Understanding the Significance of Hourly Pay

When it comes to understanding one’s compensation, hourly pay is a crucial aspect to consider. Knowing how much one earns per hour can significantly impact their financial planning, budgeting, and career decisions. In today’s fast-paced and competitive job market, having a clear understanding of hourly pay is more important than ever. For instance, knowing how much is $50 an hour annually can help individuals make informed decisions about their career paths and financial goals.

Hourly pay serves as the foundation for calculating annual salary, which is a critical factor in determining one’s overall compensation package. By understanding the hourly pay rate, individuals can better negotiate their salary, plan their finances, and make informed decisions about their career advancement. Moreover, knowing the annual equivalent of an hourly wage can help individuals compare job offers, evaluate the cost of living in different locations, and make informed decisions about their financial futures.

In addition to its practical applications, understanding hourly pay can also have a significant impact on one’s lifestyle and financial well-being. For example, knowing how much one earns per hour can help individuals create a realistic budget, prioritize their spending, and make smart financial decisions. Furthermore, having a clear understanding of hourly pay can also help individuals identify areas for improvement, such as increasing their earning potential or pursuing additional income streams.

As the job market continues to evolve, it is essential for individuals to have a clear understanding of their hourly pay and its impact on their annual salary. By doing so, individuals can take control of their financial futures, make informed decisions about their careers, and achieve their long-term financial goals. Whether you’re just starting your career or looking to make a change, understanding the significance of hourly pay is crucial for success in today’s fast-paced and competitive job market.

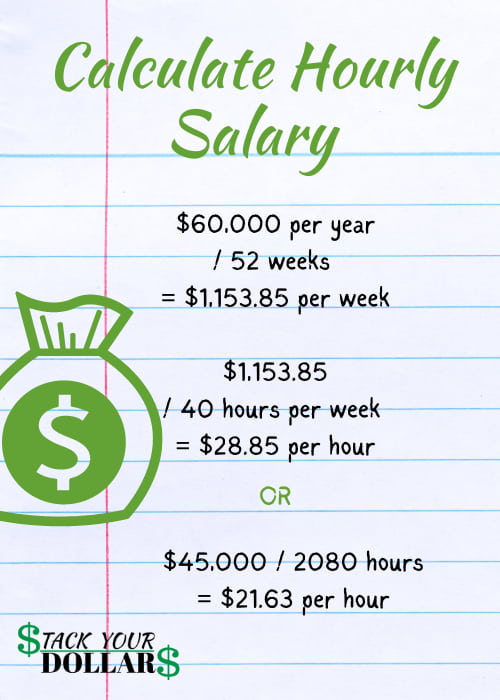

Converting Hourly to Annual Salary: The Math Behind It

To calculate the annual salary from an hourly wage, it’s essential to understand the math behind it. Assuming a standard full-time schedule of 40 hours per week and 52 weeks per year, the calculation is relatively straightforward. Let’s use the example of $50/hour to illustrate the calculation.

First, calculate the total number of hours worked per year: 40 hours/week x 52 weeks/year = 2,080 hours/year. Next, multiply the hourly wage by the total number of hours worked per year: $50/hour x 2,080 hours/year = $104,000/year. This calculation provides the annual salary equivalent of $50/hour, assuming a standard full-time schedule.

It’s essential to note that this calculation is based on a simplified assumption and does not take into account factors such as overtime, bonuses, or benefits. However, it provides a general idea of how to convert hourly pay to annual salary. By understanding this calculation, individuals can better comprehend the value of their hourly wage and make informed decisions about their careers and financial futures.

For instance, knowing how much is $50 an hour annually can help individuals evaluate job offers, compare salaries, and make informed decisions about their career advancement. Additionally, this calculation can be used to determine the annual salary equivalent of different hourly wages, providing a useful tool for career development and financial planning.

By mastering the math behind converting hourly to annual salary, individuals can gain a deeper understanding of their compensation package and make informed decisions about their financial futures. Whether you’re just starting your career or looking to make a change, understanding the annual salary equivalent of your hourly wage is crucial for success in today’s competitive job market.

How Much is $50 an Hour Annually? The Answer Revealed

As we’ve discussed earlier, calculating the annual salary equivalent of an hourly wage is a straightforward process. Assuming a standard full-time schedule of 40 hours per week and 52 weeks per year, the annual salary equivalent of $50/hour can be calculated as follows: $50/hour x 2,080 hours/year = $104,000/year.

This figure is significant, as it represents the annual salary equivalent of earning $50/hour. Knowing how much is $50 an hour annually can help individuals evaluate job offers, compare salaries, and make informed decisions about their career advancement. Additionally, this calculation can be used to determine the annual salary equivalent of different hourly wages, providing a useful tool for career development and financial planning.

The annual salary equivalent of $50/hour can have a substantial impact on one’s lifestyle and financial goals. For instance, earning $104,000/year can provide a comfortable standard of living, depending on factors such as location, family size, and personal spending habits. Furthermore, this figure can also impact one’s career aspirations, as it may provide the financial stability and security needed to pursue long-term goals.

It’s essential to note that this calculation is based on a simplified assumption and does not take into account factors such as overtime, bonuses, or benefits. However, it provides a general idea of the annual salary equivalent of $50/hour and can be used as a starting point for further calculations and financial planning.

By understanding the annual salary equivalent of $50/hour, individuals can gain a deeper understanding of their compensation package and make informed decisions about their financial futures. Whether you’re just starting your career or looking to make a change, knowing how much is $50 an hour annually can help you unlock the value of your hourly wage and achieve your long-term financial goals.

Factors That Influence Take-Home Pay: Taxes, Benefits, and More

While calculating the annual salary equivalent of an hourly wage is a straightforward process, there are various factors that can affect take-home pay. Taxes, benefits, and other deductions can significantly impact the actual amount of money earned annually, even if the hourly wage remains the same.

Taxes, for instance, can take a substantial chunk out of one’s take-home pay. Federal, state, and local taxes can range from 15% to 30% of one’s income, depending on the location and tax bracket. Additionally, benefits such as health insurance, retirement plans, and paid time off can also impact take-home pay.

Other deductions, such as student loan payments, credit card debt, and mortgage payments, can also affect take-home pay. Furthermore, factors such as overtime, bonuses, and commissions can also impact the actual amount of money earned annually.

For example, let’s assume an individual earns $50/hour and works 40 hours a week, 52 weeks a year. Their annual salary equivalent would be $104,000/year. However, after taxes, benefits, and other deductions, their take-home pay might be significantly lower, around $70,000 to $80,000 per year.

Understanding these factors is crucial in determining the actual amount of money earned annually. By taking into account taxes, benefits, and other deductions, individuals can get a more accurate picture of their take-home pay and make informed decisions about their financial futures.

When considering how much is $50 an hour annually, it’s essential to factor in these variables to get a realistic understanding of the actual take-home pay. By doing so, individuals can make informed decisions about their careers, financial planning, and lifestyle choices.

Real-Life Examples: How $50 an Hour Annually Can Impact Your Life

To illustrate the potential impact of earning $50/hour annually, let’s consider a few real-life examples. Meet Sarah, a marketing specialist who earns $50/hour and works 40 hours a week, 52 weeks a year. Her annual salary equivalent is $104,000/year.

With this income, Sarah can afford a comfortable lifestyle, including a mortgage on a nice home, a car payment, and regular vacations. She can also save for retirement and pay off her student loans. However, Sarah’s take-home pay is affected by taxes, benefits, and other deductions, which reduces her annual salary equivalent to around $70,000 to $80,000 per year.

Another example is John, a software engineer who earns $50/hour and works 40 hours a week, 52 weeks a year. John’s annual salary equivalent is also $104,000/year. However, John’s take-home pay is affected by a higher tax bracket, which reduces his annual salary equivalent to around $60,000 to $70,000 per year.

These examples illustrate how earning $50/hour annually can impact one’s lifestyle, financial goals, and career aspirations. By understanding the annual salary equivalent of an hourly wage, individuals can make informed decisions about their careers and financial futures.

For instance, knowing how much is $50 an hour annually can help individuals evaluate job offers, compare salaries, and make informed decisions about their career advancement. Additionally, this calculation can be used to determine the annual salary equivalent of different hourly wages, providing a useful tool for career development and financial planning.

By considering these real-life examples, individuals can gain a better understanding of the potential impact of earning $50/hour annually and make informed decisions about their financial futures.

Maximizing Your Earning Potential: Tips and Strategies

To maximize your earning potential, it’s essential to develop a strategic approach to your career and finances. Here are some tips and strategies to help you increase your earning potential:

1. Negotiate your salary: When starting a new job or asking for a raise, it’s essential to negotiate your salary. Research the market value of your role and make a strong case for why you deserve a higher salary.

2. Pursue additional income streams: Consider starting a side hustle or freelancing to supplement your income. This can help you earn extra money and diversify your income streams.

3. Develop in-demand skills: Invest in your education and training to develop in-demand skills. This can help you increase your earning potential and stay competitive in the job market.

4. Build a professional network: Building a professional network can help you stay informed about job opportunities and industry trends. Attend networking events, join professional organizations, and connect with people in your industry on LinkedIn.

5. Create a budget and track your expenses: To maximize your earning potential, it’s essential to manage your finances effectively. Create a budget and track your expenses to ensure you’re making the most of your money.

By implementing these strategies, you can increase your earning potential and achieve your financial goals. Remember, knowing how much is $50 an hour annually is just the first step. It’s essential to take control of your finances and make informed decisions about your career and earning potential.

Continuous learning and professional development are also crucial for maximizing your earning potential. Stay up-to-date with industry trends and developments, and invest in your education and training to stay competitive in the job market.

By following these tips and strategies, you can unlock the value of your hourly wage and achieve your financial goals.

Conclusion: Unlocking the Value of Your Hourly Wage

In conclusion, understanding the value of your hourly wage is crucial for making informed decisions about your career and financial future. By knowing how much is $50 an hour annually, you can better evaluate job offers, compare salaries, and make informed decisions about your career advancement.

Throughout this article, we have discussed the importance of understanding hourly pay and its impact on annual salary. We have also provided a step-by-step explanation of how to calculate the annual salary from an hourly wage, including the assumption of a standard full-time schedule.

Additionally, we have discussed the various factors that can affect take-home pay, including taxes, benefits, and other deductions. We have also provided real-life examples of how earning $50/hour annually can impact one’s lifestyle, financial goals, and career aspirations.

Finally, we have offered tips and strategies for maximizing earning potential, including negotiating salary, pursuing additional income streams, and developing in-demand skills. By following these tips and strategies, you can unlock the value of your hourly wage and achieve your financial goals.

Remember, understanding the value of your hourly wage is just the first step. It’s essential to take control of your finances and make informed decisions about your career and earning potential. By doing so, you can create a brighter financial future for yourself and achieve your long-term goals.

Next Steps: Turning Your Hourly Wage into a Brighter Financial Future

Now that you have a better understanding of how much is $50 an hour annually, it’s time to take control of your financial future. Here are some potential next steps to consider:

1. Create a budget: Start by tracking your income and expenses to get a clear picture of your financial situation. Make a budget that accounts for all your necessary expenses, savings, and debt payments.

2. Set financial goals: Determine what you want to achieve with your hourly wage. Do you want to pay off debt, save for a down payment on a house, or build up your emergency fund? Set specific, measurable goals and create a plan to achieve them.

3. Explore ways to increase earning potential: Consider taking on additional work, pursuing additional income streams, or developing in-demand skills to increase your earning potential.

4. Review and adjust your benefits: Make sure you’re taking advantage of all the benefits your employer offers, such as health insurance, retirement plans, and paid time off.

5. Seek professional advice: If you’re unsure about how to manage your finances or need personalized advice, consider consulting a financial advisor.

By taking these next steps, you can turn your hourly wage into a brighter financial future. Remember, understanding the value of your hourly wage is just the first step. It’s essential to take control of your finances and make informed decisions about your career and earning potential.

Don’t wait any longer to unlock the value of your hourly wage. Take the first step today and start building a brighter financial future for yourself.