Understanding the Importance of a Down Payment

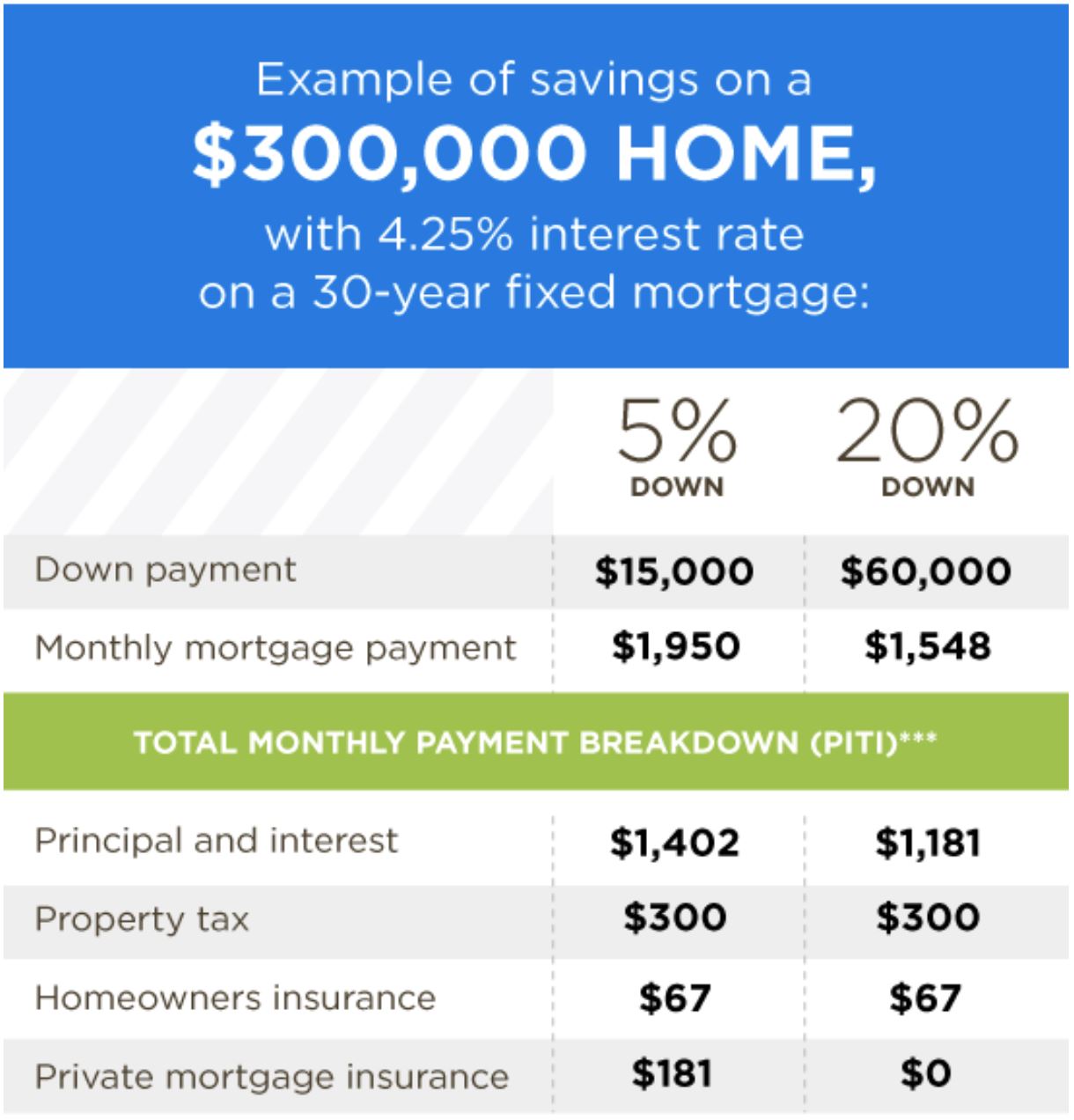

A down payment is a critical component of the home buying process, and its significance cannot be overstated. When considering how much down payment on a house, it’s essential to understand the impact it has on mortgage rates, monthly payments, and overall affordability. A substantial down payment can lead to lower mortgage rates, reduced monthly payments, and increased equity in the property. On the other hand, a lower down payment may result in higher mortgage rates, higher monthly payments, and private mortgage insurance (PMI) premiums.

In the United States, the typical down payment for a home purchase is around 10% to 20% of the purchase price. However, some mortgage options allow for lower down payments, such as 3% or 5%. It’s crucial to weigh the pros and cons of each option and consider factors like credit score, income, debt-to-income ratio, and financial goals when determining the right down payment amount.

For instance, a higher down payment can lead to lower mortgage rates, which can result in significant savings over the life of the loan. According to a study by the National Association of Realtors, a 20% down payment can save homeowners around $10,000 in interest payments over the first five years of a $250,000 mortgage. On the other hand, a lower down payment may require PMI premiums, which can increase monthly payments and reduce affordability.

Ultimately, the right down payment amount depends on individual circumstances and financial goals. It’s essential to carefully consider the options and seek professional advice to ensure the best possible outcome. By understanding the importance of a down payment and its impact on the home buying process, prospective homeowners can make informed decisions and achieve their goal of homeownership.

How to Determine the Right Down Payment Amount for You

Determining the right down payment amount for a house purchase involves considering several factors that influence your financial situation and goals. When deciding how much down payment on a house, it’s essential to evaluate your credit score, income, debt-to-income ratio, and financial objectives. A thorough analysis of these factors will help you determine the ideal down payment amount for your specific situation.

Credit score plays a significant role in determining the down payment amount. A good credit score can qualify you for better interest rates and lower down payment requirements. For instance, a credit score of 760 or higher may qualify you for a conventional loan with a down payment as low as 5%. On the other hand, a lower credit score may require a higher down payment or a subprime loan with less favorable terms.

Income is another crucial factor to consider when determining the down payment amount. Your income will impact your ability to afford monthly mortgage payments, property taxes, and insurance. A general rule of thumb is to spend no more than 30% of your gross income on housing costs. Considering your income and other debt obligations will help you determine a comfortable down payment amount.

Debt-to-income ratio is also an essential factor to evaluate when deciding on a down payment amount. Your debt-to-income ratio is the percentage of your monthly gross income that goes towards paying debts, including credit cards, student loans, and other debt obligations. A lower debt-to-income ratio will provide more flexibility when it comes to affording a down payment and monthly mortgage payments.

Finally, your financial goals and objectives should also influence your decision on the down payment amount. Are you looking to minimize your monthly mortgage payments or pay off your mortgage quickly? A larger down payment may be beneficial if you want to reduce your monthly payments, while a smaller down payment may be suitable if you prioritize paying off your mortgage quickly.

By carefully evaluating these factors, you can determine the right down payment amount for your specific situation and make an informed decision when purchasing a house.

Exploring Down Payment Options: From 3% to 20%

When it comes to determining

Exploring Down Payment Options: From 3% to 20%

When it comes to determining how much down payment on a house, homebuyers have several options to consider. The down payment amount can vary significantly, ranging from as low as 3% to as high as 20% or more. Each down payment option has its pros and cons, and understanding these differences is crucial to making an informed decision.

One of the most popular down payment options is the 20% down mortgage. This option offers several benefits, including lower mortgage rates, lower monthly payments, and increased equity in the property. However, saving for a 20% down payment can be challenging, especially for first-time homebuyers. A 20% down payment on a $250,000 home would require $50,000 in cash, which can be a significant hurdle for many buyers.

A more accessible option for many homebuyers is the 5% down mortgage. This option requires a lower down payment amount, making it easier for buyers to qualify for a mortgage. However, a 5% down payment may require private mortgage insurance (PMI), which can increase monthly payments. A 5% down payment on a $250,000 home would require $12,500 in cash, which is more manageable for many buyers.

For buyers who are struggling to save for a down payment, a 3% down mortgage may be a viable option. This option requires an even lower down payment amount, making it more accessible to buyers who are just starting out. However, a 3% down payment may also require PMI, and the mortgage rates may be slightly higher. A 3% down payment on a $250,000 home would require $7,500 in cash, which is a more achievable goal for many buyers.

Ultimately, the right down payment option depends on individual circumstances and financial goals. By understanding the pros and cons of each option, homebuyers can make an informed decision and choose the down payment amount that works best for them.

Low Down Payment Mortgage Options: What You Need to Know

For homebuyers who are struggling to save for a down payment, low down payment mortgage options can be a viable solution. These options allow buyers to purchase a home with a lower down payment amount, making it more accessible to those who may not have a significant amount of savings. In this section, we will explore some of the most popular low down payment mortgage options, including FHA loans, VA loans, and USDA loans.

FHA loans are a popular option for homebuyers who are looking for a low down payment mortgage. These loans require a down payment as low as 3.5% and are available to borrowers with credit scores as low as 580. FHA loans also offer more lenient debt-to-income ratio requirements, making it easier for buyers to qualify. However, FHA loans do require mortgage insurance premiums, which can increase monthly payments.

VA loans are another option for homebuyers who are looking for a low down payment mortgage. These loans are available to eligible veterans and require no down payment. VA loans also offer more favorable interest rates and lower mortgage insurance premiums compared to other low down payment mortgage options. However, VA loans do require a funding fee, which can range from 1.25% to 3.3% of the loan amount.

USDA loans are a low down payment mortgage option that is available to borrowers who are purchasing a home in a rural area. These loans require no down payment and offer more favorable interest rates compared to other low down payment mortgage options. However, USDA loans do require mortgage insurance premiums and have income and credit score requirements.

When considering low down payment mortgage options, it’s essential to weigh the pros and cons of each option carefully. While these options can make it easier to purchase a home, they may also require mortgage insurance premiums or other fees that can increase monthly payments. By understanding the requirements and benefits of each option, homebuyers can make an informed decision and choose the best low down payment mortgage option for their needs.

How to Save for a Down Payment: Tips and Strategies

Saving for a down payment can be a challenging task, but with the right strategies and mindset, it can be achieved. When determining how much down payment on a house, it’s essential to consider the various costs associated with homeownership, including mortgage payments, property taxes, and insurance. In this section, we will provide practical advice on saving for a down payment, including creating a budget, automating savings, and exploring assistance programs.

Creating a budget is the first step in saving for a down payment. It’s essential to track income and expenses to understand where money is being spent and identify areas for reduction. By cutting back on unnecessary expenses, such as dining out or subscription services, buyers can allocate more funds towards saving for a down payment. A budgeting app or spreadsheet can help track expenses and stay organized.

Automating savings is another effective way to save for a down payment. By setting up automatic transfers from a checking account to a savings account, buyers can ensure that a fixed amount is saved regularly. This can be done through a bank’s online platform or mobile app. Automating savings can help build discipline and make saving easier and less prone to being neglected.

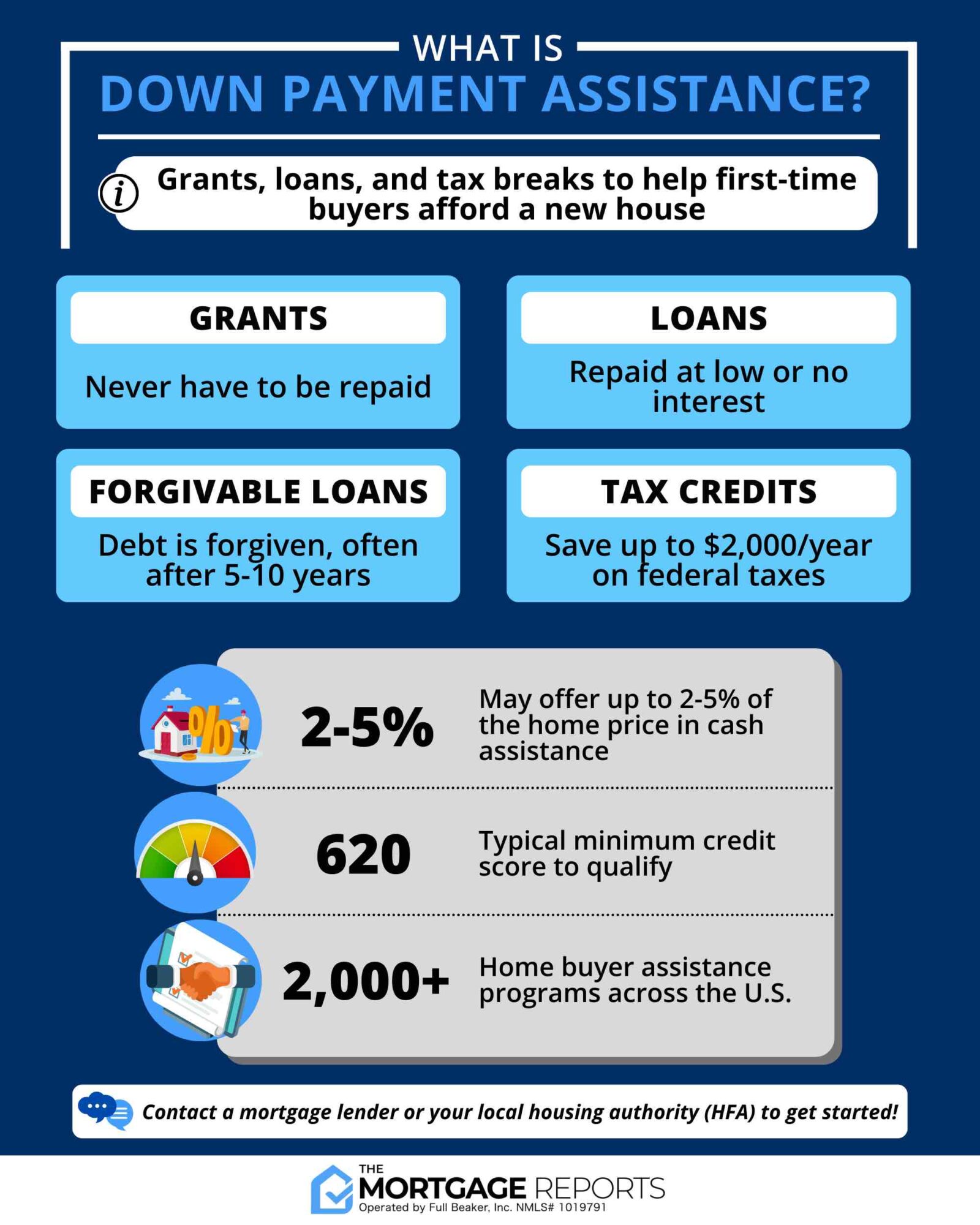

Exploring assistance programs is also an option for buyers who are struggling to save for a down payment. Many government agencies and non-profit organizations offer down payment assistance programs, such as grants, gifts, and matching funds. These programs can help buyers cover a portion of the down payment, making it easier to achieve their goal of homeownership.

Additionally, buyers can consider using tax-advantaged accounts, such as a first-time homebuyer savings account, to save for a down payment. These accounts offer tax benefits, such as deductions or credits, that can help reduce the amount of taxes owed. By taking advantage of these accounts, buyers can save more efficiently and effectively.

Finally, buyers can consider working with a financial advisor or planner to create a personalized savings plan. A financial advisor can help buyers understand their financial situation, identify areas for improvement, and develop a tailored plan to achieve their goal of saving for a down payment.

Down Payment Assistance Programs: A Closer Look

Down payment assistance programs are designed to help homebuyers overcome the hurdle of saving for a down payment. These programs can provide financial assistance, such as grants, gifts, and matching funds, to help buyers cover a portion of the down payment. In this section, we will examine down payment assistance programs and discuss their requirements and limitations.

Grants are a type of down payment assistance program that provides a lump sum of money to help buyers cover the down payment. These grants are usually offered by government agencies, non-profit organizations, and private companies. To be eligible for a grant, buyers typically need to meet certain income and credit score requirements. Grants can range from a few thousand dollars to tens of thousands of dollars, depending on the program and the buyer’s qualifications.

Gifts are another type of down payment assistance program that allows buyers to receive a gift of money from a family member, friend, or non-profit organization. These gifts can be used to cover a portion of the down payment, but they must be properly documented and disclosed to the lender. Gifts can be a great option for buyers who have a supportive network of family and friends.

Matching funds are a type of down payment assistance program that provides a matching contribution to the buyer’s down payment. These programs are usually offered by government agencies and non-profit organizations. To be eligible for matching funds, buyers typically need to meet certain income and credit score requirements. Matching funds can range from a few thousand dollars to tens of thousands of dollars, depending on the program and the buyer’s qualifications.

Down payment assistance programs can be a great option for buyers who are struggling to save for a down payment. However, it’s essential to carefully review the requirements and limitations of each program to ensure that it’s a good fit for your needs. Additionally, buyers should be aware that down payment assistance programs may have income and credit score requirements, and may require repayment of the assistance amount.

When considering down payment assistance programs, buyers should also be aware of the potential impact on their mortgage rates and monthly payments. Some programs may require a higher interest rate or higher monthly payments, so it’s essential to carefully review the terms and conditions of each program.

Conclusion: Finding the Right Down Payment Solution for Your Dream Home

When it comes to determining how much down payment on a house, there is no one-size-fits-all solution. The right down payment amount depends on individual circumstances, financial goals, and creditworthiness. By understanding the various down payment options, including 3% down mortgages, 5% down mortgages, and 20% down mortgages, homebuyers can make an informed decision that aligns with their financial situation and goals.

Low down payment mortgage options, such as FHA loans, VA loans, and USDA loans, can provide a viable solution for homebuyers who are struggling to save for a down payment. Additionally, down payment assistance programs, such as grants, gifts, and matching funds, can help bridge the gap between the down payment amount and the buyer’s savings.

Ultimately, finding the right down payment solution requires careful consideration of the pros and cons of each option. By weighing the advantages and disadvantages of each down payment option, homebuyers can make a decision that works best for their financial situation and goals.

As a homebuyer, it’s essential to remember that the down payment is just one aspect of the home buying process. By carefully considering the various down payment options and seeking professional advice, homebuyers can achieve their goal of homeownership and start building wealth through real estate.

By following the tips and strategies outlined in this article, homebuyers can make an informed decision about their down payment and take the first step towards achieving their dream of homeownership.

:max_bytes(150000):strip_icc()/choosing-a-down-payment-315602-Final-21f6f43a49084466afd65a24f1d288b9-c5b260ea1f384a3ca1741b548106ea45.jpg)