Understanding the Annual Salary Equivalent of $50 an Hour

Knowing the annual salary equivalent of an hourly wage is crucial for effective budgeting, financial planning, and career decisions. When considering a job offer or evaluating a current salary, understanding the annual implications of an hourly wage can help individuals make informed decisions about their financial future. For instance, if someone is offered a job at $50 an hour, they may wonder how much is $50 an hour annually. This calculation can significantly impact their ability to plan for expenses, savings, and long-term financial goals.

In today’s fast-paced job market, it’s essential to have a clear understanding of the annual salary equivalent of an hourly wage. This knowledge can help individuals negotiate better salaries, make informed decisions about job offers, and create realistic financial plans. Furthermore, understanding the annual implications of an hourly wage can also help individuals identify opportunities for career advancement and professional growth.

For those who are unsure about how to calculate the annual salary equivalent of an hourly wage, the process is relatively straightforward. By multiplying the hourly wage by the number of hours worked per week and then by the number of weeks worked per year, individuals can quickly determine their annual salary. However, it’s essential to consider factors such as overtime, bonuses, and benefits when making this calculation.

By understanding the annual salary equivalent of an hourly wage, individuals can gain a deeper understanding of their financial situation and make informed decisions about their career and financial future. Whether you’re considering a job offer, evaluating a current salary, or simply looking to improve your financial literacy, knowing the annual implications of an hourly wage is essential.

How to Calculate Your Annual Salary from an Hourly Wage

Calculating the annual salary equivalent of an hourly wage is a straightforward process that requires a few simple steps. To determine how much is $50 an hour annually, you’ll need to consider the number of hours worked per week and the number of weeks worked per year. Here’s a step-by-step guide to help you calculate your annual salary:

Step 1: Determine the number of hours worked per week. This can vary depending on your job, industry, and location. For example, if you work a standard 40-hour workweek, you’ll multiply your hourly wage by 40.

Step 2: Determine the number of weeks worked per year. This can also vary depending on your job, industry, and location. For example, if you work a standard 52-week year, you’ll multiply your weekly earnings by 52.

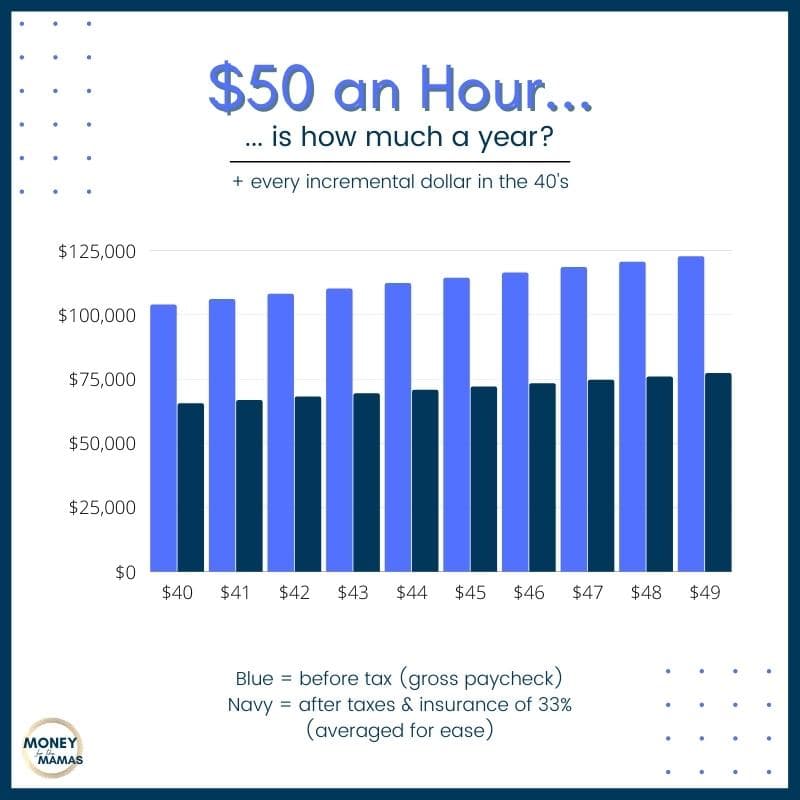

Step 3: Multiply your hourly wage by the number of hours worked per week and then by the number of weeks worked per year. This will give you your annual salary. For example, if you earn $50 an hour and work 40 hours per week for 52 weeks per year, your annual salary would be:

$50/hour x 40 hours/week = $2,000/week

$2,000/week x 52 weeks/year = $104,000/year

As you can see, calculating the annual salary equivalent of an hourly wage is a simple process that requires a few basic calculations. By understanding how to calculate your annual salary, you can make informed decisions about your career and financial future.

It’s also important to consider factors such as overtime, bonuses, and benefits when calculating your annual salary. These variables can impact your take-home pay and overall compensation package. By factoring these variables into your calculation, you can get a more accurate picture of your annual salary and make informed decisions about your financial future.

The Impact of Overtime and Bonuses on Your Annual Salary

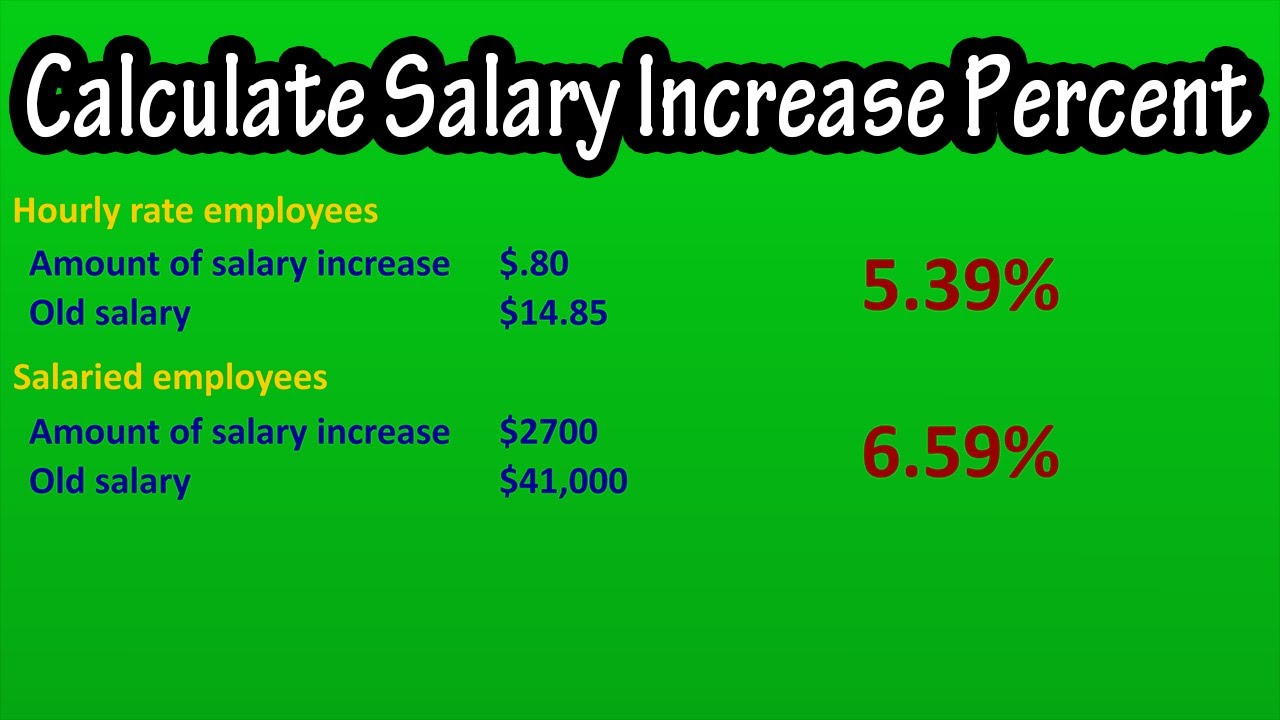

Overtime and bonuses can significantly impact the annual salary equivalent of $50 an hour. When calculating how much is $50 an hour annually, it’s essential to consider these variables to get an accurate picture of your take-home pay. In this section, we’ll discuss how overtime and bonuses can affect your annual salary and provide tips on how to factor these variables into your calculation.

Overtime pay can increase your annual salary significantly, especially if you work in industries that require long hours or irregular schedules. For example, if you work 10 hours of overtime per week at a rate of 1.5 times your regular hourly wage, your annual salary could increase by $10,000 or more. To calculate the impact of overtime on your annual salary, you’ll need to multiply your overtime hours by your overtime rate and add this amount to your regular annual salary.

Bonuses can also impact your annual salary, especially if you work in industries that offer performance-based bonuses or profit-sharing plans. For example, if you receive a 10% bonus on your annual salary, your take-home pay could increase by $10,000 or more. To calculate the impact of bonuses on your annual salary, you’ll need to multiply your annual salary by the bonus percentage and add this amount to your regular annual salary.

When calculating the annual salary equivalent of $50 an hour, it’s essential to consider both overtime and bonuses. By factoring these variables into your calculation, you can get a more accurate picture of your take-home pay and make informed decisions about your financial future. For example, if you earn $50 an hour and work 40 hours per week for 52 weeks per year, your annual salary would be $104,000. However, if you work 10 hours of overtime per week at a rate of 1.5 times your regular hourly wage, your annual salary could increase to $114,000 or more. Additionally, if you receive a 10% bonus on your annual salary, your take-home pay could increase to $125,000 or more.

By understanding the impact of overtime and bonuses on your annual salary, you can make informed decisions about your career and financial future. Whether you’re negotiating a new salary or evaluating a job offer, it’s essential to consider these variables to get an accurate picture of your take-home pay.

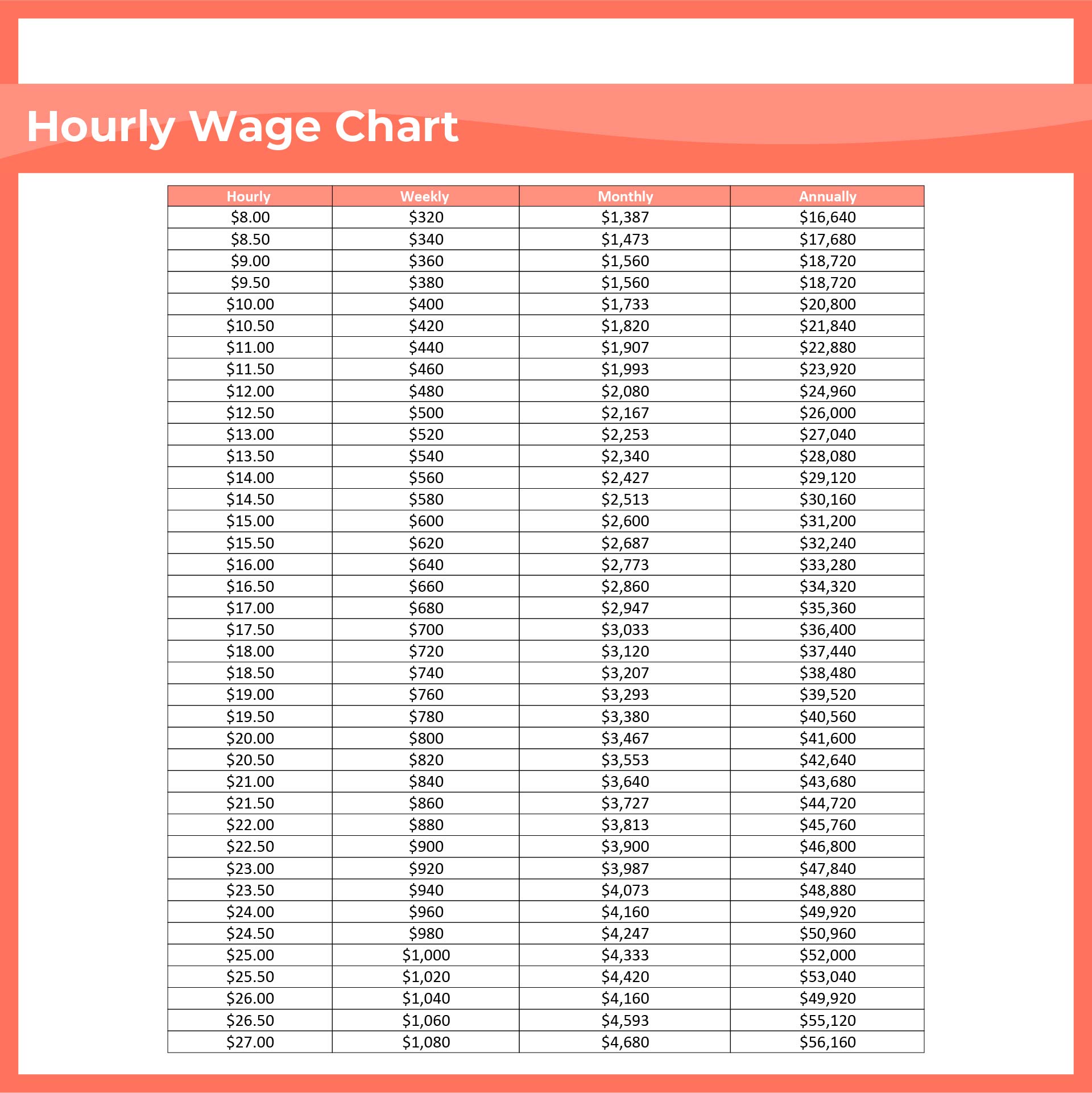

Comparing $50 an Hour to Other Hourly Wages: A Benchmark Analysis

When considering an hourly wage of $50, it’s essential to understand how it compares to other hourly wages in different industries and locations. This benchmark analysis will help you determine whether $50 an hour is a competitive wage and provide insights into the factors that influence hourly wage variations.

According to data from the Bureau of Labor Statistics, the median hourly wage for all occupations in the United States is around $25. However, hourly wages can vary significantly depending on the industry, location, and occupation. For example, workers in the tech industry tend to earn higher hourly wages, with median hourly wages ranging from $40 to over $100 per hour.

In contrast, workers in the retail and food service industries tend to earn lower hourly wages, with median hourly wages ranging from $10 to $20 per hour. When considering an hourly wage of $50, it’s essential to understand the industry and location-specific factors that influence hourly wage variations.

One way to benchmark an hourly wage of $50 is to compare it to the hourly wages of similar occupations in different industries. For example, a software engineer in the tech industry may earn an hourly wage of $75, while a registered nurse in the healthcare industry may earn an hourly wage of $45. By comparing hourly wages across different industries and occupations, you can gain a better understanding of whether $50 an hour is a competitive wage.

Another way to benchmark an hourly wage of $50 is to consider the cost of living in different locations. For example, the cost of living in cities like New York or San Francisco is significantly higher than in cities like Des Moines or Omaha. As a result, hourly wages in these cities may be higher to account for the increased cost of living. By considering the cost of living in different locations, you can gain a better understanding of whether $50 an hour is a competitive wage in your area.

By understanding how $50 an hour compares to other hourly wages in different industries and locations, you can make informed decisions about your career and financial future. Whether you’re negotiating a new salary or evaluating a job offer, it’s essential to consider the benchmark data to determine whether $50 an hour is a competitive wage.

Maximizing Your Earnings: Tips for Increasing Your Hourly Wage

Increasing your hourly wage can have a significant impact on your annual salary and overall financial well-being. Whether you’re looking to negotiate a raise or seeking new job opportunities, there are several strategies you can use to maximize your earnings. In this section, we’ll provide tips on how to increase your hourly wage, including strategies for negotiation, skill development, and career advancement.

One of the most effective ways to increase your hourly wage is to develop in-demand skills. By acquiring skills that are in high demand, you can increase your value to employers and negotiate higher wages. Some of the most in-demand skills include programming, data analysis, and digital marketing. By investing in your education and training, you can increase your earning potential and stay competitive in the job market.

Another way to increase your hourly wage is to negotiate with your employer. By doing your research and understanding the market rate for your position, you can make a strong case for a raise. It’s also essential to be confident and assertive during the negotiation process, as this can help you achieve a better outcome. Some tips for negotiating a raise include:

Know your worth: Understand the market rate for your position and be prepared to make a strong case for a raise.

Be confident: Confidence is key during the negotiation process. Be assertive and make a strong case for why you deserve a raise.

Be flexible: Be open to negotiation and willing to consider alternative solutions, such as additional benefits or a performance-based raise.

In addition to developing in-demand skills and negotiating with your employer, there are several other strategies you can use to increase your hourly wage. These include:

Seeking out new job opportunities: If you’re not able to negotiate a raise with your current employer, it may be time to seek out new job opportunities. By researching the job market and understanding the going rate for your position, you can find a job that pays a higher hourly wage.

Starting your own business: If you have an entrepreneurial spirit, starting your own business can be a great way to increase your hourly wage. By creating a successful business, you can earn a higher income and achieve financial independence.

By using these strategies, you can increase your hourly wage and achieve financial success. Whether you’re looking to negotiate a raise or seeking new job opportunities, there are several ways to maximize your earnings and achieve your financial goals.

The Tax Implications of Earning $50 an Hour: What You Need to Know

Earning $50 an hour can have significant tax implications, and it’s essential to understand how your hourly wage affects your tax liability. In this section, we’ll explain the tax implications of earning $50 an hour, including how to minimize tax liabilities and maximize take-home pay.

When you earn $50 an hour, you’ll need to consider the following tax implications:

Federal income tax: As a high-income earner, you’ll be subject to a higher federal income tax rate. The tax rate will depend on your filing status, number of dependents, and other factors.

State and local taxes: Depending on where you live, you may be subject to state and local taxes on your earnings. These taxes can range from a few percent to over 10% of your income.

Payroll taxes: As an employee, you’ll be subject to payroll taxes, including Social Security and Medicare taxes. These taxes are typically withheld from your paycheck and paid to the government on your behalf.

To minimize tax liabilities and maximize take-home pay, consider the following strategies:

Take advantage of tax deductions: You may be eligible for tax deductions, such as mortgage interest, charitable donations, or business expenses. These deductions can help reduce your taxable income and lower your tax liability.

Utilize tax credits: Tax credits, such as the Earned Income Tax Credit (EITC) or the Child Tax Credit, can provide a direct reduction in your tax liability.

Consider tax-deferred savings: Contributing to tax-deferred savings accounts, such as a 401(k) or IRA, can help reduce your taxable income and lower your tax liability.

Consult a tax professional: A tax professional can help you navigate the tax implications of earning $50 an hour and provide personalized advice on minimizing tax liabilities and maximizing take-home pay.

By understanding the tax implications of earning $50 an hour, you can make informed decisions about your financial future and take steps to minimize tax liabilities and maximize take-home pay.

Creating a Budget with a $50 an Hour Salary: A Practical Guide

Creating a budget with a $50 an hour salary requires careful planning and consideration of your financial goals. In this section, we’ll provide a practical guide on how to create a budget with a $50 an hour salary, including tips on saving, investing, and managing expenses.

Step 1: Determine Your Net Income

The first step in creating a budget is to determine your net income. This is the amount of money you take home after taxes and other deductions. To calculate your net income, you can use the following formula:

Net Income = Gross Income – Taxes – Deductions

For example, if you earn $50 an hour and work 40 hours a week, your gross income would be $2,000 per week. After taxes and deductions, your net income might be around $1,500 per week.

Step 2: Categorize Your Expenses

Next, you’ll need to categorize your expenses into different areas, such as:

Housing: rent/mortgage, utilities, maintenance

Transportation: car loan/gas/insurance, public transportation

Food: groceries, dining out

Insurance: health, life, disability

Debt: credit cards, loans

Entertainment: hobbies, travel, entertainment

Savings: emergency fund, retirement

Step 3: Set Financial Goals

Now that you have a clear picture of your income and expenses, it’s time to set financial goals. What do you want to achieve with your $50 an hour salary? Do you want to save for a down payment on a house? Pay off debt? Build an emergency fund?

Step 4: Create a Budget Plan

Using the 50/30/20 rule, allocate 50% of your net income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment.

For example, if your net income is $1,500 per week, you could allocate:

50% ($750) towards necessary expenses (housing, utilities, food)

30% ($450) towards discretionary spending (entertainment, hobbies)

20% ($300) towards saving and debt repayment (emergency fund, retirement)

By following these steps and creating a budget plan, you can make the most of your $50 an hour salary and achieve your financial goals.

Conclusion: Unlocking the Full Potential of Your $50 an Hour Salary

In conclusion, understanding the value of your hourly wage is crucial for making informed decisions about your financial future. By knowing how much is $50 an hour annually, you can better plan your budget, make smart financial decisions, and achieve your long-term goals.

Throughout this article, we’ve provided a comprehensive guide to help you unlock the full potential of your $50 an hour salary. We’ve covered topics such as calculating your annual salary, understanding the impact of overtime and bonuses, comparing your hourly wage to others, and creating a budget that works for you.

By following the tips and strategies outlined in this article, you can take control of your financial future and make the most of your $50 an hour salary. Remember to stay informed, stay disciplined, and stay focused on your goals.

As you move forward, keep in mind that your hourly wage is just one aspect of your overall financial picture. By making smart financial decisions and staying committed to your goals, you can achieve financial freedom and live the life you deserve.

So, what’s next? Take the first step towards unlocking the full potential of your $50 an hour salary. Start by calculating your annual salary, creating a budget, and making smart financial decisions. With time and effort, you can achieve financial freedom and live the life you deserve.