Assessing Your Financial Situation

Before determining how much to spend on a car, it’s essential to evaluate your financial situation. This involves calculating your net income, expenses, debts, and savings to understand your overall financial health. A thorough assessment will help you create a budget that accounts for all necessary expenses, ensuring you can afford the car you want without compromising your financial stability.

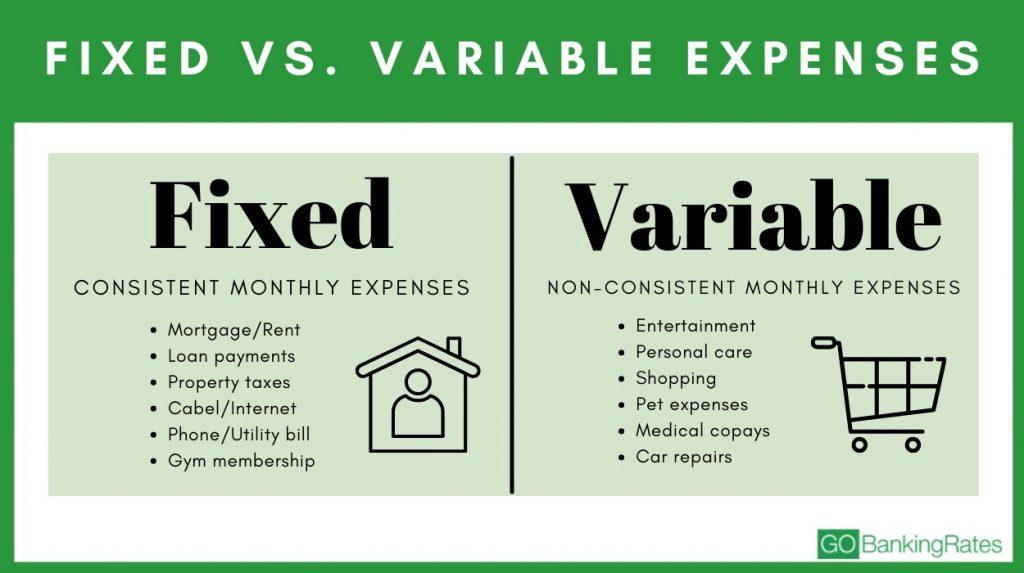

To calculate your net income, start by adding up all your sources of income, including your salary, investments, and any side hustles. Then, subtract taxes, deductions, and other expenses to arrive at your take-home pay. Next, track your expenses, including essential costs like rent/mortgage, utilities, groceries, and transportation, as well as discretionary spending like entertainment and hobbies.

Debts, such as credit card balances, student loans, and personal loans, should also be factored into your financial assessment. Make a list of your debts, including the balance, interest rate, and minimum payment for each. This will help you understand your debt obligations and identify areas for improvement.

Savings are also a critical component of your financial situation. Consider your emergency fund, retirement savings, and other long-term savings goals. Aim to save at least 10% to 20% of your net income for long-term goals and 3-6 months’ worth of expenses in an easily accessible savings account.

By evaluating your income, expenses, debts, and savings, you’ll gain a clear understanding of your financial situation and be better equipped to determine how much you can afford to spend on a car. Remember, the key is to strike a balance between enjoying your new vehicle and maintaining a stable financial foundation.

When considering how much to spend on a car, it’s essential to think about the long-term costs of ownership, not just the purchase price. This includes financing costs, insurance, fuel, maintenance, and repairs. By factoring these expenses into your budget, you’ll be able to make a more informed decision about how much you can afford to spend on a car.

Understanding the True Cost of Car Ownership

When determining how much to spend on a car, it’s essential to consider the various costs associated with car ownership. The purchase price is just the beginning, as financing costs, insurance, fuel, maintenance, and repairs can add up quickly. In fact, the total cost of owning a car can be 2-3 times the purchase price over a 5-year period.

Financing costs, including interest rates and loan fees, can significantly impact the overall cost of car ownership. For example, a $20,000 car loan with a 5% interest rate over 5 years can result in an additional $2,500 in interest payments. Insurance premiums, which can range from $1,000 to $3,000 per year, depending on the vehicle and driver, are another significant expense.

Fuel costs, maintenance, and repairs are also important considerations. According to the United States Department of Energy, the average American spends around $1,500 per year on fuel. Maintenance costs, including oil changes, tire rotations, and brake pads, can add up to $1,000 per year. Repairs, which can range from $500 to $2,000 or more, depending on the issue, can also be a significant expense.

To illustrate the true cost of car ownership, consider the following example: a $25,000 car with a 5% interest rate over 5 years, insurance premiums of $2,000 per year, fuel costs of $1,500 per year, maintenance costs of $1,000 per year, and repair costs of $1,000 per year. Over a 5-year period, the total cost of owning this car would be around $43,000.

When deciding how much to spend on a car, it’s essential to factor in these additional costs to ensure you can afford the total cost of ownership. By considering the purchase price, financing costs, insurance, fuel, maintenance, and repairs, you can make a more informed decision about how much you can afford to spend on a car.

How to Calculate Your Affordable Car Price Range

Calculating a comfortable car price range requires considering several factors, including income, expenses, debts, and savings. By following a step-by-step approach, you can determine how much you can afford to spend on a car.

Step 1: Determine your net income. Calculate your take-home pay by subtracting taxes, deductions, and other expenses from your gross income.

Step 2: Calculate your monthly expenses. Include essential costs such as rent/mortgage, utilities, groceries, and transportation, as well as discretionary spending like entertainment and hobbies.

Step 3: Determine your debt obligations. Make a list of your debts, including credit card balances, student loans, and personal loans, and calculate your monthly payments.

Step 4: Calculate your savings rate. Aim to save at least 10% to 20% of your net income for long-term goals and 3-6 months’ worth of expenses in an easily accessible savings account.

Step 5: Determine your car budget. Based on your income, expenses, debts, and savings, calculate how much you can afford to spend on a car each month. Consider the total cost of ownership, including financing costs, insurance, fuel, maintenance, and repairs.

For example, let’s say you have a net income of $4,000 per month, monthly expenses of $2,500, debt obligations of $500, and a savings rate of 10%. Based on these factors, you may be able to afford a car payment of $500 to $750 per month. Using a car loan calculator, you can determine that this translates to a car price range of $15,000 to $25,000.

By following these steps, you can calculate a comfortable car price range based on your individual financial situation. Remember to consider all the costs associated with car ownership and prioritize your needs over wants to stay within budget.

The 20/4/10 Rule: A Simple Car Budgeting Guideline

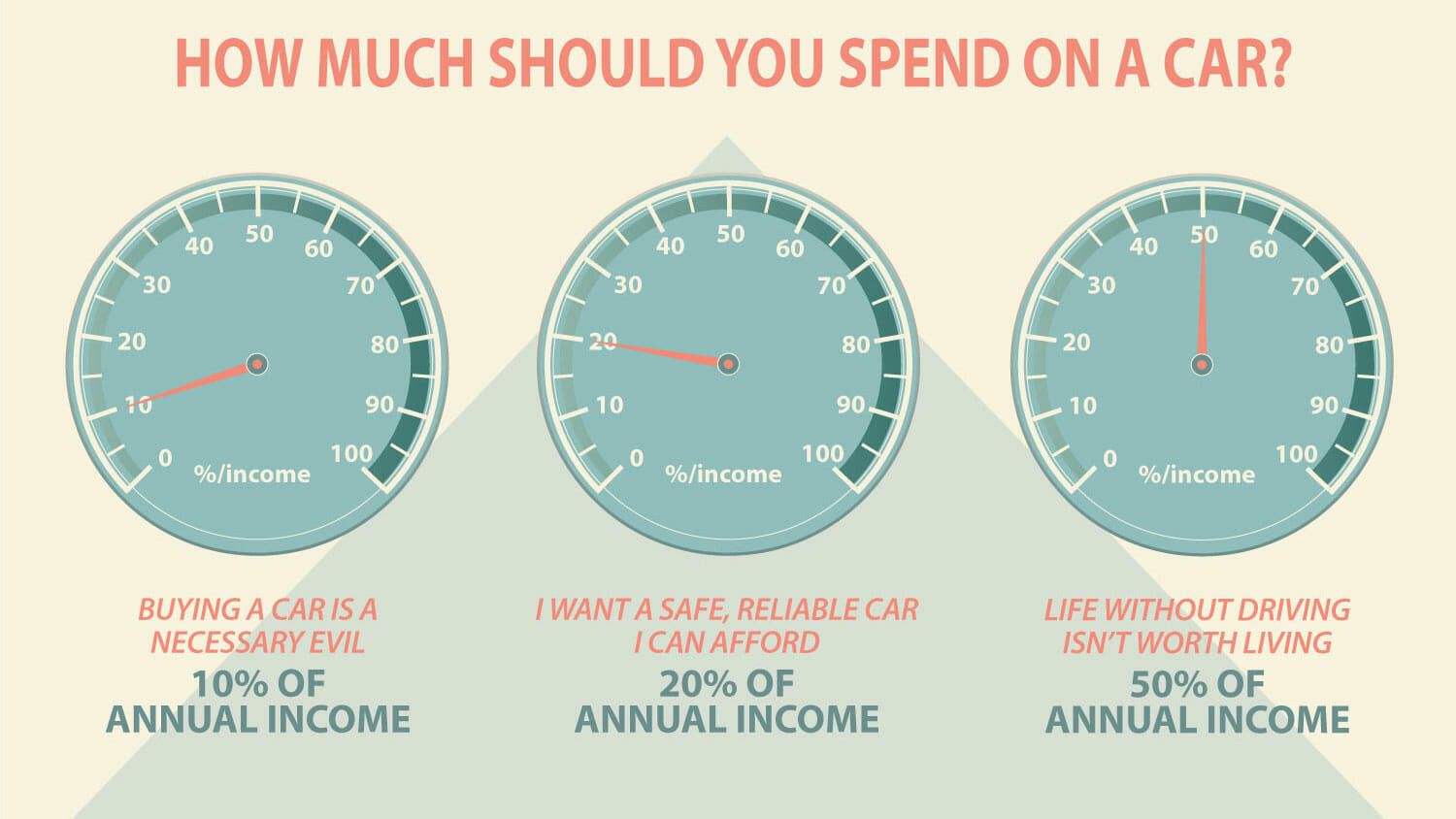

The 20/4/10 rule is a simple and effective guideline for car buyers to follow when determining how much to spend on a car. This rule suggests that car buyers should make a 20% down payment, finance for no more than 4 years, and spend no more than 10% of their income on car expenses.

The 20% down payment is a crucial aspect of the 20/4/10 rule. By putting down 20% of the purchase price, car buyers can avoid paying too much in interest over the life of the loan. Additionally, a larger down payment can also help to reduce the monthly payment amount.

Financing for no more than 4 years is also an important aspect of the 20/4/10 rule. Longer loan terms may result in lower monthly payments, but they can also lead to paying more in interest over the life of the loan. By keeping the loan term to 4 years or less, car buyers can avoid paying too much in interest and ensure that they are not upside-down on their loan.

Spend no more than 10% of your income on car expenses is the final aspect of the 20/4/10 rule. This includes not only the monthly payment but also insurance, fuel, maintenance, and repairs. By keeping car expenses to 10% or less of your income, you can ensure that you have enough money left over for other expenses and savings.

While the 20/4/10 rule is a useful guideline, it’s essential to remember that it’s not a one-size-fits-all solution. Car buyers should consider their individual financial situations and adjust the rule accordingly. For example, if you have a high income and low expenses, you may be able to afford a more expensive car. On the other hand, if you have a low income and high expenses, you may need to adjust your expectations and consider a more affordable option.

By following the 20/4/10 rule, car buyers can make a smart and informed decision about how much to spend on a car. Remember to always prioritize your needs over wants and consider all the costs associated with car ownership to ensure that you make a purchase that fits within your budget.

Considering Additional Costs and Expenses

When determining how much to spend on a car, it’s essential to consider additional costs and expenses beyond the purchase price. These costs can add up quickly and impact your overall car budget.

Registration fees, for example, can range from $50 to $500 or more, depending on the state and type of vehicle. Parking costs, including garage fees, street parking, and parking tickets, can also add up over time. Additionally, potential repair expenses, such as replacing brake pads or fixing a faulty transmission, should be factored into your car budget.

To factor these costs into your overall car budget, consider the following tips:

1. Research registration fees in your state and factor them into your car budget.

2. Consider parking costs, including garage fees and street parking, and factor them into your daily or monthly expenses.

3. Set aside a portion of your car budget for potential repair expenses, such as 1% to 3% of the purchase price.

4. Consider purchasing a vehicle with a good warranty or maintenance package to reduce repair expenses.

5. Keep track of your car expenses, including fuel, maintenance, and repairs, to ensure you’re staying within your budget.

By considering these additional costs and expenses, you can create a comprehensive car budget that accounts for all the expenses associated with car ownership. Remember to prioritize your needs over wants and stay within your budget to ensure a smart and informed purchase decision.

When deciding how much to spend on a car, it’s essential to consider all the costs associated with car ownership, including additional costs and expenses. By factoring these costs into your car budget, you can make a more informed decision and avoid financial stress down the road.

How to Prioritize Your Car Needs and Wants

When car shopping, it’s essential to distinguish between essential features and nice-to-haves to stay within budget. By prioritizing your needs over wants, you can make a smart and informed purchase decision.

Start by making a list of the features you need in a car, such as a reliable engine, comfortable seating, and adequate safety features. Then, make a separate list of the features you want, such as a premium sound system, heated seats, or a sunroof.

Next, prioritize your needs over your wants. Consider the costs associated with each feature and determine which ones are essential to your daily driving needs. For example, if you have a large family, you may need a car with a third row of seating. On the other hand, if you’re a solo driver, you may not need a car with a large cargo area.

When evaluating cars, consider the following factors:

1. Safety features: Look for cars with a 5-star safety rating, advanced airbags, and electronic stability control.

2. Reliability: Research the car’s reliability and durability by reading reviews and consulting with friends or family members who own the same car.

3. Fuel efficiency: Consider the car’s fuel efficiency and how it will impact your daily driving costs.

4. Comfort and convenience: Evaluate the car’s comfort and convenience features, such as heated seats, Bluetooth connectivity, and a touchscreen infotainment system.

By prioritizing your needs over wants, you can make a smart and informed purchase decision that fits within your budget. Remember to stay focused on your needs and avoid getting caught up in the excitement of car shopping.

When deciding how much to spend on a car, it’s essential to consider your needs and wants carefully. By prioritizing your needs over wants, you can make a smart and informed purchase decision that fits within your budget.

Real-World Examples of Affordable Cars

When it comes to finding an affordable car, there are many options available in different price ranges. Here are some examples of affordable cars from reputable manufacturers such as Toyota, Honda, and Hyundai:

Under $15,000:

The Toyota Corolla is a reliable and fuel-efficient sedan that starts at around $13,000. The Honda Fit is another affordable option, starting at around $14,000. The Hyundai Elantra is also a great choice, starting at around $13,000.

$15,000-$25,000:

The Toyota Camry is a popular mid-size sedan that starts at around $18,000. The Honda Civic is another great option in this price range, starting at around $19,000. The Hyundai Sonata is also a good choice, starting at around $20,000.

$25,000-$35,000:

The Toyota RAV4 is a reliable and spacious SUV that starts at around $25,000. The Honda CR-V is another great option in this price range, starting at around $26,000. The Hyundai Tucson is also a good choice, starting at around $27,000.

These are just a few examples of affordable cars in different price ranges. When deciding how much to spend on a car, it’s essential to consider your needs and budget carefully. By doing your research and prioritizing your needs over wants, you can find a car that fits within your budget and meets your needs.

When evaluating these cars, consider factors such as fuel efficiency, reliability, and overall value. Additionally, be sure to test drive the car and research the manufacturer’s warranty and maintenance costs.

Finalizing Your Car Budget and Making a Purchase

Now that you have a better understanding of your financial situation, the true cost of car ownership, and how to calculate your affordable car price range, it’s time to finalize your car budget and make a purchase.

Remember to prioritize your needs over wants and stay within your budget. Consider all the costs associated with car ownership, including financing costs, insurance, fuel, maintenance, and repairs.

When making a purchase, be sure to research the car’s market value and negotiate the price. Don’t be afraid to walk away if the deal isn’t right for you.

Additionally, consider the following final tips:

1. Be patient and don’t rush into a purchase. Take your time to research and compare different models.

2. Read reviews and consult with friends or family members who own the same car.

3. Test drive the car and pay attention to any issues or concerns.

4. Carefully review the sales contract and ensure you understand all the terms and conditions.

5. Don’t forget to factor in additional costs, such as registration fees and parking costs.

By following these tips and staying within your budget, you can make a smart and informed purchase decision that meets your needs and fits within your budget.

When deciding how much to spend on a car, it’s essential to consider all the costs associated with car ownership and prioritize your needs over wants. By doing your research and staying within your budget, you can find a car that meets your needs and fits within your budget.

.jpg)