What is a Financial Advisor and Why Do You Need One

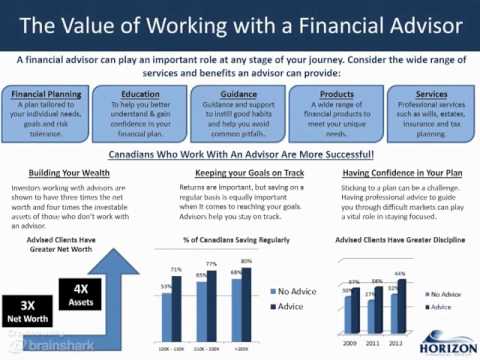

A financial advisor is a professional who provides expert guidance on managing one’s finances, including investments, taxes, and retirement planning. Their primary goal is to help clients achieve their financial objectives by creating a personalized plan tailored to their unique needs and circumstances. With the increasing complexity of financial markets and regulations, hiring a financial advisor has become essential for individuals seeking to secure their financial future.

Financial advisors possess extensive knowledge and expertise in areas such as investment management, tax optimization, and estate planning. They stay up-to-date with market trends, regulatory changes, and emerging opportunities, allowing them to provide informed advice and guidance to their clients. By leveraging their expertise, clients can make informed decisions about their financial resources, minimize risks, and maximize returns.

One of the primary benefits of hiring a financial advisor is the creation of a customized financial plan. This plan takes into account the client’s financial goals, risk tolerance, and current financial situation, providing a roadmap for achieving success. Financial advisors also offer ongoing support and guidance, helping clients navigate the complexities of financial markets and make adjustments to their plan as needed.

In addition to personalized planning, financial advisors can help clients optimize their investment portfolios, reduce tax liabilities, and develop strategies for retirement and estate planning. By working with a financial advisor, individuals can gain peace of mind, knowing that their financial affairs are being managed by a trusted professional.

While the cost of hiring a financial advisor may seem prohibitive to some, the benefits far outweigh the expenses. In fact, studies have shown that working with a financial advisor can lead to increased investment returns, improved financial stability, and a greater sense of financial security. When considering the question of “how much is a financial advisor,” it’s essential to weigh the costs against the potential benefits and long-term value that a financial advisor can provide.

Factors Affecting the Cost of Hiring a Financial Advisor

When considering the question of “how much is a financial advisor,” it’s essential to understand the various factors that influence their costs. The experience and credentials of a financial advisor can significantly impact their fees. Advisors with advanced degrees, certifications, or extensive experience may charge higher rates due to their expertise and the value they bring to clients.

Location is another factor that affects the cost of hiring a financial advisor. Advisors based in major cities or urban areas tend to charge higher fees compared to those in smaller towns or rural areas. This is due to the higher cost of living, office expenses, and other overhead costs associated with operating a business in a major city.

The services offered by a financial advisor also play a crucial role in determining their costs. Advisors who provide comprehensive financial planning, investment management, and ongoing support may charge higher fees than those who offer limited services. Additionally, advisors who specialize in specific areas, such as retirement planning or estate planning, may charge higher rates due to their expertise and the complexity of the services they provide.

The size and complexity of a client’s financial situation can also impact the cost of hiring a financial advisor. Clients with larger investment portfolios, multiple income streams, or complex financial situations may require more time and expertise from their advisor, resulting in higher fees.

Finally, the fee structure used by a financial advisor can also affect their costs. Advisors who charge asset-based fees, for example, may charge higher rates than those who charge hourly or flat fees. Understanding these factors can help clients better navigate the process of hiring a financial advisor and make informed decisions about their financial planning needs.

By considering these factors, clients can gain a better understanding of the costs associated with hiring a financial advisor and make informed decisions about their financial planning needs. When evaluating the cost of hiring a financial advisor, it’s essential to consider the value they bring to the table, including their expertise, services, and ongoing support.

Understanding the Different Fee Structures for Financial Advisors

When considering the question of “how much is a financial advisor,” it’s essential to understand the different fee structures used by financial advisors. The most common fee structures include asset-based fees, hourly fees, and flat fees. Each fee structure has its pros and cons, and understanding these differences can help clients make informed decisions about their financial planning needs.

Asset-based fees are the most common fee structure used by financial advisors. This fee structure is based on the value of the client’s investment portfolio, typically ranging from 0.25% to 1.5% per year. The pros of asset-based fees include alignment with the client’s interests, as the advisor’s fees are directly tied to the performance of the portfolio. However, the cons include the potential for conflicts of interest, as advisors may be incentivized to recommend investments that generate higher fees.

Hourly fees are another common fee structure used by financial advisors. This fee structure is based on the number of hours worked by the advisor, typically ranging from $100 to $500 per hour. The pros of hourly fees include transparency and flexibility, as clients can choose the services they need and pay only for the time worked. However, the cons include the potential for higher costs, as clients may require more time and expertise from their advisor.

Flat fees are a less common fee structure used by financial advisors. This fee structure is based on a fixed fee for specific services, such as financial planning or investment management. The pros of flat fees include simplicity and predictability, as clients know exactly what they will pay for specific services. However, the cons include the potential for limited services, as advisors may not offer comprehensive financial planning or investment management for a flat fee.

Other fee structures used by financial advisors include retainer fees, subscription fees, and performance-based fees. Retainer fees are based on a recurring fee for ongoing services, while subscription fees are based on a recurring fee for access to specific services or tools. Performance-based fees are based on the performance of the client’s investment portfolio, typically ranging from 10% to 20% of the portfolio’s returns.

Understanding the different fee structures used by financial advisors can help clients make informed decisions about their financial planning needs. By considering the pros and cons of each fee structure, clients can choose the advisor and fee structure that best aligns with their interests and financial goals.

How Much Does a Financial Advisor Cost: Average Fees and Expenses

The cost of hiring a financial advisor can vary widely depending on several factors, including their experience, credentials, location, and services offered. When considering the question of “how much is a financial advisor,” it’s essential to understand the average fees and expenses associated with hiring a financial advisor.

According to industry benchmarks, the average fee for a financial advisor can range from 0.25% to 1.5% of the client’s investment portfolio per year. For example, a client with a $100,000 investment portfolio might pay an annual fee of $250 to $1,500. However, this fee can vary depending on the advisor’s experience, credentials, and services offered.

In addition to the annual fee, clients may also incur other expenses, such as investment management fees, trading fees, and administrative fees. These fees can range from 0.1% to 1.0% of the client’s investment portfolio per year, depending on the investment products and services used.

Some financial advisors may also charge hourly fees or flat fees for specific services, such as financial planning or investment management. These fees can range from $100 to $500 per hour or $500 to $5,000 per year, depending on the advisor’s experience and services offered.

It’s essential to note that while the cost of hiring a financial advisor may seem high, the benefits of working with a professional advisor can far outweigh the costs. A good financial advisor can help clients achieve their financial goals, reduce their tax liability, and increase their investment returns over the long term.

When evaluating the cost of hiring a financial advisor, it’s essential to consider the value they bring to the table. A good financial advisor can provide personalized financial planning, investment management, and ongoing support to help clients achieve their financial goals. By understanding the average fees and expenses associated with hiring a financial advisor, clients can make informed decisions about their financial planning needs and find a advisor who fits their budget and meets their needs.

What to Expect from a Financial Advisor: Services and Deliverables

When working with a financial advisor, clients can expect a range of services and deliverables designed to help them achieve their financial goals. These services may include financial planning, investment management, and ongoing support.

Financial planning is a comprehensive process that involves assessing a client’s current financial situation, identifying their financial goals, and developing a personalized plan to achieve those goals. A financial advisor will work with the client to gather financial data, analyze their financial situation, and create a tailored plan that addresses their specific needs and objectives.

Investment management is another key service offered by financial advisors. This involves managing a client’s investment portfolio to help them achieve their financial goals. A financial advisor will work with the client to develop an investment strategy that aligns with their risk tolerance, investment horizon, and financial objectives.

Ongoing support is also an essential service provided by financial advisors. This may include regular portfolio reviews, investment monitoring, and financial planning updates. A financial advisor will work with the client to ensure that their financial plan remains on track and make adjustments as needed to help them achieve their financial goals.

In addition to these core services, financial advisors may also offer other services and deliverables, such as retirement planning, estate planning, and tax optimization. These services are designed to help clients achieve their financial goals and ensure that they are well-prepared for the future.

When working with a financial advisor, clients can expect to receive a range of deliverables, including a personalized financial plan, investment portfolio reports, and regular progress updates. A financial advisor will work with the client to ensure that they understand their financial situation and are empowered to make informed decisions about their financial future.

By understanding what to expect from a financial advisor, clients can make informed decisions about their financial planning needs and find a advisor who fits their budget and meets their needs. Whether you’re looking for financial planning, investment management, or ongoing support, a financial advisor can provide the guidance and expertise you need to achieve your financial goals.

How to Find a Financial Advisor Who Fits Your Budget and Needs

When searching for a financial advisor, it’s essential to find someone who fits your budget and meets your financial planning needs. Here are some tips and advice to help you find the right financial advisor for you.

First, consider your financial goals and objectives. What are you trying to achieve? Are you looking for investment advice, retirement planning, or tax optimization? Knowing your goals will help you find a financial advisor who specializes in the areas you need help with.

Next, ask for referrals from friends, family, or colleagues who have worked with a financial advisor in the past. They can provide valuable insights into the advisor’s expertise, communication style, and fees.

Another way to find a financial advisor is to check professional associations, such as the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA). These organizations have directories of certified financial planners (CFPs) and other financial professionals who can help you achieve your financial goals.

When selecting a financial advisor, consider their experience, credentials, and services offered. Look for advisors who are CFPs or have other professional certifications, such as Chartered Financial Analyst (CFA) or Certified Public Accountant (CPA).

It’s also essential to consider the advisor’s fee structure and how it aligns with your budget. Ask questions about their fees, such as how much they charge per hour, what services are included, and what additional costs you may incur.

Finally, don’t be afraid to ask questions during the selection process. Some questions to ask include:

- What services do you offer, and how will you help me achieve my financial goals?

- What is your fee structure, and how much can I expect to pay?

- What is your investment philosophy, and how will you manage my investments?

- How will we communicate, and how often can I expect to hear from you?

By following these tips and asking the right questions, you can find a financial advisor who fits your budget and meets your financial planning needs. Remember, investing in professional financial guidance can help you achieve long-term financial success and peace of mind.

Maximizing the Value of Your Financial Advisor Relationship

To get the most out of your financial advisor relationship, it’s essential to communicate effectively, set clear goals, and monitor progress. Here are some tips to help you maximize the value of your financial advisor relationship:

Communicate Effectively: Clear and open communication is key to a successful financial advisor relationship. Be sure to ask questions, provide feedback, and share your concerns with your advisor. This will help them understand your needs and provide personalized guidance.

Set Clear Goals: Setting clear financial goals is essential to achieving success. Work with your advisor to establish specific, measurable, achievable, relevant, and time-bound (SMART) goals. This will help you stay focused and motivated, and ensure that your advisor is working towards the same objectives.

Monitor Progress: Regularly monitoring your progress is crucial to achieving your financial goals. Work with your advisor to establish a system for tracking your progress, and schedule regular check-ins to review your performance.

Be Proactive: Don’t wait for your advisor to reach out to you – be proactive and take the initiative to communicate with them. Ask questions, seek guidance, and provide updates on your financial situation.

Seek Ongoing Education: Financial planning is a lifelong process, and it’s essential to stay educated and informed about personal finance and investing. Seek ongoing education and guidance from your advisor, and take advantage of their expertise and resources.

By following these tips, you can maximize the value of your financial advisor relationship and achieve long-term financial success. Remember, investing in professional financial guidance is a smart decision that can pay off in the long run.

When considering the question of “how much is a financial advisor,” it’s essential to think about the value they bring to the table. A good financial advisor can provide personalized guidance, help you achieve your financial goals, and give you peace of mind. By communicating effectively, setting clear goals, and monitoring progress, you can get the most out of your financial advisor relationship and achieve long-term financial success.

Conclusion: Investing in Your Financial Future with Confidence

In conclusion, hiring a financial advisor can be a smart decision for individuals seeking to achieve long-term financial success. By understanding the role of a financial advisor, the factors that influence their cost, and the different fee structures used, individuals can make informed decisions about their financial planning needs.

When considering the question of “how much is a financial advisor,” it’s essential to think about the value they bring to the table. A good financial advisor can provide personalized guidance, help individuals achieve their financial goals, and give them peace of mind.

By following the tips and advice outlined in this article, individuals can find a financial advisor who fits their budget and meets their financial planning needs. By communicating effectively, setting clear goals, and monitoring progress, individuals can maximize the value of their financial advisor relationship and achieve long-term financial success.

Investing in professional financial guidance is a smart decision that can pay off in the long run. By working with a financial advisor, individuals can gain a deeper understanding of their financial situation, develop a personalized financial plan, and achieve their long-term financial goals.

Remember, hiring a financial advisor is an investment in your financial future. By taking the time to research, compare, and select the right financial advisor for your needs, you can achieve long-term financial success and peace of mind.