Understanding the Social Security System: How Benefits Are Calculated

The Social Security system is a complex network of rules and regulations that determine how much individuals can receive in benefits. At its core, the system is designed to provide a safety net for workers who have paid into the system through payroll taxes. To understand how much you can make on Social Security, it’s essential to grasp the basics of how benefits are calculated.

The Social Security Administration (SSA) uses a formula to determine an individual’s Primary Insurance Amount (PIA), which is the basis for their monthly benefit amount. The formula takes into account an individual’s 35 highest-earning years, with a focus on their earnings history. The SSA then applies a series of adjustments to the PIA to determine the final benefit amount.

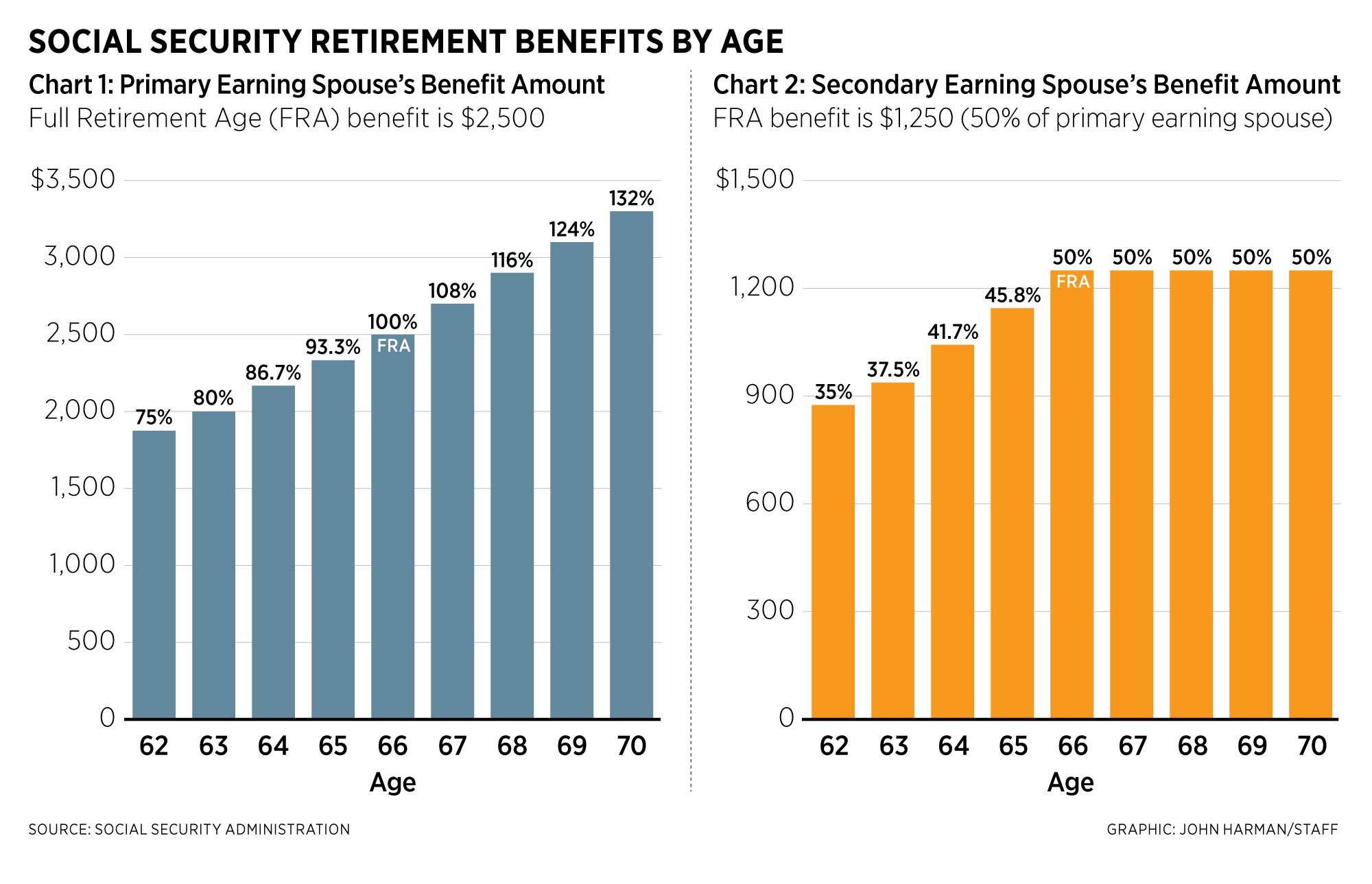

One of the most critical factors in determining Social Security benefits is the age at which an individual claims their benefits. Claiming benefits early, typically between ages 62 and 65, can result in a reduced benefit amount. Conversely, delaying benefits until after full retirement age, typically between ages 66 and 67, can increase the benefit amount. Understanding how these age-related adjustments impact benefits is crucial for maximizing your Social Security income.

In addition to age, other factors such as income level and work history also play a significant role in determining Social Security benefits. For example, individuals with higher earnings histories tend to receive higher benefit amounts. Similarly, those who have worked for longer periods may be eligible for higher benefits due to their increased contributions to the system.

While the Social Security system can seem complex, understanding how benefits are calculated is essential for making informed decisions about your retirement income. By grasping the basics of the system and how benefits are determined, you can better navigate the process and maximize your Social Security income.

Factors Affecting Your Social Security Benefits: Age, Income, and Work History

When it comes to determining how much you can make on Social Security, several factors come into play. Understanding these factors is crucial to maximizing your benefits and creating a sustainable retirement income stream. In this section, we’ll explore the key factors that impact Social Security benefits, including age, income level, and work history.

Age is a critical factor in determining Social Security benefits. Claiming benefits early, typically between ages 62 and 65, can result in a reduced benefit amount. Conversely, delaying benefits until after full retirement age, typically between ages 66 and 67, can increase the benefit amount. For example, if you claim benefits at age 62, your benefit amount may be reduced by up to 30%. On the other hand, if you delay benefits until age 70, your benefit amount may increase by up to 24%.

Income level is another important factor in determining Social Security benefits. The Social Security Administration (SSA) uses a formula to calculate benefits based on an individual’s 35 highest-earning years. If you have a higher income level, you may be eligible for higher benefits. However, if you have a lower income level, your benefits may be reduced. For instance, if you have a high income level and claim benefits at full retirement age, your benefit amount may be higher than someone with a lower income level who claims benefits at the same age.

Work history is also a significant factor in determining Social Security benefits. The SSA requires a minimum of 10 years of work history to be eligible for benefits. However, the more years you work, the higher your benefits may be. For example, if you work for 20 years and claim benefits at full retirement age, your benefit amount may be higher than someone who works for 10 years and claims benefits at the same age.

Understanding how these factors interact and impact your Social Security benefits is essential to making informed decisions about your retirement income. By considering your age, income level, and work history, you can create a strategy to maximize your benefits and achieve a secure retirement.

How to Calculate Your Social Security Benefits: A Step-by-Step Guide

Calculating your Social Security benefits can seem like a daunting task, but it’s essential to understand how much you can expect to receive in retirement. In this section, we’ll provide a step-by-step guide on how to calculate your Social Security benefits using online tools and resources.

Step 1: Gather Your Information

To calculate your Social Security benefits, you’ll need to gather some information, including your Social Security number, birthdate, and earnings history. You can find your earnings history on your Social Security statement, which is typically mailed to you each year.

Step 2: Use the Social Security Administration’s (SSA) Retirement Estimator

The SSA’s Retirement Estimator is a free online tool that allows you to estimate your Social Security benefits based on your earnings history. To use the tool, simply visit the SSA’s website and enter your Social Security number, birthdate, and earnings history.

Step 3: Enter Your Earnings History

Once you’ve entered your information, the Retirement Estimator will ask you to enter your earnings history. You can enter your earnings history manually or import it from the SSA’s database.

Step 4: Choose Your Retirement Age

The Retirement Estimator will ask you to choose your retirement age, which will affect your benefit amount. You can choose to retire at any age between 62 and 70, but keep in mind that retiring earlier will result in a reduced benefit amount.

Step 5: Review Your Results

Once you’ve entered all your information, the Retirement Estimator will provide you with an estimate of your Social Security benefits. Review your results carefully and consider factors such as inflation, taxes, and other sources of retirement income.

By following these steps, you can get an accurate estimate of how much you can make on Social Security and plan accordingly for your retirement. Remember to review and update your estimate regularly to ensure you’re on track to meet your retirement goals.

Strategies to Increase Your Social Security Benefits: Delayed Retirement and More

While understanding how Social Security benefits are calculated is essential, it’s equally important to know how to increase your benefits. In this section, we’ll explore strategies to boost your Social Security benefits, including delayed retirement, working longer, and optimizing spousal benefits.

Delayed Retirement: A Key to Higher Benefits

One of the most effective ways to increase your Social Security benefits is to delay retirement. For every year you delay retirement beyond your full retirement age, your benefits will increase by a certain percentage. This percentage varies depending on your birth year, but it can range from 5% to 8% per year. For example, if you delay retirement from age 66 to 67, your benefits may increase by 6.5%. This can result in a significant increase in your monthly benefits, especially if you delay retirement for several years.

Working Longer: Another Way to Boost Benefits

Working longer can also increase your Social Security benefits. The Social Security Administration (SSA) uses your 35 highest-earning years to calculate your benefits. If you continue working beyond age 62, you may be able to replace lower-earning years with higher-earning years, resulting in higher benefits. Additionally, working longer can also increase your earnings history, which can lead to higher benefits.

Optimizing Spousal Benefits: A Often-Overlooked Strategy

Spousal benefits are often overlooked, but they can be a valuable way to increase your Social Security benefits. If you’re married, you may be eligible for spousal benefits based on your spouse’s earnings history. This can result in higher benefits, especially if your spouse has a higher earnings history than you. To optimize spousal benefits, it’s essential to understand how they work and how to claim them.

By implementing these strategies, you can increase your Social Security benefits and create a more sustainable retirement income stream. Remember, understanding how to maximize your benefits is crucial to making the most of your Social Security income.

The Impact of Inflation on Social Security Benefits: What You Need to Know

Inflation can have a significant impact on Social Security benefits, and it’s essential to understand how cost-of-living adjustments (COLAs) work and how they affect benefit amounts over time. In this section, we’ll explore the impact of inflation on Social Security benefits and what you need to know to maximize your benefits.

What are COLAs?

COLAs are annual increases to Social Security benefits that are designed to keep pace with inflation. The Social Security Administration (SSA) calculates COLAs based on the Consumer Price Index (CPI), which measures the average change in prices of a basket of goods and services. When the CPI increases, COLAs are applied to Social Security benefits to ensure that they keep pace with inflation.

How do COLAs affect Social Security benefits?

COLAs can have a significant impact on Social Security benefits over time. For example, if you receive a 2% COLA, your benefits will increase by 2% of the previous year’s benefit amount. While this may not seem like a lot, it can add up over time. For instance, if you receive a 2% COLA for 10 years, your benefits will increase by 20% of the original benefit amount.

How to maximize your benefits in the face of inflation

To maximize your Social Security benefits in the face of inflation, it’s essential to understand how COLAs work and how they affect benefit amounts. Here are a few tips to keep in mind:

Delay claiming benefits: If you delay claiming benefits, you may be eligible for higher benefits due to COLAs.

Consider working longer: Working longer can increase your earnings history, which can lead to higher benefits and a higher COLA.

Optimize spousal benefits: If you’re married, you may be eligible for spousal benefits based on your spouse’s earnings history. This can result in higher benefits and a higher COLA.

By understanding how COLAs work and how they affect Social Security benefits, you can make informed decisions about your retirement income and maximize your benefits.

Common Mistakes to Avoid When Claiming Social Security Benefits

Claiming Social Security benefits can be a complex process, and making mistakes can result in reduced benefits or even penalties. In this section, we’ll identify common mistakes people make when claiming Social Security benefits and provide tips on how to avoid them.

Claiming Too Early or Too Late

One of the most common mistakes people make when claiming Social Security benefits is claiming too early or too late. Claiming too early can result in reduced benefits, while claiming too late can result in missed benefits. To avoid this mistake, it’s essential to understand your full retirement age and plan accordingly.

Not Considering Spousal Benefits

Spousal benefits can be a valuable source of income in retirement, but many people fail to consider them when claiming Social Security benefits. To avoid this mistake, it’s essential to understand how spousal benefits work and how to claim them.

Not Accounting for Taxes

Social Security benefits are taxable, and failing to account for taxes can result in reduced benefits. To avoid this mistake, it’s essential to understand how taxes affect Social Security benefits and plan accordingly.

Not Optimizing Other Sources of Retirement Income

Social Security benefits are just one source of retirement income, and failing to optimize other sources can result in reduced benefits. To avoid this mistake, it’s essential to understand how to optimize other sources of retirement income, such as pensions and retirement accounts.

By avoiding these common mistakes, you can ensure that you receive the maximum Social Security benefits you’re eligible for and create a sustainable income stream in retirement.

How to Make the Most of Your Social Security Benefits in Retirement

Maximizing your Social Security benefits in retirement requires a strategic approach to creating a sustainable income stream. In this section, we’ll offer advice on how to make the most of your Social Security benefits, including how to manage taxes, optimize other sources of retirement income, and create a sustainable income stream.

Managing Taxes on Social Security Benefits

Social Security benefits are taxable, and managing taxes is essential to maximizing your benefits. To minimize taxes, consider the following strategies:

Delay claiming benefits: Delaying benefits can reduce taxes on your benefits.

Consider a Roth IRA: Converting a traditional IRA to a Roth IRA can reduce taxes on your benefits.

Optimize Other Sources of Retirement Income

Social Security benefits are just one source of retirement income. To maximize your benefits, consider optimizing other sources of retirement income, such as:

Pensions: If you have a pension, consider how it will impact your Social Security benefits.

Retirement accounts: Consider how your retirement accounts, such as 401(k) or IRA, will impact your Social Security benefits.

Create a Sustainable Income Stream

Creating a sustainable income stream is essential to maximizing your Social Security benefits. Consider the following strategies:

Invest in dividend-paying stocks: Dividend-paying stocks can provide a sustainable income stream.

Consider an annuity: An annuity can provide a guaranteed income stream for life.

By following these strategies, you can make the most of your Social Security benefits and create a sustainable income stream in retirement.

Conclusion: Maximizing Your Social Security Benefits for a Secure Retirement

In conclusion, maximizing your Social Security benefits is crucial to creating a secure retirement income stream. By understanding how benefits are calculated, the factors that impact benefits, and strategies to increase benefits, you can make informed decisions about your retirement income.

Remember, Social Security benefits are just one source of retirement income, and it’s essential to optimize other sources of income, such as pensions and retirement accounts, to create a sustainable income stream.

By following the strategies outlined in this article, you can maximize your Social Security benefits and create a secure retirement income stream. Don’t leave your retirement income to chance – take control of your Social Security benefits today.

Understanding how much you can make on Social Security is just the first step. By taking the time to understand the Social Security system and how to maximize your benefits, you can create a secure retirement income stream that will last a lifetime.