What You Need to Know Before Cashing a Check

Cashing a check can be a convenient way to access your money, but it’s essential to understand the associated fees and costs. The cost of cashing a check can vary significantly depending on the institution, location, and type of check. Before you cash a check, it’s crucial to know how much it will cost you. The question “how much does it cost to cash a check” is a common one, and the answer can help you make informed decisions about your finances.

Check cashing fees can add up quickly, and they can be a significant expense for individuals who rely on checks as a primary source of income. For example, a flat fee of $5 per check may not seem like a lot, but if you’re cashing multiple checks per month, the costs can add up to $20 or more. Additionally, some institutions may charge a percentage-based fee, which can range from 1% to 5% of the check amount. This can result in significant costs, especially for larger checks.

Furthermore, some institutions may also charge additional fees, such as ATM fees or maintenance fees, which can further increase the cost of cashing a check. It’s essential to understand these fees and how they can impact your finances. By knowing the costs associated with cashing a check, you can make informed decisions about how to manage your money and avoid unnecessary expenses.

In this article, we’ll provide a comprehensive guide to help you navigate the process of cashing a check and avoiding unnecessary fees. We’ll explore the different types of fees associated with check cashing, discuss the various options for cashing a check, and provide tips and strategies for minimizing check cashing fees. By the end of this article, you’ll have a better understanding of how to cash a check and how to save money in the process.

How Check Cashing Fees Work: A Breakdown of the Costs

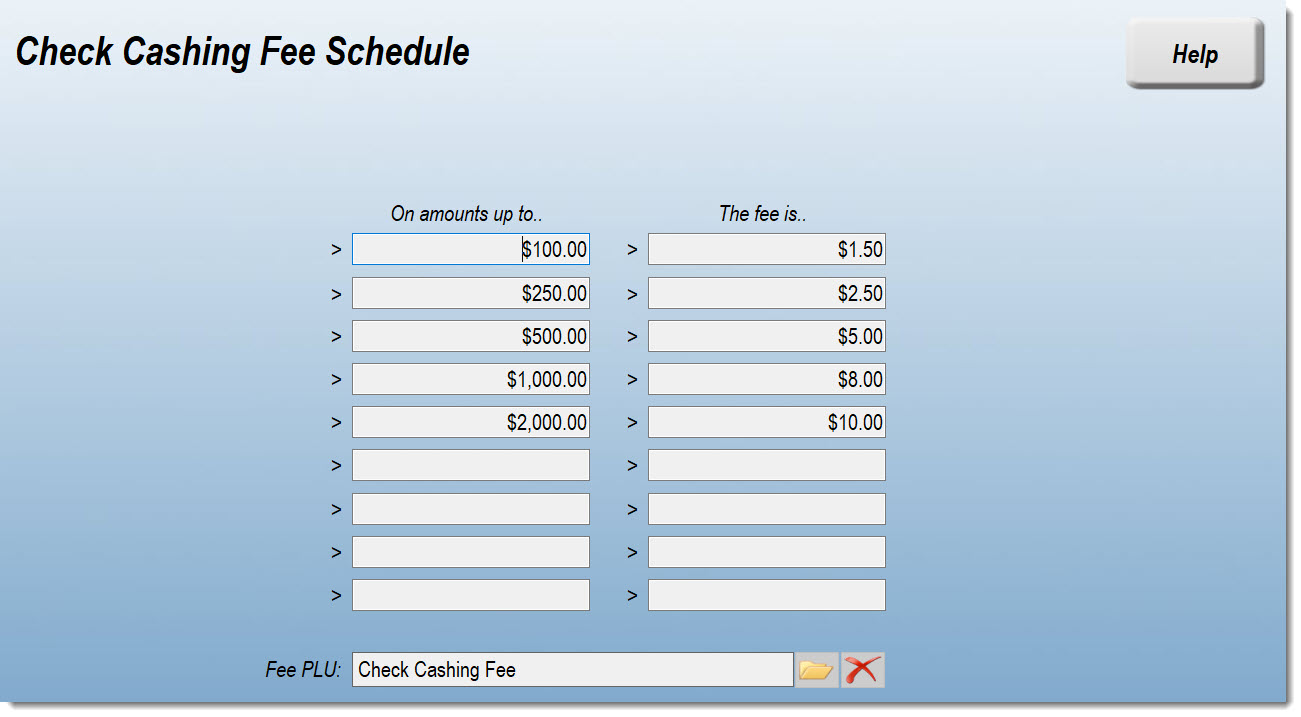

Check cashing fees can be a significant expense for individuals who rely on checks as a primary source of income. To understand how much it costs to cash a check, it’s essential to break down the different types of fees associated with this process. There are three primary types of fees: flat fees, percentage-based fees, and ATM fees.

Flat fees are a fixed amount charged per check, regardless of the check amount. For example, a check cashing store may charge a flat fee of $5 per check. This type of fee can be beneficial for individuals who cash small checks, as the fee is a fixed amount. However, for larger checks, the flat fee can be a smaller percentage of the overall check amount.

Percentage-based fees, on the other hand, are a percentage of the check amount. For example, a bank may charge a 1% fee on checks over $1,000. This type of fee can be beneficial for individuals who cash large checks, as the fee is a smaller percentage of the overall check amount. However, for small checks, the percentage-based fee can be a larger percentage of the overall check amount.

ATM fees are charged when an individual uses an ATM to cash a check. These fees can range from $2 to $5 per transaction, depending on the ATM operator and the individual’s bank. ATM fees can add up quickly, especially for individuals who use ATMs frequently.

It’s essential to understand how these fees can add up and impact the overall cost of cashing a check. For example, if an individual cashes a $1,000 check at a check cashing store with a 1% fee, they will pay $10 in fees. If they also use an ATM to cash the check, they may pay an additional $2 to $5 in ATM fees. This can result in a total fee of $12 to $15, which is 1.2% to 1.5% of the overall check amount.

By understanding how check cashing fees work, individuals can make informed decisions about how to manage their finances and avoid unnecessary expenses. In the next section, we’ll discuss the various options for cashing a check and compare the fees and services offered by each option.

Where to Cash a Check: Comparing Fees and Services

When it comes to cashing a check, there are several options available, each with its own set of fees and services. Understanding the pros and cons of each option can help individuals make informed decisions about how to manage their finances and avoid unnecessary fees. In this section, we’ll compare the fees and services offered by banks, credit unions, check cashing stores, and online services.

Banks are a popular option for cashing checks, and they often offer competitive fees and services. Many banks offer free check cashing for account holders, and some may even offer mobile deposit services that allow individuals to deposit checks remotely. However, banks may have stricter requirements for check cashing, such as requiring a minimum balance or a specific type of account.

Credit unions are another option for cashing checks, and they often offer more competitive fees and services than banks. Credit unions are member-owned and operated, which means they may offer more personalized service and more competitive rates. However, credit unions may have limited locations and hours of operation, which can make it less convenient for individuals to cash checks.

Check cashing stores are a convenient option for cashing checks, but they often come with higher fees. Check cashing stores may charge flat fees or percentage-based fees, and they may also offer additional services such as money orders and prepaid debit cards. However, check cashing stores may have limited hours of operation and may not offer the same level of security as banks or credit unions.

Online services are a relatively new option for cashing checks, but they offer a convenient and often lower-cost alternative to traditional check cashing methods. Online services may allow individuals to deposit checks remotely using a mobile device, and they may offer competitive fees and services. However, online services may require a minimum balance or a specific type of account, and they may not offer the same level of security as banks or credit unions.

When deciding where to cash a check, individuals should consider the fees and services offered by each option. By understanding the pros and cons of each option, individuals can make informed decisions about how to manage their finances and avoid unnecessary fees. In the next section, we’ll discuss tips and strategies for minimizing check cashing fees and avoiding unnecessary expenses.

How to Minimize Check Cashing Fees: Tips and Strategies

Minimizing check cashing fees requires a combination of understanding the fees associated with each option and using strategies to reduce or avoid these fees. By following these tips and strategies, individuals can save money and avoid unnecessary expenses when cashing checks.

One of the most effective ways to minimize check cashing fees is to use a bank or credit union. These institutions often offer free or low-cost check cashing services, especially for account holders. Additionally, banks and credit unions may offer mobile deposit services, which allow individuals to deposit checks remotely using a mobile device.

Another strategy for minimizing check cashing fees is to avoid using check cashing stores. These stores often charge high fees, which can add up quickly. Instead, individuals can use online services or mobile apps to cash checks. These services often offer lower fees and faster access to funds.

Using online services or mobile apps can also help individuals avoid ATM fees. Many online services and mobile apps allow individuals to deposit checks remotely, eliminating the need to use an ATM. Additionally, some online services and mobile apps may offer fee-free ATM access, which can save individuals money on ATM fees.

Individuals can also minimize check cashing fees by taking advantage of cash back rewards programs. Some banks and credit unions offer cash back rewards programs that provide a percentage of the check amount back to the individual. This can be a great way to earn rewards and reduce the cost of cashing checks.

Finally, individuals can minimize check cashing fees by being mindful of the fees associated with each option. By understanding the fees and taking steps to reduce or avoid them, individuals can save money and avoid unnecessary expenses when cashing checks. In the next section, we’ll discuss check cashing apps as a convenient alternative to traditional check cashing methods.

Check Cashing Apps: A Convenient Alternative

Check cashing apps have become a popular alternative to traditional check cashing methods. These apps allow individuals to cash checks remotely using a mobile device, eliminating the need to visit a physical location. Check cashing apps offer a range of benefits, including lower fees, faster access to funds, and increased convenience.

One of the main advantages of check cashing apps is the lower fees. Many check cashing apps charge lower fees than traditional check cashing methods, such as check cashing stores or banks. This can be especially beneficial for individuals who cash checks frequently, as the fees can add up quickly.

Another benefit of check cashing apps is the faster access to funds. With traditional check cashing methods, individuals may have to wait several days for the funds to become available. Check cashing apps, on the other hand, often provide immediate access to funds, allowing individuals to use the money right away.

Check cashing apps also offer increased convenience. Individuals can cash checks from anywhere, at any time, using a mobile device. This eliminates the need to visit a physical location, which can be especially beneficial for individuals with busy schedules or those who live in areas with limited access to check cashing services.

Some popular check cashing apps include Ingo Money, Check Cashing USA, and Brigit. These apps offer a range of features, including mobile deposit, bill pay, and prepaid debit cards. Individuals can use these apps to cash checks, pay bills, and manage their finances on the go.

When using check cashing apps, individuals should be aware of the fees and terms associated with each app. Some apps may charge higher fees for certain types of checks or for using certain features. Individuals should carefully review the terms and conditions before using a check cashing app.

Overall, check cashing apps offer a convenient and cost-effective alternative to traditional check cashing methods. By using these apps, individuals can save time and money, and enjoy faster access to their funds.

What to Do If You Can’t Cash a Check: Alternative Options

If you’re unable to cash a check, there are alternative options available. One option is to deposit the check into a bank account. This can be done at a bank branch or through an ATM. The funds will be available in your account after the check has cleared, which can take several days.

Another option is to use a prepaid debit card. Prepaid debit cards can be loaded with funds from a check, and can be used to make purchases or pay bills. Some prepaid debit cards also offer the ability to deposit checks remotely using a mobile device.

Mobile deposit services are also available through some banks and credit unions. These services allow you to deposit checks remotely using a mobile device, and the funds will be available in your account after the check has cleared.

It’s also possible to use a check cashing service that offers alternative payment methods, such as a money order or a prepaid debit card. These services can be more expensive than traditional check cashing methods, but can provide a convenient alternative if you’re unable to cash a check.

When using alternative options, it’s essential to understand the fees and terms associated with each service. Some services may charge higher fees for certain types of checks or for using certain features. Be sure to carefully review the terms and conditions before using an alternative option.

Additionally, it’s crucial to ensure that the alternative option you choose is secure and reputable. Look for services that are licensed and regulated by the relevant authorities, and that have a good reputation among customers.

By understanding the alternative options available, you can make informed decisions about how to manage your finances and avoid unnecessary fees. In the next section, we’ll provide a state-by-state comparison of check cashing fees, highlighting the states with the highest and lowest fees.

https://www.youtube.com/watch?v=qzqnYMXi7Us

Check Cashing Fees: State-by-State Comparison

Check cashing fees can vary significantly from state to state. Some states have laws that regulate check cashing fees, while others do not. In this section, we’ll provide a state-by-state comparison of check cashing fees, highlighting the states with the highest and lowest fees.

According to a recent study, the top 5 states with the highest check cashing fees are:

- California: 3.5% of the check amount

- New York: 3.25% of the check amount

- Florida: 3.15% of the check amount

- Texas: 3.05% of the check amount

- Illinois: 2.95% of the check amount

On the other hand, the top 5 states with the lowest check cashing fees are:

- Utah: 1.5% of the check amount

- Idaho: 1.45% of the check amount

- Wyoming: 1.4% of the check amount

- Montana: 1.35% of the check amount

- North Dakota: 1.3% of the check amount

It’s essential to note that these fees are subject to change and may not reflect the current fees. Additionally, some states may have different fees for different types of checks or for using certain services.

Understanding the check cashing fees in your state can help you make informed decisions about how to manage your finances and avoid unnecessary fees. In the next section, we’ll summarize the key takeaways from the article and provide encouragement to use the tips and strategies outlined in the article to minimize check cashing fees.

Conclusion: Taking Control of Check Cashing Fees

Understanding check cashing fees is crucial for managing your finances effectively. By knowing how much it costs to cash a check, you can make informed decisions about how to handle your financial transactions. In this article, we’ve provided a comprehensive guide to help you navigate the process of cashing a check and avoiding unnecessary fees.

We’ve discussed the different types of fees associated with cashing a check, including flat fees, percentage-based fees, and ATM fees. We’ve also compared the fees and services offered by various options, including banks, credit unions, check cashing stores, and online services.

Additionally, we’ve provided tips and strategies for minimizing check cashing fees, such as using a bank or credit union, avoiding check cashing stores, and taking advantage of online services. We’ve also introduced check cashing apps as a convenient alternative to traditional check cashing methods.

By taking control of your check cashing fees, you can save money and avoid unnecessary expenses. Remember to always read the fine print and understand the fees associated with each option before making a decision. By being informed and taking action, you can take control of your finances and make the most of your money.

In conclusion, understanding check cashing fees is essential for managing your finances effectively. By following the tips and strategies outlined in this article, you can minimize your check cashing fees and take control of your finances. Remember to always be informed and take action to make the most of your money.