Understanding the Math Behind Your Weekly Earnings

Calculating weekly earnings is a straightforward process, but it’s essential to consider all the factors that affect your take-home pay. When determining how much is $15 an hour 30 hours a week, you need to multiply the hourly wage by the number of hours worked. In this case, the calculation is $15/hour x 30 hours/week = $450/week. However, this is just the gross income, and you need to consider taxes and deductions to get the net income.

Taxes play a significant role in reducing your take-home pay. Federal, state, and local taxes can range from 10% to 30% of your gross income, depending on your location and tax filing status. Additionally, you may have other deductions such as health insurance, retirement contributions, or union dues. These deductions can further reduce your take-home pay, so it’s crucial to factor them into your calculations.

To give you a better idea, let’s assume a 25% tax bracket and 10% deductions for other benefits. This would leave you with a take-home pay of around $337.50 per week ($450 x 0.75). While this may seem like a significant reduction, it’s essential to remember that taxes and deductions are a necessary part of the employment process.

Understanding the math behind your weekly earnings can help you make informed decisions about your finances and career. By considering all the factors that affect your take-home pay, you can create a more accurate budget and plan for your future.

Breaking Down the Numbers: What $15 an Hour 30 Hours a Week Really Means

Now that we’ve discussed the importance of considering hourly wage, number of hours worked, and potential deductions or taxes, let’s take a closer look at the numbers. If you’re working 30 hours a week at $15 an hour, your weekly earnings would be $450. But what does this mean in terms of annual salary?

Assuming a 52-week work year, your annual salary would be $23,400. This is a significant amount of money, and it’s essential to consider how it can impact your financial situation. For example, you could use this income to pay off debt, build up your savings, or invest in your future.

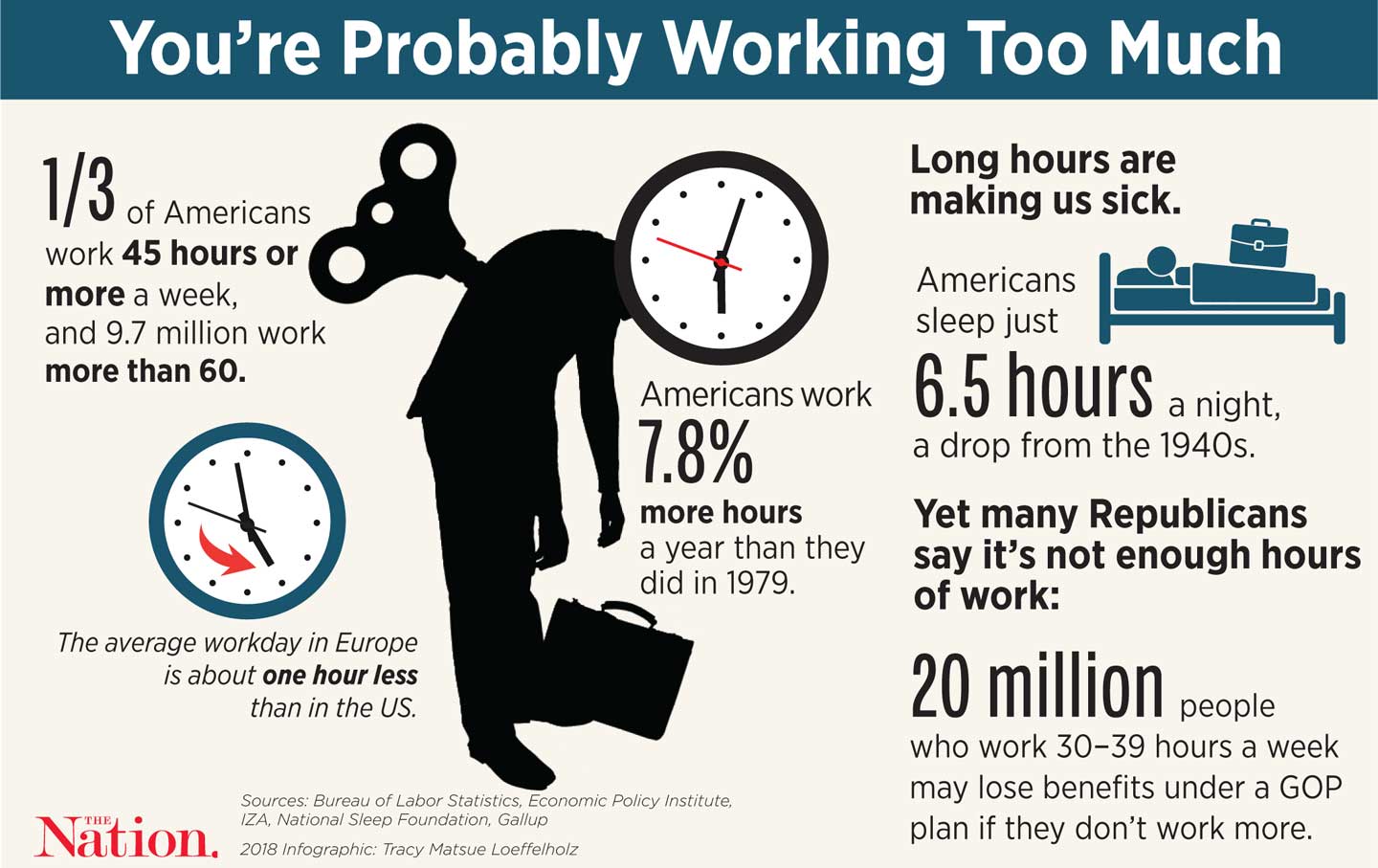

It’s also worth noting that $15 an hour is a relatively high hourly wage for a part-time job. According to the Bureau of Labor Statistics, the median hourly wage for part-time workers in the United States is around $12 an hour. This means that you’re earning significantly more than the average part-time worker, which can give you a competitive edge in the job market.

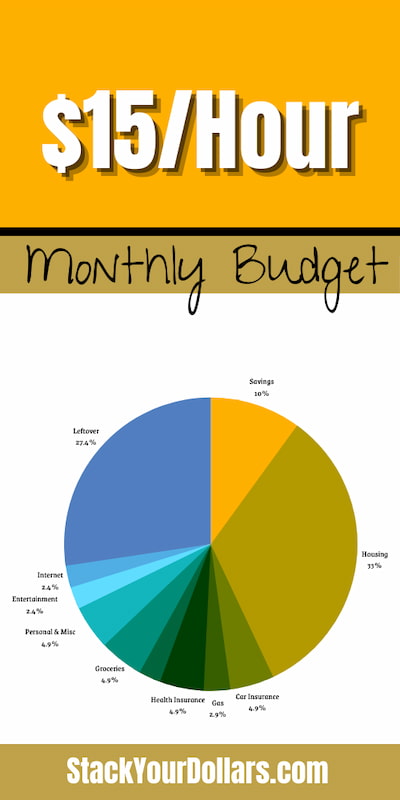

But how much is $15 an hour 30 hours a week really worth? To put it into perspective, let’s consider some common expenses that you might incur. For example, if you’re paying $1,500 a month in rent, your weekly earnings would cover around 30% of your housing costs. Similarly, if you’re paying $500 a month for groceries, your weekly earnings would cover around 90% of your food costs.

By breaking down the numbers and considering the real-world implications of your earnings, you can get a better sense of how much is $15 an hour 30 hours a week. This can help you make informed decisions about your finances and career, and ensure that you’re making the most of your part-time job opportunity.

The Impact of Taxes and Deductions on Your Take-Home Pay

When considering how much is $15 an hour 30 hours a week, it’s essential to factor in the impact of taxes and deductions on your take-home pay. Taxes can significantly reduce your earnings, and understanding how they work can help you make informed decisions about your finances.

Federal income taxes are typically the largest tax deduction from your paycheck. The amount of federal taxes withheld depends on your tax filing status, the number of allowances you claim, and your income level. For example, if you’re single and claim one allowance, you might expect to pay around 20-25% of your income in federal taxes.

State and local taxes can also impact your take-home pay. These taxes vary depending on where you live and work, but they can range from 5-10% of your income. Some states, like California and New York, have higher state income taxes, while others, like Florida and Texas, have no state income tax.

In addition to taxes, you may also have other deductions from your paycheck, such as health insurance premiums, retirement contributions, or union dues. These deductions can further reduce your take-home pay, but they can also provide valuable benefits and savings opportunities.

To give you a better idea of how taxes and deductions can impact your take-home pay, let’s consider an example. If you’re earning $450 per week, or $23,400 per year, and you’re paying 25% in federal taxes, 5% in state taxes, and 5% in other deductions, your take-home pay might be around $315 per week, or $16,380 per year. This is a significant reduction from your gross income, but it’s essential to understand that taxes and deductions are a necessary part of the employment process.

By understanding how taxes and deductions impact your take-home pay, you can make informed decisions about your finances and career. You can also explore ways to optimize your tax deductions and reduce your tax liability, which can help you keep more of your hard-earned money.

How to Make the Most of Your $15 an Hour 30 Hours a Week

Now that we’ve discussed the calculation behind weekly earnings and the impact of taxes and deductions, let’s explore ways to maximize your earnings. If you’re earning $15 an hour 30 hours a week, there are several strategies you can use to increase your take-home pay.

One way to boost your earnings is to increase your hours worked. If you’re currently working 30 hours a week, you may be able to pick up additional shifts or work overtime to increase your earnings. This can be especially beneficial during peak periods or holidays when demand for labor is high.

Another way to maximize your earnings is to explore additional income streams. This could include taking on a side hustle, freelancing, or starting a small business. By diversifying your income streams, you can reduce your reliance on a single source of income and increase your overall earnings.

Optimizing your tax deductions is also an effective way to increase your take-home pay. By taking advantage of tax credits and deductions, you can reduce your tax liability and keep more of your hard-earned money. For example, you may be eligible for the Earned Income Tax Credit (EITC) or the Child Tax Credit, which can provide significant tax savings.

In addition to these strategies, you can also consider negotiating a raise or promotion. If you’ve been with your employer for a while and have consistently delivered high-quality work, you may be able to negotiate a higher hourly wage or a promotion to a higher-paying position.

Finally, it’s essential to make the most of your $15 an hour 30 hours a week by using your earnings wisely. This could include creating a budget, saving for retirement, or paying off debt. By using your earnings effectively, you can achieve financial stability and security.

By implementing these strategies, you can make the most of your $15 an hour 30 hours a week and achieve your financial goals. Remember to always stay focused on your goals and be proactive in seeking out opportunities to increase your earnings.

Comparing $15 an Hour to Other Part-Time Job Opportunities

When considering how much is $15 an hour 30 hours a week, it’s essential to compare the earnings potential to other part-time job opportunities. Different industries and companies may offer varying hourly wages, and understanding these differences can help you make informed decisions about your career.

For example, in the retail industry, part-time workers may earn an average hourly wage of $10-$12 per hour. In contrast, part-time workers in the food service industry may earn an average hourly wage of $8-$10 per hour. However, some companies in these industries may offer higher hourly wages, such as $15 an hour or more, depending on the location and the specific job requirements.

In other industries, such as healthcare or technology, part-time workers may earn significantly higher hourly wages. For example, a part-time nurse may earn an average hourly wage of $25-$30 per hour, while a part-time software developer may earn an average hourly wage of $30-$40 per hour.

It’s also important to consider the benefits and perks offered by different companies. Some companies may offer benefits such as health insurance, retirement plans, or paid time off, which can impact the overall value of the job. Additionally, some companies may offer opportunities for advancement or professional development, which can be valuable for career growth.

When comparing $15 an hour 30 hours a week to other part-time job opportunities, it’s essential to consider the overall compensation package and the potential for career growth. By understanding the differences in hourly wages, benefits, and perks, you can make informed decisions about your career and choose the best opportunity for your needs and goals.

In conclusion, while $15 an hour 30 hours a week may be a competitive hourly wage in some industries, it’s essential to compare the earnings potential to other part-time job opportunities. By considering the overall compensation package and the potential for career growth, you can make informed decisions about your career and choose the best opportunity for your needs and goals.

The Benefits of a Part-Time Job: More Than Just a Paycheck

While the financial benefits of a part-time job are obvious, there are many non-monetary benefits that can be just as valuable. When considering how much is $15 an hour 30 hours a week, it’s essential to think about the other advantages that come with a part-time job.

One of the most significant benefits of a part-time job is the opportunity to gain new skills and experience. Whether you’re working in retail, food service, or another industry, you’ll have the chance to develop skills that can be applied to future careers. This can include communication skills, problem-solving skills, and time management skills, among others.

Another benefit of a part-time job is the chance to build professional networks. By working with colleagues and supervisors, you’ll have the opportunity to build relationships that can be beneficial in the future. This can include getting recommendations for future jobs, learning about new job opportunities, and gaining access to valuable advice and mentorship.

A part-time job can also provide a better work-life balance. By working part-time, you’ll have more time to focus on other aspects of your life, such as education, family, or personal interests. This can lead to a more fulfilling and balanced life, which can be just as valuable as a higher salary.

In addition to these benefits, a part-time job can also provide a sense of purpose and fulfillment. By contributing to a team and working towards a common goal, you’ll have the opportunity to feel a sense of accomplishment and pride in your work. This can be especially important for those who are looking for a sense of meaning and purpose in their lives.

Finally, a part-time job can be a stepping stone to a full-time career. By gaining experience and building skills, you’ll be better positioned to apply for full-time jobs in the future. This can be especially important for those who are just starting out in their careers or who are looking to make a career change.

In conclusion, while the financial benefits of a part-time job are important, they’re not the only benefits to consider. By thinking about the non-monetary benefits of a part-time job, you can gain a more complete understanding of the value of your work and make the most of your part-time job opportunities.

Turning Your Part-Time Job into a Full-Time Career

While a part-time job can provide a steady income and valuable work experience, it may not be enough to achieve long-term career goals. However, with the right strategies and mindset, it is possible to turn a part-time job into a full-time career.

One of the most important steps in turning a part-time job into a full-time career is to demonstrate your value to your employer. This can be done by taking on additional responsibilities, volunteering for new projects, and consistently delivering high-quality work. By showing your employer that you are capable and committed, you can increase your chances of being considered for a full-time position.

Another key strategy is to build relationships with your colleagues and supervisors. By networking and building relationships, you can gain valuable insights into the company culture and learn about potential job opportunities. You can also use these relationships to get recommendations or referrals, which can be helpful in securing a full-time position.

In addition to demonstrating your value and building relationships, it’s also important to develop new skills and knowledge. This can be done by taking courses, attending workshops or conferences, and seeking out mentorship. By continuously learning and growing, you can increase your earning potential and make yourself a more competitive candidate for full-time positions.

Finally, it’s essential to be proactive and take initiative in your career. This can involve seeking out new opportunities, applying for jobs, and being open to new challenges. By being proactive and taking control of your career, you can increase your chances of turning your part-time job into a full-time career.

When considering how much is $15 an hour 30 hours a week, it’s essential to think about the long-term potential of your part-time job. By demonstrating your value, building relationships, developing new skills, and being proactive, you can turn your part-time job into a full-time career and achieve your long-term career goals.

Conclusion: Making the Most of Your $15 an Hour 30 Hours a Week

In conclusion, understanding the value of your part-time job is crucial to making the most of your $15 an hour 30 hours a week. By considering the calculation behind your weekly earnings, the impact of taxes and deductions, and the non-monetary benefits of a part-time job, you can gain a deeper understanding of the value of your work.

Additionally, by exploring ways to maximize your earnings, comparing your part-time job to other opportunities, and considering the possibilities of turning your part-time job into a full-time career, you can take control of your financial future and achieve your long-term goals.

Remember, $15 an hour 30 hours a week may seem like a modest income, but it can be a stepping stone to greater things. By being proactive, taking initiative, and continuously learning and growing, you can unlock the full potential of your part-time job and achieve financial stability and success.

So, how much is $15 an hour 30 hours a week really worth? The answer is, it’s worth as much as you make it. By taking the time to understand the value of your part-time job and making the most of your opportunities, you can turn your $15 an hour 30 hours a week into a fulfilling and lucrative career.