary by multiplying your weekly salary by the number of weeks you work per year. Using the example above, if you earn $2,000 per week and work 52 weeks a year, your annual salary would be $104,000 (52 weeks x $2,000 per week).

So, how much a year is $50 an hour? Based on the calculation above, if you work a standard 40-hour workweek and 52 weeks a year, your annual salary would be $104,000. However, this amount can vary depending on your specific job, industry, and employer.

It’s essential to note that this calculation assumes you don’t work any overtime or receive any bonuses. If you do work overtime or receive bonuses, you’ll need to factor these into your calculation to get an accurate estimate of your annual salary.

Factors Affecting Your Annual Salary: Overtime, Bonuses, and Benefits

While calculating your annual salary from an hourly wage may seem straightforward, there are several factors that can impact your total yearly income. Overtime pay, bonuses, and benefits can all increase or decrease your annual salary, depending on your specific situation.

Overtime pay, for example, can significantly increase your annual salary. If you work more than 40 hours a week, you may be eligible for overtime pay, which can range from 1.5 to 2 times your regular hourly wage. This can add up quickly, especially if you work long hours or have a high-paying job. For instance, if you earn $50 an hour and work 10 hours of overtime per week, your annual salary could increase by $26,000 (10 hours x $50 per hour x 52 weeks per year).

Bonuses can also impact your annual salary. Many employers offer bonuses to their employees, which can range from a few hundred dollars to tens of thousands of dollars. These bonuses can be paid out at various times throughout the year, such as during the holidays or at the end of the year. If you receive a bonus, it can increase your annual salary and provide a nice boost to your finances.

Benefits, such as health insurance, retirement plans, and paid time off, can also affect your annual salary. While these benefits may not directly increase your take-home pay, they can still have a significant impact on your overall compensation package. For example, if your employer offers a comprehensive health insurance plan, you may save thousands of dollars per year on medical expenses. Similarly, if your employer offers a 401(k) matching program, you may be able to save more for retirement and increase your overall compensation.

It’s essential to consider these factors when calculating your annual salary. By taking into account overtime pay, bonuses, and benefits, you can get a more accurate estimate of your total yearly income. This can help you make informed decisions about your finances, such as budgeting, saving, and investing. For instance, if you know that you’ll be receiving a bonus at the end of the year, you may be able to plan ahead and make smart financial decisions.

In the next section, we’ll explore how to compare hourly and annual salaries, including the pros and cons of each. We’ll also discuss how to determine which type of salary is best for your financial situation.

Comparing Hourly and Annual Salaries: Which is Better?

When it comes to salaries, there are two main types: hourly and annual. Both have their advantages and disadvantages, and which one is better for you depends on your individual financial situation and goals. In this section, we’ll explore the pros and cons of each type of salary and help you decide which one is best for you.

Hourly salaries are paid based on the number of hours worked, and the rate is usually fixed. For example, if you earn $50 an hour and work 40 hours a week, your weekly salary would be $2,000. Hourly salaries can be beneficial for those who work variable hours or have a non-traditional schedule. However, they can also be unpredictable, and your income may fluctuate from week to week.

Annual salaries, on the other hand, are paid based on a fixed annual amount, usually divided into monthly or bi-weekly payments. For example, if you earn $100,000 per year, your monthly salary would be $8,333. Annual salaries can provide a sense of stability and predictability, making it easier to budget and plan for the future.

So, which type of salary is better? It depends on your individual circumstances. If you value flexibility and are willing to take on variable hours, an hourly salary might be the better choice. However, if you prefer a predictable income and a stable financial situation, an annual salary might be the way to go.

It’s also worth noting that some industries and jobs may be more suited to one type of salary over the other. For example, jobs in the healthcare industry may be more likely to offer annual salaries, while jobs in the gig economy may be more likely to offer hourly wages.

Ultimately, the decision between an hourly and annual salary comes down to your individual needs and preferences. By understanding the pros and cons of each type of salary, you can make an informed decision and choose the one that best aligns with your financial goals.

In the next section, we’ll explore real-life examples of how much a year is $50 an hour in different industries, including healthcare, technology, and finance.

Real-Life Examples: How Much a Year is $50 an Hour in Different Industries

Now that we’ve discussed the importance of understanding the annual equivalent of an hourly wage, let’s take a look at some real-life examples of how much a year is $50 an hour in different industries.

In the healthcare industry, for example, a registered nurse earning $50 an hour could expect to earn around $104,000 per year, assuming a 40-hour workweek and 52 weeks per year. However, this amount can vary depending on factors such as location, experience, and employer.

In the technology industry, a software engineer earning $50 an hour could expect to earn around $120,000 per year, assuming a 40-hour workweek and 52 weeks per year. However, this amount can also vary depending on factors such as location, experience, and employer.

In the finance industry, a financial analyst earning $50 an hour could expect to earn around $100,000 per year, assuming a 40-hour workweek and 52 weeks per year. However, this amount can also vary depending on factors such as location, experience, and employer.

As you can see, the annual salary for someone earning $50 an hour can vary significantly depending on the industry and other factors. It’s essential to research industry standards and understand the factors that can impact your annual salary to ensure you’re earning a fair wage.

According to data from the Bureau of Labor Statistics, the median annual salary for all occupations in the United States is around $41,693. However, this amount can vary significantly depending on the industry, location, and other factors.

For example, the median annual salary for registered nurses is around $76,840, while the median annual salary for software engineers is around $114,140. The median annual salary for financial analysts is around $85,660.

These examples illustrate the importance of understanding the annual equivalent of an hourly wage and researching industry standards to ensure you’re earning a fair wage.

In the next section, we’ll provide tips and advice on how to negotiate a higher annual salary, including researching industry standards, highlighting skills and experience, and making a strong case for a raise.

Tips for Negotiating a Higher Annual Salary

Negotiating a higher annual salary can be a challenging task, but it’s essential to ensure you’re earning a fair wage for your skills and experience. Here are some tips to help you negotiate a higher annual salary:

Research industry standards: Knowing the average salary for your position in your industry is crucial in determining a fair salary range. Use online resources such as Glassdoor, Payscale, or the Bureau of Labor Statistics to research the average salary for your position.

Highlight your skills and experience: Make a list of your skills, qualifications, and experience, and be prepared to explain how they align with the job requirements. This will help you demonstrate your value to the employer and justify a higher salary.

Make a strong case for a raise: Prepare a solid case for why you deserve a raise, including specific examples of your accomplishments and how they’ve positively impacted the company. Be confident and assertive when presenting your case, and be open to negotiation.

Consider benefits and perks: In addition to salary, consider other benefits and perks that can impact your overall compensation package. These may include health insurance, retirement plans, paid time off, or flexible work arrangements.

Be prepared to negotiate: Negotiation is a give-and-take process, so be prepared to compromise on salary or other benefits. Think creatively about what you’re willing to accept, and be open to finding a mutually beneficial solution.

For example, if you’re currently earning $50 an hour and want to negotiate a higher annual salary, you could research industry standards to determine a fair salary range. Let’s say the average salary for your position is $60 an hour. You could make a strong case for a raise to $65 an hour, highlighting your skills and experience and explaining how they align with the job requirements.

By following these tips, you can effectively negotiate a higher annual salary and ensure you’re earning a fair wage for your skills and experience.

In the next section, we’ll discuss common mistakes to avoid when calculating annual salary, including neglecting to account for taxes, benefits, and overtime pay.

Common Mistakes to Avoid When Calculating Annual Salary

When calculating annual salary, there are several common mistakes to avoid. These mistakes can lead to inaccurate calculations and a misunderstanding of your true annual income.

One common mistake is neglecting to account for taxes. Taxes can significantly impact your take-home pay, and failing to account for them can lead to an inaccurate calculation of your annual salary. For example, if you earn $50 an hour and work 40 hours a week, your annual salary would be $104,000. However, if you don’t account for taxes, you may be surprised to find that your take-home pay is significantly lower.

Another common mistake is neglecting to account for benefits. Benefits such as health insurance, retirement plans, and paid time off can impact your annual salary and should be included in your calculations. For example, if you earn $50 an hour and receive a comprehensive health insurance plan, your annual salary may be higher than if you didn’t receive this benefit.

Overtime pay is another factor that can impact your annual salary. If you work overtime, you may earn a higher hourly wage, which can increase your annual salary. However, if you don’t account for overtime pay, you may underestimate your annual salary.

Finally, neglecting to account for bonuses and other forms of compensation can also lead to an inaccurate calculation of your annual salary. Bonuses and other forms of compensation can significantly impact your annual salary and should be included in your calculations.

By avoiding these common mistakes, you can ensure that your annual salary calculations are accurate and reflect your true annual income. This will help you make informed decisions about your finances and negotiate a fair annual salary.

In the next section, we’ll summarize the key takeaways from the article and encourage readers to take control of their financial situation by understanding the value of their hourly wage and negotiating a fair annual salary.

Conclusion: Unlocking the Full Potential of Your Hourly Wage

In conclusion, understanding the annual equivalent of an hourly wage is crucial for effective financial planning, budgeting, and tax preparation. By knowing your total yearly income, you can make informed decisions about your career, investments, and lifestyle.

Throughout this article, we’ve discussed the importance of converting hourly to annual salary, factors that can impact your annual salary, and tips for negotiating a higher annual salary. We’ve also explored real-life examples of how much a year is $50 an hour in different industries and warned readers about common mistakes to avoid when calculating annual salary.

By taking control of your financial situation and understanding the value of your hourly wage, you can unlock the full potential of your income and achieve your long-term financial goals. Remember to research industry standards, highlight your skills and experience, and make a strong case for a raise to negotiate a fair annual salary.

Don’t let your hourly wage hold you back from achieving your financial goals. Take the first step today by calculating your annual salary and negotiating a fair wage. With the right knowledge and tools, you can unlock the full potential of your hourly wage and achieve financial success.